Press release

Specialty Insurance Market Report by Growth, Share, Size, Analysis and Forecast 2022 to 2027

According to the latest report by IMARC Group, "Global Specialty Insurance Market Size, Share, Growth, Industry Trends, Opportunity and Forecast 2022-2027", the global specialty insurance market reached a value of US$ 78.97 Billion in 2021. Looking forward, IMARC Group expects the market to reach a value of US$ 131.21 Billion by 2027, exhibiting a CAGR of 8.50% during 2022-2027.Request Free Sample Report: https://www.imarcgroup.com/specialty-insurance-market/requestsample

Specialty insurance is specially designed for companies that require unusual coverage. It covers high-risk investments or assets not protected by conventional insurance plans. Some commonly available policies include livestock, aquaculture, marine, aviation and transport (MAT), arts, entertainment, and political risk and credit insurance. It also protects against lawsuits under specialty insurance known as errors and omissions (E&O) to help an organization recover financially. As a result, specialty insurance is gaining immense popularity among businesses across the healthcare, construction, and energy industries.

Market Trends:

The global specialty insurance market is primarily driven by the rising need to safeguard businesses from potential risks, commercial obligations, and negligence claims not typically covered by conventional business insurance plans. Additionally, numerous insurers, brokers, and policyholders rely on specialized knowledge to provide specialty coverages that help fulfill the needs of organizations with unique risk profiles. In line with this, the rapid expansion of businesses worldwide has catalyzed market growth.

Besides this, the rising instances of human-caused catastrophes, natural disasters, and sudden or gradual property damages in the real estate industry have augmented product demand. Furthermore, the surging adoption of innovative digital solutions by key players to offer better services to customers and extend their operations is positively influencing the market growth. Other factors, including technological advancements, surging demand for specialized expertise, and increasing implementation of the Internet of Things (IoT), are also anticipated to drive the market further.

Checkout Now: https://www.imarcgroup.com/checkout?id=5085&method=1

Specialty Insurance Market 2022-2027 Competitive Analysis and Segmentation:

Competitive Landscape With Key Players:

The competitive landscape of the global specialty insurance market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of these key players include:

Mapfre S.A., Munich Reinsurance Company, Nationwide Mutual Insurance Company, American International Group Inc., Assicurazioni Generali S.P.A., Axa XL (Axa S.A), Hiscox Ltd., Manulife Financial Corporation, RenaissanceRe Holdings Ltd., Selective Insurance Group Inc., The Hanover Insurance Group Inc. and Zurich Insurance Group Ltd.

Key Market Segmentation:

The report has segmented the global specialty insurance market based on type, distribution channel, end user and region.

Breakup by Type:

• Marine, Aviation and Transport (MAT)

o Marine Insurance

o Aviation Insurance

• Political Risk and Credit Insurance

• Entertainment Insurance

• Art Insurance

• Livestock and Aquaculture Insurance

• Others

Breakup by Distribution Channel:

• Brokers

• Non-Brokers

Breakup by End User:

• Business

• Individuals

Breakup by Region:

• North America

• Asia Pacific

• Europe

• Latin America

• Middle East and Africa

Ask Analyst for 10% Free Customized Report: https://www.imarcgroup.com/request?type=report&id=5085&flag=C

Note: We are updating our reports, if you want the report with the latest primary and secondary data (2023-2028) including industry trends, market size and competitive landscape, etc. click request free sample report, published report will be delivered to you in PDF format via email within 24 to 48 hours.

Key highlights of the report:

• Market Performance (2016-2021)

• Market Outlook (2022-2027)

• Porter's Five Forces Analysis

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain

• Comprehensive Mapping of the Competitive Landscape

If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Media Contact:

Company Name: IMARC Group

Contact Person: Elena Anderson

Email: sales@imarcgroup.com

Phone: +1-631-791-1145

Address: 134 N 4th St

City: Brooklyn

State: NY

Country: United States

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Specialty Insurance Market Report by Growth, Share, Size, Analysis and Forecast 2022 to 2027 here

News-ID: 3036517 • Views: …

More Releases from IMARC Group

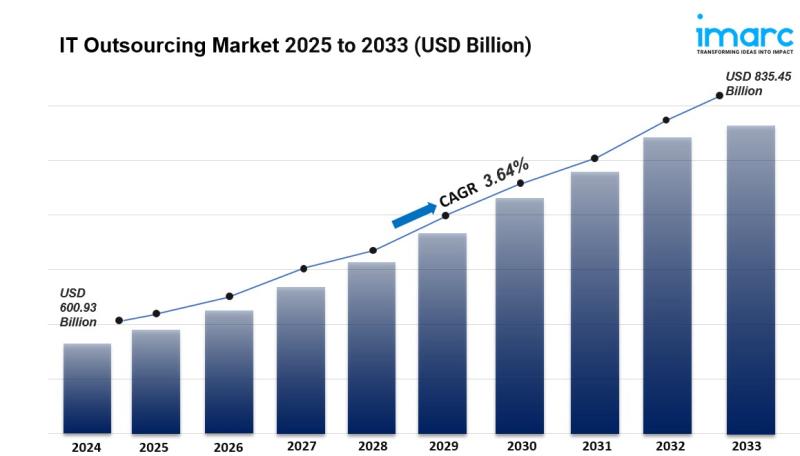

IT Outsourcing Market Size, Share, Trends And Growth Report 2025-2033

Overview IT Outsourcing Market:

The IT Outsourcing Market is rapidly evolving, driven by the need for cost efficiency and access to specialized skills. Companies increasingly outsource IT functions such as application development, infrastructure management, and business process outsourcing to third-party vendors. This trend allows organizations to focus on core competencies while leveraging advanced technologies. Key regions include North America, Europe, and Asia-Pacific, with North America leading due to its robust IT…

Urban EV Shift Drives India Electric Scooter Market to USD 3.0 Billion by 2033, …

India Electric Scooter Market 2025-2033

According to IMARC Group's report titled "India Electric Scooter Market Size, Share, Trends and Forecast by Drive, Battery, Product, Battery Fitting, End Use, and Region, 2025-2033", The report offers a comprehensive analysis of the industry, including India electric scooter market growth, share, trends, and regional insights.

How Big is the India Electric Scooter Industry?

The India electric scooter market size was valued USD 1.3 Billion in 2024. By…

Rising Cyber Threats Push India Cyber Insurance Market to USD 6,907.8 Million by …

India Cyber Insurance Market 2025-2033

According to IMARC Group's report titled "India Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2025-2033", The report offers a comprehensive analysis of the industry, including India cyber insurance market forecast, share, growth and regional insights.

Market Size & Future Growth Potential:

The cyber insurance market in india was valued USD 582.2 Million in 2024. By 2033,…

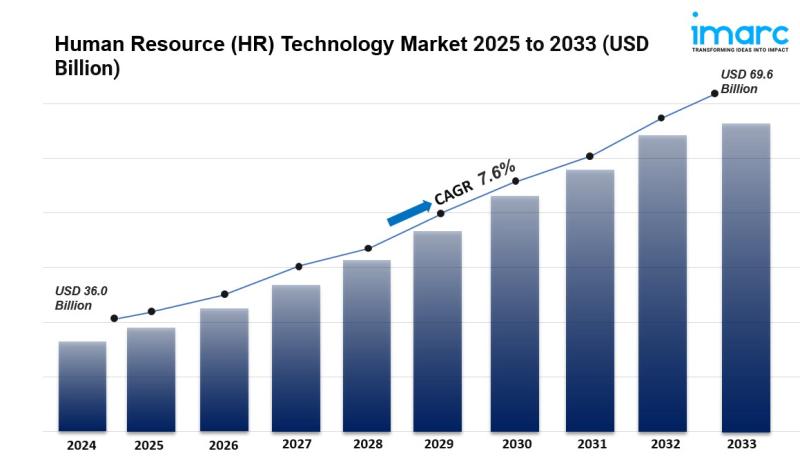

Human Resource (HR) Technology Market Size, Share, Trends and Forecast 2025-2033

Human Resource Technology Market Overview:

The human resource (HR) technology market is witnessing significant growth, driven by increasing digital transformation across organizations and the rising need for automation in workforce management. HR technology solutions, including talent acquisition platforms, payroll systems, performance management software, employee engagement tools, and learning & development platforms, are becoming integral to modern businesses. Cloud adoption, AI-powered analytics, and the shift toward remote and hybrid work models have…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…