Press release

Global Third-party Banking Software Market is Expected to Grow at a CAGR of 8.38% from 2018 to 2022

Research Beam added a report, “Global Third-party Banking Software Market 2018-2022.” The report delivers a comprehensive analysis of the third-party banking software market and its prospects. It covers various aspects of the industry such as the market summary, scope of the report, research methodology, market landscape, market size, five forces analysis, market segmentation, customer and regional landscape, market drivers and challenges, decision framework, market trends, vendor landscape, and vendor analysis.View complete report: https://www.researchbeam.com/global-third-party-banking-software-2018-2022-market

The data in the report is a result of an extensive primary and secondary research of the market performed by research analysts along with vital inputs from core industry experts. The study serves as a useful guide for market players, investors, industry experts, and other stakeholders interested in the industry as it helps them make well-informed decisions based on their business goals.

The report first provides a summary of the global third part banking software market. It then goes on to explain the scope of the report, the research methodology used, and the market landscape covering the aspects such as the market ecosystem, characteristics, and market segmentation analysis.

The market sizing discussed in the report includes details about the definition of the third-party banking software market, sizing of the market, and market forecast. The market size helps stakeholders to determine the overall potential of the industry.

Request for sample report: https://www.researchbeam.com/global-third-party-banking-software-2018-2022-market/request-sample

The five forces analysis that helps determine the competitive intensity and the attractiveness of the global third-party banking software industry is discussed in the report. It comprises the bargaining power of buyers, bargaining power of suppliers, the threat of new entrants, the threat of substitutes, and the threat of rivalry.

The report discusses the drivers and restraints that affect the growth of the third-party banking software market. Factors such as the growing adoption of customer-centric perspective and more propel the industry growth. On the other hand, high switching costs from legacy systems restrain the market growth.

Do inquire about report: https://www.researchbeam.com/global-third-party-banking-software-2018-2022-market/enquire-about-report

The market trends that the report identifies include migration to componentization of software, the advent of open banking paradigm, the evolving regulatory regime, and the technological advances in the future.

The report segments the third-party banking software market based on product type, application/end-user, deployment model, and geography. Based on product type, the market is divided into core banking software, asset and wealth management software, and other banking software. Based on application/end-user, the market is divided into retail users and corporate users. Based on deployment model, the industry is classified into on-premises model and cloud model. Based on region, the market analysis covers the top three countries in EMEA, Americas, and APAC. The report covers the market size and forecast for the period, 2017-2022 as well as the year-over-year growth during 2018-2022 for each of the segments.

The report covers an analysis of the vendor landscape including the overview, landscape disruption, and competitive scenario. The vendor analysis covers details about the vendors operating in the third-party banking software market, classification of the vendors, and their market positioning.

The leading players in the global third-party banking software market include FIS, Fiserv, Infosys, Oracle, and Temenos. The report includes important information about the businesses such as their business segments, organizational developments, geographic focus, key offerings, and key customers.

With the arsenal of different search reports, we help you here to look and buy research reports that will be helpful to you and your organization. Our research reports have the capability and authenticity to support your organization for growth and consistency.

With the window of opportunity getting open and shut at a speed of light, it has become very important to survive in the market and only the fittest and competent enough can do so. So, we try and provide with latest changes in the market that can suit your needs and help you take decision accordingly.

Global Head Quarters

5933 NE Win Sivers Drive,

#205, Portland, OR 97220

United States

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Third-party Banking Software Market is Expected to Grow at a CAGR of 8.38% from 2018 to 2022 here

News-ID: 1050233 • Views: …

More Releases from Research Beam

Proton Therapy Market: Global Analysis & Forecast by Koninklijke Philips N.V., A …

Market study on Global Proton Therapy Market 2018 by Manufacturers, Regions, Type and Application, Forecast to 2023 Research Report presents a professional and complete analysis of Global Proton Therapy Market on the current market situation.

This report focuses on the Proton Therapy in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Request…

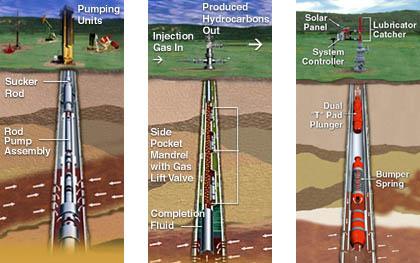

Artificial Lift System Market by Top Key Participant The major companies profile …

The market research report ‘Global Artificial Lift System, 2018 Market Research Report’ aims to offer insights into new business opportunities for companies active in Artificial Lift Systemas well as for those players that are aiming to get an entry into the industry.

Artificial Lift System Market by Type (Rod lift, ESP, PCP, Plunger, Gas lift, Others), Component (Pump, Motor, Cable System, Drive head, Separator, Pump Jack, Sucker Rod, Gas-lift Valves,…

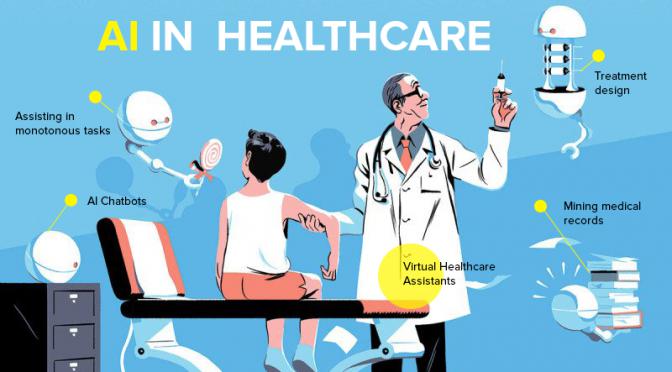

Artificial Intelligence in Healthcare Market Report Competition by Manufacturers …

Artificial Intelligence in Healthcare Market by Offering (Hardware, Software, and Services), Technology (Deep Learning, Querying Method, Natural Language Processing, and Context Aware Processing), Application (Robot-assisted Surgery, Virtual Nursing Assistant, Administrative Workflow Assistance, Fraud Detection, Dosage Error Reduction, Clinical Trial Participant Identifier, Preliminary Diagnosis, and Others), and End User (Healthcare Provider, Pharmaceutical & Biotechnology Company, Patient, and Payer) - Global Opportunity Analysis and Industry Forecast, 2017-2023

Request Sample copy of this Report…

Artificial Turf Market Key Player Analysis By - Victoria PLC (Avalon Grass), Spo …

Artificial turfs are synthetic surfaces made of fibers including polyethylene, polypropylene, and polyamides. These are used across the globe due to attractive features such as high durability, low maintenance, superior quality, all weather utility, visual appeal, and eco-friendly attribute. Such turfs are in high demand in sports such as football, hockey, baseball, golf, and other activities that require a durable grass surface. Furthermore, these turfs can be 100% recycled due…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…