Press release

Small Is Beautiful - The New Era of Home Building by David F. Parker of Parker Associates, Real Estate Development Marketing Specialists

Over past decades, America has glorified "Bigger is Better." From Hummers to Big Macs, the notion of big has captured the attention of all sectors of our society as well as people around the world. The competition for tall buildings just reached a new high with the Burj Khalifa in Dubai rising over 800 meters (2,625 feet) above the ground, and containing 160 floors of leasable space. In housing, the average size of American new homes zoomed from 1,500 square feet in 1970 to over 2,350 square feet in 2007. The term "MacMansions" was coined to describe the expanding number of new homes of several thousand square feet emerging in suburbs and replacing smaller teardown dwellings throughout the land. New communities emerged with tens of thousands of acres devoted to planned working and living environments based upon bigness.But, suddenly, the "Big" boom stopped in the fall of 2007 when we entered what has now become known as The Great Recession - a period of two years of devastating job losses, credit restrictions and foreclosures that brought the economy to a halt. Money became scarce for both individuals and corporations. Downsizing replaced "Big" as the hallmark of individual householders and businesses. WalMart and Target enjoyed escalating sales as consumers switched from quality to value in their purchasing criteria. Toyota has proclaimed a banner year for sales of its hybrid Prius automobile. Homebuilders turned to small space designs to satisfy price-sensitive buyers of all ages.

As the economic recovery slowly evolves, we appear to be embracing "Small" as the principle of new consumerism. But, will the new trend persevere or just be a brief fad, before a continuation of "Big?" The answer may be found in the following brief examination of consumer behavior traits and how they may affect residential development..

DEMOGRAPHIC SHIFTS

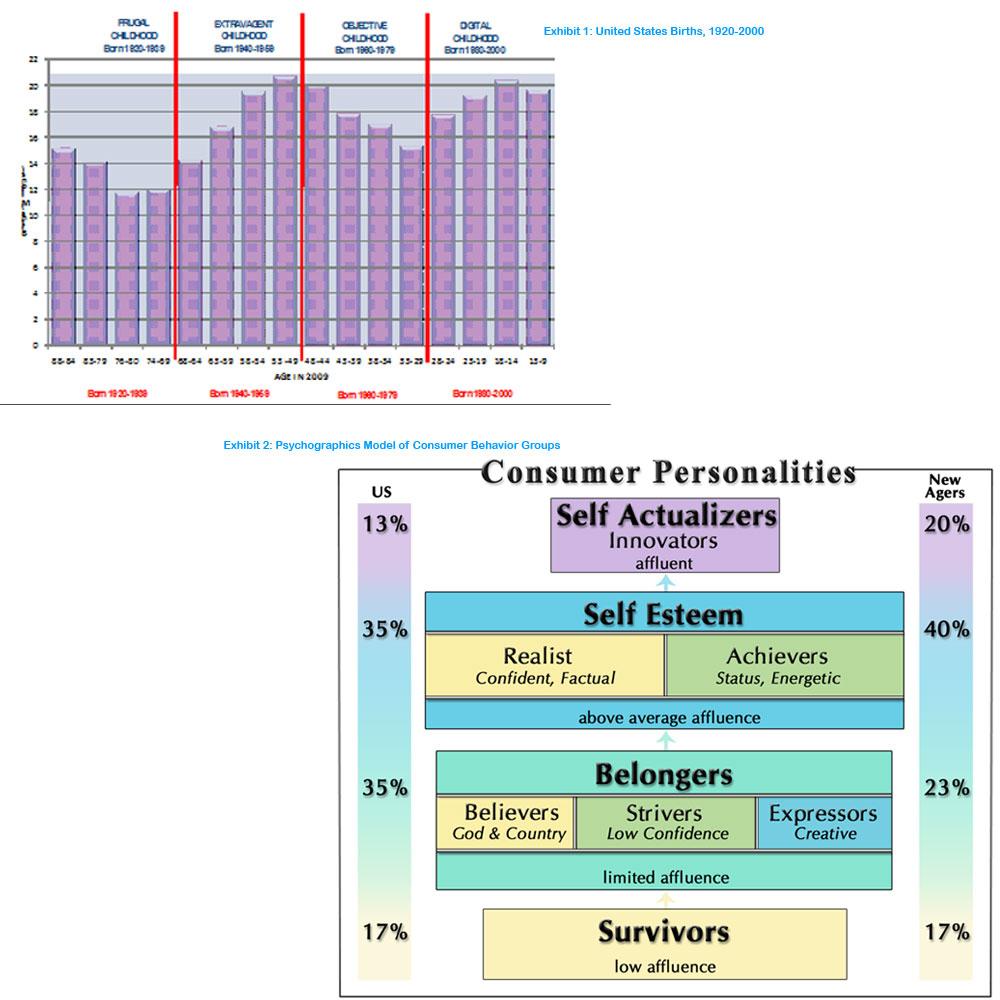

The United States population has exhibited dramatic changes in birth rates over the past century, changes that have caused significant shifts in current age groups and their characteristics. After declining rapidly during the depression years of the 1930s, births increased rapidly during the 1940s preceding the highly publicized "Baby Boom" generation defined by American Demographics Magazine as those born between 1946 and 1964. The 15 million war babies are the leading edge of the Baby Boomers now approaching 70 years of age, a group that has curbed their prior expansive spending habits as a result of The Great Recession that continues to limit national productivity in 2010.

The objective childhood of the fewer babies born in the 1960s and 70s, termed Generation X, already limited their spending habits in contrast with the larger Baby Boom Echo, or Millennial, Generation following them in the 1980s and 90s. However, the 20-30 year-olds in this younger generation are having difficulty finding suitable employment and many of their parents also are struggling with unemployment and investment decline, so they cannot be relied upon for financial support.

The combined population of the young Millennial Generation and the parent Baby Boom Generation is more than half the United States population, including children. These will be the predominant consumer age groups during the next decade, with the leading edge of Millennials ranging from 32 to 43 and the leading edge of Baby Boomers from 63 to 74 - two vastly different age groups with distinctly different purchase needs.

PSYCHOGRAPHIC SHIFTS

The behavior traits of these major consumer groups also have experienced substantial shifts over the past few years. The Millennials have been proceeding through adolescence to young adulthood and enjoying the excitement and frustrations of selecting career paths and life partners. Their parents, the Baby Boomers, are in transition from their vocations to retirement. Both groups face decisions on housing choices, with a majority of Baby Boomers continuing to age in place, and an increasing number of Millennials opting to live with their parents subject to finding a suitable occupation.

Over the past several decades, the predominant "Belonger" population in this country has declined with the emergence of higher education for an increasing share of Americans. Higher educated persons achieve greater self-esteem and become less reliant upon group memberships for personal confidence. Thus, as illustrated in Exhibit 2, major psychographic categorizations in this country indicate at least as many higher income Self-esteem personalities as Belonger personalities.

The above trends toward higher affluence Self-esteem households generated higher rates of expenditures on primary and second homes during the decade prior to The Great Recession, expenditures that reached a peak during the housing investment buying frenzy during 2003 through 2006, stimulated by relaxed lending policies of financial institutions. However, the devastating recession realities, including the stock market crash of 2008 and climbing rates of unemployment, caused these normally self-confident Americans to assume a new lifestyle of frugality. They adopted "small" as a new criterion of security, particularly those who had advanced to or were approaching the fixed-income status of retirement.

It seems likely that the plurality of Self-esteem Achievers, with status-sensitive behavioral patterns, over Self-esteem Realists, with value-sensitive behavioral patterns, will reverse as a result of The Great Recession. The affect of this shift is likely to extend to a declining ratio of Striver personalities versus Believer personalities in the Belonger category. Furthermore, the deep impact of this economic downturn is likely to extend these psychographic shifts for an indefinite period in future.

NEW BUYER PARADIGM

As stated at the beginning of this article, Americans of all income groups have adopted a new framework of frugality for purchase decisions that is apparent in sales of household staples as well as discretionary goods. All sectors of consumer goods and services, with the apparent exception of health care and discount staples, have experienced reduced revenues during the past two years - a condition that shows no signs of abating in 2010.

Sales of large passenger vehicles and luxury homes have declined sharply, while sales of efficiency automobiles and entry level housing have increased (albeit, with the aid of federal stimulus programs continuing into 2010). At the same time, voters in by-elections have exhibited impatience with government programs designed to stimulate economic recovery and employment growth. As stated by Governor Arnold Schwarzenegger after the Massachusetts election of Republican Scott Brown, "anyone holding public office is a likely target of consumer backlash during this period of economic stress."

The real question of importance for longer-term business planning is whether this sharp reversal of consumer attitudes over the past three years will remain or revert to the free-spending era preceding The Great Recession? There is good reason to believe that, despite historic short memories of Americans over past setbacks, the prolonged severity of this economic downturn will remain in the forefront of consumer minds for several years to come. Although we still will witness high-income Americans purchasing luxury goods, the predominant middle class is likely to remain frugal with respect to discretionary purchases.

The new buyer paradigm may already be cast as "small is beautiful" particularly with respect to the household large-ticket items of cars and housing. The simultaneous rise of the "green" movement for energy efficiency and carbon waste reduction is likely to be tempered by this new movement of cost-effectiveness. Environmental conservation and energy efficiency will continue to be desirable objectives, but tempered by unnecessary cost considerations. Smaller versions of cars and dwellings can be tolerated as long as their reduced size is not out-balanced by greater costs for discretionary conservation and efficiency options.

IMPACT ON RESIDENTIAL DEVELOPMENT

The above demographic and psychographic shifts in American consumers are having and will continue to have a major impact on residential development in this country. The enormous size of our population (308.5 million at the beginning of 2010) means that even minority segments can impact the nationwide economy. So, housing demand will be apparent at all price levels for dwellings and lots across a wide range of dwelling sizes, and this demand will increase in all sectors over the next five years, as recently dormant demand becomes active.

However, the consumer shifts will impact demand sufficiently to cause already emergent trends toward smaller dwellings to increase. Price differentials in new homes will be more dependent on features than floor area. The traditional parameter of describing price in terms of square feet will become less meaningful as production builder dwellings of the same size exhibit price variations of 50 percent or more. We will develop new standards of energy efficiency and interior finishes that provide varying price categories for the same floor plan, very similar to automobiles of the same size classified with sub-titles indicating different sets of standard features.

Although custom homes will still be in demand for affluent consumers, the housing market increasingly will consist of production home offerings described in terms of rooms and feature packages rather than square feet of interior area. Interior floor plans will improve to the point that slow-selling dysfunctional plans will be discarded and popular plans increased in features categorization - large production builders will offer substantially better prices and variety than small builders, with a subsequent decline in the number of small builders.

The reduction in average dwelling size will be accompanied by escalation in features packages with Realist value criteria replacing Achiever status criteria as the primary selection parameters for purchase. Thus, a builder may produce the same 1,600 square foot floor plan for both young Millennial households and older Baby Boom households, but with the models called by different names to reflect the substantially different features packages and pricing offered to the two different target groups.

Although large scale communities may decrease in number because of financing constraints, builders will increasingly target neighborhoods to specific age groups with Millennials attracted to neighborhoods featuring convenient playgrounds and family recreation center and Baby Boomers attracted to activity centers that cater to their interests. The historic notion that dwellings are shelter adaptable to any household will no longer be sustained.

About Parker Associates

David F. Parker is the president of Parker Associates (www.parkerassociates.com), a real estate development/marketing consultant firm headquartered in Jacksonville, Florida. Dr. Parker has written four books and countless articles on residential development and marketing as well as serving as a feature speaker for many professional organizations. He can be reached at (904) 992-9888 or david@parkerassociates.com.

Parker Associates

14500 Beach Boulevard

Jacksonville, FL 32250

USA

David Parker

904-992-9888

david@parkerassociates.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Small Is Beautiful - The New Era of Home Building by David F. Parker of Parker Associates, Real Estate Development Marketing Specialists here

News-ID: 119278 • Views: …

More Releases for America

Stabilit America Highlights Applications of Fiberglass Roof Panels with Stabilit …

Roofing materials are very important in the realm of modern construction, as they should be long lasting, economical and attractive. Fiberglass roof panels are a few of the numerous choices among several alternatives that have received a reputation of being versatile, long life, and adaptable in various sectors. They are favored by the architects, contractors, and property developers due to their lightweight construction, resistance to weather factors, and the ease…

Deodorants Market Report by Region (North America, EMEA, Latin America, Asia)

2025 - Pristine Market Insights, a leading market research firm, announced the release of its latest and comprehensive market research report on Deodorants market. The report spans over 500 pages and delivers 10-year market forecast in US dollars (or custom currencies upon request). It provides in-depth analysis of market dynamics (drivers, opportunities, restraints), PESTLE insights, latest industry trends, and demand factors. The report includes segmented market value, share (%), compound…

Sequestrant Market Report by Region (North America, EMEA, Latin America, Asia)

2025 - Pristine Market Insights, a leading market research firm, announced the release of its latest and comprehensive market research report on Sequestrant market. The report spans over 500 pages and delivers 10-year market forecast in US dollars (or custom currencies upon request). It provides in-depth analysis of market dynamics (drivers, opportunities, restraints), PESTLE insights, latest industry trends, and demand factors. The report includes segmented market value, share (%), compound…

Buttermilk Market Study by Region (North America, Latin America, Europe, Asia, M …

2025 - Pristine Market Insights, a leading market research firm, announced the release of its latest and comprehensive market research report on Buttermilk market. The report spans over 500 pages and delivers 10-year market forecast in US dollars (or custom currencies upon request). It provides in-depth analysis of market dynamics (drivers, opportunities, restraints), PESTLE insights, latest industry trends, and demand factors. The report includes segmented market value, share (%),…

Textiles Market Analysis Report, Regional Outlook - Europe, North America, South …

Adroit Market Research has announced the addition of the “Global Textiles Market Size Status and Forecast 2025”, The report classifies the global Textiles in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth.

This report studies the global Textiles Speaker market, analyzes and researches the Textiles Speaker development status and forecast in Europe, North America, Central America, South America, Asia Pacific…

Global Gaucher Disease Market 2018 Covering North America, South America, Europe

Gaucher Disease Market

Summary

The Global Gaucher Disease Market is defined by the presence of some of the leading competitors operating in the market, including the well-established players and new entrants, and the suppliers, vendors, and distributors. The key players are continuously focusing on expanding their geographic reach and broadening their customer base, in order to expand their product portfolio and come up with new advancements.

Gaucher Disease market size to maintain the average annual growth…