Press release

Transaction Monitoring Market Size, Trend & Forecast (2025-2032)

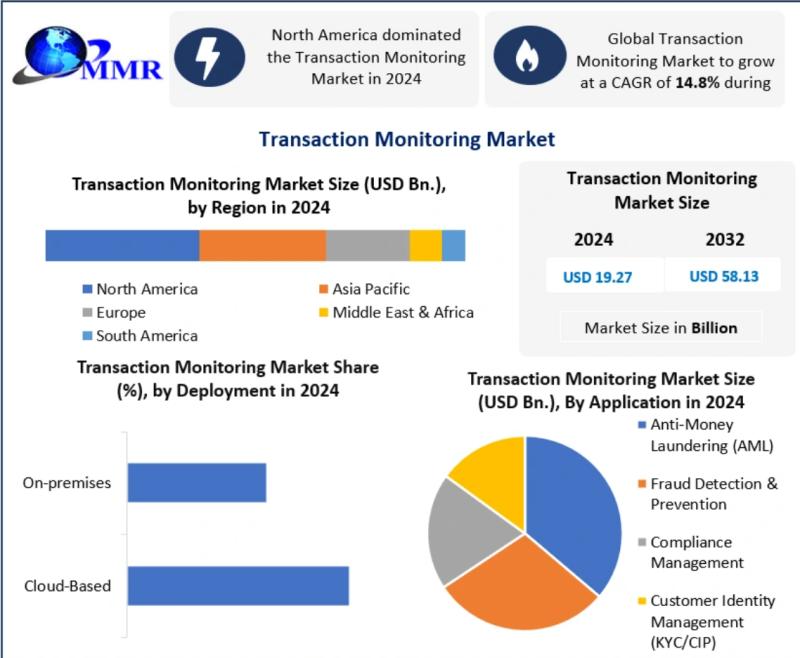

Transaction Monitoring Market Set for Rapid Expansion, Expected to Reach USD 58.13 Billion by 2032The Global Transaction Monitoring Market was valued at USD 19.27 Billion in 2024 and is projected to grow at a robust compound annual growth rate (CAGR) of 14.8% from 2025 to 2032, reaching nearly USD 58.13 Billion by 2032. The market's rapid expansion is primarily driven by the accelerating adoption of digital payments, rising e-commerce activities, increasing regulatory scrutiny, and the growing need to combat financial crimes such as money laundering, fraud, and terrorist financing.

Transaction monitoring has become a critical component of modern financial and digital ecosystems, enabling organizations to ensure secure, compliant, and transparent transactions across banking, retail, government, healthcare, and other industries. As global transaction volumes surge, enterprises are increasingly investing in advanced monitoring solutions to protect their systems and customers from financial and cyber risks.

♦Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/28094/

Transaction Monitoring Market Overview

Transaction monitoring refers to the process used by organizations to verify, analyze, and manage transactions occurring within an information system. These systems are designed to continuously track customer transactions, analyze behavioral patterns, and identify suspicious or anomalous activities in real time. The primary objective of transaction monitoring is to ensure compliance with regulatory frameworks while preventing fraudulent activities, money laundering, and other financial crimes.

Banks, financial institutions, payment service providers, and enterprises rely heavily on transaction monitoring solutions to evaluate customer profiles and transaction histories, ensuring that no unusual or high-risk activities go undetected. With increasing digitization and the shift toward cashless economies, transaction monitoring has evolved into a strategic necessity rather than a regulatory formality.

The Transaction Monitoring Market report provides an in-depth analysis of key market segments, including Deployment Mode, Organization Size, Application, Industry Vertical, and Region. The study covers major regions such as North America, Europe, Asia Pacific, Middle East & Africa, and South America, offering a comprehensive view of global market trends. Historical data from 2019 to 2024 is analyzed alongside forward-looking insights through 2032, enabling stakeholders to understand both current dynamics and future growth potential.

Transaction Monitoring Market Dynamics

Advanced Analytics to Identify High-Risk Behaviors

One of the key forces driving the transaction monitoring market is the growing demand for advanced analytics capable of identifying high-risk behaviors in complex transaction environments. Traditional rule-based systems are increasingly being replaced or supplemented by advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics.

These technologies enable organizations to detect suspicious patterns more accurately, reduce false positives, and generate proactive risk alerts. Regulatory requirements related to Anti-Money Laundering (AML), Know Your Customer (KYC), and Counter-Terrorist Financing (CTF) further accelerate the adoption of advanced transaction monitoring systems, particularly across financial institutions and payment networks.

Rising Online Commerce and Digital Payments

The rapid growth of e-commerce platforms, mobile wallets, and real-time digital payment systems has significantly increased the volume and complexity of financial transactions worldwide. As consumers increasingly rely on online and contactless payment methods, the risk of fraud and cybercrime has also intensified.

E-commerce companies and payment service providers are required to use secure transaction monitoring solutions that comply with stringent regulatory standards. Ensuring secure payment gateways and protecting customer data are critical factors driving demand for transaction monitoring solutions across both developed and emerging markets.

Lack of Skilled Professionals

Despite strong growth prospects, the transaction monitoring market faces challenges related to the shortage of skilled professionals. Transaction monitoring systems generate vast volumes of data that require expert analysis to interpret alerts, investigate suspicious activities, and optimize system performance.

The lack of qualified professionals capable of managing advanced analytics platforms and interpreting complex data sets can restrain market growth, particularly for small and medium-sized enterprises (SMEs). As the market expands, the need for skilled compliance analysts, data scientists, and risk management professionals is expected to rise significantly.

Know Your Transaction (KYT) as an Emerging Trend

The concept of Know Your Transaction (KYT) is gaining prominence as organizations move toward more proactive and predictive risk management strategies. KYT focuses on continuously monitoring transaction behavior rather than relying solely on static customer information.

By leveraging advanced analytics, KYT solutions can identify potentially fraudulent or high-risk transactions before they are completed. This approach enhances fraud prevention, strengthens regulatory compliance, and sets new benchmarks for transaction monitoring effectiveness.

Transaction Monitoring Market Trends

Key trends shaping the transaction monitoring market include the rapid rise in digital payments, increasing incidents of money laundering, and growing demand for efficient management of AML, KYC, and CTF compliance activities. Organizations are increasingly deploying sophisticated transaction monitoring software to address evolving regulatory requirements and mitigate financial risks.

The expanding regulatory framework across regions is compelling businesses to adopt advanced monitoring solutions that offer real-time insights, automated reporting, and enhanced risk detection capabilities. As a result, the adoption of AI-driven and cloud-based transaction monitoring platforms is accelerating across industries.

Transaction Monitoring Market Segment Analysis

By Deployment Mode

Based on deployment mode, the cloud-based segment dominated the transaction monitoring market in 2024. Cloud-based solutions are particularly attractive to SMEs, as they allow organizations to focus on core business activities without investing heavily in IT infrastructure. These solutions eliminate the need for expensive hardware, software maintenance, and dedicated technical staff while offering scalability and flexibility.

By Organization Size

The SMEs segment is expected to grow at a higher CAGR during the forecast period due to increasing data protection regulations and limited access to cost-intensive security solutions. Despite their smaller size, SMEs handle large volumes of transactions and customer data, making them vulnerable to fraud and regulatory non-compliance.

♦Download Sample Report Here:https://www.maximizemarketresearch.com/market-report/global-transaction-monitoring-market/28094/

Regional Analysis

North America

North America held the largest market share, accounting for approximately 32% in 2023, and is expected to continue its dominance throughout the forecast period. The region's growth is driven by stringent regulatory requirements, widespread adoption of advanced analytics, and a strong presence of leading transaction monitoring solution providers.

Asia Pacific

The Asia Pacific region is witnessing rapid growth due to the expansion of digital payment ecosystems and increasing awareness of transaction monitoring among both SMEs and large enterprises. Proactive security measures and growing adoption of transaction monitoring solutions are driving regional market expansion.

Europe

In Europe, AML remains a top regulatory priority, with financial institutions facing increased scrutiny from regulatory bodies such as the European Banking Authority (EBA). Collaborative regulatory frameworks and enforcement measures are driving demand for advanced transaction monitoring systems.

Opportunities in the Transaction Monitoring Market

The transaction monitoring market presents significant growth opportunities driven by AI-powered analytics, cloud-based deployments, and the integration of transaction monitoring with broader financial crime prevention platforms. Emerging markets, increased fintech adoption, and evolving regulatory standards further enhance market potential.

Future Outlook

The global transaction monitoring market is poised for substantial growth through 2032, supported by rising digital transactions, regulatory mandates, and technological advancements. With the market expected to reach USD 58.13 Billion by 2032, transaction monitoring will remain a cornerstone of secure and compliant financial operations worldwide.

Conclusion

As digital payments and online commerce continue to reshape the global financial landscape, transaction monitoring solutions are becoming essential for safeguarding financial systems. The market's strong growth trajectory underscores its importance in enabling secure transactions, regulatory compliance, and proactive risk management across industries.

Trending Reports:

♦Global Plastic Packaging Market https://www.maximizemarketresearch.com/market-report/global-plastic-packaging-market/31840/

♦Speech To Speech Translation Market https://www.maximizemarketresearch.com/market-report/speech-to-speech-translation-market/188460/

♦Global Intelligent Document Processing Solutions Market https://www.maximizemarketresearch.com/market-report/global-intelligent-document-processing-solutions-market/84051/

♦Telehandler Market https://www.maximizemarketresearch.com/market-report/global-telehandler-market/65220/

♦Recycled Carbon Fiber Market https://www.maximizemarketresearch.com/market-report/recycled-carbon-fiber-market/216051/

♦Global Oilfield Biocides Market https://www.maximizemarketresearch.com/market-report/global-oilfield-biocides-market/65563/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Transaction Monitoring Market Size, Trend & Forecast (2025-2032) here

News-ID: 4378960 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Brain Health Supplement Market Forecast (2025-2032) Growth Fueled by Mental Well …

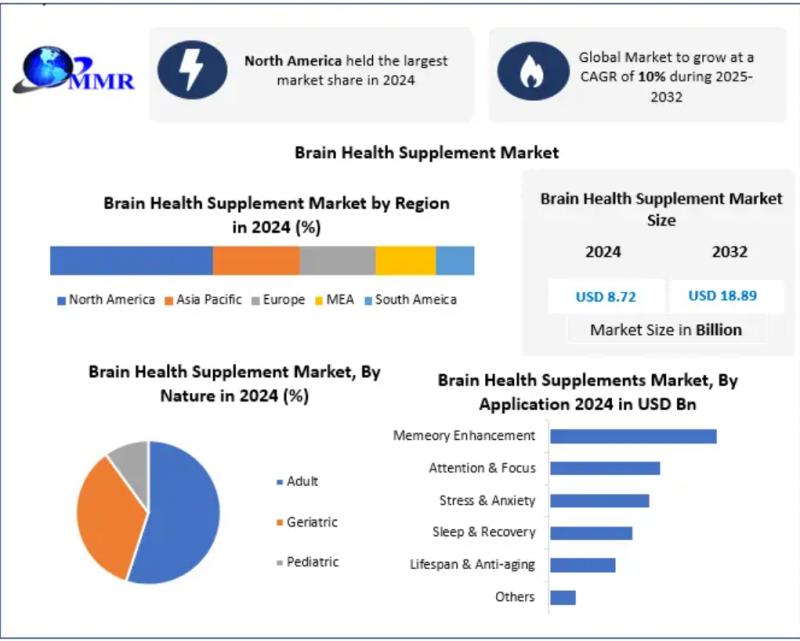

Brain Health Supplement Market Poised for Robust Growth, Expected to Reach USD 18.89 Billion by 2032

The Global Brain Health Supplement Market was valued at USD 8.72 Billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of 10% from 2025 to 2032, reaching nearly USD 18.89 Billion by 2032. This growth is largely driven by the surging demand for memory enhancement, stress relief solutions, and…

Wind Turbine Forging Market: Prospects for Growth in Developing Economies

The Wind Turbine Forging Market size was valued at USD 7.90 billion in 2023 and the total Wind Turbine Forging Market revenue is expected to grow at a CAGR of 7.5 % from 2024 to 2030, reaching nearly USD 13.10 billion.

The Wind Turbine Forging Market plays a vital role in strengthening the structural integrity of modern wind energy systems. Forged components such as main shafts, flanges, gears, and bearing rings…

Nuclear Power Market: An Overview of Key Players and Competitive Landscape

The Nuclear Power Market size was valued at USD 63.24 Billion in 2024 and the total Nuclear Power revenue is expected to grow at a CAGR of 3% from 2025 to 2032, reaching nearly USD 80.11 Billion.

The Nuclear Power Market plays a critical role in delivering reliable, large-scale, low-carbon electricity to meet growing global energy demand. Governments and utilities continue to prioritize nuclear energy for its ability to provide stable…

LNG Filling Stations Market : Emerging Trends and Opportunities in End-Use Indus …

The LNG Filling Stations Market size was valued at USD 2.38 Billion in 2025 and the total LNG Filling Stations revenue is expected to grow at a CAGR of 3.9% from 2025 to 2032, reaching nearly USD 3.12 Billion by 2032.

The LNG Filling Stations Market is gaining strong momentum as countries push for cleaner transportation fuels and lower carbon emissions across heavy-duty mobility. LNG stations support long-haul trucks, buses, and…

More Releases for Transaction

Key Trend Reshaping the Digital Transaction Management Market in 2025: Advanceme …

What Are the Projections for the Size and Growth Rate of the Digital Transaction Management Market?

The digital transaction management market will grow from $14 billion in 2024 to $17.36 billion in 2025, at a CAGR of 23.9%. This is driven by the digitization of business processes, advancements in mobile technology, cloud computing, e-signature legislation, and increasing concerns around cybersecurity and compliance.

The digital transaction management market is expected to experience exponential…

Key Trend Reshaping the Digital Transaction Management Market in 2025: Advanceme …

What Are the Projections for the Size and Growth Rate of the Digital Transaction Management Market?

The digital transaction management market will grow from $14 billion in 2024 to $17.36 billion in 2025, at a CAGR of 23.9%. This is driven by the digitization of business processes, advancements in mobile technology, cloud computing, e-signature legislation, and increasing concerns around cybersecurity and compliance.

The digital transaction management market is expected to experience exponential…

Transaction Monitoring Software Market

The Transaction Monitoring Software Market Perspective, Comprehensive Analysis along with Major Segments and Forecast, 2020-2026. The Transaction Monitoring Software Market report is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). Report explores the current outlook in global and key regions from the perspective of players, countries, product types and…

Mobile Payment Transaction Market: Rising Demand For Mobile Payment Transaction …

The urge of a faster and convenient payment method has resulted in the evolution of mobile payment transaction market. Further, the involvement of the giant industry veterans has given a kick start to the emergence of the mobile transaction market. Major credit to this rapidly growing industry goes to the advanced technologies involved in the field. Their contribution in easing out the payment processes has multiplied growth in the…

Contactless Payment Transaction Market Outlook 2025

Global Contactless Payment Transaction Market: Snapshot

Contactless payment is increasingly becoming an inseparable part of the payments procedure across a large number of industries. Businesses as well as consumers are increasingly embracing a wide variety of highly convenient and safe ways of paying for their purchases through contactless methods such as contactless card (NFC/RFID), contactless wearable devices, and dedicated contactless mobile payment apps, by using the NFC or RFID technologies. The…

Welded Steel Pipe Market Transaction Costs

With the slowdown in China's economic growth, the steel industry and imports of iron supply market demand is further extended, steel futures varieties offer a larger decline. From the recent operation of the rebar futures market, the small changes in the price per ton effectively take into account the needs of the market depth and liquidity, in line with the majority of market participants trading habits, and the recent market…