Press release

Copper Cable Manufacturing Plant Cost 2026: Detailed Project Report and Investment Outlook

The global copper cable market presents a compelling investment opportunity driven by growing demands for reliable and efficient power delivery systems, infrastructural development particularly in urban areas, expanding industrial and commercial facilities, and greater preference by consumers for safety and standardization in electrical components. Copper cable represents insulated conductive assemblies manufactured with copper conductors, insulating compounds, shielding materials, and protective jackets designed to transmit electricity efficiently and safely.These cables offer exceptional conductivity, safety, and transmission performance with minimal installation time and variance in system design. The market encompasses diverse product variants including power cables, control cables, instrumentation cables, coaxial cables, fiber-hybrid cables, and specialty products like fire-resistant or armored cables. With longer useful service life, ease of handling, and compatibility with both high-voltage and low-voltage electrical systems, copper cables deliver consistent performance across large-scale industrial installations and small-scale commercial and household applications.

According to IMARC Group estimates, copper cable accounts for over 32.2% share in the copper wire and cable market.

Market Overview and Growth Potential

The copper cable market demonstrates robust growth potential supported by the expansion of the global power sector, construction activity, and the rise in electrification projects in urban and semi-urban areas. The construction industry alone represents substantial market demand, with 4 million businesses operating in the construction industry in the United States, illustrating the vast scale of potential end-users.

This continuous growth of the electrical and infrastructure market is driving copper cable demand as stakeholders balance performance requirements with cost efficiency while adopting standardized and durable wiring solutions that deliver consistent quality. The increase in renewable energy installations and smart grid projects has further amplified the demand for high-performance and durable cabling products.

Key market drivers include organized infrastructure development and government-led electrification programs that have expanded product deployment across regions. Industrial operators increasingly turn to copper cable to ensure operational safety and long-term reliability. Innovative products such as low-smoke, halogen-free, and fire-resistant cables are supporting sustained market growth, offering enhanced safety features for specialized applications.

IMARC Group's report, "Copper Cable Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a plant. The copper cable manufacturing plant cost report offers insights into the process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Plant Capacity and Production Scale

The proposed copper cable manufacturing facility is designed with an annual production capacity ranging between 30,000 - 60,000 MT (metric tons), enabling economies of scale while maintaining operational flexibility. This substantial capacity range positions manufacturers to serve diverse market segments effectively, from large infrastructure projects to regional distribution networks.

The production volume creates competitive advantages through:

• Optimized procurement of copper rods and insulation materials with enhanced negotiating power

• Efficient utilization of capital-intensive wire drawing and extrusion equipment

• Lower per-unit production costs through economies of scale

• Enhanced market positioning to serve the power generation and distribution sector, construction and infrastructure industry, industrial manufacturing sector, telecommunications and data networks, and residential and commercial buildings

Financial Viability and Profitability Analysis

The copper cable manufacturing project demonstrates viable profitability potential under normal operating conditions, though margins are influenced by the commodity nature of copper and competitive pricing dynamics.

Gross profit margins typically range between 15-25%, reflecting the standardized nature of the product and the significant raw material cost component. These margins are supported by stable institutional demand and long-term supply contracts with major infrastructure and industrial buyers.

Net profit margins are projected at 5-10%, indicating the importance of operational efficiency and scale in achieving satisfactory returns. While lower than specialty products, these margins remain attractive given the high-volume nature of the business and the essential role of copper cable in power infrastructure.

The financial projections have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. These projections provide a comprehensive view of the project's financial viability, return on investment (ROI), profitability, and long-term sustainability in a commodity-influenced market environment.

Request for a Sample Report: https://www.imarcgroup.com/copper-cable-manufacturing-plant-project-report/requestsample

Operating Cost Structure

The operating cost structure of a copper cable manufacturing plant is dominated by raw material expenses, with copper prices representing the primary cost driver and source of margin volatility.

Raw materials represent the overwhelming majority of operating expenses, accounting for approximately 80-85% of total OpEx. The primary raw materials include copper rods and PVC (polyvinyl chloride) for insulation. Copper rods constitute the largest single cost component, making supplier relationships and pricing strategies critical to profitability. Long-term contracts with reliable copper suppliers help mitigate price volatility and ensure consistent supply, though manufacturers remain exposed to global copper market fluctuations.

Utilities account for 5-10% of operating expenses, covering electricity for wire drawing machines, extrusion equipment, and production lines, as well as water requirements for cooling systems and plant operations. Energy-efficient equipment and process optimization can help control utility costs.

Other operating expenses include packaging materials for cable reels and protective wrapping, transportation and logistics for bulky finished products, salaries and wages for production staff and quality control personnel, depreciation on machinery and equipment, taxes, and repair and maintenance costs. By the fifth year of operations, total operational costs are expected to increase substantially due to inflation, market fluctuations, potential rises in copper prices, supply chain disruptions, rising demand, and shifts in the global economy.

Capital Investment Requirements

Establishing a copper cable manufacturing plant requires substantial capital investment distributed across multiple categories:

Machinery Costs: Equipment represents the largest portion of total capital expenditure. Essential machinery includes:

• Copper rod breakdown machines for initial processing

• Wire drawing and stranding lines for conductor formation

• Insulation extrusion units for applying protective coatings

• Armoring and sheathing machines for protective layers

• Testing and inspection systems for quality assurance

• Packaging and coiling equipment for finished products

All machinery must comply with industry standards for safety, efficiency, and reliability. The scale of production and automation level will determine total machinery costs, with advanced automated systems delivering higher throughput and consistency.

Land and Site Development: Land acquisition and site development costs, including land registration charges, boundary development, and site preparation, form a substantial part of overall investment. The location must offer easy access to copper rods and PVC suppliers, while proximity to target markets helps minimize distribution costs for heavy, bulky finished products.

Civil Works: Construction costs include facility buildings designed to accommodate wire drawing lines, extrusion equipment, quality control laboratories, raw material storage areas, finished goods warehousing for cable reels, and administrative offices. The site requires robust infrastructure including reliable transportation access for heavy materials, three-phase power supply for energy-intensive equipment, and waste management systems.

Other Capital Costs: Additional investments include utilities infrastructure setup, environmental compliance systems, initial working capital for copper inventory, safety equipment and fire suppression systems, and contingency reserves for cost overruns.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=8397&flag=C

Major Applications and Market Segments

Copper cables serve critical functions across multiple industrial and commercial segments:

Power and Energy Sector: Cables are employed in main transmission and distribution systems where stable conductivity, safety, and reliability define performance requirements. The integration ensures efficient power delivery from generation facilities to end-users with minimal energy loss.

Construction and Infrastructure Sector: Quick installation, low maintenance requirements, and reliable operation represent major advantages in building wiring, municipal infrastructure, and commercial developments. Standardized cable specifications simplify procurement and installation across large projects.

Industrial Manufacturing Sector: The integration of machinery wiring and automated power solutions for industrial operations depends on consistent copper cable performance. Manufacturing facilities require reliable electrical connections for production equipment, control systems, and material handling infrastructure.

Telecommunications and Data Networks: While fiber optic technology dominates long-distance communications, copper cables remain essential for local area networks, building connectivity, and legacy system support where cost-effectiveness and adequate bandwidth align with application requirements.

Residential and Commercial Buildings: This segment enables customers to create safe and efficient electrical connections using standardized installation methods and effective power transmission without requiring specialized technical expertise. Building codes and safety standards drive consistent demand for certified cable products.

Renewable Energy Installations: Solar farms, wind installations, and battery storage facilities require extensive cabling infrastructure to connect generation equipment to power grids, supporting the global transition toward sustainable energy sources.

Why Invest in Copper Cable Manufacturing?

Several strategic factors make copper cable manufacturing an attractive investment opportunity:

Growing Demand for Reliable Power Infrastructure: The usage of copper cable aligns with the global trend toward stable and safe electrical networks, ensuring efficiency in power transmission with reduced energy loss during operation. Expanding electrification in developing regions creates sustained demand growth.

Consistency and Quality Control: Manufacture of copper cables allows precise control over conductor quality and insulation standards, enabling electrical performance and safety compliance to remain consistent between production batches. This standardization supports brand reputation and customer loyalty.

Expanding Construction and Industrial Sector: The increasing number of infrastructure projects, factories, data centers, and commercial buildings creates substantial demand for copper cable and other standard electrical components. Urbanization trends and industrial growth in emerging markets provide long-term volume drivers.

Product Customization Opportunities: Firms can develop specialized formulations for voltage-specific applications, industry-oriented solutions, or specialty-grade products designed to attract customers with variant technical requirements such as fire resistance, low-smoke characteristics, or enhanced shielding.

Scalable and Cost-Efficient Production: Cable manufacturing operations require moderate capital investment relative to output value and allow scalable production with efficient supply chain management systems. Established processes and widely available technology reduce technical risk.

Technology and Innovation: Recent developments demonstrate ongoing market evolution. In October 2025, Marvell Technology expanded its connectivity portfolio by adding active copper cable linear equalizers designed to support longer reach and power-efficient copper interconnects for high-speed data center environments. In April 2025, Amphenol Communications Solutions and Semtech introduced a 1.6T Active Copper Cable at OFC 2025, supporting next-generation AI/ML and data center infrastructure. These innovations create opportunities for manufacturers to serve specialized, higher-margin market segments.

Essential Infrastructure Component: Copper cable represents an essential component of electrical infrastructure with consistent replacement demand driven by aging installations, building renovations, and infrastructure upgrades. This creates baseline demand independent of new construction activity.

Buy Now: https://www.imarcgroup.com/checkout?id=8397&method=2175

Industry Leadership

The global copper cable industry is served by established manufacturers with extensive production capacities and diverse application portfolios. Leading companies in this space include:

• Belden Inc

• Cords Cable Industries Ltd.

• Fujikura Ltd.

• Furukawa Electric Co., Ltd.

• KEI Industries Ltd

These industry leaders serve critical end-use sectors including power generation and distribution, construction and infrastructure, industrial manufacturing, telecommunications and data networks, and residential and commercial buildings. Their market presence demonstrates the viability and scale potential of copper cable manufacturing operations across global markets.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Services:

• Plant Setup

• Factoring Auditing

• Regulatory Approvals, and Licensing

• Company Incorporation

• Incubation Services

• Recruitment Services

• Marketing and Sales

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Copper Cable Manufacturing Plant Cost 2026: Detailed Project Report and Investment Outlook here

News-ID: 4378699 • Views: …

More Releases from IMARC Group

Tomato Sauce Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/ …

The global food processing industry continues to witness robust growth, with tomato sauce emerging as one of the most consumed condiments worldwide. As urbanization accelerates and consumer preferences shift toward convenience foods with extended shelf lives, the tomato sauce manufacturing sector presents a compelling investment opportunity for entrepreneurs and established food processors alike.

IMARC Group's report, "Tomato Sauce Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment…

Steel Rebar Manufacturing Plant DPR - 2026, Machinery Cost, CapEx/OpEx and Profi …

The global construction industry stands at the foundation of economic development and infrastructure modernization worldwide, requiring essential building materials that provide structural integrity and long-term durability. Steel rebar, consisting of hot-rolled or mechanically processed steel bars manufactured to reinforce concrete and masonry structures, represents a critical component for improving tensile strength and ensuring structural safety across diverse construction applications. As rapid urbanization accelerates, infrastructure development intensifies, residential and commercial construction…

Bio-CNG Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Project …

The global energy landscape is undergoing a fundamental transformation as nations and industries worldwide seek cleaner, more sustainable alternatives to conventional fossil fuels. Bio-CNG (compressed natural gas), a renewable fuel derived from organic waste through advanced anaerobic digestion and biogas upgrading processes, represents a critical solution in this energy transition. This comprehensive investment guide examines the compelling opportunity of establishing a bio-CNG manufacturing facility, drawing on market intelligence, financial projections,…

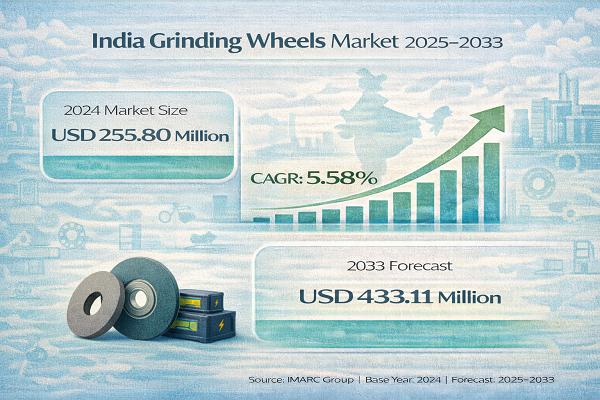

India Grinding Wheels Market Set for Steady Expansion, Forecast to Hit USD 433.1 …

India Grinding Wheels Market - Report Introduction

According to IMARC Group's report titled "India Grinding Wheels Market Size, Share, Trends, and Forecast by Type, Material, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Note : We are in the process of updating our reports to cover the 2026-2034 forecast period. For the most recent data, insights, and industry updates, please…

More Releases for Copper

Copper Mining Market is Booming Worldwide | Major Giants Turquoise Hill, Copper …

HTF MI recently introduced Global Copper Mining Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2033). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

Major companies in Copper Mining Market are:

Codelco, BHP, Freeport-McMoRan, Glencore, Rio Tinto, KGHM, First Quantum Minerals, Southern Copper, Antofagasta, Lundin Mining,…

Copper And Copper Alloy Welding Wire Market Size Analysis by Application, Type, …

According to Market Research Intellect, the global Copper And Copper Alloy Welding Wire market under the Internet, Communication and Technology category is expected to register notable growth from 2025 to 2032. Key drivers such as advancing technologies, changing consumer behavior, and evolving market dynamics are poised to shape the trajectory of this market throughout the forecast period.

With a robust Compound Annual Growth Rate (CAGR) of roughly 4.5%, the global market…

Copper Alloy And Copper Powder Market Size Analysis by Application, Type, and Re …

USA, New Jersey- According to Market Research Intellect, the global Copper Alloy And Copper Powder market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The market for copper alloys and copper powder is steadily rising due to rising demand from a variety of industrial sectors, such…

Copper and Copper Alloy Foil Market Size, Scope 2031 by Key Companies- Amari Cop …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲: According to Verified Market Reports analysis, the global Copper and Copper Alloy Foil Market size was valued at USD 13.60 Billion in 2023 and is projected to reach USD 24.34 Billion by 2031, growing at a CAGR of 8.67% during the forecasted period 2024 to 2031.

The Copper and Copper Alloy Foil Market is poised for growth due to the increasing demand for high-performance materials across various industries,…

Global Copper and Copper-alloy Foils

LP INFORMATION recently released a research report on the Copper and Copper-alloy Foils

Contact US

LP INFORMATION

E-mail: info@lpinformationdata.com

Tel: 001-626-346-3938 (US) 00852-58080956 (HK) 0086 15521064060 (CN)

Add: 17890 Castleton St. Suite 162 City of Industry, CA 91748 US

Website: https://www.lpinformationdata.com

About Us:

LP INFORMATION (LPI) is a professional market report publisher based in America, providing high quality market research reports with competitive prices to help decision makers make informed decisions and take strategic actions…

Global Copper and Copper-alloy Foils (

LP INFORMATION offers a latest published report on Copper and Copper-alloy Foils (

Contact US

LP INFORMATION

E-mail: info@marketresearchreportstore.com

Tel: CN:0086-13660489451 HK: 00852-58081523 USA:001-626-3463946

Add: 17890 Castleton Street Suite 218 City of Industry CA 91748 United States

Website: https://www.marketresearchreportstore.com

About Us

LP INFORMATION (LPI) is a professional organization related to market research reports in all directions .To provide customers with a variety of market research reports,…