Press release

Biofertilizer Production Plant DPR & Unit Setup - 2026: Investment Cost, Market Growth & ROI

The global biofertilizer production industry is witnessing robust growth driven by the rapidly expanding organic farming, sustainable agriculture, and soil health management sectors and increasing demand for eco-friendly agricultural inputs that reduce chemical fertilizer dependence. At the heart of this expansion lies a critical agricultural innovation-biofertilizers. As farmers and agricultural stakeholders worldwide transition toward environmentally responsible farming practices and government policies promote sustainable agriculture, establishing a biofertilizer production plant presents a strategically compelling business opportunity for entrepreneurs and agribusiness investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global biofertilizer market demonstrates a strong growth trajectory, valued at USD 3.76 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 9.33 Billion by 2034, exhibiting a robust CAGR of 10.6% from 2026-2034. This sustained expansion is driven by increasing demand for sustainable and organic farming solutions, rising adoption of eco-friendly agricultural practices, government initiatives promoting organic inputs, and growing awareness of soil health and crop productivity.

Biofertilizers are natural products containing living microorganisms beneficial to plants' nutrient uptake and sustainable soil fertility. There are quite a few types of biofertilizers composed of nitrogen-fixing bacteria, phosphate-solubilizing bacteria, potassium-mobilizing microbes, and mycorrhizal fungi. These products cut chemical fertilizer dependence, yield healthier crops, keep soil in good condition, and promote eco-friendly agricultural practices. Biofertilizers come in various forms, such as powder, liquid, or granules, suitable for application by both smallholder and large-scale farmers. Continuous application leads to consistent nutrient supply, faster plant growth, and less environmental pollution.

The biofertilizer market is driven by a worldwide movement towards eco-friendly farming, adoption of organic farming practices, and regulations favoring inputs less harmful to the environment. This shift toward sustainable farming has boosted demand for biofertilizers, driving growth as farmers seek eco-friendly solutions. Moreover, governmental measures like providing financial support, subsidies, and organic farming promotions drive the market significantly.

Plant Capacity and Production Scale

The proposed biofertilizer production facility is designed with an annual production capacity ranging between 5,000-10,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from nutrient enrichment for soil and crop growth enhancement to organic farming input, soil rehabilitation, and integrated nutrient management programs-ensuring steady demand and consistent revenue streams across multiple agricultural applications.

Request for a Sample Report: https://www.imarcgroup.com/biofertilizer-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The biofertilizer production business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 40-50%

Net Profit Margins: 15-25%

These margins are supported by stable demand across agriculture, horticulture, organic farming, and commercial plantation sectors, value-added microbial input positioning, and the critical nature of biofertilizers in sustainable farming and soil health management. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established agricultural input manufacturers looking to diversify their product portfolio in the biological inputs segment.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a biofertilizer production plant is primarily driven by:

Raw Materials: 50-60% of total OpEx

Utilities: 20-25% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with microbial cultures, carrier materials, and growth media being the primary input materials. Establishing long-term relationships with reliable microbial strain suppliers and carrier material sources helps mitigate procurement challenges and ensures consistent production quality, which is critical given that high-quality microbial cultures represent the most significant cost factor in biofertilizer production.

Capital Investment Requirements

Setting up a biofertilizer production plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic access to microbial culture sources and carrier material suppliers. Proximity to target agricultural markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and controlled environment facilities. Compliance with local zoning laws, biosafety regulations, and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized production equipment essential for manufacturing. Key machinery includes:

• Fermenters and bioreactors for controlled cultivation of beneficial microbial strains under optimal temperature, pH, and aeration conditions

• Mixers and blending equipment for combining cultured microorganisms with carrier materials and performance-enhancing additives

• Drying units including fluidized bed dryers or tray dryers for moisture reduction while maintaining microbial viability and product shelf life

• Screening equipment and sieving systems for particle size distribution control and removal of oversized or undersized material

• Packaging machines for automated filling, sealing, and labeling of biofertilizer products in moisture-proof containers

• Quality inspection systems including microbial count analyzers, contamination detection equipment, and viability testing instruments

• Cold storage facilities for maintaining optimal storage conditions for microbial cultures and finished biofertilizer products

• Autoclave and sterilization equipment for maintaining aseptic conditions throughout the production process and preventing contamination

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure biosafety standards, and maintain strict quality control throughout the production process. The layout should be optimized with separate areas for microbial culture storage, fermentation zone, blending and mixing section, drying unit, screening area, quality control laboratory, finished goods cold storage, utility block, waste management area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, biosafety and regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=7403&flag=C

Major Applications and Market Segments

Biofertilizer products find extensive applications across diverse agricultural segments, demonstrating their versatility and critical importance:

Agriculture and Horticulture: Using microbial formulations, the soil is enriched and harvests are increased through improved nutrient availability, nitrogen fixation, and phosphorus solubilization in cereal, pulse, vegetable, and fruit crops.

Organic Farming Sector: Enables farmers to comply with organic certification standards while reducing chemical fertilizer dependency, supporting premium pricing and market access for certified organic produce.

Plantation and Commercial Farming: Productivity in large plantations is increased along with nutrient uptake efficiency in crops like tea, coffee, rubber, sugarcane, and other commercial agricultural operations.

Government-Supported Soil Management Programs: Supports initiatives for sustainable soil health, integrated nutrient management, and environmentally responsible agricultural intensification programs promoted by agricultural departments worldwide.

Why Invest in Biofertilizer Production?

Several compelling factors make biofertilizer production an attractive investment opportunity:

Growing Demand for Sustainable Agriculture: The planet's eco-friendliness drive is increasing demand for agricultural inputs that are chemical-fertilizer-free, supporting soil health and reducing environmental pollution from synthetic fertilizers.

Improved Soil Health and Productivity: Biofertilizers enhance nutrient availability and microbial activity, ensuring long-term soil fertility, improved crop yields, and sustainable agricultural productivity across diverse cropping systems.

Expanding Organic Farming Sector: To meet the demand for high-quality biofertilizers, the area cultivated with organic crops sees the greatest growth, driven by consumer preferences for chemical-free food products.

Customization Opportunities: Manufacturers can develop crop-specific, region-specific, or multi-nutrient formulations for targeted applications, creating differentiated products and premium pricing opportunities.

Scalable and Cost-Efficient Production: Capital investment in fermentation and blending processes is moderated, allowing flexible production volumes and gradual capacity expansion aligned with market demand growth.

Government Policy Support: Subsidies, financial assistance, and promotion of organic farming inputs through agricultural extension programs create favorable policy environments supporting biofertilizer adoption and market growth.

Import Substitution Potential: Emerging economies are expanding local biofertilizer production capacity to reduce dependence on imported biological inputs, creating significant domestic market opportunities for efficient manufacturers.

Manufacturing Process Excellence

The biofertilizer production process involves several precision-controlled stages:

• Microbial Cultures Preparation: Pure microbial strains are cultured and maintained under controlled laboratory conditions to ensure genetic purity, viability, and consistent performance characteristics

• Fermentation: Selected microbial cultures are inoculated into nutrient-rich growth media in fermenters where they multiply under optimal temperature, pH, aeration, and agitation conditions

• Blending: Fermented microbial biomass is mixed with sterilized carrier materials like peat, lignite, or vermiculite along with protective additives to ensure microbial survival

• Carrier Material Incorporation: Carrier materials are prepared through sterilization, moisture adjustment, and pH balancing to provide optimal environment for microbial survival during storage and application

• Quality Testing: Samples undergo comprehensive testing for microbial population count, contamination absence, moisture content, pH level, and shelf-life viability to ensure product efficacy

• Drying: Blended biofertilizer is dried using controlled-temperature systems to reduce moisture content while maintaining microbial viability and preventing heat damage to beneficial organisms

• Packaging and Labeling: Dried biofertilizer is filled into moisture-proof packaging with proper labeling indicating microbial strain, application instructions, manufacturing date, and expiry date for end-user guidance

Industry Leadership

The global biofertilizer industry is led by established agricultural input companies with extensive production capabilities and diverse microbial product portfolios. Key industry players include:

• Gujarat State Fertilizers & Chemicals Limited (GSFC)

• IPL Biologicals Limited

• Kiwa Bio-Tech Products Group Corporation

• Madras Fertilizers Limited (MFL)

• National Fertilizers Limited (NFL)

These companies serve diverse end-use sectors including agriculture, horticulture, organic farming, and commercial plantations segment, demonstrating the broad market applicability of biofertilizer products.

Buy Now:

https://www.imarcgroup.com/checkout?id=7403&method=2175

Recent Industry Developments

June 2025: MVAC and DPH Biologicals introduced TerraTrove AmplAphex, a liquid biofertilizer, which received the Organic Materials Review Institute (OMRI) Listed seal for certified organic use. The product demonstrated improvements in soil structure, nutrient uptake, and crop stress resilience, supporting sustainable agriculture across the Western and Southern U.S. with verified organic certification.

May 2025: Syngenta completed the acquisition of Intrinsyx Bio, strengthening its global leadership in the biologicals sector and expanding its biofertilizer portfolio. The deal combines Intrinsyx Bio's nutrient use efficiency products, including NUELLO iN, with Syngenta's R&D and commercial reach, supporting higher crop yields, sustainable farming, and growth in the fastest-growing Nutrient Use Efficiency (NUE) market.

Conclusion

The biofertilizer production sector presents a strategically positioned investment opportunity at the intersection of sustainable agriculture, soil health management, and organic farming advancement. With favorable profit margins ranging from 40-50% gross profit and 15-25% net profit, strong market drivers including expanding organic farming adoption, government policies promoting biological inputs, growing environmental awareness among farmers, and increasing global focus on sustainable food production systems, establishing a biofertilizer production plant offers significant potential for long-term business success and sustainable returns. The combination of essential agricultural applications, critical role in reducing chemical fertilizer dependence, expanding market opportunities across conventional and organic farming, and favorable regulatory support creates an attractive value proposition for serious agribusiness investors committed to quality production and agricultural sustainability.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Biofertilizer Production Plant DPR & Unit Setup - 2026: Investment Cost, Market Growth & ROI here

News-ID: 4378842 • Views: …

More Releases from IMARC Group

PVC Pipes Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpE …

The global PVC pipes manufacturing industry is witnessing robust growth driven by the rapidly expanding construction, water infrastructure, agricultural irrigation, and industrial sectors and increasing demand for durable, cost-effective, and corrosion-resistant piping solutions. At the heart of this expansion lies a critical infrastructure material-PVC pipes. As governments worldwide invest heavily in water supply systems, sanitation infrastructure, and smart city development, establishing a PVC pipes manufacturing plant presents a strategically compelling…

Sorbitol Production Plant DPR 2026: CapEx/OpEx Analysis with Profitability Forec …

The global sorbitol production industry is witnessing steady growth driven by the rapidly expanding food and beverage, pharmaceutical, and personal care sectors and increasing demand for sugar substitutes, humectants, and functional ingredients. At the heart of this expansion lies a critical polyol product-sorbitol. As consumers worldwide transition toward low-calorie, sugar-free, and health-conscious product choices, establishing a sorbitol production plant presents a strategically compelling business opportunity for entrepreneurs and specialty ingredients…

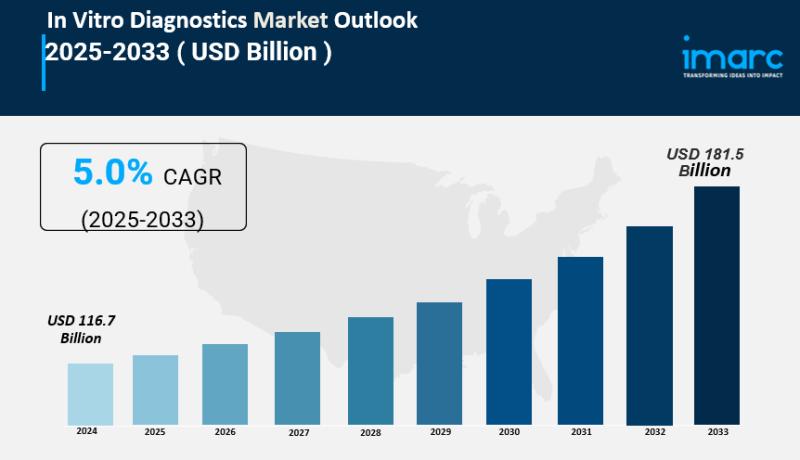

In Vitro Diagnostics Market is Expected to Grow USD 181.5 Billion by 2033 | At C …

IMARC Group, a leading market research company, has recently released a report titled "In Vitro Diagnostics Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the In Vitro Diagnostics market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

In Vitro…

Epoxy Resin Prices January 2026: Sharp Increases Across Middle East and North Am …

Northeast Asia Epoxy Resin Prices Movement January 2026:

Northeast Asia epoxy resin prices in January 2026 were assessed at USD 2.11/kg, rising by 7.7% due to improved downstream demand. The epoxy resin price trend turned positive amid restocking activity. The epoxy resin price index strengthened, while the epoxy resin price chart reflected upward momentum. The epoxy resin price forecast suggests continued firmness if demand remains stable.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/epoxy-resin-pricing-report/requestsample

Note:…

More Releases for Bio

Human Plasma Products Market 2023: Industry Future Trends | Takeda, CSL, Grifols …

The Human Plasma Products market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with…

Gene Therapy Products Market | Advantagene, Avalanche Bio, Bluebird Bio, Cellado …

The global gene therapy products market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the gene therapy products market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth…

Bio-based Polymethyl Methacrylate (Bio-PMMA) Market 2023 | Detailed Report

The Bio-based Polymethyl Methacrylate (Bio-PMMA) report compiles the market information depending upon market development and growth factors, optimizing the growth path. In addition, it highlights the strategies and market share of the leading vendors in the particular market. The report follows a robust research methodology model that helps to make informed decisions. It obtains both qualitative and quantitative market information supported by primary research.

The Bio-based Polymethyl Methacrylate (Bio-PMMA) research report…

Bio Pharma Buffer Market – A comprehensive study by Key Players: Bio-Rad, Lonz …

Latest Market intelligence report released by HTF MI with title "COVID-19 Outbreak-Global Bio Pharma Buffer Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020" is designed covering micro level of analysis by manufacturers and key business segments. The COVID-19 Outbreak-Global Bio Pharma Buffer Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary…

IVIG Market Anticipated a Noteworthy CAGR during 2019-2024 & Companies Included …

A report added to the rich database of Qurate Business Intelligence, titled “World IVIG Market by Product Type, Players and Regions - Forecast to 2024”, provides a 360-degree overview of the Global market. Approximations associated with the market values over the forecast period are based on empirical research and data collected through both primary and secondary sources. The authentic processes followed to exhibit various aspects of the market makes the…

Green & Bio-based Solvents Market Analysis, Demand, & Opportunities till 2023 | …

A latest research report titled as “Green & Bio-based Solvents Market for Paints & Coatings, Printing Inks, Commercial & Domestic Cleaning, Adhesives & Sealants, Pharmaceutical, Cosmetics, and Other Applications - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2015 - 2023” has been recently added to the vast portfolio of Market Research Reports Search Engine (MRRSE) online research offerings. This report is a professional and in-depth analysis on the…