Press release

Mobile Payment Transaction Service Market Growth to be Fuelled by Advancements in Technology

The mobile payment transaction service is an integrated system linked by various components of the value chain which typically includes the merchant, the consumer, the financial institution involved and not to forget the payment gateway and the telecom network. The global Mobile Payment Transaction Service market was valued at US$ 768.8 Bn in 2016 and is expected to expand at a CAGR of 18.7% during the forecast period (2017–2025). Demand for Mobile Payment Transaction Service is expected to be driven by increasing consumer demand for advanced technologies and enhanced experience by mobile applications for performing transactions.Market Dynamics

Proliferation of smartphones worldwide is expected to fuel market revenue growth over the forecast period. Increasing adoption of mobile money services across financial institutions and other vendors is another key market driver. Rapidly expanding urban population and a growing mobile broadband penetration is also anticipated to boost the revenue of the global mobile payment transaction service market over the forecast period.

Data privacy and the security threats associated with mobile payment transactions is likely to inhibit market growth during the forecast period. Further, lack of awareness of such systems is predicted to hamper revenue growth of the global mobile payment transaction service market.

Request Sample: https://www.persistencemarketresearch.com/samples/19108

Persistence Market Research presents a revised forecast for the global mobile payment transaction service market titled “Mobile Payment Transaction Service Market: Global Industry Analysis 2012 – 2016 and Forecast 2017 – 2025.” According to this report, the global Mobile Payment Transaction Service market was valued at US$ 768.8 Bn in 2016, and is expected to register a CAGR of 19.2% from 2017 to 2025. Increasing adoption of mobile money services across financial institutions and other vendors globally is the major factor driving revenue growth of the global Mobile Payment Transaction Service market.

The mobile payment transaction service is an integrated system linked by various components of the value chain which typically includes the merchant, the consumer, the financial institution involved and not to forget the payment gateway and the telecom network. The Global Mobile Payment Transaction Service market is categorized on the basis technology, purpose and region. On the basis of technology, the market is segmented as WAP/WEB, SMS, NFC, and USSD. The NFC sub segment is anticipated to register a CAGR of 24.2% during the forecast period.

On the basis of purpose segment, the market is segmented into Air time top ups, Bill Payment, Merchandise Purchase, Money Transfer, Ticketing, and Others. The Money Transfer segment accounted for a market share of 25.7% in 2016. Moreover, increasing adoption of mobile money services across financial institutions and other vendors globally is likely to contribute primarily to the growth of the segment in the global market in the coming years.

Download TOC: https://www.persistencemarketresearch.com/market-research/mobile-payment-transaction-service-market-102017/toc

This report also covers drivers, restraints and trends driving each segment and offers analysis and insights regarding the potential of the global Mobile Payment Transaction Service market in regions including North America, Latin America, Europe, Asia Pacific, and Middle East and Africa. Among these regions, Asia Pacific accounted for the largest market share in 2016 owing to a growing need of Mobile Payment Transaction Service due to increase in internet penetration in different countries in the region. Also, demand for Mobile Payment Transaction Service is increasing in the leading markets of North America and Europe.

Persistence Market Research (PMR) is a third-platform research firm. Our research model is a unique collaboration of data analytics and market research methodology to help businesses achieve optimal performance.

To support companies in overcoming complex business challenges, we follow a multi-disciplinary approach. At PMR, we unite various data streams from multi-dimensional sources. By deploying real-time data collection, big data, and customer experience analytics, we deliver business intelligence for organizations of all sizes.

305 Broadway,7th Floor

New York City, NY 10007

United States

+1-646-568-7751

+1 800-961-0353 (USA-Canada Toll free)

Email: sales@persistencemarketresearch.com

Website: https://www.persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Transaction Service Market Growth to be Fuelled by Advancements in Technology here

News-ID: 778018 • Views: …

More Releases from Persistance Market Research

Evolving Trends in the Insulin Pens Market: A Comprehensive Report

Market Overview:

The Insulin Pens Market has witnessed remarkable growth and innovation over the years. Insulin pens are medical devices used by individuals with diabetes to administer insulin easily and accurately. These devices have become an integral part of diabetes management, offering numerous advantages over traditional insulin delivery methods, such as syringes and vials.

In 2022, the global market for insulin pens brought in US$ 16.2 billion in revenue and is predicted…

Smart Machines Market to register growth at a CAGR of 20.1% throughout 2023-2033

The market for smart machines was valued at US$ 73,456.2 Mn in 2022, and it is expected to grow to US$ 5,44,986.6 Mn by the end of 2033. In 2023, the market for smart machines is expected to be worth US$ 87,045.6 Mn. From 2023 to 2033, the market for Smart Machines is expected to grow at a CAGR of 20.1%.

The market for artificially intelligent machines and systems that can…

Unified Cloud Communication and Collaboration Market will register a 11.1% CAGR …

The global cloud collaboration market was valued at US$ 48 billion in 2022, and it is expected to grow at an 11.1% CAGR, likely reaching US$ 137.3 billion by the end of the forecast period, which runs from 2022 to 2032. The expansion of organizations' cross-border projects, increased productivity, and the rise of the bring your own device (BYOD) trend are some of the major factors expected to drive the…

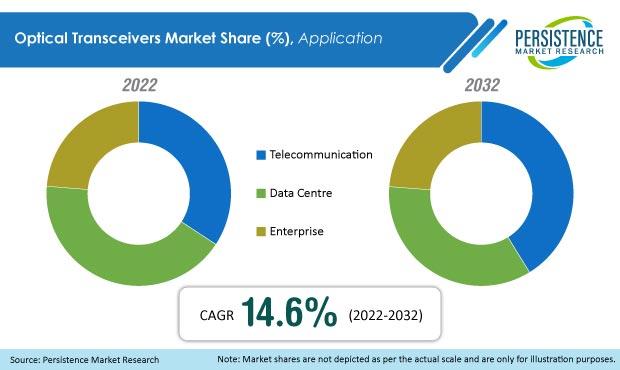

Optical Transceivers Market is Set to Grow At A CAGR Of 14.6 % By 2032

Persistence Market Research's new report "Optical Transceivers Market" examines the competitive landscape and the market's growth prospects in the coming years. The report of the Optical Transceivers market for the analysis period of 2023 - 2033 includes an in-depth study of some new and prominent industry trends, engagement analysis, and detailed regional analysis.

Need More Insights on Competitor Analysis of the Smart Home Cloud Platform Market, Request for Sample https://www.persistencemarketresearch.com/samples/4798

Through…

More Releases for Payment

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…

Payment Card Industry 2025 by Product (Contactless Payment, Card Contact Payment …

ReportsWeb.com has announced the addition of the “Global Payment Card Market Professional Survey Report 2018” ,provides a vital recent industry data which covers in general market situation along with future scenario for industry around the Globe.

Key Players -

MasterCard, Visa, American Express, Banco Itau, Bank of America Merrill Lynch, Bank of Brazil, Bank of East Asia, Chase Commercial Banking, Diner's Club, Hang Seng Bank, Hyundai, JP Morgan, SimplyCash, Sumitomo…

Payment Security Software Market 2018- Digital Transformation in Payment Methods …

Market Highlights

“The increasing number of cashless transactions is the main factor behind the rising demand for payment security software across the world,” says a FGR analyst. With the ongoing digital transformation, the payment market is witnessing a significant change in the pattern of financial transactions, which is shifting towards cashless increasingly.

The digitization across industries is leading to high investments in the development and the deployment of new technologies, encouraging…

Payment Gateway Industry Worth US$ 86.9 Billion By 2025 - Hosted Payment Gateway …

The merchants all over the globe are avidly willing to expand their businesses cross-border by adaption of a logical approach, by partnering with the payment gateways. With the help of this partnership, these merchants gain the advantage of tapping the opportunities created by the globalization of e-commerce. Majority of merchants today, are eyeing up global expansion and wish to grow at a faster pace, however, the last thing they would…

Contactless Payment Observe Huge Demand in Australia Payment Market

Pune, India, 04 December 2017: WiseGuyReports announced addition of new report, titled “Payments in Australia 2017: What Consumers Want”.

A 'payment system' is new technology that allows consumers, businesses, and many organizations to transfer money to a financial institution and vice versa. This includes Payment Instructions - Cash, Card, Check and Electronic Funds Transfer which customers use to pay - and generally unseen arrangements ensure that the funds move from one…