Press release

Digital Banking Industry 2018 Market Trend, Top Key Players (Urban FT, Kony, Backbase, Technisys, Infosys, Digiliti Money, Mobilearth, D3 Banking Technology, Alkami, Q2, Misys, SAP) and 2025 Forecast Report

Digital Banking Industry Report covers the Market preparation models, producing method, situation and business operations of this Market. Global Digital Banking Market industry report 2018-2025 report covers the most recent development establishing in the market, development opportunities and situation.Get Sample Copy of this Report @ https://www.orianresearch.com/request-sample/593848

Global Digital Banking Market 2018 research report provide the details about industry overview and analysis about size, share, growth, trend, demand, outlook, classification revenue details, competitive scenario, industry analysis, markets forecast, manufacturers with development trends and forecasts 2025.

Top Key Companies Analyzed in Global Digital Banking Industry are -

• Urban FT

• Kony

• Backbase

• Technisys

• Infosys

• Digiliti Money

• Digiliti Money

• Mobilearth

• D3 Banking Technology

• Alkami

• Q2

• Misys

• SAP

Complete report Global Digital Banking Market spreads across 66 pages profiling 13 companies and supported with tables and figures, Purchases this Report @ https://www.orianresearch.com/checkout/593848 .

The Global Digital Banking Industry report provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. The Digital Banking industry analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development status.

Firstly, this report focuses on price, sales, revenue and growth rate of each type, as well as the types and each type price of key manufacturers, through interviewing key manufacturers. Second on basis of segments by manufacturers, this report focuses on the sales, price of each type, average price of Digital Banking, revenue and market share, for key manufacturers.

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins.

Inquire more about this report @ https://www.orianresearch.com/enquiry-before-buying/593848 .

By Application:

• Retail Digital Banking

• SME Digital Banking

• Corporate Digital Banking

The Global Digital Banking Industry focus on Global major leading industry players, providing information such as company profiles, product picture and specification, capacity, production, price, cost, revenue and contact information. Upstream raw materials and equipment and downstream demand analysis are also carried out.

With the list of tables and figures the report provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market

Major Points from Table of Contents –

1 Market Definition

2 World Market by Vendors

3 World Market by Type

4 World Market by End-Use / Application

5 World Market by Regions

6 North America Market

7 Europe Market

8 Asia-Pacific Markets

9 South America Market

10 Middle East & Africa Market

11 Market Forecast

12 Key Manufacturers

13 Price Overviewnts.

About Us

Orian Research is one of the most comprehensive collections of market intelligence reports on the Global Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the Global most complete and current database of expert insights on Global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clie

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US: +1 (832) 380-8827 | UK: +44 0161-818-8027

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Industry 2018 Market Trend, Top Key Players (Urban FT, Kony, Backbase, Technisys, Infosys, Digiliti Money, Mobilearth, D3 Banking Technology, Alkami, Q2, Misys, SAP) and 2025 Forecast Report here

News-ID: 1162895 • Views: …

More Releases from Orian Research

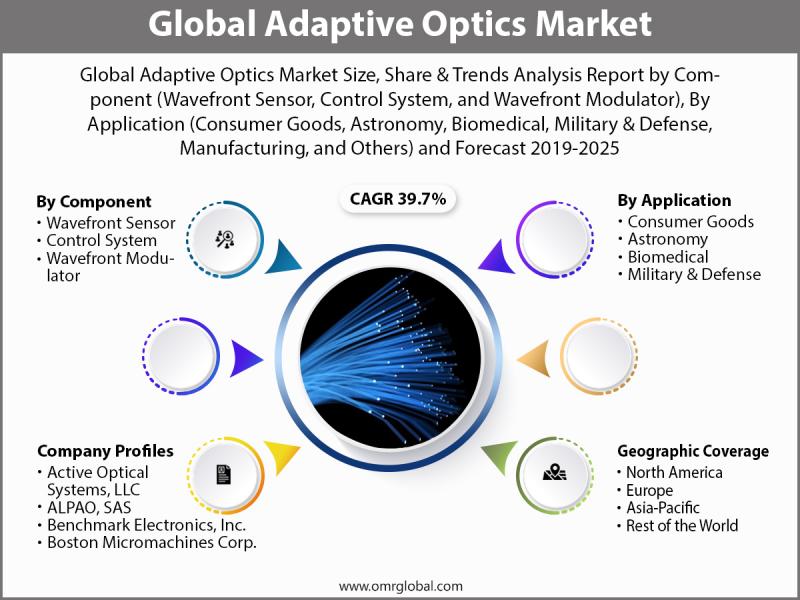

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

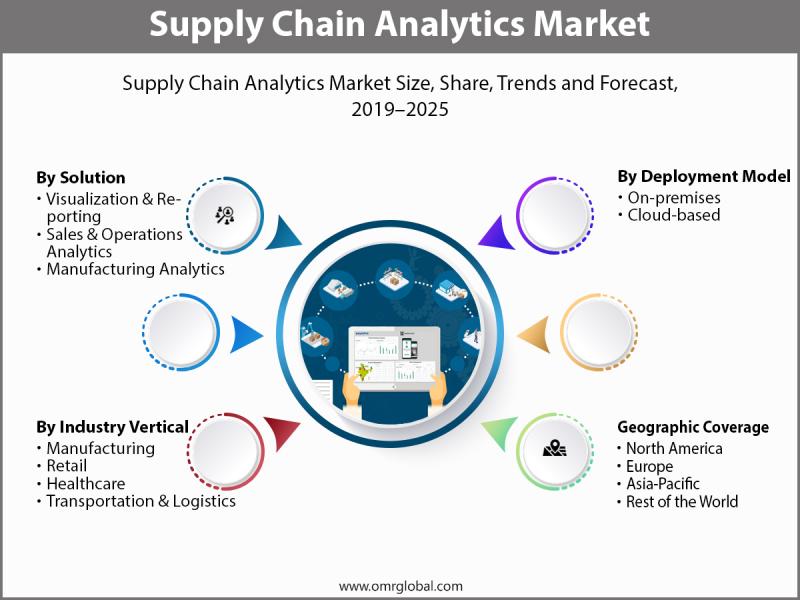

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

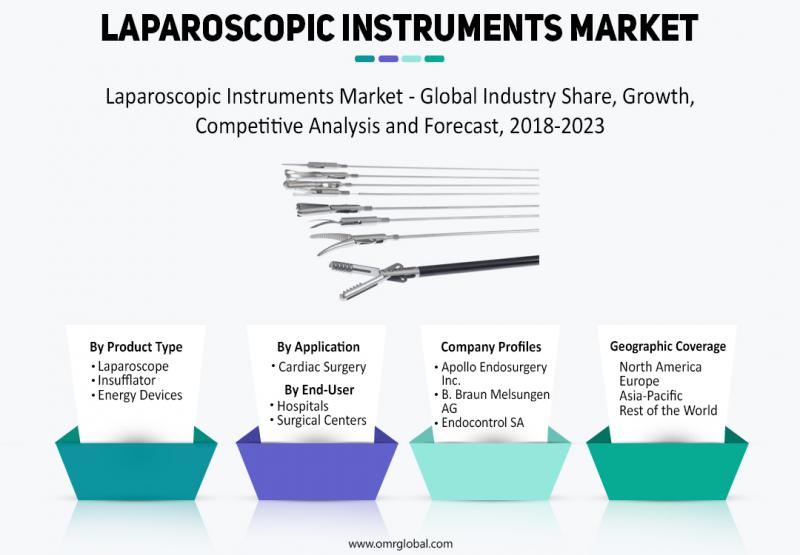

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…