Press release

Microinsurance Market – In-Depth Analysis on Size, Status & Forecast 2022

Global Microinsurance Market Size, Status and Forecast 2022 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk analysis, and leveraged with strategic and tactical decision-making support. This study recognizes that in this quick-evolving, competitive environment, up-to-date industry information is essential to monitor performance & make critical decisions for growth and profitability. It provides information on trends and developments, focuses on markets and materials, capacities, technologies, and on the changing structure of the Global Microinsurance Market.The Global Microinsurance Market consists of different international, regional, and local vendors. The market competition is foreseen to grow higher with the rise in technological innovation and M&A activities in the future. Moreover, many local and regional vendors are offering specific application products for varied end-users. The new vendor entrants in the market are finding it hard to compete with the international vendors based on quality, reliability, and innovations in technology.

Get Access to sample pages @ https://www.htfmarketreport.com/sample-report/739746-global-microinsurance-market-1

Global Microinsurance market competition by top manufacturers, with production, price, revenue (value) and market share for each manufacturer; the top players includes Albaraka, ASA, Banco do Nordeste, Bandhan Financial Services, FundaciOn de la Mujer, Amhara Credit and Savings Institution, Al Amana Microfinance, Compartamos Banco, FundaciOn WWB Colombia, ICICI Bank, Standard Chartered& Wells Fargo

The research study is segmented by Application such as City& Rural with historical and projected market share and compounded annual growth rate.

Global Microinsurance (Thousands Units) by Application (2016-2022)

Market Segment by Application 2012 2016 2022 Market Share (%)2022 CAGR (%)

(2016-2022)

City xx xx xx xx% xx%

Rural xx xx xx xx% xx%

Total xx xx xx 100% xx%

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), and market share and growth rate of Microinsurance in these regions, from 2012 to 2022 (forecast), covering

This independent 102 page research with title Global Microinsurance Market Size, Status and Forecast 2022 guarantees you will remain better informed than your competition. The study covers geographic analysis that includes regions/countries and important players/vendors such as Albaraka, ASA, Banco do Nordeste, Bandhan Financial Services, FundaciOn de la Mujer, Amhara Credit and Savings Institution, Al Amana Microfinance, Compartamos Banco, FundaciOn WWB Colombia, ICICI Bank, Standard Chartered& Wells Fargo. With n-number of tables and figures examining the Microinsurance , the research gives you a visual, one-stop breakdown of the leading products, submarkets and market leader’s market revenue forecasts as well as analysis to 2022

Further it focuses on Global major leading industry players with information such as company profiles, product picture and specifications, sales, market share and contact information. What’s more, the Microinsurance industry development trends and marketing channels are analyzed.

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/739746-global-microinsurance-market-1

The study is organized with the help of primary and secondary data collection including valuable information from key vendors and participants in the industry. It includes historical data from 2012 to 2016 and projected forecasts till 2022 which makes the research study a valuable resource for industry executives, marketing, sales and product managers, consultants, analysts, and other people looking for key industry related data in readily accessible documents with easy to analyze graphs and tables. The report answers future development trend of Microinsurance on the basis of stating current situation of the industry in 2017 to assist manufacturers and investment organization to better analyze the development course of Microinsurance Market.

The research insights solutions to the following key questions:

What will be the market size and the growth rate in 2022?

What are the key factors driving the Global Microinsurance market?

Who are the key market players and what are their strategies in the Global Microinsurance market?

What are the key market trends impacting the growth of the Global Microinsurance market?

What trends, challenges and barriers are influencing its growth?

What are the market opportunities and threats faced by the vendors in the Global Microinsurance market?

What are the key outcomes of the five forces analysis of the Microinsurance market?

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=739746

There are 15 Chapters to deeply display the Global Microinsurance market.

Chapter 1, to describe Microinsurance Introduction, product scope, market overview, market opportunities, market risk, market driving force;

Chapter 2, to analyze the top manufacturers of Microinsurance , with sales, revenue, and price of Microinsurance , in 2016 and 2017;

Chapter 3, to display the competitive situation among the top manufacturers, with sales, revenue and market share in 2016 and 2017;

Chapter 4, to show the Global market by regions, with sales, revenue and market share of Microinsurance , for each region, from 2012 to 2017;

Chapter 5, 6, 7, 8 and 9, to analyze the key regions, with sales, revenue and market share by key countries;

Chapter 10 and 11, to show the market by type and application, with sales market share and growth rate by type, application [ City& Rural], from 2012 to 2017;

Chapter 12, Microinsurance market forecast, by regions, type and application, with sales and revenue, from 2017 to 2022;

Chapter 13, 14 and 15, to describe Microinsurance sales channel, distributors, traders, dealers, Research Findings and Conclusion, appendix and data source.

Get customization & check discount for report @ https://www.htfmarketreport.com/enquiry-before-buy/739746-global-microinsurance-market-1

Thanks for reading this article; you can also get individual chapter

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

Contact Us:

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road, Edison, NJ USA - 08837

sales@htfmarketreport.com

Ph: +1 (206) 317 1218

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Microinsurance Market – In-Depth Analysis on Size, Status & Forecast 2022 here

News-ID: 770009 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Booster Compressor Market SWOT Analysis by Key Players: Siemens, Sulzer, Gardner …

The latest survey on Booster Compressor Market is conducted to provide hidden gems performance analysis of Booster Compressor to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

Brake Caliper Market SWOT Analysis by Key Players: Continental, Knorr-Bremse, Br …

The latest survey on Brake Caliper Market is conducted to provide hidden gems performance analysis of Brake Caliper to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

Residential Solar Energy Storage Market SWOT Analysis by Key Players: LG, Samsun …

HTF Market Intelligence recently released a survey document on Residential Solar Energy Storage market and provides information and useful stats on market structure and size.

The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities.

Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints…

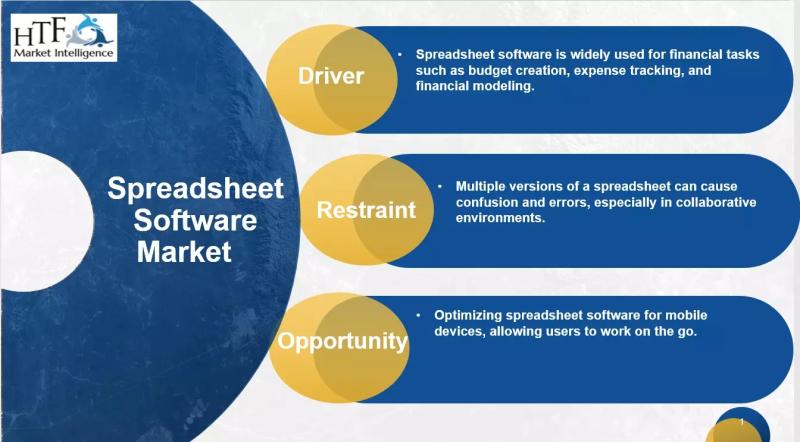

Spreadsheet Software Market Regaining Its Glory: LibreOffice, Zoho, Corel

HTF Market Intelligence recently released a survey document on Spreadsheet Software market and provides information and useful stats on market structure and size.

The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in the…

More Releases for Microinsurance

Microinsurance Market to Witness a Pronounce Growth during 2025

The Global Microinsurance Market research by Market Study Report. It offers a feasibility analysis for investment and returns supported with data on development trend analysis across important regions of the world

Global Microinsurance Research Report presents a competitive assessment and detailed statistical analysis on Global Microinsurance Industry prospects. The Microinsurance Report will enlighten the readers with market dynamics and market trends to provide a holistic market overview. The key aspects of…

Microinsurance Market by Technology, Application, Type and Geography – 2025

2018 Global Microinsurance Market Report is an expert and inside and in-depth research report about the world's major regional market situations of the Microinsurance Market, concentrating on the primary regions and the fundamental nations (United States, EU, Japan, China, India and Southeast Asia).

The company profiling highlight of the report has been anticipated to unveil a portion of the key techniques, late improvements, and other imperative parts of key players functioning…

Current Trends and Future Growth of Global Microinsurance Market

Qyresearchreports include new market research report Microinsurance to its huge collection of research reports.

The global Microinsurance market has been exclusively and elaborately examined in this report while taking into account some of the most pivotal factors holding the capability to influence growth. For the said forecast tenure, the report has shed light on critical market dynamics, which include trends, opportunities, restraints, and growth drivers. The analysts have provided ample of…

Global Microinsurance Market Top Industry Key Players Analysis 2016 - 2022

This report studies the global Microinsurance market, analyzes and researches the Microinsurance development status and forecast in United States, EU, Japan, China, India and Southeast Asia. This report focuses on the top players in global market, like

Albaraka

ASA

Banco do Nordeste

Bandhan Financial Services

FundaciOn de la Mujer

Amhara Credit and Savings Institution

Al Amana Microfinance

Compartamos Banco

FundaciOn WWB Colombia

ICICI Bank

Standard Chartered

Wells Fargo

Browse complete report at https://www.researchtrades.com/report/global-microinsurance-market-size-status-and-forecast-2022/1044297

Market segment by Regions/Countries, this report covers

United States

EU

Japan

China

India

Southeast Asia

Market segment by…

Global Microinsurance Market Size, Status and Forecast 2022

This report studies the global Microinsurance market, analyzes and researches the Microinsurance development status and forecast in United States, EU, Japan, China, India and Southeast Asia.

This report focuses on the top players in global market, like

Albaraka

ASA

Banco do Nordeste

Bandhan Financial Services

FundaciOn de la Mujer

Amhara Credit and Savings Institution

Al Amana Microfinance

Compartamos Banco

FundaciOn WWB Colombia

ICICI Bank

Standard Chartered

Wells Fargo

Request a sample of this report @ https://www.reporthive.com/enquiry.php?id=1086079&req_type=smpl

Market segment by Regions/Countries, this report covers

United States

EU

Japan

China

India

Southeast…

Global Microinsurance Market Forecasts to 2022 and Analysis

“Global Microinsurance Market 2022 Research Report” Purchase This Report by calling ResearchnReports.com at +1-888-631-6977.

The report also discusses the dynamics of microinsurance business, providing insights into the microinsurance supply chain, business models, microinsurance products and the targeted consumer. Insurers are considering microinsurance as a long-term growth strategy in new and potentially high-growth markets. Insurers are increasingly collaborating with government agencies, non-government organizations (NGOs) and development organizations to create a market for…