Press release

Italian True Fleet Market continues to produce record figures

Italian True Fleet has continued on from its outstanding form in 2016 by producing an exceptional start to 2017. The fleet market produced the highest volume on record for a January with a robust + 9.2% growth over January 2016 figures. This has helped propel the passenger car Total Market to finish with 172,000 registrations equating to a + 8.7% in terms of growth.Inside January’s Top 20 models for True Fleet we found some high climbers in terms of volume, with no less than seven new entries. The Fiat Tipo was the highest climber moving from 77th to 3rd with release date perhaps playing a factor. The same might be said of the VW Tiguan moving from 61st to 7th, the BMW X1 jumping from 44th to 15th and the Opel Astra accelerating from 39th to 16th which could have also capitalised with their new generation releases. The Fiat Punto moving from 51st to 8th the Lancia Ypsilon shifting from 26th to 9th and the Mercedes GLC rising from 30th into 14th were the remaining entries with only 106 units separating them.

We decided on taking a deeper look into the Middle-Class vehicle segment. The segment had suffered a significant decline between the 2006 high of 72,620 till the 2013 low of 28,104 but the last four years has seen it once again start to grow. While on the surface this is perhaps the result of German brands continuing to dominate the market with more models available than ever before, it might also be a reflection on the other brands not having a product that matched the markets needs or wants and thereby losing some market share. There are however clear signs that manufacturers still regard this segment as open for disruption.

Alfa Romeo has re-emerged into this vehicle class bringing the new Giulia to where they had once competed with the 156 and the 159 before a seemingly 4 year hiatus for the manufacturer. After returning in 2016 the Giulia finished with 5.2% of the market share and in 2017 they have already managed to claim 4th position in the model ranking for January behind BMW 3 series in 1st, VW Passat in 2nd and Audi A4 in 3rd.

However for 2017 the Alfa Romeo brand may well encounter some competition along the way. Opel will release the new Insignia, the Skoda Superb finished out 2016 with record numbers, tripling its volume from 2015 and with the resurgence of the Jaguar brand, alongside three new engines available for the Jaguar XE mean it may not be as straight forward as it first seems. What we can see is room for the Middle Class vehicles to continuing to regain some of the lost True Fleet segment share in Italy.

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Contact: Mario Zagar

Dataforce Verlagsgesellschaft für

Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-229

Fax: +49 69 95930-333

E-Mail: mario.zagar@dataforce.de

www.dataforce.de

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Italian True Fleet Market continues to produce record figures here

News-ID: 446216 • Views: …

More Releases from Dataforce Verlagsgesellschaft für Business Informationen mbH

What is the Dataforce Sales channel outlook for 2021?

Following a contraction of around 26% in 2020 things can only get better. But how fast will the recovery be and what is the outlook for the channels?

Slow start, rev up

We expect the first half year of 2021 to remain rather challenging. Strict Containment measures will probably need to be maintained into spring, which will weigh down economic sentiment. At the same time, early 2021 may not be the best…

Generation change at Dataforce: Marc A. Odinius now sole owner and Managing Dire …

The long-standing Managing Director Marc Odinius has acquired all shares of the Dataforce Verlagsgesellschaft für Business Informationen mbH and is now Managing Director and sole owner of the Company.

Mission of Dataforce

As to the mission of the automotive data- and market-research company, with 87 Employees, counting 27 different nationalities who reside in Frankfurt, Rome and Beijing, Odinius stated: Dataforce is always in search of unique information which will make the automotive…

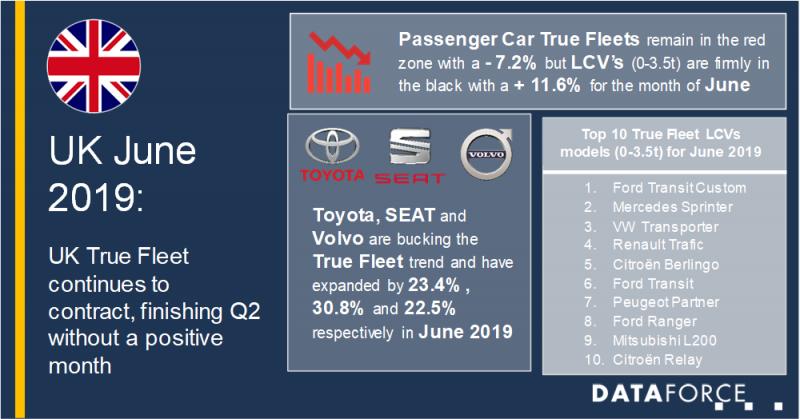

UK True Fleet continues to contract, finishing Q2 without a positive month

Now with the first half of the year having gone by in a blur of negative growth we can only hope that the second half will bring some more positive momentum especially around the plate change month in September. UK True Fleet produced a - 7.2% in June which leaves the channel down 6.2% year-to-date (YTD). The Private Market was also in the red with a 4.8% which…

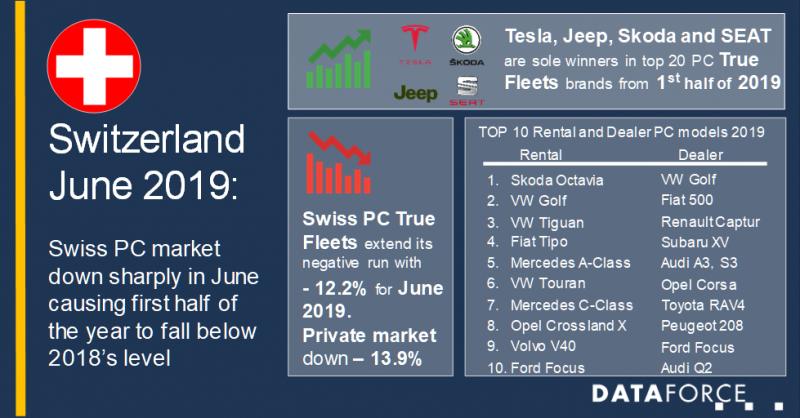

Swiss car market turns into the red on sharp contraction in June

In June 2019 new passenger car registrations in Switzerland were down sharply on the same month last year. Nearly 28,000 registered passenger cars represent an overall market decline of 11.2%. Registrations of light commercial vehicles fell even more sharply (11.9%).

Weak June causes passenger car market to fall below previous year's level

Both the Private Market ( 13.9%) and the commercial market ( 8.4%) can look back on a weak…

More Releases for Fleet

Fleet Management Consulting Service Market will reach USD 39.94 Billion by 2032 …

The global fleet management size is expected to grow USD 39.94 Billion by 2032 from USD 21.6 Billion in 2021, at a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period.

The presence of various key players in the ecosystem has led to a competitive and diverse market. The market include a high growth rate for the adoption of cloud computing and analytics, declining hardware and IoT connectivity costs,…

Fleet Management Solution Market: Start managing fleet data, access and update i …

The report "Global Fleet Management Solution Market By Deployment Model (On-premise, and On-Demand Hybrid), By Solution (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and other Solutions), By End User (Transportation, Energy, Construction, Manufacturing, and Other End Users), and Region - Global Forecast to 2029". Gradually adopting transportation by businesses to enhance their offerings this results in considerable rise over the past few years…

Fleet Management Market Insights | Key players: ARI Fleet Management, Azuga, Che …

According to recent research "Fleet Management Market by Solution (Operations Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics and Reporting), Service (Professional and Managed), Deployment Type, Fleet Type, and Region - Global Forecast to 2023", the global fleet management market size is expected to grow from USD 15.9 billion in 2018 to USD 31.5 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast…

Global Smart Fleet Management Market Real-time fleet monitoring

The smart fleet management market is moderately fragmented due to the presence of well-diversified global and regional vendors. International players have competence over smaller players in terms of features and price. The competitive environment is intensified due to widening product extensions, technological innovations, and M&A. FMS providers adopt inorganic growth strategies by acquiring regional or local players. To attain competitive advantage in the car tracking device market, the players must…

IoT Fleet Management Market by Fleet Type, Platform, Region - 2022

Qyresearchreports include new market research report "Global IoT Fleet Management Market Size, Status and Forecast 2022" to its huge collection of research reports.

The market study on the global IoT Fleet Management market is an all-inclusive business and commerce publication, prepared by seasoned research analysts with primary objectives to analyze crucial market aspects for the IoT Fleet Management forecast timeframe. Prepared using industry-best analytical tools such as Porter’s five forces and…

Fleet software comm.fleet: Effective cost control for fleet managers

Relief for fleet managers: identify the cost drivers of the company and take appropriate actions with the fleet management software comm.fleet

The adoption of a multifunctional controlling system is an indispensable prerequisite for an effective and systematic management of all company fleet costs. Be it a question of planning enhancement and control, budgeting coordination or the execution and analysis of a target-performance comparison with the purpose of a perfect fleet administration,…