Press release

Wealth Management Platform Market 2018 Analysis by Current Industry Status & Growth Opportunities, Top Key Players (SS&C, Fiserv, FIS, Profile Software, Broadridge, InvestEdge, Temenos, Finantix, SEI etc.) Target Audience and Forecast to 2025

The Wealth Management Platform Market Research Report is a valuable source of insightful data for business strategies. It provides the Wealth Management Platform industry overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. The Wealth Management Platform market study provides comprehensive data which enhances the understanding, scope and application of this report.Get Sample Copy of this Report @ https://www.orianresearch.com/request-sample/499057

The report features key market flow of division. Various definitions and classification of the industry, applications of the industry and chain structure are given. The present market situation and prospects of the sector also have been examined. Additionally, prime strategical activities in the market, which includes product developments, mergers and acquisitions, partnerships, etc., are discussed.

The Top Companies Analyzed Are Wealth Management Platform Market Research Report

• SS&C (US)

• Fiserv (US)

• FIS (US)

• Profile Software (UK)

• Broadridge (US)

• InvestEdge (US)

• Temenos (Switzerland)

• Finantix (Italy)

• SEI Investments Company (US)

• Comarch (Poland)

• Objectway (Italy)

• …

No. of Report Pages: 108

Enquire more @ https://www.orianresearch.com/enquiry-before-buying/499057

The report provides comprehensive analysis of:

• Key market segments and sub-segments

• Evolving market trends and dynamics

• Changing supply and demand scenarios

• Quantifying market opportunities through market sizing and market forecasting

• Tracking current trends/opportunities/challenges

• Competitive insights

• Opportunity mapping in terms of technological breakthroughs

Place Direct Order of this Report @ https://www.orianresearch.com/checkout/499057

The regional scope of the study is as follows:

North America, United States, Canada, Mexico, Asia-Pacific, China, India, Japan, South Korea, Australia Indonesia, , Singapore, Rest of Asia-Pacific, Europe, Germany, France, UK, Italy, Spain, Russia, Rest of Europe, Central & South America ,Brazil, Argentina, Rest of South America, Middle East , Africa, Saudi Arabia, Turkey, Rest of Middle East & Africa.

Major Points of Table and Content

1 Industry Overview of Wealth Management Platform

2 Global Wealth Management Platform Competition Analysis by Players

3 Company (Top Players) Profiles

4 Global Wealth Management Platform Market Size by Application (2013-2018)

5 United States Wealth Management Platform Development Status and Outlook

6 Europe Wealth Management Platform Development Status and Outlook

7 China Wealth Management Platform Development Status and Outlook

8 Japan Wealth Management Platform Development Status and Outlook

9 Southeast Asia Wealth Management Platform Development Status and Outlook

10 India Wealth Management Platform Development Status and Outlook

11 Market Forecast by Regions and Application (2018-2025)

12 Wealth Management Platform Market Dynamics

13 Market Effect Factors Analysis

14 Research Finding/Conclusion

15 Appendix

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealth Management Platform Market 2018 Analysis by Current Industry Status & Growth Opportunities, Top Key Players (SS&C, Fiserv, FIS, Profile Software, Broadridge, InvestEdge, Temenos, Finantix, SEI etc.) Target Audience and Forecast to 2025 here

News-ID: 1169589 • Views: …

More Releases from Orian Research

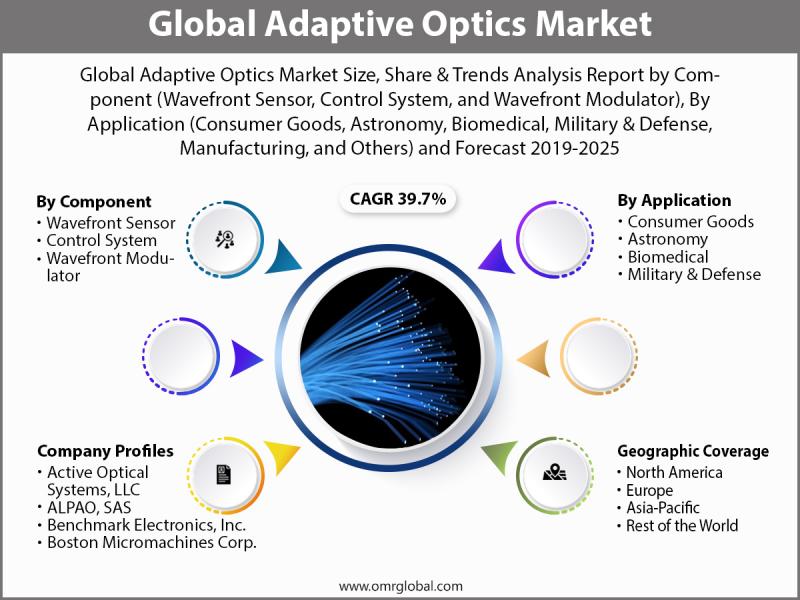

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

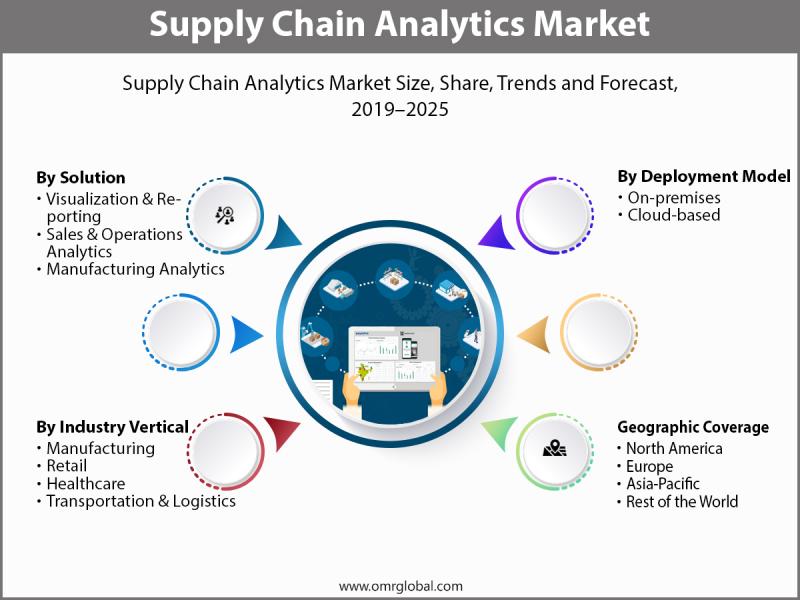

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

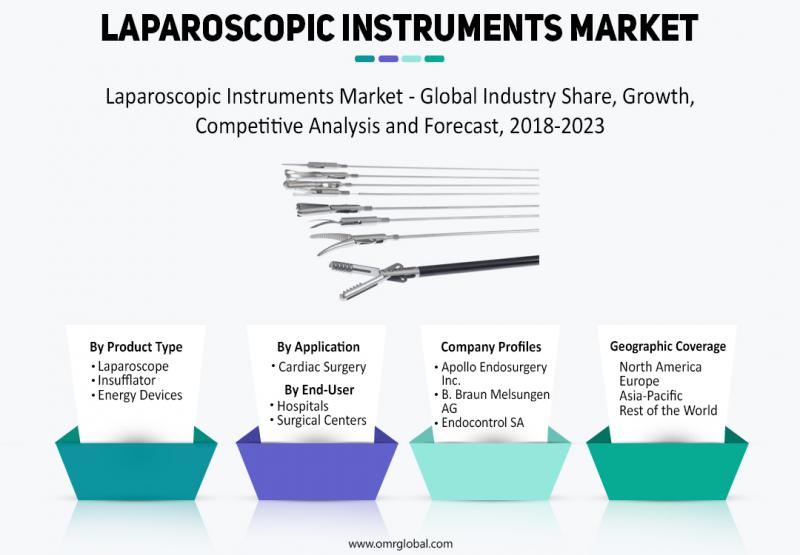

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…