Press release

Glass Bottle Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, ROI, Raw Materials

The global glass bottle manufacturing industry is witnessing robust growth driven by the rapidly expanding beverage sector and increasing demand for sustainable packaging solutions. At the heart of this expansion lies a critical packaging material: glass bottles. As consumer markets transition toward eco-friendly packaging and premium product presentation, establishing a glass bottle manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and packaging industry investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global glass bottle market demonstrates strong growth trajectory, valued at USD 75.73 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 104.12 Billion by 2034, exhibiting a robust CAGR of 3.6% from 2026-2034. This sustained expansion is driven by rapidly expanding beverage and food industries, increasing demand for sustainable packaging, rising preference for premium packaging solutions, and expanding consumer goods requirements across developing economies.

Glass bottles are rigid, transparent containers manufactured from molten glass through forming and shaping processes. They appear as durable, recyclable vessels with excellent barrier properties and aesthetic appeal. Glass bottles are produced in various sizes, shapes, and colors, making them versatile packaging solutions used primarily in beverages (alcoholic and non-alcoholic), pharmaceuticals, cosmetics, and food products. Due to their inert nature, they preserve product quality without chemical interaction. Their high recyclability, premium appearance, and compatibility with various closure systems make them a preferred option in sustainable packaging and premium product positioning.

The glass bottle market is witnessing robust demand due to the rising need for eco-friendly packaging that supports sustainability initiatives and circular economy principles. Consumer markets increasingly transitioning toward recyclable packaging-particularly in premium beverages, craft beer, wine, spirits, and organic food products-are driving large-scale adoption. The packaging industry contributes significantly to global manufacturing output and supports environmental conservation efforts through glass recycling programs. Government-led environmental regulations, bans on single-use plastics, and consumer awareness of sustainable packaging further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/glass-bottle-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed glass bottle manufacturing facility is designed with an annual production capacity ranging between 50,000-100,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments from beverages and pharmaceuticals to cosmetics, food packaging, and specialty applications-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The glass bottle manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 25-35%

Net Profit Margins: 10-15%

These margins are supported by stable demand across beverage and packaging sectors, value-added specialty packaging positioning, and the critical nature of glass bottles in premium product applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established packaging manufacturers looking to diversify their product portfolio in the sustainable packaging sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a glass bottle manufacturing plant is primarily driven by:

Raw Materials: 40-50% of total OpEx

Utilities: 35-40% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute a significant portion of operating costs, with silica sand, soda ash, limestone, and cullet (recycled glass) being the primary input materials. Utilities, particularly energy for furnace operations, represent the second-largest cost component due to the high-temperature melting process. Establishing long-term contracts with reliable silica sand and soda ash suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that energy and raw material price fluctuations represent the most significant cost factors in glass bottle manufacturing.

Capital Investment Requirements

Setting up a glass bottle manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to silica sand and soda ash suppliers. Proximity to target beverage and packaging markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, high-capacity power supply, water resources, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Batch mixing systems for precise blending of raw materials

• High-temperature melting furnaces operating at 1400-1600°C for glass formation

• Forming machines (blow-and-blow or press-and-blow) for bottle shaping

• Annealing lehrs for controlled cooling and stress relief

• Inspection systems for quality control and defect detection

• Coating application equipment for surface treatment

• Automated palletizing and packaging systems

• Quality control laboratory equipment for dimensional, strength, and clarity testing

• Effluent treatment systems for managing wastewater and ensuring environmental compliance

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for raw material storage, batch preparation, melting furnace, forming section, annealing zone, inspection and coating area, quality control laboratory, finished goods warehouse, utility block, effluent treatment area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Glass bottle products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Beverages: Primary use as packaging for alcoholic beverages (beer, wine, spirits), non-alcoholic drinks (juices, soft drinks, water), and premium beverage products where product preservation and visual appeal are essential.

Pharmaceuticals: Specialized applications in pharmaceutical packaging for medicines, syrups, injectables, and healthcare products where chemical inertness and product protection are critical for safety and efficacy.

Food Products: Utilized for packaging sauces, condiments, jams, preserves, baby food, and specialty food items where product integrity and shelf-life extension are important.

Cosmetics and Personal Care: Applications in perfume bottles, cosmetic containers, essential oil packaging, and premium personal care products where aesthetic presentation and product protection provide functional benefits.

Specialty Applications: Industrial uses in laboratory glassware, chemical storage, and specialized container applications where glass properties contribute to product safety and quality.

End-use industries include beverages, pharmaceuticals, food and condiments, cosmetics, and specialty applications, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=7661&method=2175

Why Invest in Glass Bottle Manufacturing?

Several compelling factors make glass bottle manufacturing an attractive investment opportunity:

Sustainable Packaging Leader: Glass bottles serve as a critical eco-friendly packaging solution supporting circular economy principles, recycling initiatives, and environmental sustainability, making them indispensable for brands committed to reducing plastic waste and meeting ESG targets.

Rising Premium Packaging Demand: Consumer markets increasingly transitioning toward premium packaging solutions-particularly in craft beverages, organic products, and luxury goods-are driving large-scale adoption of glass bottles.

100% Recyclability: The product's infinite recyclability without quality degradation, combined with its inert properties that don't leach chemicals into contents, offers significant environmental and health advantages and positions it favorably against plastic alternatives.

Regulatory Support: Government-led environmental regulations, plastic bans, extended producer responsibility (EPR) schemes, and sustainability mandates further strengthen market prospects and support industry growth.

Brand Differentiation: Glass packaging's premium appearance, tactile quality, and ability to preserve product freshness enable brand differentiation and justify premium pricing in competitive markets.

Import Substitution Opportunities: Emerging economies such as India, China, Brazil, and Southeast Asian nations are expanding local glass manufacturing as part of their strategy to reduce dependence on imported packaging materials, creating opportunities for domestic producers.

Beverage Industry Growth: The expanding alcoholic beverages market, craft beer revolution, premium wine segment, and health-focused beverage categories are expected to enhance long-term growth opportunities for glass bottle packaging.

Manufacturing Process Excellence

The glass bottle manufacturing process involves several precision-controlled stages:

• Batch Preparation: Raw materials (silica sand, soda ash, limestone, cullet) are precisely weighed and mixed according to formulation

• Melting: The batch is fed into a high-temperature furnace (1400-1600°C) where materials fuse to form molten glass

• Forming: Molten glass is cut into gobs and fed into forming machines that shape bottles using compressed air and molds

• Annealing: Formed bottles pass through annealing lehrs for controlled cooling to relieve internal stresses

• Surface Treatment: Optional coating application for strength enhancement and surface protection

• Inspection: Automated quality control systems detect defects, dimensional variations, and appearance flaws

• Packaging: Approved bottles are palletized and wrapped for storage and distribution

Industry Leadership

The global glass bottle industry is led by established packaging manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Owens-Illinois Inc.

• Ardagh Group

• Vidrala SA

• Vetropack Group

• Gerresheimer AG

These companies serve diverse end-use sectors including beverages, pharmaceuticals, food, cosmetics, and specialty applications, demonstrating the broad market applicability of glass bottle products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=7661&flag=C

Recent Industry Developments

2024: Major glass manufacturers announced investments in lightweight glass technology and increased recycled content usage, aiming to reduce carbon footprint while maintaining structural integrity. These innovations use advanced furnace technologies for better energy efficiency and controlled glass composition for reduced material weight without compromising bottle strength.

2024: Leading beverage companies committed to increasing glass bottle usage and returnable packaging systems as part of global sustainability pledges, driving demand for recyclable glass containers and closed-loop packaging solutions.

Conclusion

The glass bottle manufacturing sector presents a strategically positioned investment opportunity at the intersection of sustainable packaging, premium product presentation, and environmental responsibility. With favorable profit margins ranging from 25-35% gross profit and 10-15% net profit, strong market drivers including rising demand for eco-friendly packaging, growing premium beverage consumption, expanding pharmaceutical and cosmetics industries, and supportive government regulations promoting plastic reduction and recycling, establishing a glass bottle manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of infinite recyclability, chemical inertness, premium positioning, expanding beverage industry requirements, and import substitution opportunities in emerging economies creates an attractive value proposition for serious packaging investors committed to quality manufacturing and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Glass Bottle Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, ROI, Raw Materials here

News-ID: 4378792 • Views: …

More Releases from IMARC Group

Toilet Paper Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pr …

The global toilet paper manufacturing industry is witnessing robust growth driven by the rapidly expanding population and increasing demand for essential hygiene products. At the heart of this expansion lies a critical household necessity: toilet paper. As consumer markets transition toward premium quality products and sustainable manufacturing practices, establishing a toilet paper manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and consumer goods investors seeking to capitalize on…

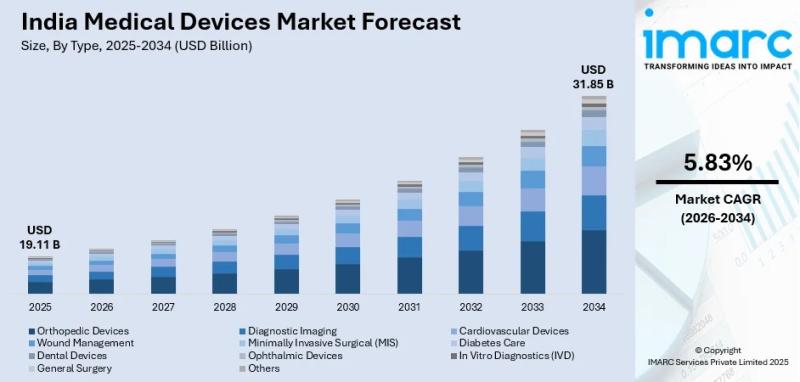

India Medical Devices Market to Reach USD 31.85 Bn by 2034 at 5.83% CAGR Driven …

The latest report by IMARC Group, "India Medical Devices Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034", provides a comprehensive industry analysis. It delivers deep insights into the Indian PCB market, highlighting growth drivers, competitive landscapes, and emerging segment trends for the 2026-2034 forecast period.

What is the India Medical Devices Market Size, Share, Trends, and Growth Forecast (2026-2034)?

According to the latest analysis by IMARC Group,…

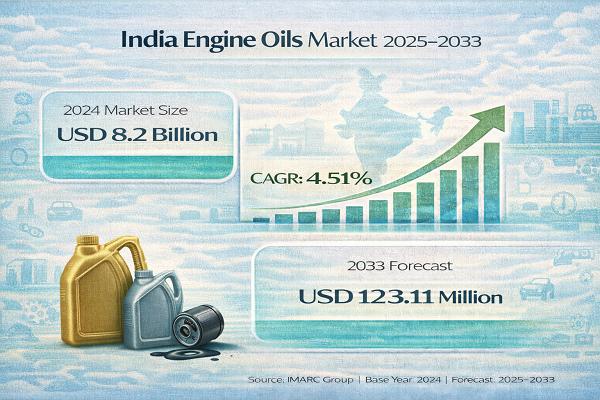

India Engine Oils Market Set to Reach USD 1,008.14 Million by 2033, Driven by 3. …

India Engine Oils Market : Report Introduction

According to IMARC Group's report titled "India Engine Oils Market Size, Share, Growth | Forecast 2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights, and industry updates, please click on 'Request Free Sample…

Copper Cable Manufacturing Plant Cost 2026: Detailed Project Report and Investme …

The global copper cable market presents a compelling investment opportunity driven by growing demands for reliable and efficient power delivery systems, infrastructural development particularly in urban areas, expanding industrial and commercial facilities, and greater preference by consumers for safety and standardization in electrical components. Copper cable represents insulated conductive assemblies manufactured with copper conductors, insulating compounds, shielding materials, and protective jackets designed to transmit electricity efficiently and safely.

These cables offer…

More Releases for Glass

Depression Glass Market 2023- Industry Revenue and Price | Hazel-Atlas Glass Com …

The Depression Glass market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Auto Glass Market Is Booming Worldwide | Fuyao Glass, Webasto, Xinyi Glass, Asah …

Advance Market Analytics published a new research publication on "Auto Glass Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Auto Glass market was mainly driven by the increasing R&D spending across the world. Some of the key players profiled…

Recycled Glass Market 2023 Business Strategies - Cap Glass, Glass Recycled Surfa …

Newly added by Fior Markets study on Global Recycled Glass Market 2023 contains a detailed analysis of data through industrial dynamics which has a major impact on the growth of the market. The report categorizes the global Recycled Glass market by segmented top key players, type, application, marketing channel, and regions. The report provides a complete understanding of the market in the coming years. It looks over the market with…

Glass Easy-clean Glass Market 2019| Pilkington Glass, PPG Industries, Ravensby W …

The global market status for Easy-clean Glass is precisely examined through a smart research report added to the broad database managed by Market Research Hub (MRH). This study is titled “Global Easy-clean Glass Market” Research Report 2019, which tends to deliver in-depth knowledge associated to the Easy-clean Glass market for the present and forecasted period until 2025. Furthermore, the report examines the target market based on market size, revenue and…

Global Ground Glass Market 2017- CSG, XINYI Glass, JINJING Glass, SYP Glass, Yao …

The market research report by QY Research provides detailed study on the overall Ground Glass market size, its financial positions, its unique selling points, key products, and key developments. This research report has segmented the Ground Glass market based on the segments covering all the domains in terms of type, country, region, forecasting revenues, and market share, along with analysis of latest trends in every sub-segment.

CLICK HERE to Request Sample…

Global Ground Glass Sales Market 2017 - XINYI Glass, JINJING Glass, SYP Glass, Y …

The study Global Ground Glass Sales Industry 2017 is a detailed report scrutinizing statistical data related to the Global Ground Glass Sales industry. Historical data available in the report elaborates on the development of the Ground Glass Sales market on a Global and national level. The report compares this data with the current state of the market and thus elaborates upon the trends that have brought the market shifts.

Download Sample…