Press release

Cross Hedging of Various Asset Classes is more effective than Direct Hedges : Research Study

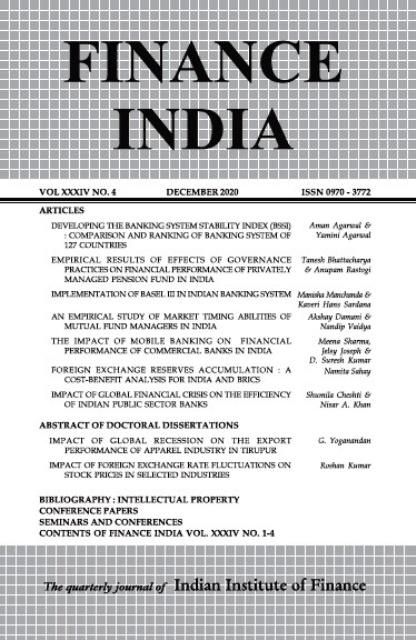

According to a research study titled “Cross Hedging of Various Asset Classes : Review and Analysis” by Prof. Namita Sahay, Amity University, Noida, published in the recently released, Vol. XXX No. 4, December 2016 issue of Finance India-Quarterly journal of Finance published by Indian Institute of Finance, Cross hedges have been found to be more effective than direct hedges. The effectiveness of hedging is judged by finding optimal hedge ratio with different models like minimum valance model, Daily Dynamic Conditional Correlation (DCC) - GARCH, traditional cross hedging, multiplicative cross hedging & Bayesian Procedures.Today, Cross hedging has emerged as an effective tool to reduce price risk for different classes where a direct hedge through futures market is not available.

Many studies have been conducted to explore the correlation between different asset classes like currency, commodity, stocks, and stock index, insurance and inflation derivatives and analyze the maximum risk reduction possible with different portfolios and combinations.

The paper analyzed several studies conducted on cross hedging ranging from simple currency and commodity derivatives to complex inflation and insurance derivatives. The methodology used for these studies and also the effectiveness of these techniques have been studied and analyzed. Starting from hedging major currency exposures, with a direct hedge, studies have been done on hedging even minor currencies exposures.

Studies have also shown that cross hedging has been done between foreign currency and a third currency where a triangular parity condition existed between home, foreign and third currency, since, no hedging instrument was available with the home currency.

According to the research paper, cross hedging has also been conducted on various commodities like US Hay, New Mexico Alfalfa Hay with corn futures; between fishmeal and soyabean meal and corn futures; ethanol with unleaded gasoline futures; jet fuel price risk with crude oil, Brent, WTI, heating oil and gasoil futures; winter canola with soyabean oil futures to name a few. Researchers have even explored conducting cross currency-commodity hedging in case of strong correlation between currency and commodity.

Overall, the idea has been to select an asset with a strong correlation and which ultimately reduces the hedging cost.

Indian Institute of Finance set up 1987 as a non profit education institution pioneered Business Finance Education in the country.

Indian Institute of Finance

45A, Knowledge Park III, Greater Noida

Ph : 0120-6471004; 9811971002

www.iif.edu

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cross Hedging of Various Asset Classes is more effective than Direct Hedges : Research Study here

News-ID: 467524 • Views: …

More Releases from INDIAN INSTITUTE OF FINANCE

"Banks should pay interest on monthly basis on Savings Accounts & Deposits of ov …

Prof. Aman Agarwal (Director, Indian Institute of Finance) welcomes the decision of Reserve Bank of India (RBI) to have accommodative stance by keeping the policy (interest) rates unchanged despite the changes in interest rates affected in some of the countries.

Prof. Agarwal in a letter to the RBI Governor, Shri Shaktikant Das and the Finance Minister Shrimati Nirmala Sitaraman, has urged that RBI to consider the payment of interest on…

“Long-term relationship exists between financial development and economic grow …

The economic and financial development in India deserves a well-calibrated policy response said Prof. Naliniprava Tripathy, Professor (Accounting & Finance), Indian Institute of Management, IIM Shillong, while delivering a Webinar on Financial Development and Economic Growth Nexus : Indian Experience organised by IIF College of Commerce and Management Studies, Greater Noida. Her research paper, co authored with Dr. Shekhar Mishra, Assistant Professor, C V Raman College of Engineering, Bhubaneshwar on…

“Commerce and Business Studies open a plethora of career options” : Prof. An …

Commerce is an interdisciplinary subject covering Accounting, Finance, Marketing, E-Commerce, Taxation, Auditing and Management said Prof. Anil Kumar, Professor, Shri Ram College of Commerce, University of Delhi, Delhi, while delivering a Webinar on Opportunities in Commerce and Business Studies organised by IIF College of Commerce and Management Studies, Greater Noida. He further explained that students need to have the skills of analysing numerical data, good communication and problem solving ability…

“Banking System Stability Index (BSSI) proposed to Rank the Banking Systems in …

IIF has developed a Banking System Stability Index (BSSI) to rank the banking systems in different economies. BSSI has been developed using key financial system soundness indicators which then leads to the determination of ranks of the banking Systems in 127 countries worldwide. This is for the first time that such an index has been developed and countries based on their BSSI, have been ranked. All countries have been…

More Releases for Cross

Platelet and Plasma markets Share Trends Analysis Growth: America's Blood Center …

Rising incidence of haemophilia, thrombocytopenia, autoimmune diseases as well as other infectious and rare disease will serve to be a key driver for the platelet and plasma market growth. According to American Academy of Neurology, plasma can be used for treatment of various neurological conditions. Plasma exchange process involves replacing plasma in a person’s blood. This process can be used for treatment of conditions such as inflammatory dysimmune neuropathies, multiple…

Platelet and Plasma Market 2018: Study on Top Players | America’s Blood Center …

Platelet and Plasma Market size is set to exceed USD 6.5 billion by 2024; according to a new research report by Global Market Insights.

Increasing prevalence of chronic diseases such as liver cirrhosis, non-alcoholic steato-hepatitis (NASH) hepatocellular carcinoma and other liver diseases will fuel the market growth during the foreseeable years. Liver diseases are the fifth most common cause of mortality across the world. According to American Association for the Study…

Platelet and Plasma Market Prominent Players – America’s Blood Centers, Amer …

Platelet and Plasma Market size is set to exceed USD 6.5 billion by 2024; according to a new research report by Global Market Insights.

Increasing prevalence of chronic diseases such as liver cirrhosis, non-alcoholic steato-hepatitis (NASH) hepatocellular carcinoma and other liver diseases will fuel the market growth during the foreseeable years. Liver diseases are the fifth most common cause of mortality across the world. According to American Association for the…

Platelet and Plasma Market : Illustrious Companies - America’s Blood Centers, …

Platelets And Plasma Market will exceed USD 6.5 billion by 2024; as per a new research report.

Increasing number of blood transfusion in regions such as Europe will drive the growth of platelets and plasma market over the forecast period. Millions of people receive donated blood and its components each year. As per the statistics of the European commission over 20 million units of blood or blood components were transfused in…

Platelet and Plasma Market : Study on Key Players | America’s Blood Centers, A …

Platelet and Plasma Market size is set to exceed USD 6.5 billion by 2024; according to a new research report by Global Market Insights.Growing number of blood transfusions globally is another impact rendering factor for the growth of platelets and plasma market. According to European commission’s 2017 annual report, more than 25 million units of blood and blood components were being issued for the purpose of transfusion in Europe. Blood…

Platelet and Plasma Market : Study on Eminent Players | America’s Blood Center …

Platelet and Plasma Market size is set to exceed USD 6.5 billion by 2024; according to a new research report by Global Market Insights.

Increasing prevalence of chronic diseases such as liver cirrhosis, non-alcoholic steato-hepatitis (NASH) hepatocellular carcinoma and other liver diseases will fuel the market growth during the foreseeable years. Liver diseases are the fifth most common cause of mortality across the world. According to American Association for the Study…