Press release

Asset And Liability Management Solutions Market Set to Witness an Uptick during 2017-2027

Asset & Liability Management is a software solution that helps enterprises in monitoring of balance sheet risks for the banking book. This Asset & Liability Management solution also helps financial institutions to get accurate view of profitability, stability and risk exposure of their balance sheet. This Asset & Liability Management solution helps in behavior modelling which further helps in understanding consumer behavior for prepayments and early redemptions. Moreover it helps in creation of unified reporting environment with detailed workflow.These Asset & Liability Management solutions are capable to manage organization risk and stand-alone treasury management system. Moreover this Asset & Liability Management solution includes treasury management, analytics, stress test, market risk control and earning risk management.

These Asset & Liability Management solutions plays a critical role in weaving together the different business lines in a financial institution. Managing liquidity and the balance sheet are crucial to the existence of a financial institution and sustenance of its operations. It is also essential for seamless growth of the balance sheet in a profitable way.

Request Sample Report @ https://www.futuremarketinsights.com/reports/sample/rep-gb-3394

Asset & Liability Management solutions Market: Drivers and Challenges

The major factor driving the adoption of Asset & Liability Management solutions is the growing usage of advance technology. The high adoption of internet has significantly affected risk management and how information analytics and risk transfer solutions are used. This has encouraged mid-level and small enterprises to implement Asset & Liability Management solutions to reduce the risk and mistakes.

The key challenge restraining the market for Asset & Liability Management solutions is the need for stronger and more accurate balance sheet risk management. With the financial changes occurring presently has led huge impact on enterprises. Enterprises have started focusing on advance solutions for liquidity management with tighter regulations and reporting requirements. Moreover, asset and liability managers need to focus on interest rate risk management with increasing demand for more dynamic simulations. This has created a major challenge for this Asset & Liability Management solutions market.

Asset & Liability Management solutions Market: Segmentation

Segmentation on the basis of Asset & Liability Management software offered:

Enterprise Risk management

Asset & Liability Treasury Management

Risk Analytics

Liquidity risk management

Others

Key Developments :

In April 2016, Malauzai software has entered into the partnership with Geezeo, a financial management solution provider. This partnership will help malauzai will provide its apps with features such as conduct transactions, but to take charge of their financial decisions and personal financial objective.

Read Comprehensive Overview with TOC of Report @ https://www.futuremarketinsights.com/askus/rep-gb-3394

In May 2015, CetoLogic has entered into the partnership with Strategic Analytics Solutions to provide asset liability management (ALM) consulting services that help financial institutions better prepare for the impact of interest rate movements and the subsequent impacts to liquidity, core deposits and other market risks. Consulting services provided include capital optimization.

In Asset & Liability Management solutions market there are many vendors some of them are Oracle, Protecht, IBM, Profile Software Numerical technologies and others.

Regional Overview

At present, North America region holds the largest market share of global Asset & Liability Management solutions market. The market is mounting broadly in countries such as U.S. and Canada due to the high adoption of risk management solutions. The major solution vendors in this market are from North America, creating high growth opportunity for users in these market.

The Asia Pacific region is following the North America region in this Asset & Liability Management solutions market is expected to have the highest growth rate in coming years due to the adoption of solutions for risk measurement, or common currency, for all types of risk in countries such as India.

Read Report Overview @ https://www.futuremarketinsights.com/reports/asset-and-liability-management-solutions-market

ABOUT US:

Future Market Insights (FMI) is a leading market intelligence and consulting firm. We deliver syndicated research reports, custom research reports and consulting services, which are personalized in nature. FMI delivers a complete packaged solution, which combines current market intelligence, statistical anecdotes, technology inputs, valuable growth insights, an aerial view of the competitive framework, and future market trends.

CONTACT:

Future Market Insights

616 Corporate Way, Suite 2-9018,

Valley Cottage, NY 10989,

United States

T: +1-347-918-3531

F: +1-845-579-5705

Email: sales@futuremarketinsights.com

Website: www.futuremarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset And Liability Management Solutions Market Set to Witness an Uptick during 2017-2027 here

News-ID: 1194220 • Views: …

More Releases from Future Market Insights

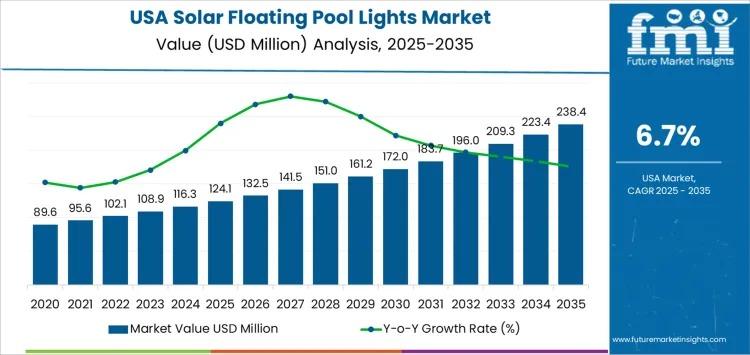

USA Solar Floating Pool Lights Market 2025-2035: Steady Growth Driven by Outdoor …

Market Overview: Rising Demand for Sustainable Pool Lighting

The Demand for Solar Floating Pool Lights in USA is gaining strong momentum, supported by expanding residential pool ownership and increasing preference for energy-efficient outdoor décor. Valued at USD 124.1 million in 2025, the market is projected to reach USD 238.4 million by 2035, registering a CAGR of 6.7%. Consumers are actively choosing solar-powered pool lighting solutions that operate without wiring, reduce electricity…

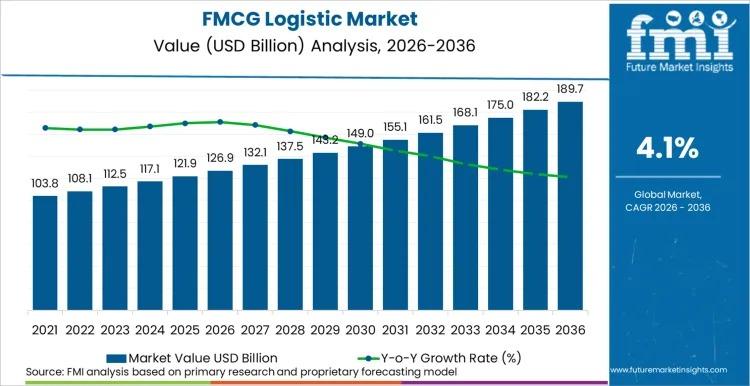

Global FMCG Logistic Market Outlook 2026-2036: Automation, Rail & Quick Commerce …

The global FMCG Logistic Market is entering a decade of transformation, shifting from cost-driven efficiency to automation-led resilience. Valued at USD 121.9 billion in 2025, the market is projected to reach USD 126.9 billion in 2026 and USD 189.5 billion by 2036, expanding at a CAGR of 4.1%. An absolute dollar opportunity of USD 62.6 billion underscores sustained structural demand rather than cyclical retail growth.

Request For Sample Report | Customize…

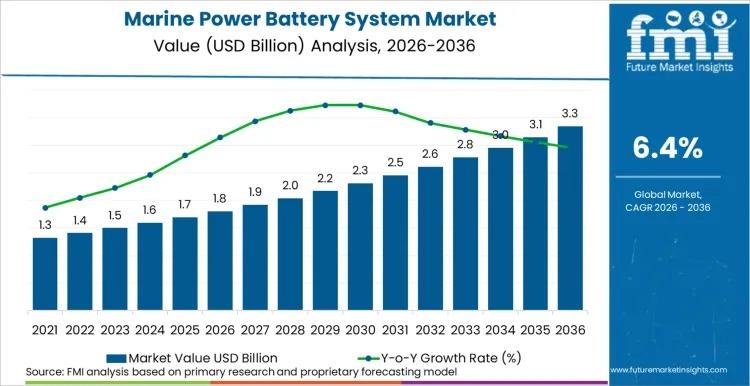

Marine Power Battery System Market 2026-2036: Hybrid Vessels Propel 6.4% CAGR Gr …

The global Marine Power Battery System Market is transitioning from pilot-scale deployments to structured commercialization. Valued at USD 1,664.2 million in 2025, the market is projected to reach USD 1,770.7 million in 2026 and USD 3,292.9 million by 2036, registering a CAGR of 6.4%. The USD 1.52 billion absolute dollar opportunity over the forecast period reflects steady electrification, anchored in hybrid propulsion efficiency, lifecycle optimization, and regulatory compliance across global…

Ice Cream and Frozen Dessert Market Forecast 2025-2035: Market to Reach USD 306, …

The global ice cream and frozen dessert market is projected to grow significantly over the next decade, expanding from USD 148,672.5 million in 2025 to USD 306,418.7 million by 2035, registering a CAGR of 7.5%. According to the latest analysis by Future Market Insights (FMI), growth is fueled by evolving consumer preferences toward indulgent yet healthier dessert options, innovative product formulations, and expanding retail accessibility.

The market has evolved far beyond…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…