Press release

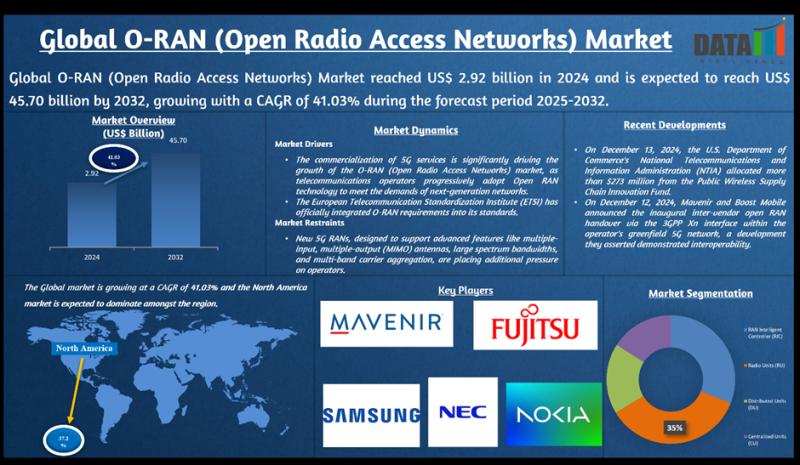

O-RAN (Open Radio Access Networks) Market Set for Massive Expansion at 41.03% CAGR, Expected to Reach USD 45.70 Billion by 2032 with Asia Pacific Holding the Highest Market Share

The O-RAN (Open Radio Access Networks) Market reached US$ 2.92 billion in 2024 and is expected to grow to around US$ 45.70 billion by 2032, expanding with a CAGR of approximately 41.03 % from 2025 to 2032 as telecommunication networks evolve toward open, flexible architectures.Growth is supported by increasing demand across key applications such as multi-vendor 5G network deployments, radio access disaggregation, cloud-native network functions, network virtualization, and private wireless infrastructures, driven by the rapid rollout of 5G services, the need for cost-efficient and scalable network solutions, and the shift toward interoperable open standards that separate hardware from software components. O-RAN enables telecommunications operators to integrate components from diverse vendors, enhance network agility, and reduce dependency on proprietary systems, fostering broad adoption across public and private network operators globally.

Download your exclusive sample report today (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/o-ran-open-radio-access-networks-market?sindhuri

O-RAN (Open Radio Access Networks) Market: Competitive Intelligence

Mavenir, NEC Corporation, Fujitsu Limited, Nokia Corporation, Samsung Electronics Co., Ltd., Radisys Corporation, Parallel Wireless, ZTE Corporation, AT&T Inc., and Casa Systems, Inc., and others.

The O-RAN (Open Radio Access Networks) Market is strongly driven by leading players such as Mavenir, NEC, Fujitsu, Nokia, and Samsung, who provide open, interoperable RAN hardware and software solutions that enable multi-vendor 5G network deployments. Their technologies spanning open RAN radio units, distributed units, centralized units, and RAN Intelligent Controllers (RIC) support disaggregated, software-defined architectures that improve flexibility, cost-efficiency, and scalability for telecom operators and enterprise network deployments. The market's rapid growth is fueled by widespread 5G commercialization, regulatory backing for open standards, and growing demand for network virtualization and vendor diversity in telecommunications infrastructure.

These companies' complementary strengths cloud-native and virtualized Open RAN platforms from Mavenir and Parallel Wireless; extensive telecom infrastructure and system integration expertise from NEC and Fujitsu; global deployment scale and portfolio breadth from Nokia and Samsung; network software and components from Radisys and Casa Systems; and connectivity and deployment initiatives driven by operators such as AT&T and ZTE are enhancing competitive positioning across regions and segments. Strategic focus areas include enhancing multi-vendor interoperability, scaling carrier-grade performance, expanding private and public network deployments, integration with 5G and future 6G networks, and partnerships aligned with disaggregation and open standards initiatives, strengthening competitiveness in next-generation wireless networks globally.

Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/o-ran-open-radio-access-networks-market?sindhuri

Recent Key Developments - United States & North America

✅ January 2026: AmpliTech Group became the first U.S. company to achieve O-RAN ALLIANCE certification for its 64T64R MIMO 5G radio platform, confirming compliance with O-RAN technical specifications and boosting confidence in multi-vendor O-RAN deployments.

✅ December 2025: AmpliTech Group achieved 100 % Open RAN handover validation at the O-RAN Global PlugFest Fall 2025, demonstrating carrier-grade interoperability for multi-vendor 5G networks an important milestone for commercialization.

✅ 2025: AT&T and Verizon continued Open RAN investments and testing with partners like Samsung, driving interoperability testing and lab validations to support large-scale implementation in U.S. networks.

Recent Key Developments - Global

✅ December 2025: The O-RAN ALLIANCE announced its Summit at MWC Barcelona 2026, focusing on capturing AI-enabled open RAN opportunities and shaping the future path to open 6G with operator and vendor participation.

✅ April 2025: The O-RAN Software Community released J and K software updates, improving integration with OpenAirInterface and Intel FlexRAN, enhancing support for RIC developers and fostering open-source innovation.

✅ March 2025: The O-RAN ALLIANCE set priorities for scaled deployments and AI/6G collaboration, highlighting interoperable open fronthaul, advanced RIC-driven network automation, and zero-trust security models in standards development.

Recent Key Developments - Product & Technology Innovation

✅ 2025: PlugFest events globally showcased advanced O-RAN use cases, including AI-enabled network optimization, energy efficiency improvements, and cross-vendor components interoperability.

✅ Late 2025: AmpliTech released new Band 50 (n50) Open RAN radios supporting fixed wireless access and expanded 5G coverage, marking progress in O-RAN radio unit commercialization.

✅ Ongoing Research: Technical studies are emerging on AI-driven automated testing and verifiable monitoring frameworks to enhance validation, compliance, and operational security of O-RAN multi-vendor systems.

Recent Regional & Industry Highlights

✅ Multi-vendor ecosystem expansion: Global O-RAN PlugFests and OTIC test centers continue to grow, enabling cross-vendor validation and boosting operator confidence worldwide.

✅ Standardization & Security: The O-RAN ALLIANCE's publication of dozens of new technical documents underscores ongoing efforts to advance interoperability, security, and deployment maturity across regions.

✅ Collaborative network initiatives: Regional telecom partners and new alliances (e.g., O-RU Alliance led by Kyocera) are forming to promote O-RAN compliant CU/DU/RU platforms and interoperability across ecosystems.

✅ 1. M&A / Strategic Developments

Nokia acquires Juniper's RAN Intelligent Controller (RIC) Business

October 2025 Nokia Corporation acquired Hewlett Packard Enterprise's (HPE) Juniper RIC business, strengthening its position in Open RAN automation and intelligence by bringing key RIC/SMO technology under Nokia's portfolio. This consolidation supports Nokia's O-RAN strategy while reducing fragmentation in O-RAN software options.

The acquisition bolsters Nokia's AI-driven network management capabilities and combines well with its own MantaRay SMO orchestration strategy.

✅ 2. New Product Launches & Technology Deployments

Rakuten Mobile & 1Finity Scale O-RAN Massive MIMO

February 2026 Rakuten Mobile announced a collaboration with 1Finity (Fujitsu's networking arm) to deploy 1Finity's Massive MIMO O-RAN radios at scale in its fully virtualized Open RAN network.

These O-RAN compliant mMIMO radios (based on the Qualcomm Dragonwing QRU100) enhance coverage, capacity, and energy efficiency while supporting integration with Rakuten's CU/DU through open fronthaul interfaces.

AmpliTech Releases New Band 50 (n50) O-RAN Radios

December 2025 AmpliTech Group, Inc. released Band 50 (n50) Open RAN radios, targeting 5G Fixed Wireless Access (FWA) deployments key for expanding O-RAN coverage in suburban and rural environments.

These radios support long-range coverage with TDD bandwidth while aligning with O-RAN open interface standards.

✅ 3. R&D News & Technological Advancements

O-RAN Software Community Releases "J" and "K" Software

April 2025 The O-RAN Software Community (O-RAN SC) announced its J and K software releases, enhancing integration with OpenAirInterface and Intel FlexRAN, and improving platforms for RIC application development and simulation accelerating ecosystem maturity.

These releases aid standard alignment with O-RAN ALLIANCE specs, enabling stronger interoperability and developer support.

Open-Source O-RAN Radio Unit Architectures

Dec 2025 (Academic research) The ProtO-RU initiative introduced an open-source, software-defined O-RAN Split-7.2 Radio Unit using SDRs and commodity CPUs demonstrating stable throughput and multi-vendor interoperability in research settings.

This could lower barriers for new O-RU design and extend research into commercial O-RAN radios.

Automated & Zero-Touch O-RAN Systems

Apr 2025 (Academic research) The AutoRAN framework showcased a zero-touch, intent-driven O-RAN automation platform using cloud-native principles and large language models (LLMs) to translate high-level intents into configurations a possible future model for O-RAN deployments.

✅ 4. Major Technological Deployments & Industry Adoption

Verizon, Samsung, & Qualcomm Deploy Multi-Vendor RIC

Feb 2025 (extended into recent industry use) Verizon Communications, with Samsung Electronics and Qualcomm Technologies, deployed a multi-vendor RAN Intelligent Controller in a commercial network, integrating Samsung's AI-powered Energy Saving Manager (AI-ESM) with Qualcomm's RIC suite to improve performance and energy efficiency.

This deployment demonstrates real-world O-RAN automation and vendor interoperability in live 5G networks.

Orange & Samsung vRAN/Open RAN Pilot

Jul 2025 Orange France and Samsung completed a pilot test of virtualized RAN (vRAN) and Open RAN with successful 4G/5G calls in the Lyons region another milestone in moving O-RAN technologies from lab to field.

5. Market & Strategic Trends (Context for Recent Activity)

Rakuten Open RAN Licensing Program Partners

Mar 2025 Rakuten Symphony announced Cisco, Airspan Networks, and Tech Mahindra as partners in its Real Open RAN Licensing Program, expanding adoption of cloud-native O-RAN solutions worldwide, a strategic ecosystem move that continues influencing deployments through 2026.

Segments Covered in the O-RAN (Open Radio Access Networks) Market:

By Offering

The market is segmented into Hardware 45%, Software 35%, and Services 20%, with hardware dominating due to high deployment of open radio units, servers, and baseband infrastructure required for O-RAN networks. Software adoption is growing rapidly with increased use of virtualization, AI-driven network optimization, and open interfaces. Services, including integration, testing, and managed services, are expanding as telecom operators seek seamless deployment and interoperability across multi-vendor environments. Continuous 5G rollouts and network disaggregation drive growth across all offerings.

By Component

Components include Radio Units (RU) 35%, Distributed Units (DU) 25%, Centralized Units (CU) 20%, and RAN Intelligent Controller (RIC) 20%, with radio units leading due to large-scale replacement of traditional base stations with open and interoperable hardware. DU and CU adoption is driven by cloud-native architectures enabling centralized processing and flexible network management. The RIC segment is witnessing strong growth as operators deploy AI/ML-based applications for traffic optimization, energy efficiency, and network automation.

By Network Deployment

The market is segmented into Hybrid Cloud Networks 40%, Public Cloud Networks 35%, and Private Cloud Networks 25%, with hybrid cloud deployments dominating due to the need for flexibility, low latency, and secure handling of critical network functions. Public cloud adoption is increasing with virtualization and scalability advantages. Private cloud networks remain important for operators requiring full control, security, and regulatory compliance. Multi-cloud strategies accelerate adoption of O-RAN architectures.

By Frequency Band

Frequency bands include Sub-6 GHz 55%, mmWave 30%, and Others 15%, with Sub-6 GHz dominating due to broader coverage, lower deployment costs, and suitability for nationwide 5G rollouts. mmWave is gaining traction in dense urban areas and enterprise applications requiring ultra-high bandwidth and low latency. Other bands support legacy and specialized network deployments. Expanding 5G use cases drive demand across frequency segments.

By End-User

End-users include Telecom Operators 60%, Enterprises/Industries 20%, Government Authorities 15%, and Others 5%, with telecom operators dominating due to large-scale network modernization and cost optimization initiatives. Enterprises adopt O-RAN for private 5G networks in manufacturing, logistics, and smart campuses. Government authorities deploy O-RAN for secure communications and smart city infrastructure. Demand for vendor-neutral and flexible networks supports broad adoption.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=o-ran-open-radio-access-networks-market?sindhuri

Regional Analysis

Asia Pacific - 35% Share

Asia Pacific leads with 35% share, driven by aggressive 5G deployment, strong government support, and large-scale adoption of O-RAN in countries such as China, Japan, South Korea, and India. Telecom operators dominate end-user adoption. Sub-6 GHz deployments and hybrid cloud networks are widely used. Local vendor ecosystems and innovation accelerate regional growth.

North America - 25% Share

North America holds 25% share, supported by early adoption of open network architectures and strong investments from telecom operators in the U.S. and Canada. RIC adoption is high due to focus on AI-driven network automation. Public and hybrid cloud deployments dominate. Government initiatives to promote open and secure networks support market expansion.

Europe - 20% Share

Europe accounts for 20% share, driven by regulatory encouragement for open and interoperable networks and 5G expansion across the region. Telecom operators and government authorities are key adopters. Hybrid cloud deployment leads due to data sovereignty concerns. Strong collaboration between vendors and operators supports steady growth.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?sindhuri

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release O-RAN (Open Radio Access Networks) Market Set for Massive Expansion at 41.03% CAGR, Expected to Reach USD 45.70 Billion by 2032 with Asia Pacific Holding the Highest Market Share here

News-ID: 4384376 • Views: …

More Releases from DataM Intelligence 4Market Research LLP

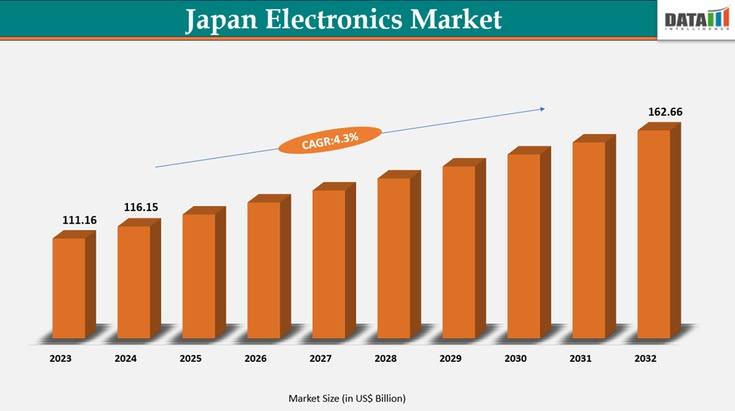

Japan Electronics Market to Reach US$ 162.66 Billion by 2032 Driven by Technolog …

The Japan Electronics Market reached a value of US$ 111.16 billion in 2023, increased to US$ 116.15 billion in 2024, and is projected to reach US$ 162.66 billion by 2032, growing at a CAGR of 4.3% during the forecast period 2025-2032, according to DataM Intelligence research.

Growth is driven by strong demand across consumer electronics, automotive electronics, industrial automation, and semiconductor applications, supported by Japan's advanced manufacturing ecosystem and continuous technological…

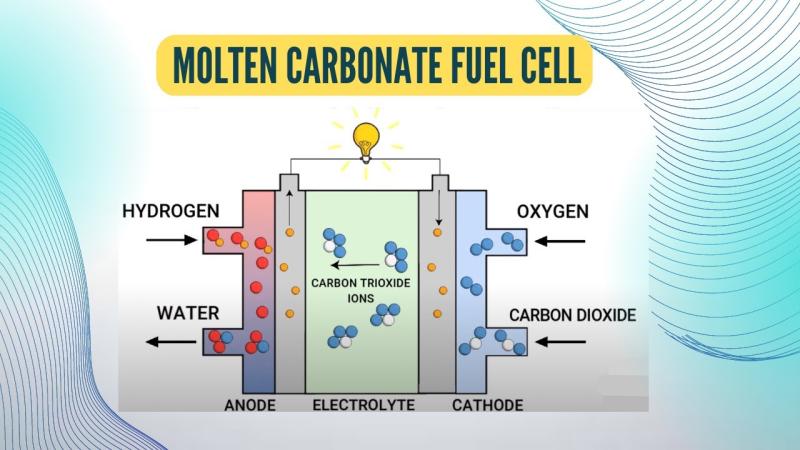

Molten Carbonate Fuel Cell Market Outlook 2025-2032: Rising Demand for High-Effi …

Molten Carbonate Fuel Cell Market Size and Forecast

DataM Intelligence has published a new research report on "Molten Carbonate Fuel Cell Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and…

Cloud Orchestration Market Set to Reach USD 84.2 Billion by 2033 Growing at 15.2 …

The Cloud Orchestration Market reached US$ 23.1 billion in 2024 and is expected to grow to around US$ 84.2 billion by 2033, expanding at a CAGR of approximately 15.2 % from 2025 to 2033 as organizations increasingly adopt automated cloud resource management to support hybrid and multi-cloud environments.

Growth is supported by increasing demand across key applications such as resource provisioning & scaling, automated deployment, configuration management, monitoring, and hybrid cloud…

3D Printing in Construction Market to Grow at an Exceptional CAGR of 94.55% Thro …

The 3D Printing in Construction Market is expected to grow at an exceptional CAGR of 94.55% during the forecast period 2024-2031, according to DataM Intelligence research.

Growth is driven by the rising demand for cost effective, time efficient, and sustainable construction solutions, along with increasing adoption of automation and digital fabrication technologies in the construction industry. 3D printing enables reduced material waste, faster project completion, design flexibility, and lower labor dependency,…

More Releases for Open

Open to Submissions

Do you have an inspiring story to tell? To celebrate the launch of CozyBookShoppe.com, we are hosting a writing contest! We are looking for the most inspirational essay of 2000 words or less to be the winner of $250. It can be a personal experience or a fictional story, but the result needs to be inspiring - to make the reader feel full of hope or encouraged.

CozyBookShoppe.com was born out…

Open Source Camp on Bareos: Call for Papers open

The organizer NETWAYS GmbH opens the Call for Papers for the Open Source Camp (OSCamp) on Bareos. Presentations can be submitted until March 30, 2020.

Nuremberg, January 23, 2020

Let's talk about backups! This is the title of this year's Open Source Camp (OSCamp) on Bareos, which takes place on June 19, 2020 in Berlin. The Call for Papers for the event is open: The organizer is looking for case studies, reports…

Open API (Application Programming Interface) Market : Key Vendors : Open Banking …

An open API is a publicly available interface which is developed to be easily accessible by the wider population of Web and mobile developers. An open API can be used both by developers inside the organization that published the API as well as by developers outside the organization who wish to register for access to the interface.

Three main characteristics of open APIs are – freely available to use by all…

Open Source Intelligence Market, Open Source Intelligence Market Analysis, Open …

Open-source intelligence is data collected from publicly available sources to be used in an intelligence context. Open-source intelligence collects data from publicly available sources such as television, radio, newspapers, commercial databases, internet, media, and others. The open source intelligence solutions are being adopted by many enterprises. The open source intelligence tools enable in collecting a wide range of information which are publicly available.

Get Sample Copy of this Report: https://www.qyreports.com/request-sample?report-id=79500…

ICORE Meets to Bridge Open Education and Open Research

ICORE members have begun a series of meetings to develop the association’s defining connection between open research and open education, as well as methods of promotion for these fields. All interested organizations and experts are invited to join one of the next open online meetings on Wednesday, 23 October 2013. The first session will start at 8:00 am UTC and the second at 4:00 pm UTC, in order to allow…

Kaplan Open Learning launches incentives for new open degree course students

Anyone who is considering taking a degree course is advised to do so this January before the large-scale changes to education funding take effect. In the light of these changes, Kaplan Open Learning, who provide online degree courses in partnership with the University of Essex, announce a new “Refer a Friend” incentive scheme for new students.

Major changes to education funding which are due to take effect in September 2012…