Press release

Future of the Shadow Banking– Market Attractiveness, Competitive Landscape and Key Players HSBC, Credit Suisse, Citibank, Deutsche Bank

HTF MI recently added a new research study in its database that highlights the in-depth market analysis with future prospects of Shadow Banking market. The study covers significant data which makes the research document a handy resource for marketing managers, analysts, industry executives, consultants, sales and product managers, and other key people who are in need of ready-to-access and self analyzed study along with graphs and tables to help understand market trends, drivers and market challenges. Some of the key players mentioned in this research are Bank of America Merrill Lynch, Barclays, HSBC, Credit Suisse, Citibank, Deutsche Bank, Goldman Sachs& Morgan Stanley.Get Access to sample pages @ https://www.htfmarketreport.com/sample-report/739977-global-shadow-banking-market-2

The research covers the current market size of the Global Shadow Banking market and its growth rates based on 5 year history data. It also covers various types of segmentation such as by geography, by product /end user type , by applications [ Banks, Finance& Other] in overall market. The in-depth information by segments of Shadow Banking market helps monitor performance & make critical decisions for growth and profitability. It provides information on trends and developments, focuses on markets and materials, capacities, technologies, CAPEX cycle and the changing structure of the Global Shadow Banking Market.

The study also contains company profiling, product picture and specifications, sales, market share and contact information of various international, regional, and local vendors of Global Shadow Banking Market, some of them are Bank of America Merrill Lynch, Barclays, HSBC, Credit Suisse, Citibank, Deutsche Bank, Goldman Sachs& Morgan Stanley. The market competition is constantly growing higher with the rise in technological innovation and M&A activities in the industry. Moreover, many local and regional vendors are offering specific application products for varied end-users. The new vendor entrants in the market are finding it hard to compete with the international vendors based on quality, reliability, and innovations in technology.

The research study is segmented by Application such as Banks, Finance& Other with historical and projected market share and compounded annual growth rate.

Global Shadow Banking (Thousands Units) by Application (2016-2022)

Market Segment by Application 2012 2016 2022 Market Share (%)2022 CAGR (%)

(2016-2022)

Banks xx xx xx xx% xx%

Finance xx xx xx xx% xx%

Other xx xx xx xx% xx%

Total xx xx xx 100% xx%

Geographically, this report is segmented into several key Regions, with production, consumption, revenue (million USD), and market share and growth rate of Shadow Banking in these regions, from 2012 to 2022 (forecast), covering

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/739977-global-shadow-banking-market-2

The research insights solutions to the following key questions:

• What will be the market size and the growth rate in 2022?

• What are the key factors driving the Global Shadow Banking market?

• Who are the key market players and what are their strategies in the Global Shadow Banking market?

• What are the key market trends impacting the growth of the Global Shadow Banking market?

• What trends, challenges and barriers are influencing its growth?

• What are the market opportunities and threats faced by the vendors in the Global Shadow Banking market?

• What are the key outcomes of the five forces analysis of the Shadow Banking market?

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=739977

There are 15 Chapters to deeply display the Global Shadow Banking market.

Chapter 1, to describe Shadow Banking Introduction, product scope, market overview, market opportunities, market risk, market driving force;

Chapter 2, to analyze the top manufacturers of Shadow Banking , with sales, revenue, and price of Shadow Banking , in 2016 and 2017;

Chapter 3, to display the competitive situation among the top manufacturers, with sales, revenue and market share in 2016 and 2017;

Chapter 4, to show the Global market by regions, with sales, revenue and market share of Shadow Banking , for each region, from 2012 to 2017;

Chapter 5, 6, 7, 8 and 9, to analyze the key regions, with sales, revenue and market share by key countries in United States, EU, Japan & China

Chapter 10 and 11, to show the market by type and application, with sales market share and growth rate by type, application [ Banks, Finance& Other], from 2012 to 2017;

Chapter 12, Shadow Banking market forecast, by regions, type and application, with sales and revenue, from 2017 to 2022;

Chapter 13, 14 and 15, to describe Shadow Banking sales channel, distributors, traders, dealers, Research Findings and Conclusion, appendix and data source.

Get customization & check discount for report @ https://www.htfmarketreport.com/enquiry-before-buy/739977-global-shadow-banking-market-2

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

sales@htfmarketreport.com

+1 (206) 317 1218

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future of the Shadow Banking– Market Attractiveness, Competitive Landscape and Key Players HSBC, Credit Suisse, Citibank, Deutsche Bank here

News-ID: 770142 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Blockchain Technology in Energy Market to Witness Huge Growth by 2030: WePower, …

The latest survey on Blockchain Technology in Energy Market is conducted to provide hidden gems performance analysis of Blockchain Technology in Energy to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of…

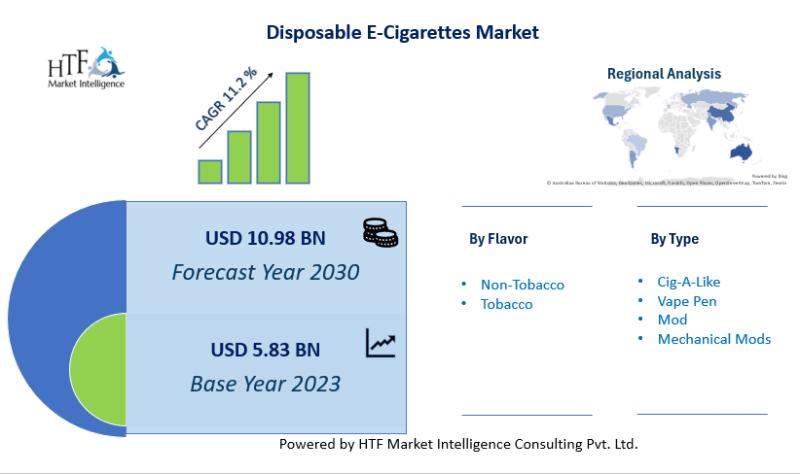

Disposable E-Cigarettes Market SWOT Analysis by Key Players- NJOY, YouMe, JAC Va …

The latest survey on Disposable E-Cigarettes Market is conducted to provide hidden gems performance analysis of Disposable E-Cigarettes to better demonstrate competitive environment. The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end-use applications. The report bridges the historical data from 2019 to 2023 and forecasted till 2030. The outbreak of the latest scenario in…

North America Luxury Tourism Market Comprehensive Study Explores Huge Growth in …

The latest study released on the North America Luxury Tourism Market by HTF MI Research evaluates market size, trend, and forecast to 2030. The North America Luxury Tourism market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Automotive LiDAR Market May See a Big Move: Major Giants Velodyne Lidar, Ouster, …

The Automotive LiDAR Market has witnessed continuous growth in the past few years and is projected to grow at a good pace during the forecast period of 2024-2030. The exploration provides a 360° view and insights, highlighting major outcomes of Automotive LiDAR industry. These insights help business decision-makers to formulate better business plans and make informed decisions to improve profitability. Additionally, the study helps venture or emerging players in understanding…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

What's driving the Neo and Challenger Bank Market trends? Key Players are Hello …

This Global Neo and Challenger Bank market report studies the industry based on one or more segments covering key players, types, applications, products, technology, end-users, and regions for historical data as well as provides forecasts for next few years.

The global Neo and Challenger Bank market is highly competitive and fragmented due to the presence of numerous small vendors in the market. Atom Bank, WeBank (Tencent Holdings Limited), N26, Starling Bank…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…