Press release

New Report Examines the Growth of Financial Services Market Forecast to 2024

Global Financial Services Market: OverviewEfficiency in financial services is considered to be the backbone of any economy. Financial services indicate the socio-economic wellbeing of any country. With rapid globalization, financial service application providers are faced with the uphill task of providing the end-users with software and applications that are risk-free, compliant, and data driven. In modern times, the strength of a country is determined by how well it progresses financially. Thus, financial systems require to function properly in order to bring in smooth and stable governance.

An increasing number of banks and financial institutions have been focusing on attracting consumers with decisive market strategies. Banks around the world are, therefore, compelled to shift from their traditional accounting services to more value added solutions such as mutual funds, insurance, mortgages, and pensions.

Browse Market Research Report @ http://www.transparencymarketresearch.com/financial-services-market.html

In order to achieve this, it is important for these institutions to automate their financial services, so that they are able to focus on their core competencies. The development of a consumer-centric approach is also considered essential in this regard. Financial services applications and software, which run on disparate technological platforms, have emerged as a perfect solution to cater to the aforementioned needs.

The report defines the global financial services apps and software market as the total sum of revenues generated from the deployment of financial services application software across the world. The key factors impacting the growth trajectory of the market have been evaluated in the report in detail. The report also identifies the most lucrative opportunities for the enterprises operating in the market.

Global Financial Services Market: Key Opportunities and Threats

Solutions provided by enterprises operating in the global financial services applications market enable organizations to use valuable financial data to plan and optimize operations and explore new opportunities with the help of software. Automating banking and financial processes has become necessary for organizations to keep track of the increasing magnitude of financial transactions. The software applications designed by financial service providers enable banks and financial institutions to digitize their daily tasks, therefore, allowing them to concentrate on their core competencies.

Organizations nowadays are concentrating on areas such as BI and analytics, audits, enhanced customer experience, and risk and compliance management. This change has been brought about by the evolving economic and regulatory environment. Hence, government institutions around the world have realized the need to shift from traditional practices to more automated alternatives. This has proven to be extremely beneficial for the global financial services applications market.

View TOC for this Market Report @ http://www.transparencymarketresearch.com/sample/sample.php?flag=T&rep_id=10706

Global Financial Services Market: Region-wise Outlook

Regionally, the global financial services market can be segmented into Asia Pacific, Europe, North America, and Rest of the World. The developed nations have been dominant in the global financial services applications market. However, emerging regions such as Asia Pacific, Latin America, the Middle East, and Africa also have been exhibiting lucrative opportunities for vendors operating in the market, since they are yet to expansively adopt financial service applications.

Global Financial Services Market: Vendor Landscape

The most prominent vendors operating in the global financial services application market are FIS, Accenture, IBM Corporation, FISERV, SAP AG, Infosys, Oracle, and TCS. These companies have been capitalizing on technological advancements, market liberalization, and innovation to attract customers and gain a competitive edge in the market.

About Us

Transparency Market Research (TMR) is a global market intelligence company providing business information reports and services. The company’s exclusive blend of quantitative forecasting and trend analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of analysts, researchers, and consultants use proprietary data sources and various tools and techniques to gather and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Contact Us

Transparency Market Research

State Tower,

90 State Street, Suite 700

Albany, NY 12207

United States

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Email: sales@transparencymarketresearch.com

Website: http://www.transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Report Examines the Growth of Financial Services Market Forecast to 2024 here

News-ID: 719513 • Views: …

More Releases from Transparency Market Research

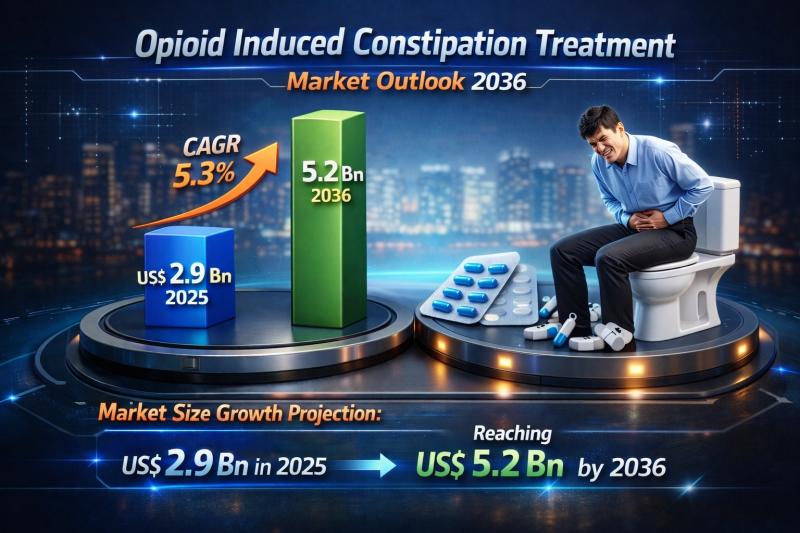

Global Opioid Induced Constipation Treatment Market Set to Reach USD 5.2 Billion …

The global opioid induced constipation (OIC) treatment market is witnessing steady and sustained growth as healthcare systems worldwide place increasing emphasis on comprehensive pain management and supportive care. Valued at US$ 2.9 billion in 2025, the market is projected to reach US$ 5.2 billion by 2036, expanding at a compound annual growth rate (CAGR) of 5.3% from 2026 to 2036. Growth is primarily fueled by the rising prevalence of chronic…

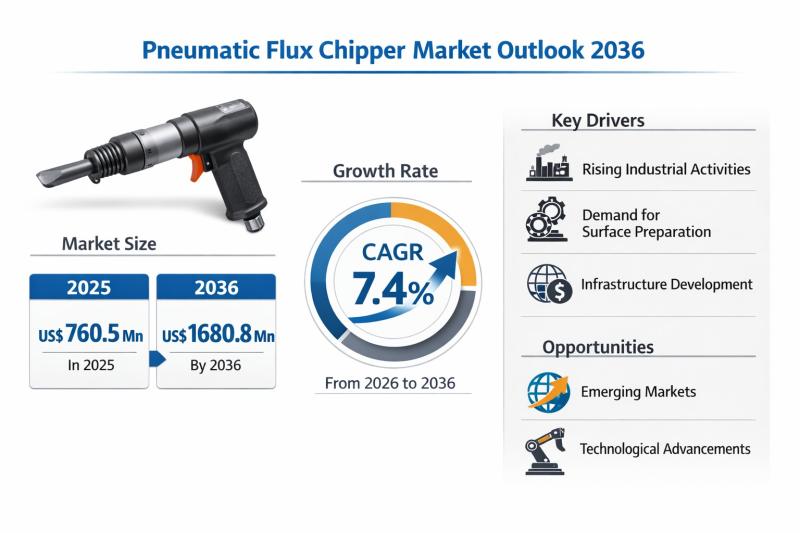

Pneumatic Flux Chipper Market Expanding at 7.4% CAGR Through 2036 - By Product T …

The global Pneumatic Flux Chipper Market is set to witness sustained and resilient growth over the next decade, underpinned by expanding heavy manufacturing activities, rising welding and fabrication demand, and continuous investments in industrial infrastructure across emerging and developed economies. According to the latest industry analysis, the market was valued at US$ 760.5 Mn in 2025 and is projected to reach US$ 1,680.8 Mn by 2036, expanding at a compound…

AI in Automotive Market Outlook 2036: Global Industry to Surge from US$ 19.8 Bil …

The AI in automotive market is entering a phase of exponential expansion, supported by rapid digitization of vehicles, growing safety mandates, and consumer demand for intelligent mobility. The global market was valued at US$ 19.8 Bn in 2025 and is projected to reach US$ 244.4 Bn by 2036, registering a remarkable CAGR of 27% from 2026 to 2036.

This growth trajectory reflects the transition of automobiles from mechanically driven products to…

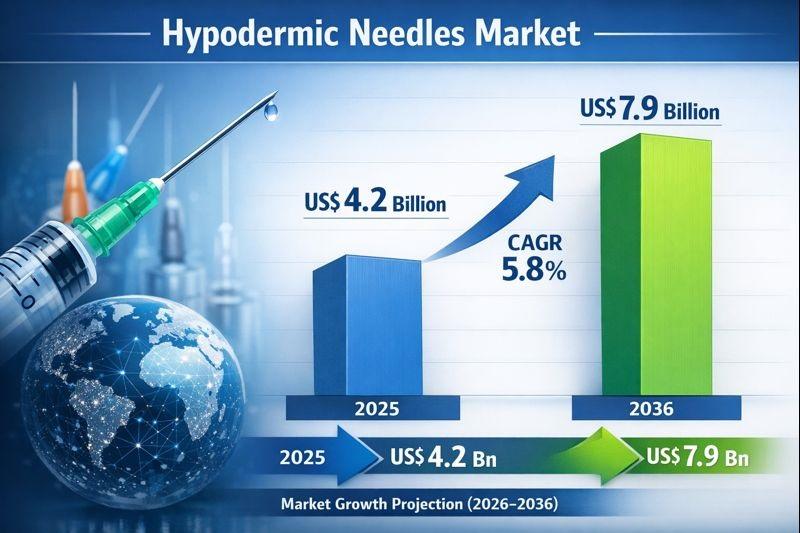

Hypodermic Needles Market to Reach US$ 7.9 Billion by 2036 on Rising Injectable …

The global hypodermic needles market was valued at approximately US$ 4.2 billion in 2025 and is projected to reach around US$ 7.9 billion by 2036, expanding at a CAGR of nearly 5.8% from 2026 to 2036, driven by the rising prevalence of diabetes, cancer, and chronic diseases, growing demand for injectable drugs and biologics, and the expansion of global vaccination and immunization programs; increasing adoption of safety-engineered and disposable needles,…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…