Press release

Global Corporate Travel Insurance Market (2017-2024)- Research Nester

Corporate travel insurance is an insurance that is meant to cover medical expenses and others losses incurred while doing business travel. Corporate travel insurance includes an extensive range of benefits for various events such as trip cancellation, loss of baggage, evacuation due to medical conditions and others.Market Size and Forecast

The corporate travel insurance market is showcased to witness a robust growth during the forecast period 2017-2024. The market is anticipated to flourish at a CAGR of 8.6% over the forecast period. Increase in business travels is expected to foster the growth of corporate travel insurance market across the globe.

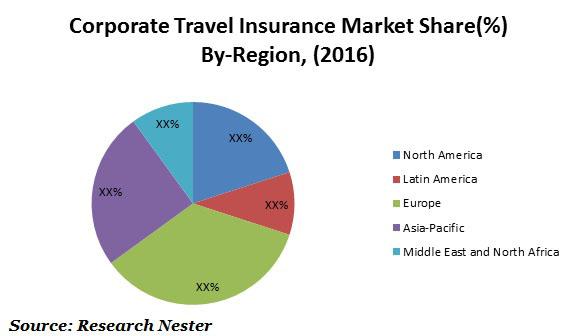

Geographically, Europe region accounts for the largest market share in global corporate travel insurance market followed by Asia-Pacific.

For Sample Pages please go through link below: http://www.researchnester.com/sample-request/2/rep-id-326

Moreover, Europe is anticipated to continue its dominance over the forecast period owing to recent terror attacks in France, Germany, and other European countries. Moreover, rise in number of business travelers with high travel spending is expected to garner the growth of corporate travel insurance market in this region. Germany and France is likely to capture the largest market share in European corporate travel insurance market.

Asia-pacific is anticipated to maintain second position over the forecast period. The major countries witnessing the increased demand for corporate travel insurance include China, Korea and Japan. North America region is also witnessing a positive corporate travel insurance growth and is expected to witness the significant growth over the forecast period. Further, in North America, enhanced travel options and advanced technological access have made business traveler’s access to insurance companies easier, thereby escalating the adoption rate of corporate travel insurance.

Market Segmentation

Our in-depth analysis segmented the global corporate travel insurance market in the following segments:

By Insurance

Single trip travel insurance

Annual multi-trip travel insurance

Long-stay travel insurance

By Distribution Channel

Bank

Insurance company

Insurance intermediaries

Insurance broker

Others

By Region

Global corporate travel insurance market is further classified on the basis of region as follows:

North America (U.S. & Canada) Market size, Y-O-Y growth & Opportunity Analysis

Latin America (Brazil, Mexico, Rest of Latin America) Market size, Y-O-Y growth & Opportunity Analysis

Western and Eastern Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, Rest of Western Europe) Market size, Y-O-Y growth & Opportunity Analysis

Asia-Pacific (China, India, Japan, Singapore, Australia, New Zealand, South Korea &Rest of Asia-Pacific) Market size, Y-O-Y growth & Opportunity Analysis

Middle East and North Africa (MENA) Market Size and Y-O-Y Growth Analysis

Growth Drivers and Challenges

Increase in expansion of business across the globe coupled with rising business travelers is anticipated to foster the demand for corporate travel insurance. Further, rising awareness among business travelers is anticipated to be the dynamic factor behind the rapid growth of corporate travel insurance market. Also, government regulation of several countries have made travel insurance mandatory, which is envisioned to bolster the growth of corporate travel insurance market.

Request For TOC Here: http://www.researchnester.com/toc-request/1/rep-id-326

However, lack of awareness about insurance policies is believed to dampen the growth of corporate travel insurance market. Moreover, this can be attributed to various factors such as low percentage level of economic development of countries, extent of saving in financials and the reach of insurance sector.

Key players

The major key players for corporate travel insurance market are as follows

CSA Travel Protection

Company Overview

Key Product Offerings

Business Strategy

SWOT Analysis

Seven Corners

TravelSafe Insurance

USI Affinity

ACE Asia Pacific

Allianz Global Assistance

American International Group Inc.

AXA

Scope and Context

Overview of the Parent Market

Analyst View

Segmentation

The global corporate travel insurance market is segmented as follows:

By Insurance Market Size & Y-O-Y Growth Analysis

By Distribution Channel Market Size & Y-O-Y Growth Analysis

By Region Market Size & Y-O-Y Growth Analysis

Market Dynamics

Supply & Demand Risk

Competitive Landscape

Porter’s Five Force Model

Geographical Economic Activity

Key Players (respective SWOT Analysis) and their Strategies and Product Portfolio

Recent Trends and Developments

Industry Growth Drivers and Challenges

Key Information for Players to establish themselves in current dynamic environment

To know more about this research, kindly visit: http://www.researchnester.com/reports/corporate-travel-insurance-market-global-demand-analysis-opportunity-outlook-2024/326

For Table of Content & Free Sample Report Contact:

Ajay Daniel

Email: ajay.daniel@researchnester.com

U.S. +1 646 586 9123

U.K. +44 203 608 5919

Web: www.researchnester.com

Research Nester is a global market research and consulting firm helping organizations, private entities, governments undertaking, non-legislative associations and non-profit organizations. With our decades of experience in the market research, we help our clients to gain a competitive edge over other players. Thus, helping them making strategic yet dynamic decisions for the future investments.

Ajay Daniel

Email: ajay.daniel@researchnester.com

U.S. +1 646 586 9123

U.K. +44 203 608 5919

1820 Avenue M, Suite# 1113,

Brooklyn, New York 11230

web : www.researchnester.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Corporate Travel Insurance Market (2017-2024)- Research Nester here

News-ID: 643209 • Views: …

More Releases from Research Nester Pvt Ltd

Chemical Fertilizers Market Outlook By Industry Size, Share, Revenue, Regions An …

The chemical fertilizers market has been segmented into macronutrients, micronutrients, application and forms. Based on macronutrients, the market has been segmented into nitrogen based fertilizers, phosphate based fertilizers and potash based fertilizers.

Among these segments, the nitrogen based fertilizers are estimated to dominate the market by holding the largest share of approximately 50%. This can be attributed to the absorption of nitrogen by plants. In 2013, the demand for nitrogen…

Glass Coating Market Overview By Share, Size, Industry Players, Revenue And Prod …

The global glass coating market is segmented by coating type into pyrolytic coating, magnetic sputtering coating and sol-gel coating; by technology into liquid glass coating and nano glass coating; by application into construction, paints & coating, automotive, aviation and others and by regions.

According to Federal Reserve Bank of Chicago represents increase in sales of light vehicle in China by 2.1%, Latin America by 6.2%, Europe by 2.6%, and Rest…

Insect Repellent Market Outlook By Industry Size, Share, Revenue, Regions And To …

The global insect repellent market is segmented by repellent type into coils, liquid vaporizers, sprays/aerosol, mats, cream and oil; by ingredient into natural and synthetic; by sales channel into online and offline and by regions. The insect repellent market is anticipated to mask a CAGR of 8.3% during the forecast period i.e. 2019-2027.

The rising penetration of insect repellents in untapped rural markets across the developing countries as well as…

Waterproofing Chemicals Market 2017 Share Growing Rapidly With Latest Trends, De …

The global waterproofing market is segmented on the basis of type, application and end-use. The market is segmented on the basis of type, it is segmented into Bitumen, PVC, TPO and EPDM. Bitumen leads the product segment in 2017 on the account of superior properties which include high viscosity, resistance to UV light and better binding nature. On the basis of application, it is segmented into Roofing and Walls, Flooring,…

More Releases for Insurance

Household Insurance market by top keyaplayers - Discount Insurance Home Insuran …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance marketgrowth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market have also been included in…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Non-Life Insurance Market :Health Insurance, Property Insurance, Cargo Insurance …

Non-Life Insurance Market Overview:

Summary:Excellence consistency maintains by Garner Insights in Research Report in which studies the global Non-Life Insurance market status and forecast, categorizes and Equipment market value by manufacturers, type, application, and region.

Get Access to Report Sample: http://bit.ly/2Q9Hd8z

Non-Life Insurance market was valued at Million US$ in 2017 and is projected to reach Million US$ by 2025, at a CAGR of during the forecast period. In this study, 2017 has been…

Agricultural Insurance Market 2018-2023: AnHua Agricultural Insurance, Anxin Agr …

A new research study titled, “Global Agricultural Insurance Market” has been added to the comprehensive repository of Orbis Research

Agricultural Insurance Market - Global Status and Trend Report 2018-2023 offer a comprehensive analysis of the Agricultural Insurance industry, standing on the readers’ perspective, delivering detailed market data and penetrating insights. No matter the client is the industry insider, potential entrant or investor, the report will provide useful data and information.

The…

Insurance Market-Saga’s Retail Broking Business Offers Motor Insurance, Pet In …

Orbis Research Market brilliance released a new research report of 33 pages on title ‘Insurance Company Profile: Saga’ with detailed analysis, forecast and strategies.

Insurance Company Profile: Saga", profile provides a comprehensive review of Saga and its UK business. This includes its strategy for growth and focus on digitization as well as its performance in the UK and marketing and distribution strategy.

Request a sample of this report at http://orbisresearch.com/contacts/request-sample/2026595

Saga…