Press release

Animal Feed Manufacturing Plant Cost 2026: Industry Overview and Profitability Assessment

The global animal feed manufacturing industry stands as a critical pillar of the agricultural value chain, serving as the foundational nutritional solution that sustains livestock, poultry, aquaculture species, and companion animals worldwide. Animal feed functions as a comprehensive nutritional solution providing essential dietary needs through specific blending of cereals, oilseed meals, vitamins, minerals, amino acids and feed additives mixed in exact proportions to enhance animal growth, reproductive capabilities, immune system functioning and overall performance. The production process creates different feed types including mash, pellets, crumbles and liquid feed to match the requirements of different animal species and their respective feeding methods.Current formulations aim to develop products which enhance digestibility and feed conversion rates while delivering complete nutrition and meeting safety and quality standards that safeguard animal health and productivity. The global animal feed market is primarily driven by rapid expansion of the livestock and poultry sectors, rising demand for nutritionally balanced feed formulations, and increasing focus on improving animal productivity and health. As commercial farming operations intensify globally and consumer demand for high-quality animal protein products continues rising, animal feed manufacturing presents an exceptionally attractive investment opportunity for manufacturers and entrepreneurs seeking to participate in the essential agricultural supply chain supporting global food security.

MARKET OVERVIEW AND GROWTH POTENTIAL

The global animal feed market demonstrates substantial scale and steady growth trajectory reflecting its fundamental importance to worldwide agricultural production. The global animal feed market size was valued at USD 548.1 Billion in 2025, establishing a massive foundation that underscores the industry's critical role in supporting global livestock, poultry, and aquaculture sectors. According to market projections, the market is expected to reach USD 702.75 Billion by 2034, exhibiting a CAGR of 2.8% from 2026 to 2034.

This consistent growth reflects multiple converging market drivers including significant expansion of commercial livestock farming, increasing intensification of poultry production, and rising demand for high-quality animal protein across developing and developed markets. The market is primarily driven by improvements in feed technology, including precision nutrition and functional additives, which are enhancing feed efficiency and animal health outcomes. The livestock and pet care sectors continue to expand steadily, driving large-scale demand for nutritionally balanced and commercially manufactured feed products. According to the American Feed Industry Association (AFIA), there were approximately 5,650 animal food manufacturing facilities in the United States producing feed for livestock and pets each year, with animals consuming nearly 284 million tons of finished feed and pet food annually in 2023.

These figures demonstrate sustained growth supported by rising livestock production, increasing pet ownership, and ongoing advancements in feed formulation and manufacturing efficiency. Asian-Pacific emerging economies including India and China are experiencing rapid economic growth driven by rising disposable incomes, increased meat and dairy consumption, and modern farming techniques adoption. North American and European regions maintain efforts to ensure safe feed products while establishing systems that track feed materials and promote environmentally friendly raw material sourcing, supported by increasing public awareness about animal welfare and more stringent regulations on antibiotic usage driving demand for nutritionally enhanced feed products with special additives.

IMARC Group's report, "Animal Feed Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The animal feed manufacturing plant cost report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

PLANT CAPACITY AND PRODUCTION SCALE

The proposed animal feed manufacturing facility is designed with an annual production capacity ranging between 20,000 - 100,000 MT, providing substantial operational flexibility while enabling significant economies of scale across diverse production requirements. This capacity range positions the facility to serve multiple market segments effectively, from regional livestock and poultry operations to large-scale commercial farming enterprises and aquaculture facilities requiring consistent feed supplies. The production scale supports efficient processing of various feed formulations including broiler growth feed, layer feed for egg production, breeder feed for poultry operations, cattle and buffalo feed for dairy and livestock sectors, sheep and goat nutrition products, fish and shrimp feed formulations for aquaculture, and nutritionally balanced pet food and specialty feed for companion animals. The facility's capacity structure enables optimization of raw material procurement through bulk purchasing agreements, efficient utilization of processing equipment across production runs, and flexibility to respond to seasonal demand variations and market opportunities.

This production volume positions the plant competitively within regional and potentially national markets, capable of fulfilling both large-scale contracts with integrated farming operations and specialized requirements from diverse animal farming segments seeking reliable, high-quality feed products meeting specific nutritional requirements and performance objectives.

Request for a Sample Report: https://www.imarcgroup.com/animal-feed-manufacturing-plant-project-report/requestsample

FINANCIAL VIABILITY AND PROFITABILITY ANALYSIS

The animal feed manufacturing project demonstrates healthy profitability potential under normal operating conditions, supported by stable recurring demand dynamics and essential role in animal agriculture value chains. Gross profit margins typically range between 15-25%, reflecting efficient processing operations and value-added formulation capabilities that deliver nutritional benefits translating to improved animal performance and farm profitability. The project achieves net profit margins within the 5-12% range, indicating strong operational efficiency and controlled cost management throughout the production and distribution cycle. These profitability metrics showcase the business's sustainable revenue generation capabilities and attractive investment returns for stakeholders participating in the essential agricultural supply chain.

The financial projections have been developed based on realistic assumptions related to capital investment requirements, operating cost structures, production capacity utilization rates, pricing trends across different animal feed segments, and comprehensive demand outlook assessments considering livestock production growth, poultry sector expansion, and aquaculture development. These projections provide stakeholders with a comprehensive view of the project's financial viability, return on investment (ROI) potential, profitability trajectories, and long-term sustainability prospects. The analysis encompasses detailed break-even calculations, net present value (NPV) assessments, and internal rate of return (IRR) projections that validate the investment's financial attractiveness across various market scenarios and agricultural commodity price cycles.

OPERATING COST STRUCTURE

The operating cost structure of an animal feed manufacturing plant is characterized by a material-intensive model reflecting the agricultural commodity-based nature of feed production. Raw materials constitute approximately 80-85% of total operating expenses (OpEx), with maize representing the primary cost driver supplemented by soybean meal, oil cake, and vitamins/mineral premix formulations. This substantial raw material component underscores the critical importance of strategic agricultural commodity procurement, establishing reliable supplier networks, implementing effective inventory management systems, and potentially developing direct relationships with grain producers to ensure consistent feed quality while controlling input costs.

Utilities account for 5-10% of operating expenses, covering electricity for grinding and pelleting equipment operations, water for mixing and steam generation processes, and energy requirements for material handling and packaging systems. The utility cost component reflects the mechanized nature of modern feed manufacturing operations requiring continuous equipment operation and precise process control. Key raw materials required include maize, soybean meal, oil cake, and vitamins/mineral premix, with sourcing strategies focusing on securing consistent quality grain supplies, negotiating favorable pricing through forward contracts or bulk purchasing agreements, and maintaining optimal inventory levels balancing supply security against working capital requirements. Additional operational costs encompass transportation for raw material procurement from agricultural producing regions and finished feed distribution to farming operations, packaging materials for various product formats serving different customer segments, salaries and wages for production staff, quality control personnel, and operations management, depreciation on processing equipment and facility infrastructure, taxes and regulatory compliance costs, repairs and maintenance expenses ensuring equipment reliability, and other miscellaneous operational requirements essential for continuous production operations meeting market demand.

CAPITAL INVESTMENT REQUIREMENTS

Establishing an animal feed manufacturing plant requires comprehensive capital investment across multiple essential categories to ensure operational readiness and long-term competitive viability. The total capital expenditure (CapEx) encompasses land and site development costs, civil works costs, machinery costs, and other capital costs, each representing critical investment components for successful facility establishment and market entry.

Land acquisition and site development constitute substantial initial investments, covering land registration charges, boundary development expenses, site preparation including grading and infrastructure installation, and foundational development ensuring safe and efficient plant operations with adequate space for raw material receiving, processing operations, and finished product storage.

Civil works costs include factory building construction optimized for feed manufacturing operations with appropriate ceiling heights for equipment installation, administrative office facilities, warehousing structures for bulk ingredient storage and finished feed inventory management, and comprehensive utility infrastructure development including electrical distribution, water supply systems, and waste management facilities supporting production requirements.

Machinery costs account for the largest portion of total capital expenditure, comprising essential processing equipment for feed manufacturing operations including:

• Grinding equipment for raw material size reduction

• Mixing systems for ingredient blending

• Pelleting machinery for feed compaction and shaping

• Cooling systems for temperature control

• Packaging equipment for various product formats

All machinery selections must comply with food safety industry standards, operational efficiency requirements, and reliability benchmarks ensuring consistent production quality meeting animal nutrition specifications. Other capital costs cover pre-operative expenses including regulatory approvals, licensing fees, environmental compliance certifications, technology procurement, initial working capital requirements for raw material inventory and operational launch, and prudent contingency reserves addressing unforeseen costs during facility establishment and commissioning phases.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=9125&flag=C

MAJOR APPLICATIONS AND MARKET SEGMENTS

Animal feed serves diverse applications across multiple animal agriculture sectors, each demonstrating distinct nutritional requirements and production characteristics:

• Poultry - Used in broiler growth feed optimizing weight gain and feed conversion efficiency, layer feed for egg production maximizing output and shell quality, and breeder feed supporting reproductive performance and chick quality. Poultry operations represent major feed consumers given intensive production systems and high feed conversion requirements.

• Dairy and Livestock - Utilized in cattle feed formulations balancing energy and protein for milk production, buffalo feed meeting specific nutritional requirements, and sheep and goat nutrition supporting meat and fiber production. Dairy and livestock sectors demand specialized feeds optimizing productivity while maintaining animal health across production cycles.

• Aquaculture - Employed in fish and shrimp feed formulations delivering precise nutrition for aquatic species growth and health. Aquaculture represents a rapidly growing feed market segment as fish and seafood consumption increases globally and production intensifies through commercial farming operations.

• Companion Animals - Used in nutritionally balanced pet food and specialty feed meeting dietary requirements for dogs, cats, and other companion animals. Pet food represents a premium market segment with growth driven by increasing pet ownership and humanization trends emphasizing nutrition and quality.

WHY INVEST IN ANIMAL FEED MANUFACTURING?

• Essential Input for Animal Agriculture: Animal feed serves as a basic requirement for livestock, poultry and aquaculture enterprises as it determines their operational effectiveness and economic success and their ability to provide food to the market. This fundamental role ensures consistent demand independent of economic cycles, positioning feed manufacturing as a stable business supporting essential food production.

• Stable and Recurring Demand: The animal farming industry needs feed products as animals eat continuously, which creates permanent demand that protects the industry from economic downturns. Unlike discretionary consumer products, feed consumption remains stable as livestock, poultry, and aquaculture operations require consistent nutrition to maintain production and animal health.

• Alignment with Protein Consumption Growth: The global demand for meat, milk, eggs and seafood products leads to persistent need for advanced compound feed formulations. As populations grow, incomes rise, and dietary preferences shift toward protein-rich foods, animal agriculture expands correspondingly, driving feed demand growth across all segments.

• Supportive Government Policies: The government supports dairy development and poultry growth and livestock health and domestic feed production through its various initiatives which create opportunities for organized animal feed manufacturing. Policy support includes subsidies, infrastructure development, quality standards establishment, and import duty structures protecting domestic feed industries.

• Scope for Value Addition and Branding: Specialized feeds and fortified formulations and species-specific nutrition solutions enable companies to achieve higher profit margins while developing unique products. Value-added feed products incorporating probiotics, enzymes, organic ingredients, or specialized nutrition profiles command premium pricing and build customer loyalty through demonstrated performance benefits.

INDUSTRY LEADERSHIP

The global animal feed manufacturing industry features several prominent companies with extensive production capacities, sophisticated formulation technologies, and diverse product portfolios serving multiple animal agriculture segments. Leading manufacturers include:

• Alltech

• Anova Feed

• Archer-Daniels-Midland Company

• Bunge Global SA

• Cargill Incorporated

• Charoen Pokphand Foods PCL

• Godrej Agrovet Limited

• Nutreco N.V

• Purina Animal Nutrition LLC

All of which serve critical end-use sectors including poultry farming, dairy industry, livestock farming, and aquaculture operations across global markets. These industry leaders demonstrate market maturity, competitive dynamics, and operational benchmarks against which new entrants can evaluate their strategic positioning and competitive advantages.

Buy Now: https://www.imarcgroup.com/checkout?id=9125&method=2175

Recent industry developments illustrate ongoing consolidation and capacity expansion strengthening market positions:

• February 2026: Akralos Animal Nutrition officially began operations on February 1 as a North American feed and nutrition company formed through a joint venture between ADM and Alltech. With over 40 feed mills and a workforce exceeding 1,400, Akralos supplies animal feeds, minerals, and supplements supported by advanced nutrition science and tailored customer solutions.

• September 2025: De Heus India inaugurated a new animal feed manufacturing facility in Rajpura, Punjab, with an investment of approximately USD 17 million. Among India's largest feed plants, the facility has an initial capacity of 180 kMT, expandable to 240 kMT, and features automated production lines for cattle, poultry, buffalo, and pig feed using European technology.

These developments underscore the industry's dynamic nature and opportunities for growth through strategic partnerships, technology adoption, capacity expansion, and market penetration in high-growth regions supporting livestock and poultry sector development.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Services:

• Plant Setup

• Factoring Auditing

• Regulatory Approvals, and Licensing

• Company Incorporation

• Incubation Services

• Recruitment Services

• Marketing and Sales

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Animal Feed Manufacturing Plant Cost 2026: Industry Overview and Profitability Assessment here

News-ID: 4393350 • Views: …

More Releases from IMARC Group

Plastic Granules Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, Ca …

The global plastic granules manufacturing industry is witnessing robust growth driven by its increasing consumption in packaging, automotive, construction, and consumer goods sectors, rising demand for recycled and sustainable plastic materials, and expanding use in high-performance polymer applications. At the heart of this expansion lies a critical material input-plastic granules. As industries transition toward lightweight materials and sustainable manufacturing practices, establishing a plastic granules manufacturing plant presents a strategically compelling…

Edible Vegetable Oil Manufacturing Plant DPR - 2026, Market Trends, Machinery Co …

The global food industry continues to depend fundamentally on edible vegetable oils as one of the most widely consumed and commercially significant food commodities, serving households, restaurants, and food processing facilities across every region of the world. Edible vegetable oil is a refined, purified oil extracted from plant sources such as soybean, sunflower, palm, canola, and groundnut, serving multiple purposes including cooking, frying, baking, and as a component of processed…

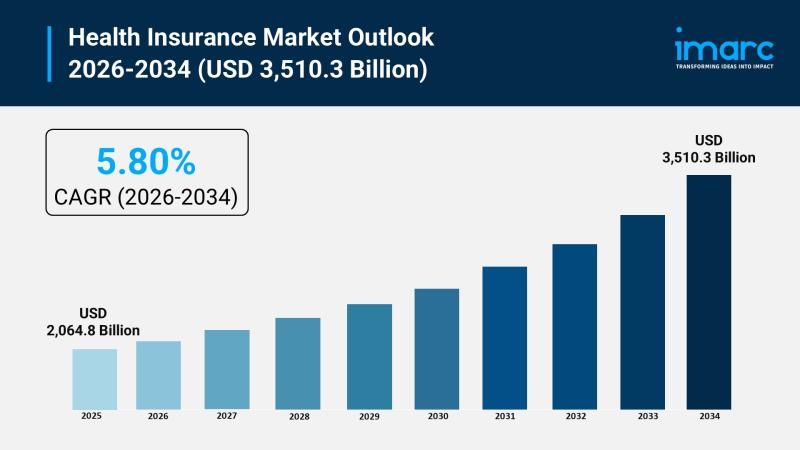

Health Insurance Market Size to Hit USD 3,510.3 Billion in 2034 | Grow CAGR by 5 …

Market Overview:

The health insurance market is experiencing rapid growth, driven by integration of artificial intelligence and advanced analytics, expanding government initiatives and universal coverage mandates, and rising healthcare costs and medical inflation. According to IMARC Group's latest research publication, "Health Insurance Market Size, Share, Trends and Forecast by Provider, Type, Plan Type, Demographics, Provider Type, and Region, 2026-2034, the global health insurance market size was valued at USD 2,064.8 Billion…

India FemTech Market Expected to Reach USD 5,518.58 Million by 2034, Industry Gr …

IMARC Group's latest research publication "India FemTech Market Size, Share, Trends and Forecast by Type, Application, End Use, and Region, 2026-2034" the India FemTech market size reached USD 1,485.81 Million in 2025. The market is expected to reach USD 5,518.58 Million by 2034, exhibiting a growth rate (CAGR) of 15.70% during 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/india-femtech-market/requestsample

What is FemTech?

FemTech, short for Female Technology, refers to a broad category of software, devices,…

More Releases for Animal

Animal Health Market Sets the Table for Continued Growth : Zoetis Animal Healthc …

Advance Market Analytics published a new research publication on "Animal Health Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Animal Health market was mainly driven by the increasing R&D spending across the world. Some of the key players profiled…

Animal Antimicrobials and Antibiotics Market 2023 Growth and Development By Bion …

Antibiotics, also called antibacterials, are a type of antimicrobial drug used in the treatment and prevention of bacterial infections. They may either kill or inhibit the growth of bacteria. Animal Antimicrobials and Antibiotics includes Premixes, Oral Powders, Oral Solutions and Injections on the base of classification, which represent 12.4%, 14.4%, 10.4% and 56.6% of global Animal Antimicrobials and Antibiotics market.

Get Sample Copy: https://www.worldwidemarketreports.com/sample/273708

Farm Animals and Companion Animals are the…

Animal Healthcare Market Analysis Focusing on Top Key Players - Merck, Bayer Ani …

Worldwide Market Reports recently released on the Animal Healthcare market for the forecast period, 2017 – 2022 is involved in screening the business environment and the companies operating in the Animal Healthcare industry. Importantly, the research sheds a lot of light on their winning strategies to help stakeholders, business owners, and field marketing executives stay ahead in the competition. Besides, the industry is thoroughly weighed upon on the basis of…

Animal Model Market trends, Animal Model Market growth, Animal Model Market size …

Key Findings of Animal Model Market

Developing Regions to Overpower Developed Ones With Regard to Demand

The Asian territory is on the verge of evolving as the next big destination for animal models. This growth can be attributed to various factors such as American and European pharmaceutical companies diversifying their research activities to curtail extra expenses and save costs. Although U.S and Europe have retained their legacy in the global market, their…

Animal Growth Promoter Market Outlook To 2023 – Bayer Animal Health, Biomin, B …

Nov 2018, New York USA (News)- Different categories of feed additives for farm animals are referred to as natural growth promoters (NGPs) or non-antibiotic growth promoters. They are commonly regarded as favorable alternatives to antibiotic growth promoters (AGPs) in livestock production. NGPs include predominantly organic acids, probiotics, prebiotics, synbiotics, phytogenics, tannins, feed enzymes and immune stimulants, an ongoing search for alternatives has created a large variety of NGPs for pigs,…

Animal Antimicrobials and Antibiotics Market Key Players : Animal Health, Bayer …

The term antibiotic or antimicrobial is used for those agents who kill or inhibit the growth of microorganism. The antimicrobials products have significant benefits to the animal and to human food safety. There are researches, which have proven that an increase in the rate of animal illness results in higher rate of human illness. Therefore, livestock dealers depend on animal antibiotics to provide safe food. The scope of this report…