Press release

Financial Services Cybersecurity Systems and Services Market Estimated to Flourish by 2022

Organizations working in the overall financial services cybersecurity systems and services market are expected to take advantage of the open doors birthing from building hearty hazard and security administration programs for financial establishments, states Transparency Market Research (TMR) in a research report. Such projects could help financial firms to enable their IT security while getting a charge out of the certainty to improve and contend unequivocally in their business. Merchants, for instance, Akamai Technologies, Inc., AlienVault, Inc., VMware, Inc., Alert Logic, Inc., and Avast Software S.R.O. could be among the best names in the market. The report gives a comprehensive profile record of every seller examined.The worldwide market for financial services cybersecurity systems and services is anticipated to enlist a CAGR of 14.1% amid the figure time allotment 2017– 2022. By 2022 end, the market could post an income of US$24.3 bn. In 2017, it earned around US$12.5 bn. As indicated by end client grouping, the universal financial services cybersecurity systems and services market is anticipated to offer open doors in sections, for example, saving money, protection, credit unions, stock businesses, stock trade, venture reserves, purchaser financing services, installment card and portable installment services, and government-related financial services. Regionally, North America is guessed to make the cut in the global financial services cybersecurity systems and services market with an income of US$7.6 bn forecasted to be collected before the finish of 2022. Different markets, for instance, Japan and Europe could likewise offer promising prospects in the coming years.

Request For Report Sample: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=30866

The worldwide financial services cybersecurity systems and services market is prognosticated to pick up driving force from the order of government statutes, for example, the Gramm-Leach-Bliley (GLB) Act which require financial organizations to guarantee the classification and security of clients' close to home information. Such client information could incorporate standardized savings numbers (SSNs), records, wage, account numbers, telephone numbers, locations, and names. Besides, an increased reaction is normal from financial firms taking a gander at the taking off pervasiveness and advancement of cybercrimes since the most recent decade and a half.

The worldwide financial services cybersecurity systems and services market is imagined to be marked as a quicker and bigger growing one for private division cybersecurity. Financial foundations and banks, for instance, Bank of America are anticipated to set no bar or requirement on cybersecurity expense because of the desperation of the time and energetically augmenting range of crimes pertaining to the internet. The American Bankers Association Banking Journal proclaimed in 2016 that digital connected hazards are presently located higher by CEOs than those related with resource bubbles, vitality costs, and financial emergency. Force point, in its 2015 Industry Drill Down Report, surefire that security occurrences in the financial services industry occur 300 times more often than in different business parts.

The global financial services cybersecurity systems and services market is visualized to grant versatile undertaking administration as a commanding fragment anticipated that would secure a more grounded income of US$4.7 bn by 2022. Be that as it may, there could be more markets for financial services cybersecurity systems and services according to services and arrangement division indicating face. These could be character, endpoint security, and admission to administration, multipurpose security, datacenter security, occasion administration and security data, information misfortune aversion (DLP), firewall, and content security.

Browse Premium Industry Research Report with Analysis: https://www.transparencymarketresearch.com/financial-services-cybersecurity-systems-services-market.html

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants, use proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Contact us:

Transparency Market Research

90 State Street,

Suite 700,

Albany

NY - 12207

United States

Tel: +1-518-618-1030

USA - Canada Toll Free 866-552-3453

Email: sales@transparencymarketresearch.com

Website: http://www.transparencymarketresearch.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Services Cybersecurity Systems and Services Market Estimated to Flourish by 2022 here

News-ID: 836889 • Views: …

More Releases from Transparency Market Research

Handheld Marijuana Vaporizer Market Key Drivers, Market Research, and Insights f …

The global handheld marijuana vaporizer market has witnessed remarkable growth in recent years, attributed to the increasing acceptance of medicinal marijuana and the demand for convenient and discreet consumption methods. Valued at US$ 5 billion in 2021, the market is projected to surge at a CAGR of 13.4% to reach US$ 15.9 billion by 2031. This article delves into the factors driving this growth, the evolving market landscape, and the…

Disinfectant Wipes Market Forecast 2020-2030 - Market Size, Drivers, Trends, And …

The COVID-19 pandemic has precipitated a remarkable surge in the demand for disinfectant products, with a notable emphasis on disinfectant wipes as an essential tool in maintaining hygiene and preventing the spread of pathogens. This research report delves into the multifaceted landscape of the disinfectant wipes market, elucidating key trends, drivers, and innovations shaping the industry.

𝐆𝐞𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐫𝐞𝐩𝐨𝐫𝐭 @ https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=70359

Key Players and Market Developments

Key players…

Tissue Banking Market is Expected to Reach US$ 2,903.3 Million to 2026| TMR Stud …

The global 𝐭𝐢𝐬𝐬𝐮𝐞 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐦𝐚𝐫𝐤𝐞𝐭 reached a value of US$ 1,056.4 million in 2017 and is projected to nearly triple to US$ 2,903.3 million by 2026, with a robust Compound Annual Growth Rate (CAGR) of approximately 12.0% from 2018 to 2026. Factors such as increasing awareness about tissue donation, technological advancements, and a growing target patient population are anticipated to propel market growth during this period.

Moreover, the market is expected…

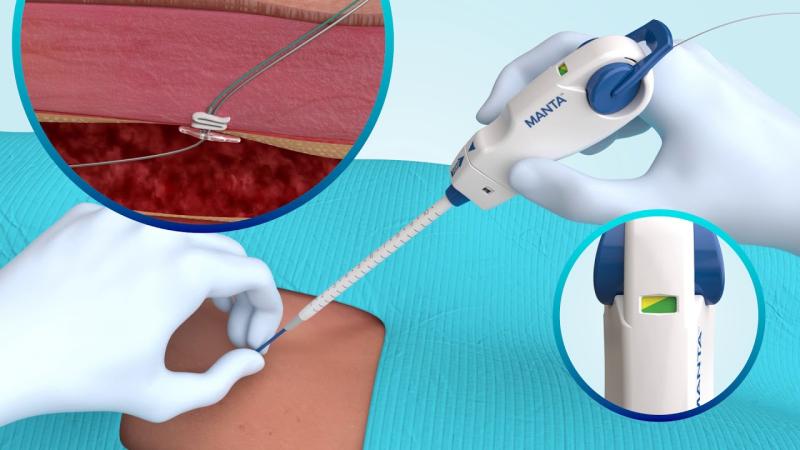

Vascular Closure Devices Market to reach US$ 1 Billion by 2027: TMR Study

This report by Transparency Market Research, Inc. assesses the present state and future growth potential of the global 𝐯𝐚𝐬𝐜𝐮𝐥𝐚𝐫 𝐜𝐥𝐨𝐬𝐮𝐫𝐞 𝐝𝐞𝐯𝐢𝐜𝐞𝐬 𝐦𝐚𝐫𝐤𝐞𝐭. It features a comprehensive executive summary, offering insights into various segments of the market. Additionally, the report provides detailed analysis and data on product, access type, application, end user, and regional segments within the global market.

Vascular closure devices is estimated to reach a value of ~US$ 1 Bn…

More Releases for Financial

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Outlook to 2023 – CDB Leasing, ICBC Financial Leasing …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

Request for Sample of Global Financial Leasing Market 2018 Research Report: https://www.researchreportsinc.com/sample-request?id=177516

Over the next five years, RRI…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Leasing Industry 2015-2020: CDB Leasing, ICBC Financial Leasing Co. Lt …

"The Latest Research Report China Research on Financial Leasing Industry, 2015-2020 provides information on pricing, market analysis, shares, forecast, and company profiles for key industry participants. - MarketResearchReports.biz"

About Financial Leasing Market

This report studies the Financial Leasing market status and outlook of global and major regions, from angles of manufacturers, regions and end industries; this report analyzes the top manufacturers in China and splits the Financial Leasing market by applications/end industries.

The…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…