Press release

Insights from 1000+ Industrial and Scientific Cameras

The online product selector Imaging.market has crossed the 1000-camera line. This is a major milestone on its mission to support faster development of better imaging systems at lower cost. The aggregated portfolio of 11 camera manufacturers constitutes a comprehensive cross section of the global market, which allows vision system developers to find a range of cameras from different suppliers for almost every requirement specification. At the same time, this portfolio allows for insightful analysis of the camera market, which shows a leading position of CMOS Global Shutter sensors, a 50% share of Sony sensors, and just 8% lag of USB 3.0 behind GigE.Imaging.market is now hosting close to 1100 area scan, line scan and smart cameras as well as camera modules from the manufacturers Baumer, FLIR Systems (formerly Point Grey), Kaya Instruments, Lumenera, Matrix Vision, Mikrotron, Pixelink, Smartek Vision, Sony, Tamron and Tattile.

The cameras are presented with their individual user benefits, specifications, descriptions, user manuals, educational content, videos, and matching accessories like lenses, cables, and frame grabbers. Each of the 1000 area scan cameras is characterized by a standardized, extensive set of technical and commercial attributes, which has been specifically developed by machine vision experts.

This does not only allow users to filter the portfolio according to their requirements and to compare selected products side by side – it also allows for insightful statistics on the current camera market.

When Sony introduced their first Pregius™ CMOS sensor IMX174 with global shutter (GS) late 2013, experts realized that the ubiquitous CCD technology would widely fade away in the long run. The long run, however, turned out to be quite short: Today, more cameras with CMOS global shutter sensors are promoted than with any other sensor technology. Out of Imaging.market’s 1000 area scan cameras, 613 are CMOS based.

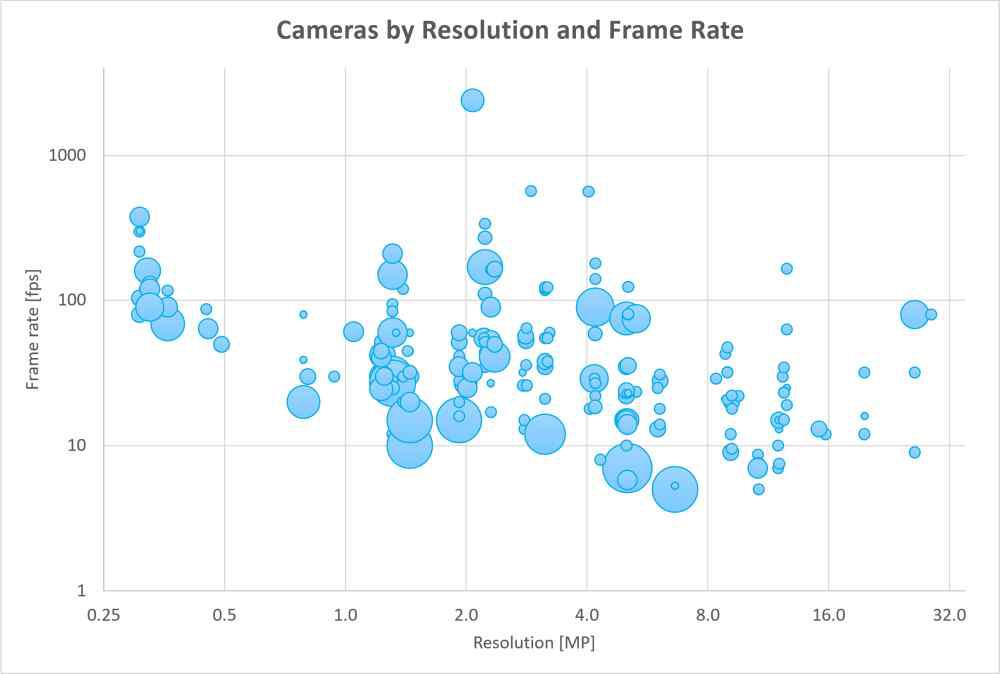

Thanks to the pixel architecture with integrated digitization, CMOS sensors can be read out much faster and it is easier to scale their size with less detrimental effects on the image quality compared to analog CCD sensors. Therefore, much more cameras with high frame rates and high resolution enrich modern camera portfolios. The figure shows the distribution of cameras over resolution and frame rate. Each bubble stands for a set of cameras with the same characteristics, while the size of the bubble indicates the number of cameras in the set.

One cluster of 112 cameras with both, CCD and CMOS sensors, features resolutions around 0.4 megapixels (VGA). CMOS cameras of this resolution reach frame rates of up to 400 fps. The majority of 470 cameras however provides resolutions between 1.2 and 3 megapixels, most with frame rates between 25 and 60 fps. Thanks to advances in high-speed CMOS sensors, as provided by Alexima, Full HD resolution can be recorded at 2400 fps, e.g. with the KAYA JetCam 19.

With the widely adopted 5MP CCD sensors ICX625 and ICX655 as well as e.g. the CMOS GS sensors CMV4000 from Cmosis, Python 5000 from ON Semi, and Sony’s first sensors of the second Pregius generation IMX250 / IMX264, the 4 to 5.5 MP range is well covered at rates between 7 and up to 563 fps.

Close to 50% of industrial and scientific area scan cameras on Imaging.market utilize image sensors from Sony, 133 of them CMOS GS sensors of the Pregius series. ON Semiconductor (including Aptina) branded sensors can be found in 35% of the cameras, where 131 are CMOS GS based. Cmosis has a share of 11%.

On Imaging.market, users can also filter their cameras by the sensor format as this is often decisive for the optical design of a vision system. The cameras are almost evenly distributed over four major categories, today.

Especially, image sensors larger than 2/3” are much more common and accepted in the age of CMOS GS, where high resolutions are required but pixels need to maintain a certain size for high sensitivity and wide dynamic range.

The trend towards higher resolution and frame rate also affects the distribution of camera interfaces. While Gigabit Ethernet is still leading, the bandwidth requirements of most CMOS GS models require at least USB 3.0 to achieve their maximum performance. Thus, USB 3.0 can now already be found with 29% of the cameras. Yet, for high-speed sensors from Sony (e.g. IMX250, IMX252), ON Semiconductor (e.g. Python 5000, Python 25k), Cmosis (e.g. CMV2000, CMV4000, CMV12000, CMV20000) and Alexima (e.g. LUX19HS, AM41), interfaces like CoaXPress, Camera Link, 10 GigE, or proprietary technologies as the KAYA Optical Fiber interface are required. So far, these interfaces can be found at 48 cameras out of 1000.

These statistical analyses and much more detailed statistics beyond are made possible by the continued effort of Imaging.market and its suppliers to unify the specification of cameras, lenses, frame grabbers, and other accessories in a standardized set of technical and commercial attributes.

Besides market studies, these efforts primarily support vision system developers, purchasers and other users of imaging components with their challenge, of finding, selecting and purchasing the right vision products for their applications. Users of the free-of-charge online platform www.Imaging.market can quickly filter the competitive portfolio for products, which fulfill their requirements. Hence, it is easy to compare the features of selected products side by side, thanks to the standardized specification. Beyond all, platform users can request best-price quotations from each manufacturer of their selected vision products with few clicks and thus speed up their entire development and purchasing processes.

Imaging.market is an online platform, designed to simplify and accelerate the product selection process for vision system developers, product managers and purchasers in imaging. Thanks to rich product data, unified specification by detailed technical and commercial product attributes and modern user interface features, platform users can quickly identify and compare products, which fulfill their requirements. Hence, they can request more information and a quotation from each manufacturer of the selected products with a single click and free of charge. To constantly increase the value for customers and suppliers, the team of Imaging.market is continuously adding new products and usability features to the platform.

Ganghoferstr. 13

82291 Mammendorf

Germany

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insights from 1000+ Industrial and Scientific Cameras here

News-ID: 677933 • Views: …

More Releases for CMOS

CMOS and sCMOS Image Sensors CMOS and sCMOS Image Sensors

The latest CMOS and sCMOS Image Sensors market study offers an all-inclusive analysis of the major strategies, corporate models, and market shares of the most noticeable players in this market. The study offers a thorough analysis of the key persuading factors, market figures in terms of revenues, segmental data, regional data, and country-wise data.

Request a sample on this latest research report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=5096977

Top Key Players are covered in this report:…

Global In-vehicle Camera CMOS Market

Global In-vehicle Camera CMOS Market Overview:

The latest report published by QY Research demonstrates that the global In-vehicle Camera CMOS market will showcase a steady CAGR in the coming years. The research report includes a thorough analysis of the market drivers, restraints, threats, and opportunities. It addresses the lucrative investment options for the players in the coming years. Analysts have offered market estimates at a global and a regional level. The research…

Global CMOS Sensor Market Insights, Forecast

The CMOS Sensor market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been considered as the base year and 2018 to 2025 as the forecast period to estimate the market size for CMOS Sensor

Get sample copy of the report:

https://www.marketdensity.com/contact?ref=Sample&reportid=49874

Table of Contents:

Table of Contents

1 Study Coverage

1.1…

CCD And CMOS Sensors Market Report 2018: Segmentation by Type (CMOS sensor, CCD …

Global CCD And CMOS Sensors market research report provides company profile for Coherent, E2V Technologies Plc, Galaxycore Inc., Infineon Technologies Ag, M2 Optics Inc., Agilent Technologies Inc., Alcatel-Lucent (Nokia Group), Broadcom Ltd., Cmosis N.V. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate,…

CMOS Image Sensor Market Report 2018: Segmentation by Product (Front-illuminated …

Global CMOS Image Sensor market research report provides company profile for ST, Nikon, PixelPlus, Pixart, SiliconFile, GalaxyCore, Sony, Samsung, OmniVision, Canon, On Semi (Aptina), Toshiba and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc.…

CMOS Camera Lens Market Outlook 2022:Analysis By Type(Ordinary CMOS Camera Lens, …

CMOS Camera Lens Market Overview

Brief Description:Miniature CCD/CMOS lenses are designed to provide optimal image performance for a variety of applications using CCD/CMOS imaging sensors. Typical consumer product applications include: digital cameras, PC cameras, cell phone and PDA cameras, security cameras, etc

The Global CMOS Camera Lens Market skilled Survey Report scrutinizes the prevailing state of affairs and also the destiny growth potentialities of the business. It covers the market place…