Press release

Track Bronze Prices 2026: Trend Analysis & Forecast

The Bronze Price Index, a key indicator of global supply-demand shifts, reflects the movements in Bronze Prices across major markets. Tracking current price swings, historical data and future projections provides manufacturers, traders and analysts with critical insights into the price of Bronze today and its outlook. This Bronze Price Trend Analysis report offers snapshot prices, trend charts and forecasts for informed decision-making.Bronze Current Price Movements:

In recent months, Bronze Prices have demonstrated mixed movement, influenced by volatility in base metals like copper and tin - essential components of bronze alloy. According to price data on IMARC Group's market page, the price per tonne has seen moderate gains in late 2025, reflecting tightening supplies and robust industrial demand. This has led to bullish sentiment among buyers and sellers, pushing Bronze price today above year-earlier levels.

Latest Regional Price Update - January 2026

•Europe: USD 18.78 per kg

16.2% increase (↑ Up) compared to the previous period

The sharp rise in European Bronze Prices reflects stronger manufacturing demand, elevated energy costs, and higher copper and tin procurement expenses. Producers in Asia and North America have also reported elevated raw material costs, while downstream users continue adjusting purchasing strategies amid price volatility.

By analyzing the Bronze price index, market watchers can better understand how these short-term price spikes align with broader long-term cycles in the global metals market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/bronze-price-trend/requestsample

Note: The analysis can be tailored to align with the customer's specific needs.

Bronze Price Snapshot (2026):

As of early 2026, Bronze Prices are trading with upward momentum. The price of Bronze per metric tonne has strengthened compared to the previous quarter, supported by

• Elevated demand from automotive and electrical sectors

• Strategic stockpiling by fabricators

• Supply constraints at key smelting facilities

The Bronze price today reflects these dynamics, with prices continuing to show resilience despite global macroeconomic headwinds. Regional supply chain frictions have also contributed to lagged price adjustments, making the Bronze Price Index a valuable real-time gauge of market health.

Bronze Price Trend Analysis:

The Bronze Price Trend Analysis reveals that Bronze continues to follow cyclical patterns tied to industrial metal pricing, especially copper and tin. Historically, bronze - an alloy of copper and tin - correlates strongly with its base metals, and this linkage shows up clearly in trend tracking.

Over the last 12 months

• Prices climbed steadily in response to robust manufacturing activity in China and Southeast Asia.

• Mid-cycle corrections occurred as global inventories rebounded.

• Recently, renewed orders from machinery and consumer electronics sectors have provided upward pressure.

This analysis, anchored in comprehensive market data, helps stakeholders anticipate key price inflection points and adjust procurement strategies accordingly.

Bronze Price Chart & Index - What They Suggest:

The Bronze price chart illustrates price fluctuations over time, with clearly identifiable peaks and troughs that map to global economic events and industrial cycles. Likewise, the Bronze price index aggregates multiple price points into an accessible metric for trend comparison.

Key insights from recent charts include

• A rising trend during late 2024 into early 2025 reflecting strong demand

• Seasonal dips tied to production slowdowns

• A stabilization phase entering 2026

These patterns suggest that the current price cycle may remain elevated if base metal price support continues and global manufacturing demand stays healthy.

Bronze Price Historical Analysis Data:

A historical view of Bronze Prices shows that prices have historically mirrored broader industrial metal cycles. When copper and tin prices surged in 2021-2022, bronze followed suit. Likewise, slower global growth periods corresponded with softer bronze pricing.

Historically, drivers of Bronze price history include

• Shifts in manufacturing output

• Geopolitical trade policies

• Currency movements affecting metal sourcing

Understanding this historical data is critical for analysts and buyers who use the past to benchmark present pricing and shape expectations for future trends.

Factors Driving Recent Bronze Price Trend Increases:

Several core factors are pushing Bronze Prices higher in the near term

1. Supply Chain Constraints: Delays at ports and smelters have tightened near-term availability.

2. Base Metal Pricing: Rising copper and tin costs lift the cost base for bronze producers.

3. Industrial Demand: Growth in electronics, automotive and renewable energy sectors has boosted consumption.

4. Inventory Restocking: End-users rebuilding stocks mid-cycle can support price levels.

These drivers feed into both the Bronze price index and broader price trend dynamics, underlining the importance of holistic market monitoring.

Bronze Price Forecast Next 12 Months:

Looking ahead, the Bronze future price outlook remains moderately bullish. Based on forward curves of base metals and projected manufacturing growth, prices could

• Increase slightly in the first two quarters of 2026

• Stabilize in mid-2026 as inventories adjust

• Show seasonal upticks tied to industrial cycles

According to forecasts from industry analysts, demand from electrical and machinery sectors will likely underpin the price of Bronze through the next 12 months, even if macroeconomic growth softens.

Regional Price Differences for Bronze:

Regional discrepancies in Bronze Prices persist due to logistics costs, tariff regimes and local supply-demand balances

• Asia Pacific: Often trades at a premium because of high manufacturing activity.

• Europe: Prices reflect energy costs and regulatory influences.

• North America: Competitive pricing aided by proximity to base metal sources.

Understanding these differences helps global buyers anticipate cost variations and strategize sourcing to optimize expenses.

Current & Near-Term Prices (Late 2025 - Early 2026):

In late 2025 and early 2026, the Bronze price today continued to show resilience. Market surveys indicate stable demand and a cautious supply outlook, with prices supported by

• Consistent industrial output

• Ongoing supply chain normalization

• Positive base metal pricing trends

This phase positions the market for incremental gains, provided demand holds and inventories remain managed.

Summary - Key Points:

• Bronze Prices have trended upward as of early 2026.

• The Bronze Price Index shows consistent demand signals.

• Historical and current price data reveal cyclical patterns.

• Forecasts indicate a moderately bullish outlook.

• Regional pricing disparities reflect broader economic conditions.

This Bronze Price Trend Analysis equips stakeholders with structured insights into price dynamics, enabling better planning and strategy.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=38232&flag=C

Key Coverage:

• Market Analysis

• Market Breakup by Region

• Demand Supply Analysis by Type

• Demand Supply Analysis by Application

• Demand Supply Analysis of Raw Materials

• Price Analysis

o Spot Prices by Major Ports

o Price Breakup

o Price Trends by Region

o Factors influencing the Price Trends

• Market Drivers, Restraints, and Opportunities

• Competitive Landscape

• Recent Developments

• Global Event Analysis

How IMARC Pricing Database Can Help:

The latest IMARC Group study, Bronze Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2026 Edition, presents a detailed analysis of bronze price trend, offering key insights into global Bronze market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines bronze demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Track Bronze Prices 2026: Trend Analysis & Forecast here

News-ID: 4386946 • Views: …

More Releases from IMARC Group

Methanol Prices Analysis and Regional Trend Jan 2026

Africa Methanol Prices Movement Jan 2026

In January 2026, Methanol Prices in Africa increased to USD 0.36/kg, reflecting a 2.9% rise. The uptick was supported by firmer import costs and steady demand from fuel blending and chemical sectors, while balanced inventories limited sharper upward price movements across regional markets.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/methanol-pricing-report/requestsample

Northeast Asia Methanol Prices Movement Jan 2026

Methanol prices in Northeast Asia remained unchanged at USD 0.35/kg in January…

Formaldehyde Price Index 2026: Latest Trend and 12-Month Forecast

The Formaldehyde Price Index plays a critical role in tracking global Formaldehyde Prices across key regions. In 2025-2026, Formaldehyde Prices reflected fluctuations driven by feedstock methanol costs, downstream resin demand, and regional supply dynamics. Businesses relying on construction, automotive, and chemical intermediates closely monitor the Formaldehyde price index, historical data, and forecast trends to manage procurement risks and optimize purchasing strategies.

Formaldehyde Current Price Movements:

According to the latest updates from IMARC…

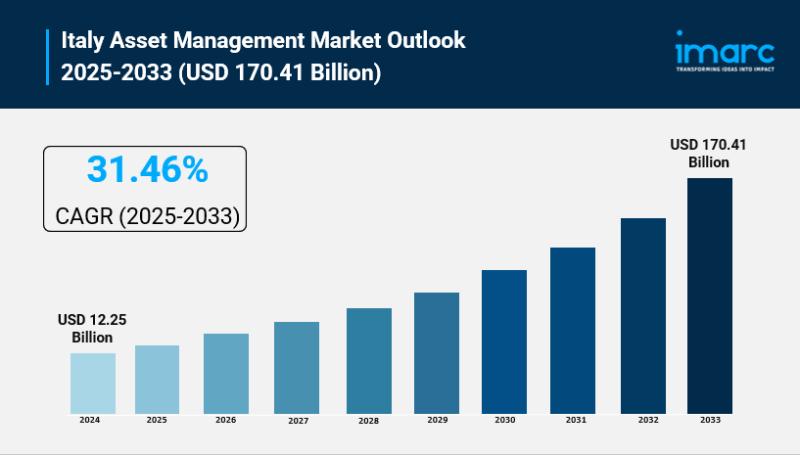

Italy Asset Management Market Size to Hit USD 170.41 Billion by 2033 | With a 31 …

Italy Asset Management Market Overview

Market Size in 2024: USD 12.25 Billion

Market Size in 2033: USD 170.41 Billion

Market Growth Rate 2025-2033: 31.46%

According to IMARC Group's latest research publication, "Italy Asset Management Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Italy asset management market size reached USD 12.25 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 170.41 Billion by 2033, exhibiting a growth rate…

HDPE Price Trend Analysis Q4 2025: Index, Chart & Forecast

The High Density Polyethylene (HDPE) Price Index serves as a critical benchmark for tracking global polymer market movements. High Density Polyethylene (HDPE) Prices have shown region-specific fluctuations driven by feedstock ethylene costs, supply-demand dynamics, and energy volatility. Businesses monitoring the High Density Polyethylene (HDPE) price index and forecast trends gain strategic procurement advantages, especially in packaging, construction, and automotive sectors where HDPE remains a key raw material.

High Density Polyethylene (HDPE)…

More Releases for Bronze

Bearing Bronze Market Giants Spending is Going to Boom | Advance Bronze, Le bron …

The latest study released on the Global Bearing Bronze Market by HTF MI evaluates market size, trend, and forecast to 2031. The Bearing Bronze market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Key Players in…

Aluminum Bronze Market Is Booming Worldwide 2025-2032 | STM International, Natio …

𝐓𝐡𝐞 𝐀𝐥𝐮𝐦𝐢𝐧𝐮𝐦 𝐁𝐫𝐨𝐧𝐳𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐢𝐬 𝐞𝐬𝐭𝐢𝐦𝐚𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 𝐔𝐒𝐃 𝟐.𝟎 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟓 𝐚𝐧𝐝 𝐢𝐬 𝐩𝐫𝐨𝐣𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 𝐔𝐒𝐃 𝟐.𝟗 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟐.

The "Aluminum Bronze Market Report" is the result of extensive research and analysis conducted by our team of experienced market researchers through -

» 70% efforts of Primary Research

» 15% efforts of Secondary Research

» 15% efforts from the subscription to Paid database providing industry overview, macro and micro economics factors,…

Nickel Aluminium Bronze Market Size, Insights 2031 by Key Vendors- Aviva Metals, …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲: According to Verified Market Reports analysis, the global Nickel Aluminium Bronze Market size was valued at USD 3.8 Billion in 2023 and is projected to reach USD 5.4 Billion by 2030, growing at a CAGR of 7.5% during the forecasted period 2024 to 2031.

What is the current outlook for the Nickel Aluminium Bronze (NAB) market, and what drives its growth?

The Nickel Aluminium Bronze market is poised for steady growth,…

Aluminum Bronze Alloys Market Growing Massively by MetalTek, Morgan Bronze, Nati …

New Jersey, United States - Research Cognizance announces the release of the Aluminum Bronze Alloys Market research report. This study is one of the most detailed and accurate ones, focusing solely on the global Aluminum Bronze Alloys market. It sheds light on important factors affecting the growth of the global Aluminum Bronze Alloys market on several fronts. Market participants can use this report to gain a correct understanding of the competitive environment…

[PDF] Bronze Market: Report Explored in Latest Research Players Are Advance Bron …

Allied Market Research published a new report, titled, “ Bronze Market by Type (Aluminum Bronze, Phosphor Bronze, Silicon Bronze, Manganese Bronze, Nickel Bronze, and Others), End User (Industrial, Marine, Infrastructure & Construction, Automotive, Electrical & Electronics, Aerospace & Defense, and Others), and Application (Architectural Parts, Musical Instruments, Industrial Parts, Transportation Parts, and Other Applications): Global Opportunity Analysis and Industry Forecast, 2021–2028.” The report offers an extensive analysis of key growth…

Nickel Aluminium Bronze Market 2019 – 2025 with Major Industries like – Aviv …

"Nickel Aluminium Bronze Market research report delivers a close watch on leading competitors with strategic analysis, micro and macro market trend and scenarios, pricing analysis and a holistic overview of the market situations in the forecast period.

Get Exclusive FREE Sample Copy Of this Report @ https://www.upmarketresearch.com/home/requested_sample/24640

UpMarketResearch offers a latest published report on “Global Nickel Aluminium Bronze Market Analysis and Forecast 2019 - 2026” delivering key insights and providing a competitive…