Press release

Mobile Payment Technologies Market: Increased Adoption of Advanced Technologies to Fuel the Market Growth

The global mobile payment technologies market is foreseen to grow manifolds in coming times. Rising interest for cutting edge payment innovation and expanding center around making cashless economy has prompted the solid emergence of mobile payment innovation suppliers in the market. A portion of the significant players in worldwide mobile payment technologies market are Visa, Inc., Boku, Inc., PayPal, Inc., Vodafone Ltd., AT and T, Inc., Apple, Inc., Microsoft Corporation, MasterCard International Inc., American Express, Co., Fortumo, Bharti Airtel Ltd., and Google, Inc.According to a recent research report by Transparency Market Research (TMR) the global mobile payment technologies market is anticipated to flourish with a tremendously strong CAGR of 20.5% within its forecast period from 2016 to 2024. In year 2015 the overall mobile payment technologies market was evaluated to be worth US$ 338.72 bn. This value is expected to reach around worth US$ 1,773.17 bn by the end of year 2024. Based on type, near field communication (NFC) segment is expected to dominate the other segments because of advancement in technologies in mobile payment sector all over the world. Geographically, Asia Pacific will stand out in the coming time as it is slated to represent an offer of 42.5% in the worldwide market before the finish of 2024.

Request Sample: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=157

Integration of IoT with Payment Application to Boost the Global Market Demand

Mobile payment is an innovation which enables buyers to make quick payments for items and administrations by utilizing a versatile electronic gadget, for example, tablets, smartphones, and cell phones which are worked as a payment vehicles. Developing selection of cutting edge technologies, for example, wearable gadgets, near field communication, and mobile point-of-sale are relied upon to lift the interest for mobile payment technologies in anticipated years. The appropriation of prompt payment technologies are persistently expanding in developing districts, for example, Middle East and Africa and Asia Pacific. This is likewise a central point which is relied upon to help the mobile payment technologies market in the coming years.

Aside from this, fast advancements in the mobile payment answers for give better payment administration to the end-clients are additionally foreseen to fuel the development of the mobile payment technologies market. What's more, developing government drove activities and expanding appropriation of shrewd machines are expected to drive the market. Besides, combination of IoT with payment applications gives real chances to expand payment arrangement offerings and create upgraded payment technologies. Thusly, it is foreseen that the Internet of Things will support more payments through advanced wallets amid the figured time frame.

Browse Our Report: https://www.transparencymarketresearch.com/mobile-payments-market.html

Lack of Engagement among the Users to Hamper the Mobile Payment Technologies Market

In any case, low consumer demand for picking new innovation is a major aspect controlling the development of the mobile payment technologies market. On the other side, there are a lot of chances in market to help up the development. Top-end security highlights, speedier and more secure exchanges, joining of traditional exchange strategies in the present working framework will draw in more clients.

Despite the fact that the mobile payment innovation market is thriving, there is a lack of engagement among clients about tolerating the new innovation. It is one of the enormous limiting elements for the development of the market. Shoppers are likewise put off by the deferrals in exchange some still like to direct the exchange in the antiquated ways. Both the clients and shippers are not completely mindful of the working framework of the mobile payment innovation and that is a reason for worry for the general development of the market.

Get TOC of This Report: https://www.transparencymarketresearch.com/report-toc/157

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants, use proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

US Office

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: https://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Technologies Market: Increased Adoption of Advanced Technologies to Fuel the Market Growth here

News-ID: 967800 • Views: …

More Releases from Transparency Market Research

Handheld Marijuana Vaporizer Market Key Drivers, Market Research, and Insights f …

The global handheld marijuana vaporizer market has witnessed remarkable growth in recent years, attributed to the increasing acceptance of medicinal marijuana and the demand for convenient and discreet consumption methods. Valued at US$ 5 billion in 2021, the market is projected to surge at a CAGR of 13.4% to reach US$ 15.9 billion by 2031. This article delves into the factors driving this growth, the evolving market landscape, and the…

Disinfectant Wipes Market Forecast 2020-2030 - Market Size, Drivers, Trends, And …

The COVID-19 pandemic has precipitated a remarkable surge in the demand for disinfectant products, with a notable emphasis on disinfectant wipes as an essential tool in maintaining hygiene and preventing the spread of pathogens. This research report delves into the multifaceted landscape of the disinfectant wipes market, elucidating key trends, drivers, and innovations shaping the industry.

𝐆𝐞𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=70359

Key Players and Market Developments

Key players…

Tissue Banking Market is Expected to Reach US$ 2,903.3 Million to 2026| TMR Stud …

The global 𝐭𝐢𝐬𝐬𝐮𝐞 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐦𝐚𝐫𝐤𝐞𝐭 reached a value of US$ 1,056.4 million in 2017 and is projected to nearly triple to US$ 2,903.3 million by 2026, with a robust Compound Annual Growth Rate (CAGR) of approximately 12.0% from 2018 to 2026. Factors such as increasing awareness about tissue donation, technological advancements, and a growing target patient population are anticipated to propel market growth during this period.

Moreover, the market is expected…

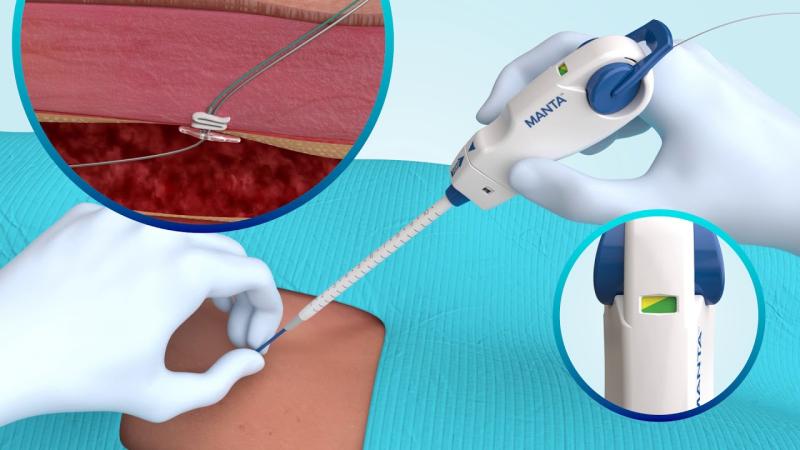

Vascular Closure Devices Market to reach US$ 1 Billion by 2027: TMR Study

This report by Transparency Market Research, Inc. assesses the present state and future growth potential of the global 𝐯𝐚𝐬𝐜𝐮𝐥𝐚𝐫 𝐜𝐥𝐨𝐬𝐮𝐫𝐞 𝐝𝐞𝐯𝐢𝐜𝐞𝐬 𝐦𝐚𝐫𝐤𝐞𝐭. It features a comprehensive executive summary, offering insights into various segments of the market. Additionally, the report provides detailed analysis and data on product, access type, application, end user, and regional segments within the global market.

Vascular closure devices is estimated to reach a value of ~US$ 1 Bn…

More Releases for Payment

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…

Payment Card Industry 2025 by Product (Contactless Payment, Card Contact Payment …

ReportsWeb.com has announced the addition of the “Global Payment Card Market Professional Survey Report 2018” ,provides a vital recent industry data which covers in general market situation along with future scenario for industry around the Globe.

Key Players -

MasterCard, Visa, American Express, Banco Itau, Bank of America Merrill Lynch, Bank of Brazil, Bank of East Asia, Chase Commercial Banking, Diner's Club, Hang Seng Bank, Hyundai, JP Morgan, SimplyCash, Sumitomo…

Payment Security Software Market 2018- Digital Transformation in Payment Methods …

Market Highlights

“The increasing number of cashless transactions is the main factor behind the rising demand for payment security software across the world,” says a FGR analyst. With the ongoing digital transformation, the payment market is witnessing a significant change in the pattern of financial transactions, which is shifting towards cashless increasingly.

The digitization across industries is leading to high investments in the development and the deployment of new technologies, encouraging…

Payment Gateway Industry Worth US$ 86.9 Billion By 2025 - Hosted Payment Gateway …

The merchants all over the globe are avidly willing to expand their businesses cross-border by adaption of a logical approach, by partnering with the payment gateways. With the help of this partnership, these merchants gain the advantage of tapping the opportunities created by the globalization of e-commerce. Majority of merchants today, are eyeing up global expansion and wish to grow at a faster pace, however, the last thing they would…

Contactless Payment Observe Huge Demand in Australia Payment Market

Pune, India, 04 December 2017: WiseGuyReports announced addition of new report, titled “Payments in Australia 2017: What Consumers Want”.

A 'payment system' is new technology that allows consumers, businesses, and many organizations to transfer money to a financial institution and vice versa. This includes Payment Instructions - Cash, Card, Check and Electronic Funds Transfer which customers use to pay - and generally unseen arrangements ensure that the funds move from one…