Press release

Alcoholic Beverage Manufacturing Plant Cost 2026: CapEx/OpEx Analysis with Profitability Forecast

The global alcoholic beverage manufacturing industry represents a sophisticated and highly regulated sector producing diverse liquid consumables through controlled fermentation and distillation processes. Alcoholic beverages are consumable liquids that result from the fermentation and distillation of agricultural products including grains, fruits, sugarcane, and molasses. These beverages contain ethanol as their main alcoholic substance and are divided into four categories: beer, wine, spirits, and flavored or ready-to-drink alcoholic products. The manufacturing process contains multiple steps which start with controlled fermentation and continue with distillation when needed, and end with the final steps of maturation, blending, filtration, and bottling.People appreciate alcoholic beverages because their sensory qualities provide pleasurable experiences through their scent, taste, mouthfeel, and alcohol content. Product quality depends on material selection, fermentation process, yeast selection, aging techniques, and blending methods. People drink alcoholic beverages in social events and cultural traditions and recreational activities, while stores, hotels, and duty-free shops sell these beverages to customers. The market continues to benefit from rising urbanization, evolving consumer preferences, premiumization trends, and the steady expansion of hospitality and retail distribution networks. Strict regulatory oversight governs production standards, labeling, taxation, and quality compliance across global markets, ensuring consumer safety while supporting industry growth and innovation in product development and manufacturing technologies.

MARKET OVERVIEW AND GROWTH POTENTIAL

The global alcoholic beverage market demonstrates substantial scale and consistent growth trajectory reflecting its established position in consumer markets worldwide. The global alcoholic beverage market size was valued at USD 1,653.77 Billion in 2025, representing a massive foundation supporting diverse product categories across beer, wine, spirits, and ready-to-drink segments. According to market projections, the market is expected to reach USD 2,029.35 Billion by 2034, exhibiting a CAGR of 2.3% from 2026 to 2034.

This steady growth reflects multiple converging market drivers including consumers developing new preferences and products becoming more expensive, as well as industry players introducing new market offerings. Urban population growth, combined with nightlife expansion and rising demand for low-alcohol flavored drinks, has created new drinking trends. According to the United Nations Department of Economic and Social Affairs (UN DESA), World Urbanization Prospects 2025 reported that about 45% of the global population, roughly 8.2 billion people, lived in urban areas. Rising urban lifestyles boosted socializing, nightlife, and disposable incomes, directly accelerating demand and innovation across beer, wine, and spirits markets. The younger generation is showing increasing interest in craft spirits, premium beers, and ready-to-drink alcoholic beverages, driving product innovation and premiumization trends across market segments.

The regulatory frameworks maintain strict standards that require businesses to implement quality control, product tracking, and sustainable production methods, supporting consumer confidence while ensuring industry compliance and responsible manufacturing practices supporting long-term market development.

IMARC Group's report, "Alcoholic Beverage Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The alcoholic beverage manufacturing plant cost report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

PLANT CAPACITY AND PRODUCTION SCALE

The proposed alcoholic beverage manufacturing facility is designed with an annual production capacity of 5 million liters, strategically positioned to achieve substantial economies of scale while maintaining operational flexibility essential for product diversification and market responsiveness. This capacity level enables efficient production across multiple beverage categories including spirits and distilled beverages such as vodka, whiskey, rum, and gin, beer and brewery products with consistent fermentation results, wine production through controlled fermentation and aging environments, and flavored or ready-to-drink alcoholic products meeting growing consumer demand for convenience beverages. The production scale supports diverse product portfolios serving retail distribution channels, hospitality and HoReCa sectors including hotels, restaurants, bars, and clubs, duty-free outlets serving international travelers, and export markets expanding geographic reach and revenue diversification.

The facility's capacity structure enables optimization of production planning across seasonal demand variations, efficient raw material utilization through batch scheduling flexibility, and ability to introduce new product formulations responding to evolving consumer preferences and market trends. This production volume positions the plant competitively within regional and potentially international markets, capable of fulfilling both large-scale distribution contracts with major retail chains and specialized requirements from hospitality operators and export customers seeking premium or craft beverage products.

Request for a Sample Report: https://www.imarcgroup.com/alcoholic-beverage-manufacturing-plant-project-report/requestsample

FINANCIAL VIABILITY AND PROFITABILITY ANALYSIS

The alcoholic beverage manufacturing project demonstrates exceptionally healthy profitability potential under normal operating conditions, supported by strong value addition through branding, maturation, and product differentiation strategies. Gross profit margins typically range between 50-70%, reflecting substantial value creation through manufacturing processes, brand development, and premiumization positioning that enables favorable pricing structures across retail, hospitality, and duty-free market segments. The project achieves net profit margins within the 25-40% range, indicating remarkably strong operational efficiency and controlled cost management throughout the production cycle combined with premium pricing capabilities inherent in branded alcoholic beverage products. These profitability metrics showcase the business's exceptional revenue generation capabilities and highly attractive investment returns for stakeholders participating in the value-added alcoholic beverage manufacturing sector.

The financial projections have been developed based on realistic assumptions related to capital investment requirements, operating cost structures, production capacity utilization rates, pricing trends across different beverage categories and distribution channels, and comprehensive demand outlook assessments considering urbanization trends, consumer preference evolution, and premiumization momentum. These projections provide stakeholders with a comprehensive view of the project's financial viability, return on investment (ROI) potential, profitability trajectories, and long-term sustainability prospects. The analysis encompasses detailed break-even calculations, net present value (NPV) assessments, and internal rate of return (IRR) projections that validate the investment's exceptional financial attractiveness across various market scenarios and economic conditions.

OPERATING COST STRUCTURE

The operating cost structure of an alcoholic beverage manufacturing plant reflects the material and energy-intensive nature of fermentation, distillation, and bottling operations combined with significant packaging and regulatory compliance requirements. Raw materials constitute approximately 50-60% of total operating expenses (OpEx), with grains and molasses for fermentation representing primary cost drivers supplemented by yeast cultures, flavoring ingredients, and water for processing. This significant raw material component emphasizes the critical importance of securing reliable agricultural commodity supplies, establishing strategic supplier relationships, implementing effective inventory management systems balancing seasonal availability patterns, and potentially developing direct procurement arrangements with grain producers or molasses suppliers to ensure consistent product quality while controlling input costs. Utilities account for 15-20% of operating expenses, representing substantial energy requirements for fermentation temperature control, distillation heat input, cooling systems, bottling line operations, and quality control laboratory equipment.

The utility cost component covers electricity for processing equipment and facility operations, water for multiple process stages including mashing and dilution, steam for distillation operations, and cooling requirements maintaining fermentation and storage temperatures. Key raw materials required include grains and molasses for fermentation, yeast for controlled alcohol production, and packaging materials including bottles and labels for finished product presentation. Additional operational costs encompass transportation for raw material procurement and finished product distribution to retail and hospitality customers, packaging materials representing significant expense given glass bottle costs and labeling requirements, salaries and wages for skilled production staff including master distillers and quality control specialists, depreciation on specialized processing equipment and aging facilities, taxes including substantial excise duties on alcoholic beverage production, repairs and maintenance ensuring equipment reliability, and other miscellaneous operational requirements essential for continuous production meeting quality standards and regulatory compliance.

CAPITAL INVESTMENT REQUIREMENTS

Establishing an alcoholic beverage manufacturing plant requires comprehensive capital investment across multiple essential categories to ensure operational readiness, regulatory compliance, and long-term competitive positioning. The total capital expenditure (CapEx) encompasses land and site development costs, civil works costs, machinery costs, and other capital costs, each representing critical investment components for successful facility establishment.

Land acquisition and site development constitute substantial initial investments, covering land registration charges, boundary development expenses, site preparation including grading and utility connections, and foundational infrastructure development ensuring safe and efficient plant operations with adequate space for production, maturation storage, and finished goods warehousing.

Civil works costs include factory building construction optimized for alcoholic beverage manufacturing with appropriate zoning for fermentation, distillation, and bottling operations, administrative office facilities, warehousing structures for raw material storage and finished product inventory management including temperature-controlled aging facilities, and comprehensive utility infrastructure development including electrical distribution, water treatment systems, and effluent management facilities supporting production requirements.

Machinery costs account for the largest portion of total capital expenditure, comprising essential processing equipment for alcoholic beverage manufacturing including:

• Fermentation tanks for controlled alcohol production

• Distillation columns for spirits production

• Storage tanks for maturation and blending

• Filtration units for product clarification

• Bottling lines for packaging operations

• Laboratory equipment for quality control and testing

All machinery selections must comply with food safety industry standards, operational efficiency requirements, and reliability benchmarks ensuring consistent production quality meeting regulatory specifications. Other capital costs cover pre-operative expenses including regulatory approvals and licensing fees which can be substantial for alcoholic beverage operations, environmental compliance certifications, technology procurement, initial working capital requirements for raw material inventory and operational launch, and prudent contingency reserves addressing unforeseen costs during facility establishment and commissioning phases.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=22275&flag=C

MAJOR APPLICATIONS AND MARKET SEGMENTS

Alcoholic beverage manufacturing serves diverse market segments across multiple distribution channels and product categories:

• Spirits and Distilled Beverages Industry - The manufacturing process produces vodka, whiskey, rum, gin, and various distilled spirits ensuring producers create products with constant quality and specific alcohol levels. This segment commands premium pricing through brand positioning, aging processes, and product differentiation strategies.

• Beer and Brewery Segment - The system streamlines brewing processes by providing breweries with a method that produces consistent fermentation results and preserves beer flavor while supporting their ability to produce large quantities of beer for sale. This segment serves mass market consumption through retail and on-premise channels.

• Wine Production Sector - Industrial facilities establish controlled environments for both fermentation and aging which help develop flavors and maintain consistent product quality throughout their wine selection. This segment ranges from value wines to premium varieties commanding substantial price differentiation.

• Hospitality and HoReCa Industry - Standardized methods for producing alcoholic beverages allow hotels, bars, restaurants, and clubs to fulfill customer needs while maintaining product stock at all their service points. This segment represents significant volume consumption through on-premise hospitality operations.

WHY INVEST IN ALCOHOLIC BEVERAGE MANUFACTURING?

• Growing Global Consumption: Global alcohol consumption is increasing because people have more money to spend, cities have more people, and people prefer expensive products. Urbanization trends with 45% of global population living in urban areas drive socializing, nightlife, and disposable income supporting sustained market growth.

• High Value Addition: The process of creating alcoholic beverages generates high value for businesses through their branding, aging, and blending techniques, and unique product characteristics. Premium positioning and craft product development enable exceptional profit margins of 50-70% gross and 25-40% net supporting attractive investment returns.

• Diverse Product Portfolio: The company enables product distribution to various markets which include beer, spirits, wine, and ready-to-drink products. Portfolio diversification reduces market risk while capturing multiple consumer segments and price points maximizing revenue potential.

• Export and Duty-Free Opportunities: The global alcohol market provides strong export demand which benefits alcohol products sold through duty-free stores. International distribution expands market reach beyond domestic constraints while duty-free channels command premium pricing and margin structures.

• Scalable Production Model: The manufacturing process enables facilities to expand their production capacity through investment in capital for better capacity management. Modular expansion supports growth aligned with market development while maintaining operational efficiency and quality consistency.

INDUSTRY LEADERSHIP

The global alcoholic beverage manufacturing industry features several prominent multinational companies with extensive production capacities, sophisticated brand portfolios, and global distribution networks. Leading manufacturers include:

• Anheuser-Busch InBev

• Asahi Group

• Ambev

• Brown Forman

• Carlsberg

All of which serve end-use sectors including retail distribution, hospitality and HoReCa operations, duty-free outlets, and export markets across multiple geographic regions. These industry leaders demonstrate market maturity, competitive dynamics, and operational benchmarks against which new entrants can evaluate their strategic positioning.

Buy Now: https://www.imarcgroup.com/checkout?id=22275&method=2175

Recent industry developments illustrate ongoing innovation and market expansion strategies strengthening competitive positions:

• March 2025: Kraft Heinz entered the alcoholic beverages segment by launching Crystal Light Vodka Refreshers, moving the Crystal Light brand into hard seltzer for the first time. The company estimated that nearly 20% of current buyers used Crystal Light as mixers. The company targets USD 2 billion incremental net sales by 2027.

• February 2025: Diageo expanded its Smirnoff vodka range with the launch of Smirnoff Miami Peach, a new flavoured vodka in a ready-to-drink (RTD) can. The 35% ABV bottle reached retail in March 2025, followed by a 5% ABV lemonade-mixed RTD can. Supplier data showed flavored vodka launches delivering GBP 7.6m off-trade sales last year, supporting incremental summer demand.

These developments underscore the industry's dynamic nature with major consumer brands entering alcoholic beverage markets, ready-to-drink product innovation driving category growth, and flavored product extensions capturing evolving consumer preferences particularly among younger demographics.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Services:

• Plant Setup

• Factoring Auditing

• Regulatory Approvals, and Licensing

• Company Incorporation

• Incubation Services

• Recruitment Services

• Marketing and Sales

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Alcoholic Beverage Manufacturing Plant Cost 2026: CapEx/OpEx Analysis with Profitability Forecast here

News-ID: 4393697 • Views: …

More Releases from IMARC Group

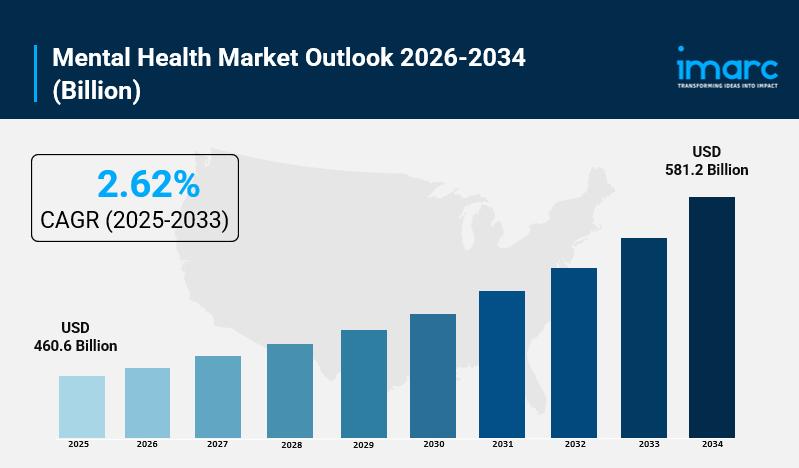

Mental Health Market Size, Share, Industry Trends, Growth Factors and Forecast 2 …

IMARC Group, a leading market research company, has recently released a report titled "Mental Health Market Size, Share, Trends, and Forecast by Disorder, Service, Age Group, and Region 2026-2034." The study provides a detailed analysis of the industry, including the global mental health market size, trends, share and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mental Health Market Highlights:

• Mental Health…

Polylactic Acid Production Plant DPR & Unit Setup Cost 2026: Machinery Requireme …

Polylactic acid (PLA) is a biodegradable thermoplastic polymer derived from renewable agricultural resources including corn starch, sugarcane, and cassava. The production process begins with sugar fermentation, which converts the sugar into lactic acid, followed by polymerization to produce PLA resin. The material demonstrates outstanding clarity, rigidity, and processing capabilities, and can be composted in industrial composting facilities.

PLA exhibits lower toxicity levels combined with superior tensile strength and beneficial thermal…

Vermicompost Manufacturing Plant Cost, DPR 2026: Demand Analysis, CapEx/OpEx & R …

The global vermicompost industry is witnessing robust growth driven by increasing adoption in organic farming, rising demand for sustainable soil amendments, and expanding use in horticulture and landscaping applications. At the heart of this expansion lies a critical agricultural input-vermicompost. As industries transition toward organic and regenerative agricultural practices, establishing a vermicompost manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and agri-business investors seeking to capitalize on this…

API Manufacturing Plant Cost DPR 2026: Capex, Opex & Compliance Requirements

Active Pharmaceutical Ingredients (APIs) are bioactive molecules that serve as the active constituent of any pharmaceutical formulation, producing the desired therapeutic effect upon administration. APIs are prepared through complex processes of chemical synthesis, fermentation, and biotechnology under highly stringent regulatory and quality guidelines. They must comply with specific attributes pertaining to quality, strength, stability, and safety as per pharmacopoeia standards such as USP, EP, and IP. APIs represent the active…

More Releases for Alcoholic

Alcoholic Energy Drinks Market Growing Trend of Caffeinated Alcoholic Beverages

On April 02, 2025, Exactitude Consultancy., Ltd. announces the release of the report "Global Alcoholic Energy Drinks Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2034". The report is a detailed and comprehensive analysis presented by region and country, type and application. As the market is constantly changing, the report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands…

Alcoholic Beverage Packaging Market Report 2024 - Alcoholic Beverage Packaging M …

"The Business Research Company recently released a comprehensive report on the Global Alcoholic Beverage Packaging Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The alcoholic beverage…

Alcoholic and Non Alcoholic Beverages Market Size 2024 to 2031.

Market Overview and Report Coverage

The Alcoholic and Non Alcoholic Beverages Market encompasses a wide range of drinks including beer, wine, spirits, soft drinks, and more. The market has been witnessing steady growth and is expected to continue its upward trajectory in the coming years. With changing consumer preferences, rising disposable incomes, and increasing demand for premium and innovative beverages, the market is poised for further expansion.

In terms of…

Alcoholic and Non-Alcoholic Beverages Market to Show Incredible Growth by 2027 C …

This Alcoholic and Non-Alcoholic Beverages market research performs systematic analysis of the market to provide profound perceptions, determine market situation and potent advancements and track prior market performances. There were several industries got shutdown due to the COVID-19 plague. This market report captures the considerable losses that businesses got and even guides them how to come out of this pandemic situation. As this pandemic left several adverse effects on different…

Alcoholic and Non-Alcoholic Beverages Market Research

This report studies the global Alcoholic and Non-Alcoholic Beverages market status and forecast, categorizes the global Alcoholic and Non-Alcoholic Beverages market size (value & volume) by manufacturers, type, application, and region. This report focuses on the top manufacturers in North America, Europe, Japan, China, and other regions (India, Southeast Asia).

Download FREE Sample of this Report @ https://www.grandresearchstore.com/report-sample/global-alcoholic-nonalcoholic-beverages-2018-575

The major manufacturers covered in this report

Anheuser-Busch

Accolade Wines

Bacardi

Beam Suntory

Carlsberg

Constellation Brands

China Resource Enterprise

Diageo

Heineken

E. & J.…

Non-alcoholic Malt Beverages Posing a Healthy Alternative to Alcoholic Drinks Pr …

Future Market Insights (FMI) delivers key insights on the global non-alcoholic malt beverages market in its upcoming outlook titled 'Global Market Study on Non-alcoholic Malt Beverages: Pairing Options with the Flavors of Non-alcoholic Malt Beverages Likely to Please the Food Palates of Consumers'. In terms of value, the global non-alcoholic malt beverages market is projected to register a healthy CAGR of 4.0% during the forecast period, due to various factors,…