Press release

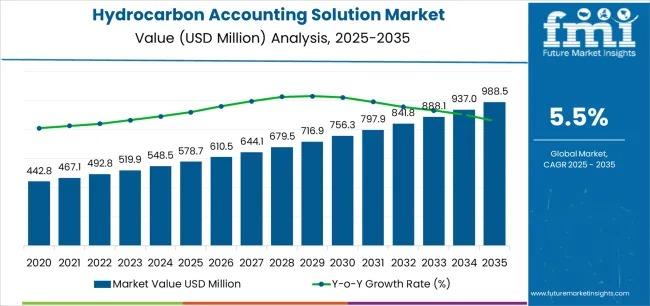

Hydrocarbon Accounting Solution Market Set to Reach USD 988.4 Million by 2035 as Digital Energy Operations Accelerate Global Adoption

The global hydrocarbon accounting solution market is projected to expand from USD 578.7 million in 2025 to USD 988.4 million by 2035, registering a steady compound annual growth rate (CAGR) of 5.5%. This expansion reflects a structural shift across the oil and gas industry toward digital platforms capable of delivering accurate production allocation, automated reconciliation, and regulatory compliance in increasingly complex operational environments. As production portfolios expand across unconventional resources, offshore basins, and integrated midstream networks, hydrocarbon accounting solutions are emerging as essential digital infrastructure supporting financial transparency, operational optimization, and revenue assurance.Hydrocarbon accounting solutions enable energy companies to track, reconcile, and audit hydrocarbon volumes from extraction to delivery, ensuring accuracy in royalty calculations, custody transfer accounting, and financial reporting. The growing complexity of joint ventures, production-sharing agreements, and multi-basin operations is driving the replacement of legacy spreadsheet systems with enterprise-grade accounting platforms capable of integrating operational data, financial workflows, and regulatory reporting into unified digital ecosystems.

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gb-2339

Market Expansion Driven by Production Complexity and Digital Transformation

The increasing operational complexity of hydrocarbon production is accelerating demand for advanced accounting solutions that ensure volumetric accuracy and revenue integrity. Modern oil and gas operations involve multiple stakeholders, diverse ownership structures, and geographically distributed production assets, requiring highly automated accounting systems capable of reconciling large data volumes in real time.

Key growth drivers shaping market expansion include:

• Rising unconventional production from shale, deepwater, and complex reservoirs requiring precise allocation and accounting

• Increasing regulatory compliance requirements for production reporting, taxation, and audit transparency

• Growing joint venture structures requiring automated partner revenue distribution and reconciliation

• Expansion of pipeline infrastructure and midstream logistics demanding accurate custody transfer tracking

• Digital transformation initiatives replacing manual accounting workflows with integrated enterprise platforms

These factors are reinforcing hydrocarbon accounting solutions as critical operational tools rather than optional administrative systems, positioning the market for sustained long-term growth.

Revenue Model Evolution Reflects Shift Toward Cloud and AI Integration

The hydrocarbon accounting solution market is undergoing a significant transformation in revenue composition as cloud platforms and AI-powered analytics gain adoption. Currently, software licenses account for 48% of total market revenue, followed by implementation and integration services at 26%, maintenance contracts at 18%, and cloud subscriptions at 8%.

However, the future revenue mix is expected to shift substantially toward recurring digital services.

Projected future revenue distribution highlights include:

• Cloud-based SaaS subscriptions projected to account for 40-45% of total revenue

• AI-driven analytics modules expected to generate 20-25% of market value

• Managed services and consulting forecast to contribute 15-20% share

• API integration services and regulatory compliance automation creating new monetization opportunities

This transition reflects broader digital transformation across the energy industry, where scalable cloud platforms enable faster deployment, reduced upfront investment, and continuous operational optimization.

On-Premises Solutions Maintain Leadership While Cloud Adoption Accelerates

On-premises hydrocarbon accounting solutions currently dominate the market, accounting for 65% of total market share, driven by enterprise demand for data sovereignty, system customization, and operational control. These systems provide robust integration with legacy infrastructure, enterprise resource planning systems, and field data acquisition platforms.

Key advantages supporting continued on-premises dominance include:

• Enhanced data security and ownership control

• Customizable workflows for complex operational environments

• Seamless integration with existing ERP, SCADA, and financial systems

• Proven reliability for mission-critical accounting operations

At the same time, cloud-based accounting solutions are gaining traction, capturing 35% of market share, particularly among operators seeking scalability, cost efficiency, and real-time data accessibility. Cloud platforms enable faster implementation and continuous feature updates while supporting remote operations and distributed asset management.

Oilfield Services Companies and Upstream Operators Drive Core Demand

Oilfield services companies represent the fastest-growing end-user segment, expanding at a 6.8% CAGR, driven by increasing demand for centralized accounting systems capable of managing multi-client operations and production tracking. These companies require accounting platforms capable of handling diverse client portfolios, complex billing structures, and field-level production allocation.

Upstream exploration and production companies remain the largest revenue contributors due to their critical need for accurate production allocation, royalty calculation, and financial reconciliation.

Primary application areas driving market demand include:

• Production allocation and volumetric reconciliation across multiple wells

• Joint venture accounting and partner revenue distribution

• Custody transfer validation and pipeline inventory management

• Refinery yield accounting and feedstock optimization

• Energy trading and commodity risk management integration

As production networks expand and ownership structures grow more complex, hydrocarbon accounting solutions are becoming indispensable for operational and financial management.

Regional Adoption Patterns Reflect Infrastructure Maturity and Digital Readiness

North America leads global adoption, driven by advanced shale production operations, large-scale pipeline infrastructure, and stringent regulatory reporting requirements. The United States and Canada have implemented comprehensive accounting platforms integrated with enterprise financial systems to ensure revenue accuracy and operational transparency.

The Middle East is experiencing steady growth as national oil companies invest in enterprise hydrocarbon management systems designed to optimize production allocation and export accounting. Countries including Saudi Arabia, the UAE, and Qatar are deploying AI-driven accounting platforms to enhance transparency and operational efficiency.

Europe is advancing adoption through regulatory-driven digital transformation, particularly in Norway and the United Kingdom, where offshore operations require precise production accounting and emissions-linked reporting compliance.

Asia-Pacific represents a high-growth region, led by China, India, and Australia, where expanding refining capacity and infrastructure modernization programs are accelerating accounting solution adoption.

Key regional growth highlights include:

• China achieving the fastest growth at 7.4% CAGR, driven by national energy security initiatives

• India expanding at 6.9% CAGR, supported by upstream development and digital modernization

• Germany maintaining 6.3% growth, driven by compliance requirements and midstream infrastructure

• United States growing at 5.2% CAGR, driven by unconventional resource accounting complexity

These regional dynamics reflect varying stages of digital maturity while reinforcing the global shift toward automated hydrocarbon accounting systems.

AI Integration and Automation Redefining Market Competitive Landscape

The hydrocarbon accounting solution market is moderately consolidated, with leading providers including Infosys, SAP, Adept Solutions, P2 Energy Solutions, and TietoEVRY driving innovation through advanced software platforms and integrated digital ecosystems. Market leaders are investing heavily in AI, automation, and cloud-native architecture to improve system accuracy, scalability, and operational performance.

Exhaustive Market Report: A Complete Study

https://www.futuremarketinsights.com/reports/hydrocarbons-accounting-solution-market

Key competitive trends shaping the market include:

• AI-powered anomaly detection improving accounting accuracy and audit readiness

• Blockchain integration enabling secure and transparent transaction tracking

• Cloud-native platforms enabling scalable deployment and reduced infrastructure costs

• API-driven architectures enabling seamless integration across operational systems

These advancements are transforming hydrocarbon accounting from a reporting function into a strategic digital capability supporting operational efficiency and financial optimization.

Long-Term Outlook Strengthened by Energy Sector Digitalization

The hydrocarbon accounting solution market is expected to maintain steady growth as digital transformation becomes a strategic priority across the global energy industry. Increasing regulatory scrutiny, operational complexity, and financial accountability requirements are accelerating adoption of automated accounting platforms.

As oil and gas companies modernize operations, hydrocarbon accounting solutions will continue to play a central role in ensuring production transparency, regulatory compliance, and financial accuracy. With continued investment in cloud computing, AI-driven analytics, and enterprise integration, the market is positioned to deliver sustained value as a foundational component of digital energy infrastructure.

The full market report provides comprehensive insights into emerging technology trends, competitive positioning, and regional investment opportunities shaping the future of hydrocarbon accounting solutions worldwide.

Similar Industry Reports

Hydrocarbon Accounting Solution Market Share Analysis

https://www.futuremarketinsights.com/reports/hydrocarbon-accounting-solution-market-share-analysis

Europe Hydrocarbons Accounting Solution Market

https://www.futuremarketinsights.com/reports/hydrocarbons-accounting-solution-industry-analysis-in-europe

Demand for Hydrocarbon Accounting Solution in United Kingdom

https://www.futuremarketinsights.com/reports/united-kingdom-hydrocarbon-accounting-solution-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Hydrocarbon Accounting Solution Market Set to Reach USD 988.4 Million by 2035 as Digital Energy Operations Accelerate Global Adoption here

News-ID: 4392546 • Views: …

More Releases from Future Market Insights

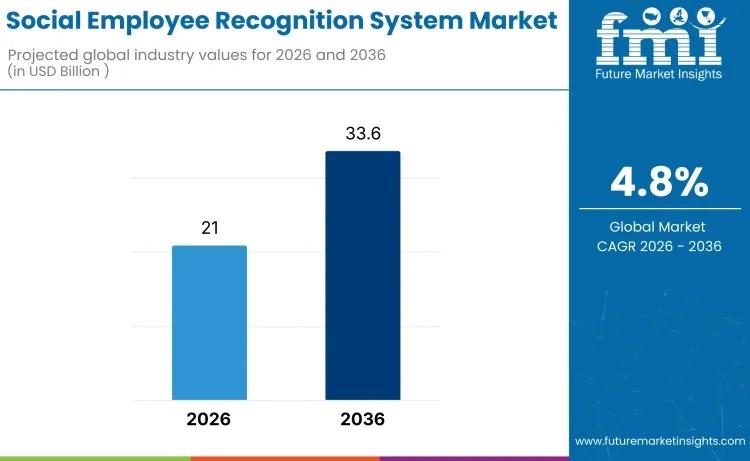

Social Employee Recognition System Market to Reach USD 33.6 Billion by 2036 as D …

The global social employee recognition system market is entering a new phase of strategic expansion, projected to grow from USD 21.0 billion in 2026 to USD 33.6 billion by 2036, reflecting a compound annual growth rate (CAGR) of 4.8%. This sustained growth trajectory highlights the increasing importance of employee engagement technologies in shaping organizational culture, enhancing workforce productivity, and supporting talent retention initiatives across diverse industries.

Organizations worldwide are prioritizing digital…

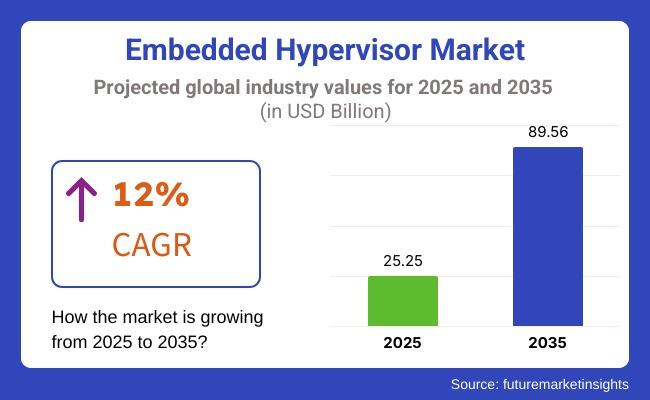

Embedded Hypervisor Market Set for Strong Expansion as Software-Defined Vehicles …

The global embedded hypervisor market is entering a period of accelerated expansion, driven by rising adoption of software-defined architectures across automotive, aerospace, industrial automation, and telecommunications industries. The market is projected to grow from USD 25.25 billion in 2025 to USD 89.56 billion by 2035, advancing at a compound annual growth rate (CAGR) of 12%, reflecting the increasing importance of secure, high-performance virtualization in mission-critical embedded systems.

Embedded hypervisors-specialized software layers…

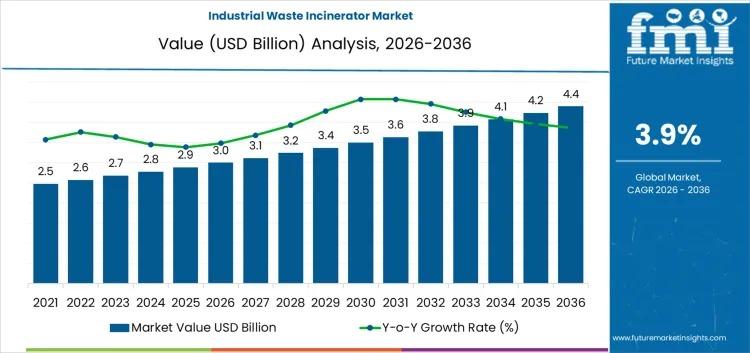

Industrial Waste Incinerator Market to Reach USD 4.4 Billion by 2036 as Industri …

The global industrial waste incinerator market is projected to grow from USD 3 billion in 2026 to USD 4.4 billion by 2036, registering a compound annual growth rate (CAGR) of 3.90% over the forecast period. This steady expansion reflects increasing global pressure on industrial operators to adopt sustainable waste management practices, comply with stringent environmental regulations, and reduce landfill dependence while improving operational efficiency.

As industrial sectors expand production capacity and…

AI-Enabled Recycling Infrastructure Market to Reach USD 12.9 Billion by 2036 as …

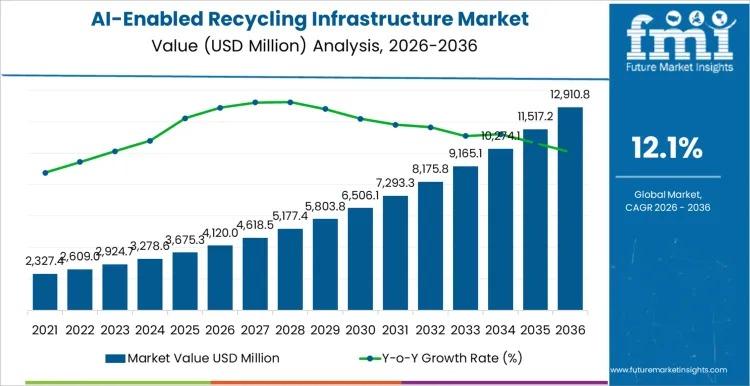

The global AI-enabled recycling infrastructure market is projected to expand from USD 4,120.0 million in 2026 to USD 12,910.8 million by 2036, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period. This growth reflects a structural transformation across global recycling systems as operators deploy artificial intelligence, robotics, and sensor-based automation to improve recovery rates, enhance feedstock quality, and meet increasingly stringent circular economy targets.

The transition toward…

More Releases for Solution

EVCC/SECC, EVCC Overall Solution, SECC Overall Solution

What is secc EV? Supply Equipment Communication Controller. Our Supply Equipment Communication Controller (SECC) acts as the main controller for the charging process.

What is a SECC [https://www.midapower.com/]? SECC may refer to: Single Edge Contact Cartridge, a connector for microprocessors. SECC (metal), a low-cost sheet metal often used for computer cases. Scottish Exhibition and Conference Centre, now known as the SEC Centre, an exhibition space in Glasgow, Scotland.

This is full functional…

Call Center Solution for your business call solution

Elevate Your Customer Service with Our Comprehensive Suite of Call Center Solution and Services. Start your customer success journey with the help of ConVox Call Center Solution.

In today's competitive landscape, delivering exceptional customer service is essential. Traditional call centers often struggle with long wait times and overwhelmed agents. This impacts your brand image and bottom line. ConVox Call Center Solution provides the tools needed to transform your call center operations.…

CompanyTRAK Launches Enterprise Solution, a Contact Tracing, Social Distancing S …

Sqwirrel LLC, a Michigan company, has developed patent-pending technology utilizing a combination of enterprise mobile apps, with Bluetooth tags and scanners to bring employees back to their workplace called "CompanyTRAK". The contact tracing technology and social distancing solution provides a safe way to get employees back to work, keep them mindful of social distancing and alert them to possible risks of exposure from symptomatic, positive tested and exposed employees. CompanyTRAK…

Robotic Process Automation (RPA) Market Insights, Forecast to 2025: By Types - A …

Marketresearchreports.biz Announced New Study on Report "Global Robotic Process Automation (RPA) Market Insights, Forecast to 2025."

This report presents the worldwide Robotic Process Automation (RPA) market size (value, production and consumption), splits the breakdown (data status 2013-2018 and forecast to 2025), by manufacturers, region, type and application.

This study also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, distributors…

Euroweb swaps existing Class 4 solution for TELES softswitch solution

Euroweb, one of Romania's leading service providers, has decided to ditch its legacy multi-vendor solution and replace it with a unified wholesale solution based on the C4 Softswitch from the Berlin based Next Generation Networks and Access Gateway vendor TELES.

Identifying TELES as a vendor for the required solution, Euroweb Romania selected TELES C4 softswitch in addition to the TELES Captura WTP (Wholesale Trading Platform), which makes life easier for operators…

RI-Solution GmbH Selects SAP Nearline Solution from SAND

SAND/DNA for SAP BI to be used by major German retailer

Hamburg, April 25, 2006 – RI-Solution GmbH, a Munich-based IT service provider specializing in information systems, services and solutions for retail companies, has licensed SAND/DNA in conjunction with SAP NetWeaver BI 3.5 to meet the needs of a major retail client. The SAND solution, officially certified by SAP as an integrated ABAP add-on with SAP NetWeaver® Business Intelligence (SAP NetWeaver®…