Press release

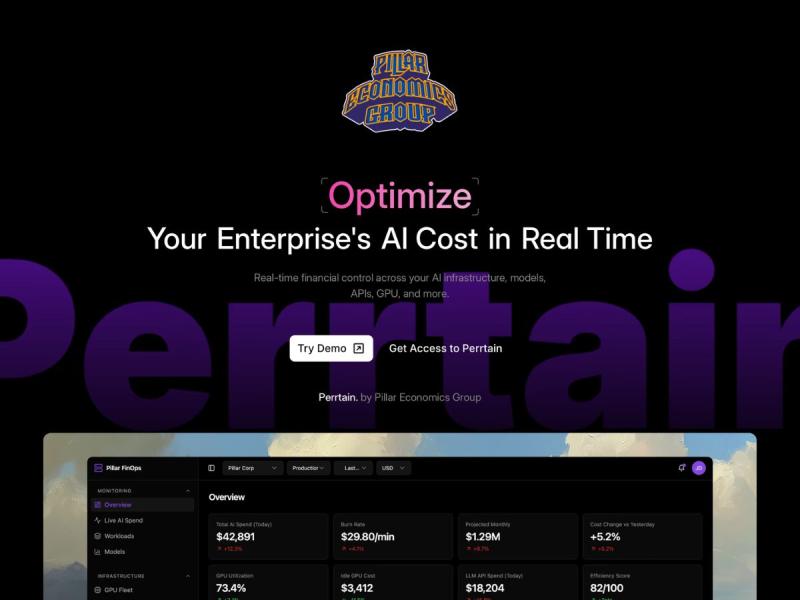

Pillar Economics Group's New AI FinOps Platform Helps Enterprises Take Control of Rapidly Rising AI Costs

Pillar Economics Group gives enterprises financial control over AI, turning unpredictable costs into clarity.

Over the past two years, AI has moved from experimentation to production at unprecedented speed. From customer support and copilots to analytics and internal automation, organizations are embedding AI into critical workflows. However, unlike traditional IT systems, AI costs are driven by usage-based factors such as inference traffic, token consumption, GPU utilization, and third-party large language model (LLM) APIs. These costs often remain fragmented across teams and platforms, becoming visible only after billing cycles close.

Industry research has repeatedly highlighted this issue. Studies from McKinsey show that a significant portion of enterprise AI initiatives fail to deliver expected ROI, while Gartner has identified uncontrolled AI and cloud spending as a growing financial risk for large organizations. CFOs and finance leaders increasingly cite a lack of visibility and predictability in AI costs as a key barrier to scaling AI responsibly.

Founded by Entrepreneur Manmohan Yadav, the newly launched platform addresses this gap by providing a purpose-built FinOps solution designed specifically for AI workloads. Unlike traditional cloud cost management tools, which treat AI as just another infrastructure expense, this platform models AI as a distinct economic system with its own cost drivers and behaviors.

The platform integrates directly with cloud billing systems, GPU infrastructure, internal model deployments, and external LLM providers. By continuously ingesting and normalizing these data streams, it enables enterprises to understand AI spend at a granular level, including cost per model, cost per feature, cost per team, and cost per user. This level of attribution allows organizations to move beyond high-level cost summaries and understand exactly where AI dollars are going and why.

Beyond visibility, the platform provides forecasting and governance capabilities that help enterprises manage AI costs proactively. Teams can predict future AI spend based on usage trends, detect anomalies before they escalate, and enforce budgets and policies that align AI usage with business priorities. This helps prevent runaway costs while allowing engineering teams to continue innovating without constant financial uncertainty.

Importantly, the platform also supports organizations that have already optimized their AI infrastructure but still operate at high spend levels. In these cases, the focus shifts from cost reduction to economic decision-making. By clearly linking AI costs to business outcomes such as revenue, customer growth, or operational efficiency, the platform enables leadership teams to justify AI investments, evaluate trade-offs, and make informed decisions about pricing, feature scope, and market expansion.

As AI becomes one of the largest operating expenses in modern enterprises, financial discipline around AI is no longer optional. Companies that fail to understand and govern AI economics risk margin erosion, stalled AI adoption, or both. Those that succeed will be able to scale AI with confidence, knowing that costs are predictable, defensible, and aligned with value creation.

The launch of this AI FinOps platform marks an important step toward that future, offering enterprises the tools they need to manage AI not just as a technology, but as a core financial system.

Pillar Economics Group's Official Website: https://pillareconomicsgroup.com

Pillar Economics Group

ISB Road, Gachibowli, Hyderabad, TS, India

Founder: Manmohan Yadav, consult@pillareconomicsgroup.com

Press Contact: my2386@srmist.edu.in

Detailed Conception of the Enterprise:

Pillar Economics Group is conceived as an enterprise software company focused on solving one of the most pressing challenges created by large-scale AI adoption: the lack of financial control over AI systems.

As artificial intelligence becomes embedded into core business workflows, AI is no longer a research expense or a one-time investment. It has become a recurring, usage-based operating cost driven by inference volume, token consumption, GPU utilization, and third-party AI services. These costs behave very differently from traditional IT or cloud infrastructure and are often difficult for organizations to predict, attribute, or govern.

Pillar Economics Group is built on the premise that AI must be managed not only as a technical system, but as an economic system. The enterprise is designed to provide organizations with a dedicated financial operating layer for AI - enabling visibility, forecasting, governance, and decision-making around AI spend at production scale.

The company's core product is an AI-native FinOps platform that integrates with cloud providers, AI infrastructure, internal model deployments, and external LLM vendors. By aggregating and normalizing these signals, the platform allows enterprises to understand AI costs at the level where real decisions are made: per model, per feature, per team, and per customer. This enables organizations to scale AI responsibly while protecting margins and ensuring long-term sustainability.

Beyond cost visibility, the enterprise is conceived to support advanced economic analysis, such as forecasting AI spend under different growth scenarios, evaluating return on AI investment, and supporting strategic trade-offs between cost, performance, and business impact. In this way, Pillar Economics Group positions itself not as a cost-cutting tool but as a decision-support system for AI-driven businesses.

The long-term vision of the enterprise is to become the financial system of record for enterprise AI, similar to how traditional FinOps platforms became essential for cloud computing - but purpose-built for the unique economics of AI.

Description of the Enterprises Involved:

Pillar Economics Group operates as a B2B SaaS enterprise, serving mid-market and large organizations that deploy AI at scale. Its primary customers include technology companies, enterprises with internal AI platforms, and organizations using large language models in production across customer-facing and internal use cases.

The enterprise works closely with multiple ecosystem participants, including:

Cloud service providers, from which infrastructure, GPU, and compute cost data is sourced

AI model and LLM providers, whose APIs and pricing structures contribute significantly to AI operating expenses

Enterprise engineering and ML teams, who deploy and operate AI systems

Finance and leadership teams, who are responsible for budgeting, forecasting, and capital allocation related to AI initiatives

Pillar Economics Group acts as an independent control and intelligence layer that sits across these systems, rather than replacing them. Its role is to unify fragmented cost and usage data, translate technical AI activity into financial insight, and enable coordinated decision-making across engineering, finance, and executive leadership.

By positioning itself at the intersection of AI operations and financial governance, Pillar Economics Group serves as a critical enabler for enterprises seeking to scale AI while maintaining economic discipline, predictability, and accountability.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Pillar Economics Group's New AI FinOps Platform Helps Enterprises Take Control of Rapidly Rising AI Costs here

News-ID: 4381401 • Views: …

More Releases from Pillar Economics Group

Pillar Economics Group's Perrtain: The First Real-Time AI Financial Control Plan …

LOS ANGELES, California - As enterprise artificial intelligence adoption accelerates from experimental pilots to mission-critical production, CFOs and engineering leaders face a growing crisis: the "Black Box" of AI infrastructure spend. Today, Pillar Economics Group, a Los Angeles-based financial engineering firm, proudly announces the breakout success of Perrtain, the industry's first Real-Time AI Financial Control Plane designed to bridge the structural gap between dynamic AI execution and static financial governance.

Since…

More Releases for FinOps

Cloud FinOps Market Penetration and Growth Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Cloud FinOps Market - (By Offering (Solutions (Native Solutions, Third-party Solutions), Services (Professional Services, Managed Services), By Application (Cost Management & Optimization, Budgeting & Forecasting, Cost Allocation & Chargeback, Workload Management & Optimization, Reporting & Analytics, Other), By Service Model (IaaS, PaaS, SaaS), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size…

Cloud FinOps Market expected to Witness Huge Revenue Growth to 2034

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Cloud FinOps Market - (By Offering (Solutions (Native Solutions, Third-party Solutions), Services (Professional Services, Managed Services), By Application (Cost Management & Optimization, Budgeting & Forecasting, Cost Allocation & Chargeback, Workload Management & Optimization, Reporting & Analytics, Other), By Service Model (IaaS, PaaS, SaaS), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size…

[Latest] Cloud Finops Market Dynamics: Investment Trends and Importance

Cloud FinOps Market Outlook and Investment Analysis

What is the current outlook for the Cloud FinOps market and its growth potential?

The Cloud FinOps market is poised for significant growth, driven by increasing cloud adoption and the rising need for efficient cloud cost management. Organizations are increasingly investing in Cloud FinOps solutions to optimize cloud spending, improve financial accountability, and enhance operational efficiency. The market is expected to grow at a robust…

[Latest] The Influence of Artificial Intelligence on the Cloud Finops Market

New Jersey, United States,- Cloud Finops Market The growth is driven by the increasing adoption of cloud platforms by businesses across various industries, coupled with the need to manage complex cloud costs and optimize financial operations. Enterprises are increasingly looking for effective solutions to gain control over their cloud expenditure, resulting in a significant demand for cloud financial operations solutions. As organizations expand their cloud infrastructures, the need for streamlined…

Cloud FinOps Market Survey Detailed Analysis and Forecast 2024-2031

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Cloud FinOps Market - (By Offering (Solutions (Native Solutions, Third-party Solutions), Services (Professional Services, Managed Services), By Application (Cost Management & Optimization, Budgeting & Forecasting, Cost Allocation & Chargeback, Workload Management & Optimization, Reporting & Analytics, Other), By Service Model (IaaS, PaaS, SaaS), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size…

Cloud FinOps Market Key Players Analysis - AWS, Microsoft, IBM, Google, Oracle, …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Cloud FinOps Market - (By Offering (Solutions (Native Solutions, Third-party Solutions), Services (Professional Services, Managed Services), By Application (Cost Management & Optimization, Budgeting & Forecasting, Cost Allocation & Chargeback, Workload Management & Optimization, Reporting & Analytics, Other), By Service Model (IaaS, PaaS, SaaS), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size…