Press release

PVC Pipes Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx & ROI

The global PVC pipes manufacturing industry is witnessing robust growth driven by the rapidly expanding construction, water infrastructure, agricultural irrigation, and industrial sectors and increasing demand for durable, cost-effective, and corrosion-resistant piping solutions. At the heart of this expansion lies a critical infrastructure material-PVC pipes. As governments worldwide invest heavily in water supply systems, sanitation infrastructure, and smart city development, establishing a PVC pipes manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and construction materials investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global PVC pipes market demonstrates a strong growth trajectory, valued at 26.88 Million Tons in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach 37.61 Million Tons by 2034, exhibiting a robust CAGR of 3.8% from 2026-2034. This sustained expansion is driven by rapid urbanization, increasing investments in water supply and sanitation infrastructure, growth in agricultural irrigation projects, and rising demand from residential, commercial, and industrial construction activities.

PVC (Polyvinyl Chloride) pipes are widely used plastic piping systems produced from polymerized vinyl chloride resin blended with stabilizers, lubricants, and performance-enhancing additives. These materials provide strength, durability, and flexibility while maintaining a lightweight structure that simplifies transportation and installation. PVC pipes are commonly employed for the conveyance of potable water, wastewater, sewage, chemicals, and industrial fluids across residential, commercial, agricultural, and industrial sectors. The smooth interior of the pipes reduces friction, enhancing flow efficiency and lowering energy usage. In addition, PVC pipes offer excellent resistance to corrosion, chemical reactions, and biological growth, making them suitable for harsh environments. With low maintenance requirements, cost effectiveness, and a long operational lifespan, PVC pipes represent a reliable and sustainable solution for modern fluid transportation and infrastructure development globally.

Urbanization and infrastructure development are factors driving the PVC pipes market, along with demand for reliable water supply, drainage, and sewage systems. Agricultural sector modernization with efficient irrigation and water distribution systems significantly increases PVC pipes usage, while government policies supporting clean drinking water access, expanding wastewater treatment facilities, and enhancing irrigation infrastructure accelerate market demand globally.

Plant Capacity and Production Scale

The proposed PVC pipes manufacturing facility is designed with an annual production capacity ranging between 30,000-60,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from drinking water pipelines and sewerage systems to agricultural irrigation, industrial fluid transport, cable conduits, borewell casing, and drainage systems-ensuring steady demand and consistent revenue streams across multiple infrastructure verticals.

Request for a Sample Report: https://www.imarcgroup.com/pvc-pipes-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The PVC pipes manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 20-30%

Net Profit Margins: 8-12%

These margins are supported by stable demand across construction, water infrastructure, agriculture, and industrial sectors, value-added infrastructure material positioning, and the critical nature of PVC pipes in modern water management and construction applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established building materials manufacturers looking to diversify their product portfolio in the piping systems segment.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a PVC pipes manufacturing plant is primarily driven by:

Raw Materials: 70-80% of total OpEx

Utilities: 10-15% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with PVC resin, stabilizers, and additives being the primary input materials. Establishing long-term contracts with reliable PVC resin suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that PVC resin procurement represents the most significant cost factor in PVC pipes manufacturing.

Capital Investment Requirements

Setting up a PVC pipes manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to PVC resin suppliers and additive sources. Proximity to construction, infrastructure, and agricultural markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• High-output extruders for continuous melting and shaping of PVC compound into pipe profiles with precise dimensional control

• Vacuum calibration tanks for maintaining pipe diameter accuracy and preventing dimensional distortion during cooling

• Haul-off units and pulling systems for maintaining consistent pipe extrusion speed and preventing sagging or stretching

• Cutters and saw systems for accurate length cutting of extruded pipes according to standard specifications

• Socketing machines for creating bell-and-spigot joints on pipe ends to enable leak-proof connections during installation

• Packaging systems for automated bundling, labeling, and palletization of finished pipes for safe transportation and storage

• Quality control testing equipment including hydrostatic pressure testers, impact resistance analyzers, and dimensional measurement tools

• Material handling conveyors and storage silos for efficient raw material movement and inventory management throughout production

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and maintain product quality throughout the production process. The layout should be optimized with separate areas for raw material storage and blending, extrusion line, cooling and calibration zone, cutting and socketing section, quality control laboratory, finished goods warehouse, utility block, waste management area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, quality and regulatory compliance certifications including ISI marks, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=7673&flag=C

Major Applications and Market Segments

PVC pipe products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Water Supply and Sanitation Infrastructure: PVC pipes are widely used in municipal water distribution and sewerage networks, providing reliable and leak-proof fluid transport in urban and rural areas worldwide.

Agriculture and Irrigation: Employed in drip irrigation systems, sprinkler networks, and water conveyance pipelines, supporting efficient water management and crop productivity in agricultural operations.

Construction Industry: Used extensively for internal plumbing, drainage systems, and rainwater harvesting installations in residential, commercial, and industrial building projects.

Industrial Applications: Suitable for chemical transport, industrial fluid handling, and process piping in manufacturing facilities where corrosion resistance and chemical compatibility are essential.

Electrical and Telecom Sector: Used as conduits for cable protection and routing in electrical installations, telecommunications infrastructure, and underground cable networks.

Why Invest in PVC Pipes Manufacturing?

Several compelling factors make PVC pipes manufacturing an attractive investment opportunity:

Strong Infrastructure Growth: Continuous investment in housing, sanitation, water supply, and smart city projects across developed and emerging economies ensures sustained long-term demand for PVC piping systems.

Cost-Effective and Durable Product: PVC pipes offer exceptional service life with minimal maintenance requirements compared to traditional metal or concrete piping, providing a superior value proposition for end-users.

Wide Application Spectrum: Applicable across agriculture, construction, industrial, municipal, and telecom sectors, providing diversified revenue streams and reducing dependence on any single end-use market.

Scalable Manufacturing Model: Capacity expansion is achievable with moderate incremental investment through addition of extrusion lines, enabling manufacturers to grow operations in response to market demand.

Technological Maturity: Established extrusion technology and standardized production processes ensure consistent quality, high productivity, and relatively straightforward manufacturing operations with proven track records.

Government Support and Policies: National initiatives promoting water access, sanitation coverage, agricultural modernization, and infrastructure development create favorable policy environments supporting PVC pipes demand.

Import Substitution Opportunities: Emerging economies are expanding local PVC pipes production capacity to reduce dependence on imported piping systems, creating significant domestic market opportunities for efficient manufacturers.

Manufacturing Process Excellence

The PVC pipes manufacturing process involves several precision-controlled stages:

• PVC Resin Blending: PVC resin is mixed with stabilizers, lubricants, impact modifiers, and colorants in high-speed mixers to create homogeneous compound with desired properties

• Material Feeding: Blended PVC compound is fed into extruder hoppers through automated feeding systems ensuring consistent material flow and preventing production interruptions

• Extrusion: PVC compound is heated to molten state in extruder barrels and forced through specially designed dies to form continuous pipe profiles with precise wall thickness

• Sizing and Calibration: Extruded pipes pass through vacuum calibration tanks where negative pressure maintains accurate outer diameter while cooling water solidifies the pipe structure

• Cooling: Pipes travel through multiple cooling tanks where temperature is gradually reduced to prevent thermal stress and ensure dimensional stability of finished products

• Cutting: Cooled pipes are cut to standard lengths using automatic saw cutters ensuring clean cuts and maintaining accurate dimensions for downstream processing

• Socketing: Bell-and-spigot joints are formed on pipe ends using socketing machines with controlled heating and shaping to create leak-proof connection interfaces

• Quality Inspection and Packaging: Finished pipes undergo comprehensive quality testing including pressure testing, dimensional verification, and visual inspection before automated bundling and packaging for distribution

Buy Now:

https://www.imarcgroup.com/checkout?id=7673&method=2175

Industry Leadership

The global PVC pipes industry is led by established building materials manufacturers with extensive production capabilities and diverse product portfolios. Key industry players include:

• Mexichem

• Radius Systems Ltd.

• National Pipes & Plastics

• Georg Fischer Ltd.

• Astral Pipes

• Yonggao Co., Ltd.

• Vinidex Pty Ltd

• COEMAC

• Adequa Water Solutions, S.A.

These companies serve diverse end-use sectors including construction and real estate, water supply and sanitation infrastructure, agriculture and irrigation, industrial processing units, and electrical and telecom sectors, demonstrating the broad market applicability of PVC pipe products.

Recent Industry Developments

March 2025: Supreme Industries agreed to acquire Wavin India's piping business for USD 30 Million, including PVC pipes and fittings, boosting its piping capacity by 73,000 tonnes annually. The acquisition covers assets, brands, employees, and technology access, strengthening Supreme's presence in building and infrastructure segments across India and SAARC markets.

February 2025: As part of its expansion, Malpani Pipes & Fittings introduced new PVC pipes, starting with an annual production capacity of 1,800 tons. Designed for applications including plumbing, sewage, drinking water, irrigation, and chemical handling, the project involved an investment of INR 3.8 Crore in advanced machinery.

Conclusion

The PVC pipes manufacturing sector presents a strategically positioned investment opportunity at the intersection of infrastructure development, water management, and sustainable construction practices. With favorable profit margins ranging from 20-30% gross profit and 8-12% net profit, strong market drivers including rapid urbanization, government water infrastructure investments, expanding agricultural irrigation, growing construction activities, and supportive policies promoting sanitation and water access, establishing a PVC pipes manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of essential infrastructure applications, critical role in water supply and sanitation systems, expanding agricultural and industrial demand, and import substitution opportunities in emerging economies creates an attractive value proposition for serious building materials investors committed to quality manufacturing and operational excellence.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release PVC Pipes Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx & ROI here

News-ID: 4378837 • Views: …

More Releases from IMARC Group

Sorbitol Production Plant DPR 2026: CapEx/OpEx Analysis with Profitability Forec …

The global sorbitol production industry is witnessing steady growth driven by the rapidly expanding food and beverage, pharmaceutical, and personal care sectors and increasing demand for sugar substitutes, humectants, and functional ingredients. At the heart of this expansion lies a critical polyol product-sorbitol. As consumers worldwide transition toward low-calorie, sugar-free, and health-conscious product choices, establishing a sorbitol production plant presents a strategically compelling business opportunity for entrepreneurs and specialty ingredients…

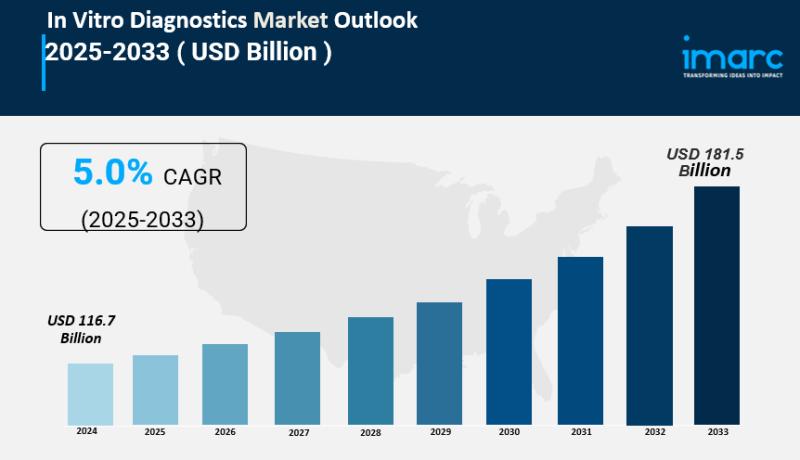

In Vitro Diagnostics Market is Expected to Grow USD 181.5 Billion by 2033 | At C …

IMARC Group, a leading market research company, has recently released a report titled "In Vitro Diagnostics Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the In Vitro Diagnostics market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

In Vitro…

Epoxy Resin Prices January 2026: Sharp Increases Across Middle East and North Am …

Northeast Asia Epoxy Resin Prices Movement January 2026:

Northeast Asia epoxy resin prices in January 2026 were assessed at USD 2.11/kg, rising by 7.7% due to improved downstream demand. The epoxy resin price trend turned positive amid restocking activity. The epoxy resin price index strengthened, while the epoxy resin price chart reflected upward momentum. The epoxy resin price forecast suggests continued firmness if demand remains stable.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/epoxy-resin-pricing-report/requestsample

Note:…

Footwear Market is Expected to Grow USD 8.4 Billion by 2034 | At CAGR 4.27%

IMARC Group, a leading market research company, has recently released a report titled "Hot Sauce Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2026-2034." The study provides a detailed analysis of the industry, including the Hot Sauce market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Hot Sauce Market Overview

The…

More Releases for PVC

PVC Coated Fabrics Market Accelerates at 5.3% CAGR as Transportation, Infrastruc …

The PVC coated fabrics market reached USD million in 2022 and is projected to witness lucrative growth by reaching up to USD million by 2031. The market is growing at a CAGR of 5.3% from 2024 to 2031.

Market growth is fueled by surging demand for durable, waterproof materials in transportation, marine, and construction sectors, alongside rising infrastructure projects and automotive upholstery needs. Key drivers include advancements in eco-friendly PVC formulations…

PVC Foam Profiles Market Outlook 2034: Global Valuation to Reach USD 4.8 Billion …

The global PVC foam profiles market was valued at US$ 2.9 Bn in 2023. As industries continue to adopt lightweight, moisture-resistant, and dimensionally stable materials, PVC foam profiles are witnessing growing integration into construction, automotive, marine, and furniture manufacturing applications. According to current projections, the market is set to expand at a CAGR of 4.2% from 2024 to 2034, ultimately reaching US$ 4.8 Bn by 2034. This sustained growth reflects…

The Growing PVC Window Market

New York, US, - [01-December- 2025] - The PVC window market is experiencing significant growth, driven by increasing demand for energy-efficient and sustainable building materials. As consumers and builders alike prioritize durability, cost-effectiveness, and environmental impact, PVC (polyvinyl chloride) windows have emerged as a preferred choice in residential and commercial construction. This press release provides an overview of the current state of the PVC window market, key trends, and future…

New PVC External Lubricant Improves Performance

Shandong HTX New Material Co., Ltd. is a newly established company that has already made a significant impact in the industry. Since its inception in March 2021, the company has been focused on producing high-quality PVC External Lubricant [https://www.htxchem.com/lubricant-manufacture-price-product/] and other related products. HTX is a comprehensive enterprise that not only specializes in PVC processing aids but also involves itself in research and development, production, and sales.

The product range offered…

PVC Pipes Market to See Major Growth by 2026 | Bow Plastics, Royal PVC, Tulsi Ex …

Latest released the research study on Global PVC Pipes Market, offers a detailed overview of the factors influencing the global business scope. PVC Pipes Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the PVC Pipes

The study covers emerging player’s data, including: competitive…

Global Polyvinyl Chloride (PVC) Market 2017 -

Worldwide Polyvinyl Chloride (PVC) 2017 Research Report presents a professional and complete analysis of Global Polyvinyl Chloride (PVC) Market on the current situation.

In the first part, the report provides a general overview of the Polyvinyl Chloride (PVC) industry 2017 including definitions, classifications, Polyvinyl Chloride (PVC) market analysis, a wide range of applications and Polyvinyl Chloride (PVC) industry chain structure. The 2017's report on Polyvinyl Chloride (PVC) industry offers the global…