Press release

Tin Market – Significant Growth During 2015 – 2023

The top three producers of tin – Yunnan Tin Group Company Limited, Malaysia Smelting Corporation, and PT Timah (Perseo) Tbk – held about 56.9% of the revenue in 2014, leaving the rest as a highly fragmented competitive landscape filled with regional players with no globally prominent presence. According to Transparency Market Research, Yunnan Tin Group Company Ltd. was the largest company in 2014, in terms of revenue share. In the same year, Malaysia Smelting Corporation was the second-largest tin producer.Request to view sample of this report at: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=9695

TMR’s study notes that most companies within the fragmented market keep their focus on improving their manufacturing capacities and securing new business projects within the new and emerging tin markets.

Demand for Consumer Electronics and Food Packaging Drives Global Tin Production

The two largest drivers for tin production rates are the rapidly increasing demands from consumer electronics and packaged foods. Tin is a core material used in most of the consumer electronic goods we see today. About half the overall annual tin consumption goes into soldering.

Another major chunk of the demand originates from the food and beverages industry. With the growth of economy in emerging nations, the demand for packaged food is increasing rapidly. Tin being one of the most preferred metallic food-grade packaging materials, is expected to be used in increasing amounts over the coming years.

Raw Material Depletion Expected to Create Significant Hurdles

“While the demand for tin is increasing at a consistently high pace, thanks to the economic and industrial developments in APAC and LATAM, tin production might not match the demand that is projected for the near future,” states a TMR analyst. “Most of the major mines in Brazil and Peru are being depleted, creating a scenario where severe lack of tin production could cripple the industry.”

At the same time, the other major production projects that are slated to be released soon do not seem to be arriving soon enough to top off the fall in supply. Most of these projects are expected to be started by 2024, with a few others to be initiated between 2016 and 2017.

“Minsur S.A. had stated in November 2015 that their San Rafael, Peru project has had a 15% shortfall in Q3 2015, than for the same quarter in the previous year. The mine is stipulated to run only till 2017,” the analyst added. “Additionally, one of the global giants of tin production, Indonesia, has started strengthening its export laws for tin in order to barricade tin smuggling and rapid environmental degradation.”

As a result, we can see that the severity of tin supply shortfall is only expected to increase in severity over the coming years. Future projects might meet market demands later, but for now, the growing demand might not be consistent with the reducing supply.

Consumer Electronics Demand to Drive Tin Market to US$7.3 bn by 2023

The rapid expansion of the consumer electronics industry will continue to push the demand for tin higher. The global tin manufacture rate is also growing due to the increasing demand from the food and beverages industry for packaging purposes. With major contributions from these two factors, the global in market is expected to be expanding at a CAGR of 3.4% between 2015 and 2023, in terms of revenue. It was valued around US$7.4 bn in 2014 and after a brief period of downturn, is expected to rise up to US$7.29 bn by the end of 2023.

In terms of volume, the global tin production is expected to expand at a CAGR of 2.5% between 2015 and 2023.

The information presented in this review is based on a Transparency Market Research report, titled, “Tin Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2015 – 2023.”

Key Takeaways:

Tin market global revenue expected to reach US$7.29 bn by 2023.

Asia Pacific expected to hold 69.7% tin by volume by 2023.

Over 50% of global annual tin consumption goes into soldering.

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants, use proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Each TMR syndicated research report covers a different sector – such as pharmaceuticals, chemicals, energy, food & beverages, semiconductors, med-devices, consumer goods and technology. These reports provide in-depth analysis and deep segmentation to possible micro levels. With wider scope and stratified research methodology, TMR’s syndicated reports strive to provide clients to serve their overall research requirement.

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tin Market – Significant Growth During 2015 – 2023 here

News-ID: 1062115 • Views: …

More Releases from Transparency Market Research

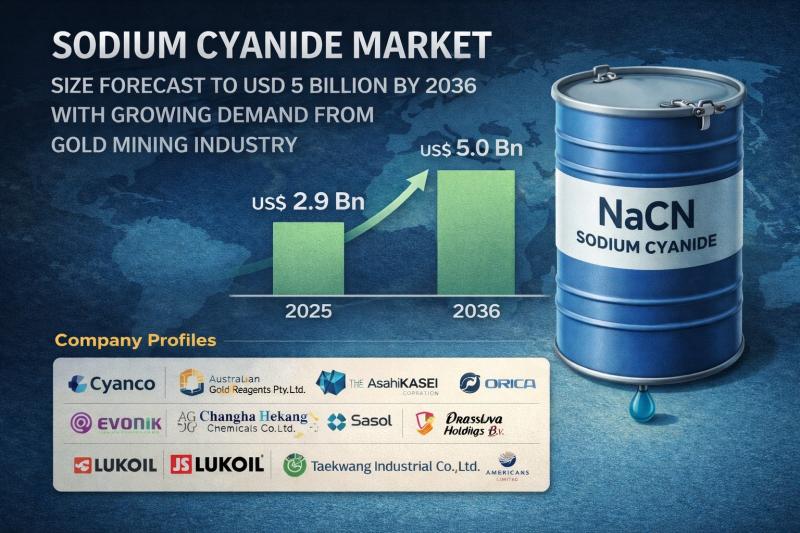

Sodium Cyanide Market Size Forecast to USD 5 Billion by 2036 with Growing Demand …

Sodium Cyanide Market Outlook 2036

The global sodium cyanide market was valued at US$ 2.9 Bn in 2025 and is projected to reach US$ 5 Bn by 2036, expanding at a CAGR of 5.2% from 2026 to 2036. Market growth is driven by increasing demand for gold extraction, rising mining activities, and technological advancements in cyanidation processes.

👉 Get your sample market research report copy today@ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=46848

Market Overview

Sodium cyanide is a highly…

Ion Implanter Market Size Forecast to USD 3.7 Billion by 2036 with Growing Semic …

Ion Implanter Market Outlook 2036

The global ion implanter market was valued at US$ 2.1 Bn in 2025 and is projected to reach US$ 3.7 Bn by 2036, expanding at a steady CAGR of 5.0% from 2026 to 2036. Market growth is driven by increasing demand for advanced semiconductor devices, expansion of consumer electronics production, and rapid developments in automotive electronics and power devices.

👉 Get your sample market research report copy…

Geosynthetics Market Size Forecast to USD 62.1 Billion by 2036 with Expanding In …

Geosynthetics Market Outlook 2036

The global geosynthetics market was valued at US$ 24.5 Bn in 2025 and is projected to reach US$ 62.1 Bn by 2036, expanding at a strong CAGR of 8.8% from 2026 to 2036. Market growth is driven by increasing infrastructure development, rising demand for sustainable construction solutions, expanding waste management projects, and growing adoption in transportation and water management applications.

👉 Get your sample market research report copy…

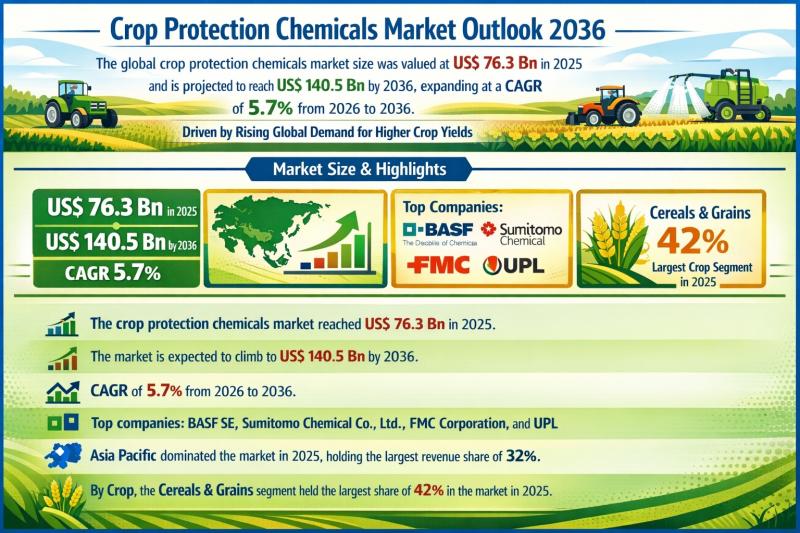

Crop Protection Chemicals Market Outlook 2036: Global Industry to Reach US$ 140. …

Crop Protection Chemicals Market Outlook 2036: Global Industry to Reach US$ 140.5 Billion at 5.7% CAGR Driven by Rising Demand for Higher Crop Yields and Food Security

The global crop protection chemicals market was valued at US$ 76.3 Bn in 2025 and is projected to reach US$ 140.5 Bn by 2036, expanding at a steady CAGR of 5.7% from 2026 to 2036. The industry's consistent growth trajectory reflects the mounting pressure…

More Releases for Tin

eTattoos Market Growth | Trends, Demand & Key Players 2024-2032 | Google LLC, Ti …

Global eTattoos Market Size, Status, and forecast for the 2025-2032. The research provides accurate economic, global, and country-level predictions and analyses. It provides a comprehensive perspective of the competitive market as well as an in-depth supply chain analysis to assist businesses in identifying major changes in industry practices. The market report also examines the current state of the eTattoos Market industry, as well as predicted future growth, technological advancements, investment…

Tin Selenide

Global Info Research announces the release of the report "Global Tin Selenide Market 2023 by Manufacturers, Regions, Type and Application, Forecast to 2029" . The report is a detailed and comprehensive analysis presented by region and country, type and application. As the market is constantly changing, the report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company…

Digital Tattoo Market to Witness Growth Acceleration | Fortune Tattoo, Tin-Tin T …

Digital tattoo is to a temporary tattoo that is outfitted with electronics, such as sensors or a near field communication (NFC) chip. A digital tattoo also refers to the permanent nature of a person's actions and communications online, also known as a digital footprint.

The Comprehensive study on Digital Tattoo includes historical data as well as share, size, and projection information for the major players, geographies, applications, and product categories for…

Global Indium Tin Oxide Market, Global Indium Tin Oxide Industry, Covid-19 Impac …

Indium tin oxide (ITO) involves of tin oxide and indium oxide prevail in solid form and on the weight basis indium oxide contains 10% tin oxide and 90% indium oxide. It is a transparent directing oxide member. Several indium tin oxide applications comprise heat reflective coatings, touch panels, electroluminescent display photovoltaic, gas sensors, LCD displays, electrochromic, field emission displays, plasma displays, and energy-effectual window.

According to the report analysis, ‘Global…

Global Tin Foil Market, Global Tin Foil Industry, Market Revenue, Tin Foil Bakin …

Tin foil is a versatile material, which is used in various packaging applications such as wrappers, household foil, pouches, blister packs, and lids. It is recyclable and therefore represents a beneficial opportunity for manufacturers as increasing recovery & collection rates for product mean less production cost along with improved profitability. It possess significant characteristics including better thermal & electrical conductivity, non-absorptive to grease, water, light, and oil, superior formability, and…

Global Tin(II) Methanesulfonate Market Top Player 2019 - Dow, TIB Chemicals, Hub …

Market Research store investigators figure the most recent report on “Tin(II) Methanesulfonate Market Will reaches at CAGR with Significant Growth”, according to their latest report. The Tin(II) Methanesulfonate Market report covers the overall and all-inclusive analysis of the Tin(II) Methanesulfonate Market with all its factors that have an impact on market growth. This report is anchored on the thorough qualitative and quantitative assessment of the global Tin(II) Methanesulfonate Market. The…