Press release

Vamos! Spanish True Fleet Market with a brilliant start of the year

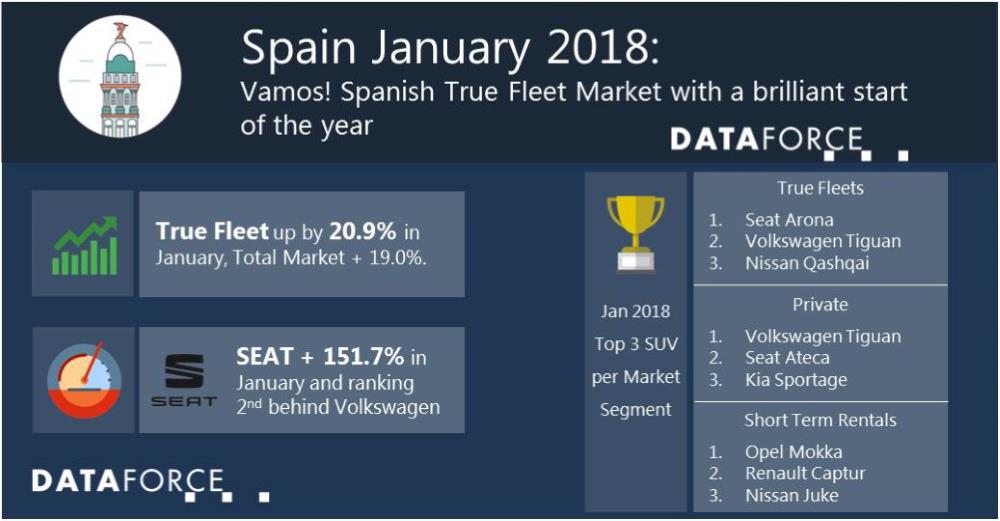

No doubt: the Spanish passenger car market had a very promising start in 2018. With almost 106,000 new registrations it was the highest January volume since 2007. The registrations in the Private Market increased by + 15.5% over January 2017 but the rise was even bigger for True Fleets: a plus of 20.9% was the highest monthly percentage growth since November 2016. Despite the good result for both Private and True Fleets the volume in the more tactically driven Special Channels also rose significantly (+ 24.9%).Brand performance

Volkswagen had a successful January with strong performances of the models Tiguan and Golf, additionally supported by registrations of the all-new small SUV T-Roc. This helped Volkswagen to recapture the lead in the ranking from Renault. The French brand dropped back to 7th position after being number one in October, November and December 2017.

SEAT scored a remarkable result in January and jumped from 11th position into rank number two with a growth of 151.7%. The manufacturer from Martorell achieved a market share of 8.8%, its best in almost three years (February 2015). While the registrations of the Compact SUV Ateca increased by + 23.7% the Ibiza and the Leon both more than doubled their volumes. The new small SUV Arona also contributed significantly and was already number four in the model ranking in True Fleets behind Volkswagen Golf, SEAT Ibiza and Leon which underlines SEAT’s success in its home (fleet) market.

Toyota did also very well and climbed into fifth position behind Audi and Peugeot with a + 51.4% followed by Mercedes, Renault, BMW, Ford and Opel.

Outside the top 10 Škoda was shining in the first month of this year. The Czech manufacturer doubled its registrations (+ 104.2%) and pushed its market share to three percent for the first time since August 2015. Nowadays it is almost a bit unusual that this increase was not only triggered by SUV models. Beside Fabia and Octavia especially the Superb performed exceptionally well and even ranked number two in the Middle Class segment behind Volkswagen Passat!

SUV top, Vans under pressure

The new SEAT Arona helped the SUV segment to score a new record share with almost 40% (39.7%) of the True Fleet Market. The popularity of SUVs in Spain is not only higher than in all other big European Markets but also based on many pillars. Only the Mercedes GLC (ranking 5th) achieved exactly the same number of registration as twelve months ago while all other models within the top 30 SUV in January had growing numbers compared to January 2017. The ranking of the top sellers shows five different brands on ranks 1–5, namely SEAT Arona, Volkswagen Tiguan, Nissan Qashqai, Audi Q3 and Mercedes GLC. And as you can see in our infographic the ranking looks pretty different depending on the market channel you are looking at.

As in many other markets the ongoing success of the Sports Utility Vehicles puts pressure on other groups of vehicles. The same applies for Spain where the Van Segment declined by - 24.0% in a growing market. In January, Vans accounted for only 5.5% of all True Fleet registrations which is the lowest percentage we ever recorded for Spain. Since 2013 the share declined by 50% while the share of SUV almost doubled. The market structure is obviously changing dramatically!

(557 words; 3,301 characters)

Publication by indication of source (DATAFORCE) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Michael Gergen

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-231

Fax: +49 69 95930-333

Email: michael.gergen@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Vamos! Spanish True Fleet Market with a brilliant start of the year here

News-ID: 960425 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for SUV

Electric SUV Market Analysis Report 2022 - 2030

Acumen Research and Consulting has announced the addition of the "Electric SUV Market" report to their offering.

The Electric SUV Market Report 2030 is an in depth study analyzing the current state of the Electric SUV Market. It provides brief overview of the market focusing on definitions, market segmentation, end-use applications and industry chain analysis. The study on Electric SUV Market provides analysis of China market covering the industry trends, recent…

SUV Wheel Market Share Chain Analysis, Forecast 2021-2027

The research report published by RMoz on the SUV Wheel market provides a detailed overview of the demands and consumptions of various products/services associated with the growth dynamics of the market during the forecast period 2021 – 2027. The in-depth market estimation of various opportunities in the segments is expressed in volumes and revenues. The insights and analytics on the SUV Wheel market span several pages. These are covered in…

SUV Wheel Speed Sensor Market, Worldwide, 2030

The “SUV Wheel Speed Sensor Market Analysis to 2030” is a specialized and in-depth study of the SUV Wheel Speed Sensor industry with a focus on the SUV Wheel Speed Sensor market trend. The report aims to provide an overview of the SUV Wheel Speed Sensor market with detailed market segmentation by component, application, end-user, and geography. The SUV Wheel Speed Sensor market is expected to witness high growth during…

SUV Market or Sports Utility Vehicles Market Analysis

SUV Market By Length SUV-F, SUV-E, SUV-D and SUV-C and Fuel Type Petrol, Diesel and Other Fuel Types - Global Industry Analysis And Forecast To 2025

Industry Outlook

The SUV also referred to as the Sport-utility vehicle or the sport-ute is the classification of car, regularly the type of station wagon/estate car with the off-road vehicle highlights like the raised clearance of ground and toughness, and accessible four-wheel drive. Numerous SUVs are…

SUV Market to Develop Rapidly by 2017- 2027

Sports Utility Vehicles (SUVs) assume a new meaning in India. In a country, where vehicles and their cost is deeply steeped into the notions of power and affluence, more Indians are shunning humble hatchbacks and gentlemanly sedans to opt for the ferocious, on-your-face SUVs. This new-found love for power and prestige has the Society of Indian Automobile Manufacturers smiling, as the segment (UVs) grew a staggering 30% in FY 2016-17.…

Global All-Wheel Drive SUV Market Insights, Forecast 2025

An up-to-date research report has been disclosed by Market Research Hub highlighting the title “Global All-Wheel Drive SUV Market Insights, Forecast to 2025” which provides an outlook for current market value as well as the expected growth of "All-Wheel Drive SUV Market" during 2018-2025. The report studies the casing heads market worldwide, especially in North America, China, Europe, Southeast Asia, Japan and India, with production, size, growth, revenue, consumption, import…