Press release

Toilet Paper Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

The global toilet paper manufacturing industry is witnessing robust growth driven by the rapidly expanding population and increasing demand for essential hygiene products. At the heart of this expansion lies a critical household necessity: toilet paper. As consumer markets transition toward premium quality products and sustainable manufacturing practices, establishing a toilet paper manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and consumer goods investors seeking to capitalize on this growing and essential market.Market Overview and Growth Potential

The global toilet paper market demonstrates strong growth trajectory, valued at USD 32.01 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 47.13 Billion by 2034, exhibiting a robust CAGR of 4.4% from 2026-2034. This sustained expansion is driven by rapidly expanding population, increasing demand for hygiene products, rising urbanization levels, and expanding consumer awareness across developing economies.

Toilet paper is a soft, absorbent paper product manufactured from paper pulp (virgin or recycled) through specialized tissue-making processes. It appears as multi-ply sheets wound into rolls, designed for personal hygiene use in bathrooms. Toilet paper is characterized by high softness, rapid water dissolution properties, and superior absorbency. The product serves as an essential household commodity used daily across residential, commercial, institutional, and hospitality sectors. Its critical role in maintaining hygiene standards, combined with consistent replacement demand, makes it one of the most stable consumer goods categories globally.

The toilet paper market is witnessing robust demand due to the rising need for hygiene products that support modern sanitation standards. Consumer markets are increasingly transitioning toward premium quality offerings-particularly in urban areas, hospitality establishments, and commercial facilities-driving large-scale adoption. According to recent demographic studies, global urban population growth and rising middle-class consumption patterns are key drivers of toilet paper demand worldwide. Government-led sanitation improvement programs, public health initiatives, and hygiene awareness campaigns further strengthen market prospects.

Request for a Sample Report: https://www.imarcgroup.com/toilet-paper-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed toilet paper manufacturing facility is designed with an annual production capacity ranging between 30,000-60,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments from household consumers and retail chains to hospitality, healthcare institutions, and commercial facilities-ensuring steady demand and consistent revenue streams across multiple distribution channels.

Financial Viability and Profitability Analysis

The toilet paper manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 25-35%

Net Profit Margins: 10-15%

These margins are supported by stable demand across consumer and institutional sectors, value-added premium product positioning, and the essential nature of toilet paper in daily hygiene applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established consumer goods manufacturers looking to diversify their product portfolio in the essential hygiene products sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a toilet paper manufacturing plant is primarily driven by:

Raw Materials: 60-70% of total OpEx

Utilities: 15-20% of OpEx

Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with paper pulp (virgin and recycled) being the primary input material. Establishing long-term contracts with reliable pulp suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that pulp price fluctuations represent the most significant cost factor in toilet paper manufacturing.

Capital Investment Requirements

Setting up a toilet paper manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to paper pulp suppliers and target consumer markets will help minimize distribution costs. The site must have robust infrastructure, including reliable water supply, power connectivity, transportation access, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Tissue paper making machines (Fourdrinier or Crescent Former technology)

• Stock preparation systems for pulp processing and fiber refinement

• Headbox and wire section for sheet formation

• Press and drying cylinders (Yankee dryer) for moisture removal

• Creping blades for softness enhancement

• Calendar rolls for smoothness control

• Rewinding machines for converting jumbo rolls into finished products

• Slitting and cutting equipment for size customization

• Embossing units for pattern application and premium product features

• Packaging machines for wrapping individual rolls and multi-pack bundles

• Quality control laboratory equipment for strength, softness, and absorbency testing

• Effluent treatment systems for managing wastewater and ensuring environmental compliance

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure workplace safety, and minimize material handling complexities throughout the production process. The layout should be optimized with separate areas for raw material storage, pulp preparation zone, paper machine section, converting area, embossing unit, quality control laboratory, finished goods warehouse, utility block, effluent treatment area, and administrative block.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Toilet paper products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Residential Consumers: Primary use in households for daily personal hygiene needs, representing the largest market segment with consistent replacement demand and brand loyalty patterns.

Hospitality Sector: Essential supplies for hotels, resorts, restaurants, and tourism establishments where product quality and guest satisfaction are critical considerations.

Healthcare Institutions: Hospitals, clinics, nursing homes, and medical facilities requiring hygienic, soft, and absorbent tissue products that meet stringent sanitation standards.

Commercial Facilities: Office buildings, shopping malls, airports, educational institutions, and public facilities with high-volume consumption requirements.

Institutional Buyers: Government facilities, military installations, and public infrastructure requiring bulk procurement of cost-effective hygiene products.

End-use sectors include residential, hospitality, healthcare, commercial, and institutional applications, all of which contribute to sustained market demand.

Buy now: https://www.imarcgroup.com/checkout?id=10221&method=2175

Why Invest in Toilet Paper Manufacturing?

Several compelling factors make toilet paper manufacturing an attractive investment opportunity:

Essential Consumer Product: Toilet paper serves as a critical daily-use hygiene product with recession-resistant demand patterns, making it indispensable across all economic conditions and ensuring stable revenue streams.

Rising Hygiene Awareness: Consumer markets are increasingly prioritizing personal hygiene and sanitation standards-particularly in developing economies, urban centers, and post-pandemic environments-driving large-scale adoption of quality tissue products.

Premium Product Opportunities: The product's evolution toward premium features including ultra-soft textures, enhanced absorbency, sustainable materials, decorative embossing, and fragrance options offers significant value-addition potential and higher profit margins.

Urbanization Trends: Rapid urban population growth, expanding middle-class consumption, and increasing per-capita tissue usage in emerging markets create substantial growth opportunities for manufacturers.

Government Support: Government-led sanitation improvement programs, hygiene education campaigns, and public health initiatives further strengthen market prospects and support industry growth.

Import Substitution Opportunities: Emerging economies such as India, Southeast Asian nations, and African countries are expanding local manufacturing as part of their strategy to reduce dependence on imported tissue products, creating opportunities for domestic producers.

Sustainable Manufacturing: Growing consumer preference for eco-friendly products manufactured from recycled pulp and sustainable forestry sources aligns with global environmental goals and creates differentiation opportunities.

Manufacturing Process Excellence

The toilet paper manufacturing process involves several precision-controlled stages:

• Pulp Preparation: Virgin or recycled pulp is mixed with water and processed to create a consistent fiber slurry

• Stock Refinement: Fiber slurry undergoes mechanical treatment to improve bonding characteristics and paper quality

• Sheet Formation: Diluted stock flows onto a moving wire mesh where water drains and paper sheet begins forming

• Pressing: Wet paper sheet passes through press rollers to remove excess water mechanically

• Drying: Sheet is transferred to heated Yankee cylinder where remaining moisture evaporates

• Creping: Doctor blade scrapes dried sheet from cylinder, creating characteristic softness and stretch

• Calendering: Optional smoothness enhancement through controlled pressure application

• Rewinding: Jumbo rolls are created by winding tissue onto large cores at controlled tension

• Converting: Jumbo rolls are slit, perforated, embossed (optional), and cut to consumer-size rolls

• Packaging: Finished rolls are wrapped individually and bundled into multi-packs for retail distribution

Industry Leadership

The global toilet paper industry is led by established consumer goods manufacturers with extensive production capabilities and diverse product portfolios. Key industry players include:

• Procter & Gamble (Charmin)

• Kimberly-Clark (Scott, Cottonelle)

• Georgia-Pacific (Angel Soft, Quilted Northern)

• Essity (Tork, Lotus)

• Asia Pulp & Paper

These companies serve diverse end-use sectors including residential consumers, hospitality, healthcare, commercial facilities, and institutional buyers, demonstrating the broad market applicability of toilet paper products.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=10221&flag=C

Recent Industry Developments

2024: Major tissue manufacturers have announced significant investments in sustainable production technologies, including advanced recycling systems, renewable energy integration, and water conservation measures. Several companies launched premium product lines featuring bamboo-based materials, plastic-free packaging, and carbon-neutral manufacturing processes to address growing consumer demand for environmentally responsible hygiene products.

Conclusion

The toilet paper manufacturing sector presents a strategically positioned investment opportunity at the intersection of essential consumer goods, hygiene products, and sustainable manufacturing practices. With favorable profit margins ranging from 25-35% gross profit and 10-15% net profit, strong market drivers including rising hygiene awareness, growing urban population, expanding middle-class consumption, and supportive government sanitation initiatives, establishing a toilet paper manufacturing plant offers significant potential for long-term business success and sustainable returns. The combination of recession-resistant demand patterns, premium product opportunities, critical role in modern sanitation standards, expanding consumer markets in emerging economies, and sustainable manufacturing potential creates an attractive value proposition for serious consumer goods investors committed to quality manufacturing and operational excellence.

About IMARC Group

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Toilet Paper Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost here

News-ID: 4378784 • Views: …

More Releases from IMARC Group

Glass Bottle Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/ …

The global glass bottle manufacturing industry is witnessing robust growth driven by the rapidly expanding beverage sector and increasing demand for sustainable packaging solutions. At the heart of this expansion lies a critical packaging material: glass bottles. As consumer markets transition toward eco-friendly packaging and premium product presentation, establishing a glass bottle manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and packaging industry investors seeking to capitalize on…

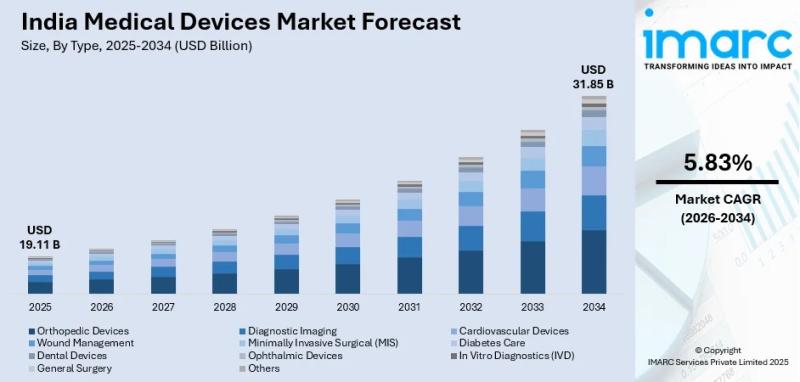

India Medical Devices Market to Reach USD 31.85 Bn by 2034 at 5.83% CAGR Driven …

The latest report by IMARC Group, "India Medical Devices Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034", provides a comprehensive industry analysis. It delivers deep insights into the Indian PCB market, highlighting growth drivers, competitive landscapes, and emerging segment trends for the 2026-2034 forecast period.

What is the India Medical Devices Market Size, Share, Trends, and Growth Forecast (2026-2034)?

According to the latest analysis by IMARC Group,…

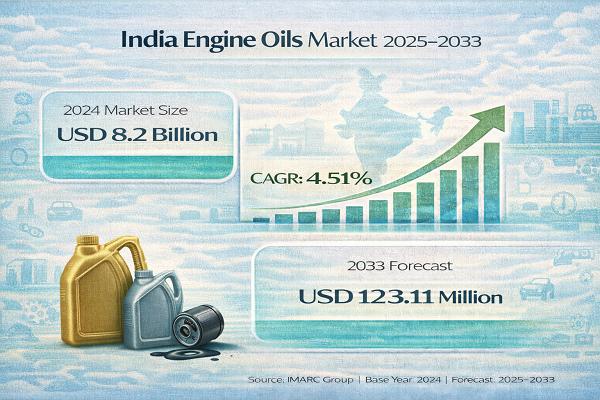

India Engine Oils Market Set to Reach USD 1,008.14 Million by 2033, Driven by 3. …

India Engine Oils Market : Report Introduction

According to IMARC Group's report titled "India Engine Oils Market Size, Share, Growth | Forecast 2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights, and industry updates, please click on 'Request Free Sample…

Copper Cable Manufacturing Plant Cost 2026: Detailed Project Report and Investme …

The global copper cable market presents a compelling investment opportunity driven by growing demands for reliable and efficient power delivery systems, infrastructural development particularly in urban areas, expanding industrial and commercial facilities, and greater preference by consumers for safety and standardization in electrical components. Copper cable represents insulated conductive assemblies manufactured with copper conductors, insulating compounds, shielding materials, and protective jackets designed to transmit electricity efficiently and safely.

These cables offer…

More Releases for Toilet

Integrated Smart Toilet and Smart Toilet Seat Market Research Report 2024: : Gro …

The global Integrated Smart Toilet and Smart Toilet Seat market was valued at US$ 180 million in 2023 and is anticipated to reach US$ 394.8 million by 2030, witnessing a CAGR of 12.0% during the forecast period 2024-2030.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-31L10706/Global_Integrated_Smart_Toilet_and_Smart_Toilet_Seat_Market_Research_Report_2022

A toilet seat is a hinged unit consisting of a seat, and usually a lid, which is bolted onto a toilet bowl for a toilet used in a sitting position.…

Integrated Smart Toilet and Smart Toilet Seat Market Revenue, Insights, Overview …

Integrated Smart Toilet and Smart Toilet Seat Market Size

The global Integrated Smart Toilet and Smart Toilet Seat market is projected to grow from US$ 200 million in 2023 to US$ 394.8 million by 2029, at a Compound Annual Growth Rate (CAGR) of 12.0% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-31L10706/Global_Integrated_Smart_Toilet_and_Smart_Toilet_Seat_Market_Research_Report_2022

Integrated Smart Toilet and Smart Toilet Seat Market Share

Global key players of integrated smart toilet and smart toilet seat include Toto,…

Integrated Smart Toilet and Smart Toilet Seat Market: Regaining Its Glory | Pana …

The global Integrated Smart Toilet and Smart Toilet Seat market was valued at 185.2 million in 2021 and is projected to reach US$ 396.4 million by 2028, at a CAGR of 11.5% during the forecast period 2022-2028. Integrated Smart Toilet and Smart Toilet Seat Market, Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging strategic…

Shower Toilet and Electronic Shower Toilet Seat Market Research Report

Shower Toilet and Electric Shower Toilet Seat Market

The Shower Toilet and Electronic Shower Toilet Seat industry can be broken down into several segments, Standing Type, Wall-mounted Type, etc. The major players cover Grohe, Villeroy & Boch, etc.

A shower toilet combines the advantages of a WC and a bidet and it uses a spray arm to clean with gentle water after using the toilet.

Shower Toilet and Electric Shower Toilet Seat Market…

Smart Toilet Seat (Intelligent Toilet Cover) Market – Global Upcoming Demand & …

Researchmoz added Most up-to-date research on "Global Smart Toilet Seat (Intelligent Toilet Cover) Market Research Report 2019 " to its huge collection of research reports.

Smart Toilet Seat (Intelligent Toilet Cover) Market report includes (6 Year Forecast 2019-2025) includes Overview, classification, industry value, price, cost and gross profit. It also offers in-intensity insight of the Smart Toilet Seat (Intelligent Toilet Cover) industry masking all vital parameters along with, Drivers, Market Trends,…

Global Smart Toilet Seat (Intelligent Toilet Cover) Market : Industry Size, Shar …

Latest industry research report on: Global Smart Toilet Seat (Intelligent Toilet Cover) Market : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts

This report presents the worldwide Smart Toilet Seat (Intelligent Toilet Cover) market size (value, production and consumption), splits the breakdown (data status 2013-2018 and forecast to 2025), by manufacturers, region, type and application.

This study also analyzes the market status, market share, growth rate, future trends,…