Press release

Toms River Bankruptcy Attorney Daniel Straffi Jr. Explains How Bankruptcy Can Eliminate Medical Debt in New Jersey

TOMS RIVER, NJ - Medical debt affects millions of Americans and is classified as nonpriority unsecured debt under federal bankruptcy law, making it eligible for discharge through either Chapter 7 or Chapter 13 bankruptcy proceedings. Toms River bankruptcy attorney Daniel Straffi Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how each chapter of bankruptcy addresses medical bills and what New Jersey residents should know before filing.According to Toms River bankruptcy attorney Daniel Straffi Jr., Chapter 7 bankruptcy eliminates medical debts within three to six months through a liquidation process where a trustee may sell certain non-exempt assets to pay creditors. Chapter 13 bankruptcy reorganizes medical debt into a repayment plan lasting three to five years based on disposable income, with remaining balances discharged upon plan completion. "Both chapters provide an automatic stay immediately after filing, which stops collection calls, suspends lawsuits, and halts wage garnishments," explains Straffi.

Toms River bankruptcy attorney Daniel Straffi Jr. notes that Chapter 7 eligibility requires passing the means test, which compares household income to New Jersey's median income for the applicable family size. For cases filed on or after April 1, 2025, federal bankruptcy exemptions include a homestead exemption up to $31,575 in equity and a motor vehicle exemption up to $5,025, subject to detailed rules and individual circumstances. Property not protected by applicable exemptions may be sold by the trustee to pay creditors.

Attorney Straffi highlights that Chapter 13 eligibility is subject to debt limits set by federal law and adjusted periodically. For cases filed on or after April 1, 2025, unsecured debts must be less than $526,700, and secured debts must be less than $1,580,125. "Chapter 13 generally allows individuals to keep their property while making monthly payments to a trustee, who distributes payments to creditors according to priority rules," he adds.

Under New Jersey Revised Statutes Section 2A:14-1, lawsuits to collect medical debt must generally be filed within six years after the claim accrues. However, the statute of limitations only prevents legal action and does not erase the debt. Creditors may continue collection efforts through phone calls and letters unless the debt is discharged through bankruptcy.

Before filing, individuals must complete mandatory credit counseling from an approved agency within 180 days of the petition date. Required documentation includes income records, tax returns, bank statements, medical bills, collection notices, mortgage or lease agreements, and a list of monthly living expenses. After filing, a meeting of creditors conducted by a bankruptcy trustee reviews the petition under oath, and a debtor education course must be completed before a discharge is granted.

"Bankruptcy only discharges medical debts that existed before the filing date," observes Straffi. "Post-filing medical expenses become new obligations, so individuals expecting ongoing medical costs should discuss timing with their attorney before filing." The U.S. Bankruptcy Court for the District of New Jersey, with locations in Newark, Trenton, and Camden, handles all bankruptcy proceedings in the state. Ocean County residents typically file at the Trenton courthouse.

For those overwhelmed by medical debt in New Jersey, consulting an experienced bankruptcy attorney may help determine whether Chapter 7 or Chapter 13 is the appropriate path toward financial recovery.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law is a Toms River-based law firm dedicated to bankruptcy law and financial recovery. Led by attorney Daniel Straffi Jr., the firm has over 20 years of experience helping individuals and families navigate Chapter 7 and Chapter 13 bankruptcy proceedings throughout Ocean County and New Jersey. For consultations, call (732) 341-3800.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=-HCr5G1Hbmc

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website

Email: infodocuments@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi, Jr.

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=toms-river-bankruptcy-attorney-daniel-straffi-jr-explains-how-bankruptcy-can-eliminate-medical-debt-in-new-jersey]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Toms River Bankruptcy Attorney Daniel Straffi Jr. Explains How Bankruptcy Can Eliminate Medical Debt in New Jersey here

News-ID: 4396237 • Views: …

More Releases from ABNewswire

Brooklyn Slip and Fall Attorney Samantha Kucher Explains Settlement Options for …

BROOKLYN, NY - Property owners in New York face liability for injuries sustained on their premises when dangerous conditions exist and proper warnings or remedies are not provided. Brooklyn slip and fall attorney Samantha Kucher of Kucher Law Group (https://www.rrklawgroup.com/slip-and-fall-settlements-is-surgery-required/) explains that injured individuals can pursue compensation regardless of whether surgical intervention is required.

According to Brooklyn slip and fall attorney Samantha Kucher, New York premises liability law allows recovery for…

Why Everyone in Long Island Is Talking About Promaster Maintenance Corp NY Pavin …

Word spreads quickly about the Paving contractor's exceptional results and customer-first approach.

Feb 18, 2026 - The first thing people notice when arriving at a home is its driveway, patio, or walkway, features that enhance property value as well as aesthetics. In New York, when homeowners ask who's behind the most durable and stylish paving work, one name that is Promaster Maintenance Corp, consistently stands out.

They are known for quality craftsmanship…

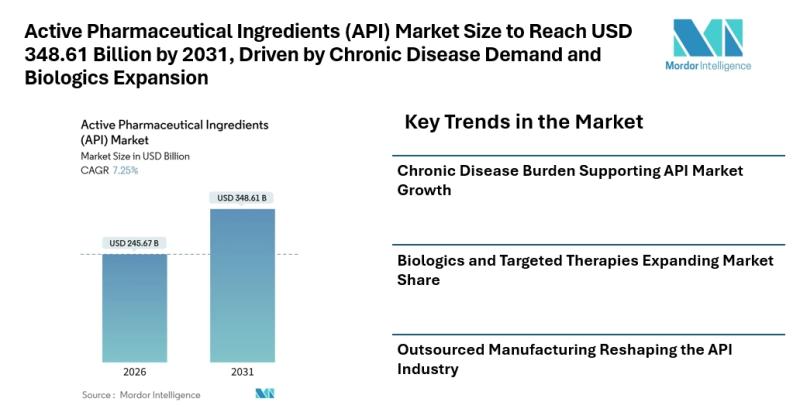

Active Pharmaceutical Ingredients (API) Market Size to Reach USD 348.61 Billion …

Mordor Intelligence has published a new report on the active pharmaceutical ingredients (API) market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the active pharmaceutical ingredients (API) market size [https://www.mordorintelligence.com/industry-reports/global-active-pharmaceutical-ingredients-api-market?utm_source=abnewswire] is estimated at USD 245.67 billion in 2026 and is expected to reach USD 348.61 billion by 2031, registering a CAGR of 7.25% during the forecast period. The active pharmaceutical ingredients (API) market continues…

Miami Employment Attorney Jason D. Berkowitz Explains When At-Will Employees Can …

MIAMI, FL - Florida's at-will employment doctrine gives employers broad discretion to terminate employees, but federal and state law prohibit firings based on illegal discrimination, retaliation, or violations of public policy. Miami employment attorney Jason D. Berkowitz of BT Law Group, PLLC (https://btattorneys.com/can-you-sue-wrongful-termination-florida/) explains the exceptions that allow at-will employees to pursue wrongful termination claims and recover compensation for unlawful firings.

According to Miami employment attorney Jason D. Berkowitz, federal law…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…