Press release

P2P Payment Market to Reach $2,851.1 million by 2024 in the short term and $14,506.8 Million by 2034 Globally, at 17.3% CAGR

Allied Market Research published a report titled, "P2P Payment Market - Global Opportunity Analysis and Industry Forecast, 2024-2034," valued at $2,851.1 million in 2024. The market is expected to grow at a CAGR of 17.3% from 2025 to 2034, reaching $14,506.8 million by 2034. Key factors fueling this growth include a rise in smartphone penetration and internet connectivity, consumer preference for digital payments, and an increase in technological advancements and innovations to enhance transaction security and user experience.Get a Sample Copy of this Report: https://www.alliedmarketresearch.com/request-sample/2568

Report Overview:

Rise in smartphone penetration and internet connectivity coupled with growing consumer preference for digital payments have driven the demand for peer-to-peer (P2P) payment solutions, prompting service providers to enhance platform security and transaction speed. Additionally, technological advancement and innovations are driving the development of seamless and user-friendly payment platforms, further accelerating overall market growth.

However, the security concerns and risks of fraud, along with regulatory challenges, pose significant restraints. Conversely, the integration of P2P payment with IoT devices within the P2P payment landscape presents significant opportunities for market players.

Key Segmentation Overview:

The P2P payment market is segmented based on transaction mode, payment type, end-user, and region.

By Transaction Mode: Mobile Web Payments, Near Field Communication, SMS/Direct Carrier Billing, and Others.

By Payment Type: Remote and Proximity

By End User: Personal and Business

By Region:

North America (U.S., and Canada)

Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

LAMEA (Brazil, South Africa, UAE, Saudi Arabia, Rest of LAMEA)

Market Highlights

By transaction mode, the mobile web payments segment dominated the market in 2024 and is expected to continue leading due to the integration of P2P payments with social media and messaging apps, increase in the use of mobile web payments, and adoption of cross-border remittances.

By payment type, the proximity segment witnessed significant growth due to the adoption of proximity-based payments, increase in the use of digital wallets, and the government's supportive policies aimed at enhancing financial inclusion, digital infrastructure, and cashless transactions.

By end user, the personal segment experienced significant growth due to rise in digital awareness, growing adoption of mobile-first solutions, and the integration of P2P payment with e-commerce and gig economy.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/2568

Factors Affecting Market Growth & Opportunities:

Rise in smartphone penetration and internet connectivity, expansion of mobile banking services, and increasing affordability of smart devices have propelled the growth of the P2P payment market. Factors such as the growing consumer preference for digital payments, enabling faster transactions, greater convenience, and real-time fund transfers, along with technological advancements and innovations that enable enhanced security and seamless user experience in the P2P payment market are driving the market forward.

Demand for Enhanced Security Measure: Biometric authentication, such as fingerprint and facial recognition, enhances transaction security by ensuring user verification. Encryption and tokenization help protect sensitive data, minimize the risk of fraud, and build trust in digital payment platforms.

Innovations in P2P Payment: Embedded finance in super apps offers seamless access to services like payments, loans, and insurance within one platform, enhancing convenience and user engagement.

However, persistent security issues and the risk of fraud coupled with regulatory challenges remain concerns for industry players. Market participants are focusing on strengthening authentication protocols, adopting advanced encryption technologies, and ensuring regulatory compliance to ensure secure, reliable, and trustworthy P2P payment solutions.

Regulatory Landscape & Compliance:

The P2P payment market operates within a highly regulatory landscape, shaped by various global, regional, and national frameworks aimed at ensuring security, transparency, and consumer protection. These regulations are designed to ensure data privacy, anti-money laundering (AML) compliance, and the prevention of fraudulent activities, while also promoting trust and financial stability. Key regulations such as the General Data Protection Regulation (GDPR) in the European Union and the Payment Services Directive 2 (PSD2) mandate strong customer authentication and data protection practices. Compliance in P2P payment aims to ensure secure transactions, user verification, financial accountability, and operational integrity by setting clear standards for identity verification, transaction monitoring, and reporting obligations for financial institutions, fintech companies, and service providers involved in peer-to-peer payment systems.

Recent regulations aim to strengthen and streamline P2P payment by enhancing transaction security, data privacy, and fraud detection mechanisms, while ensuring financial transparency and consumer trust.

Technological Innovations & Future Trends:

NFC and QR code payments enable fast, contactless transactions via smartphones or wearables, allowing easy P2P transfers without sharing card details.

Decentralized Finance (DeFi) integration allows users to lend, borrow, and invest directly on P2P platforms without intermediaries. It also enables the tokenization of assets, creating new financial products, and opportunities.

Voice-activated payments are growing with the rise of voice assistants like Alexa and Siri, allowing users to initiate P2P transactions hands-free for greater convenience.

Regional Insights

Asia-Pacific dominated the P2P payment market owing to the rapid adoption of digital payment technologies and the large unbanked population seeking alternative financial services. In addition, the widespread use of smartphones and increasing internet penetration fuels the growth of the market in this region. China leads the P2P payment market in this region due to its large consumer base, government support for cashless transactions, and the presence of major P2P payment platforms like Alipay and WeChat Pay. The country's advanced mobile infrastructure and digital ecosystem provide ample opportunities for P2P payment solutions, especially for small and medium-sized enterprises (SMEs) and individual consumers. For instance, in June 2025, Alipay partnered with AR tech company Rokid to launch in-store payment functionality via AR glasses in China. This innovation allows users to make hands-free payments by linking their Alipay account to Rokid Glasses, using voice commands like "Rokid, pay 10 RMB" to complete transactions. The glasses scan the merchant's QR code, and users confirm payments via voice, with details shown on the display. This marks a major step toward immersive commerce, enabling faster, more intuitive shopping experiences and opening new engagement opportunities for businesses.

LAMEA is expected to witness rapid growth during the forecast period, driven by factors such as increasing smartphone penetration, rising internet accessibility, and growing demand for convenient financial services. In addition, the government's financial inclusion initiatives aim to expand banking access and promote digital payments, enhancing trust in P2P payment by ensuring regulatory frameworks and consumer protection, which contribute toward the market growth in the region. Africa stands out as a dominant player in the P2P payment industry, due to widespread mobile money adoption, large unbanked populations, and innovative fintech solutions. In countries like Kenya and Nigeria, mobile network operators and fintech companies are actively supporting P2P payment in both urban and rural areas. The digital payment system is emerging in the Middle East, with government-backed strategies aimed at boosting cashless transactions and improving financial inclusion.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/2568

Key Players:

Major players in the P2P payment market include PayPal Holdings, Inc., Google LLC, Apple Inc., Payoneer Inc., Block, Inc., National Association and Bremer Insurance Agencies, Inc., ONE97 COMMUNICATIONS LIMITED, PAYTM), N26 Bank SE, Circle Internet Financial, LLC, Wise plc, Samsung Electronics Co., Ltd., Remitly, Inc., Skrill (Paysafe Holdings UK Limited), NetSpend Corporation, Vodafone Group Plc., Chime Financial, Inc., Early Warning Services, LLC, Tencent Holdings Limited, Alipay, and Paysend. These companies are focusing on expanding their service offerings and strategic partnerships, enhancing digital accessibility, customer outreach, and financial inclusion in the P2P payment industry.

Key Strategies Adopted by Competitors

In April 2025, PayPal's remittance service Xoom partnered with Tenpay Global, Tencent's cross-border payment platform, to enable cross-border money transfers to Weixin Pay users in China. This collaboration allows users in the U.S., Canada, and Europe to send funds directly to recipients' Weixin Pay wallet balances or linked bank accounts. The service is designed to be fast, secure, and user-friendly, supporting everyday needs like family support and daily expenses, and is accessible via the Xoom or PayPal apps and websites.

In August 2024, major fintech platforms including Google Pay, PhonePe, Cred, Mobikwik, and Amazon Pay joined the Reserve Bank of India's (RBI) digital currency pilot. These companies are now authorized to offer transactions using the e-rupee, India's central bank digital currency , through their apps. Initially, only the RBI could offer e-rupee services, but in April 2024, it allowed approved fintechs to participate in the pilot, expanding access and testing broader use cases for digital currency in India.

Trending Reports:

Mortgage Brokerage Services Market https://www.alliedmarketresearch.com/mortgage-brokerage-services-market-A06699

Prepaid Card Market https://www.alliedmarketresearch.com/prepaid-card-market

Home Banking Market https://www.alliedmarketresearch.com/home-banking-market-A324245

Universal Banking Market https://www.alliedmarketresearch.com/universal-banking-market-A323732

Revenue-Based Financing Market https://www.alliedmarketresearch.com/revenue-based-financing-market-A07537

Business Travel Accident Insurance Market https://www.alliedmarketresearch.com/business-travel-accident-insurance-market-A119319

E-Banking Market https://www.alliedmarketresearch.com/e-banking-market-A15165

Credit Bureaus Market https://www.alliedmarketresearch.com/credit-bureaus-market-A323733

Employment Screening Services Market https://www.alliedmarketresearch.com/employment-screening-services-market

Senior Citizen Travel Insurance Market https://www.alliedmarketresearch.com/senior-citizen-travel-insurance-market-A323729

Small Personal Loans Market https://www.alliedmarketresearch.com/small-personal-loans-market-A324099

Small Business Loans Market https://www.alliedmarketresearch.com/small-business-loans-market-A324248

Digital Mortgage Software Market https://www.alliedmarketresearch.com/digital-mortgage-software-market-A12740

Alternative Investment Funds (AIFs) Market https://www.alliedmarketresearch.com/alternative-investment-funds-market-A324228

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release P2P Payment Market to Reach $2,851.1 million by 2024 in the short term and $14,506.8 Million by 2034 Globally, at 17.3% CAGR here

News-ID: 4377710 • Views: …

More Releases from Allied Market Research

Gift Cards Market to Reach $950.86 Billion by 2024 in the short term and $2,290. …

Allied Market Research published a report titled, "Gift Card Market - Global Opportunity Analysis and Industry Forecast, 2024-2034," valued at $950.86 billion in 2024. The market is expected to grow at a CAGR of 9.0% from 2025 to 2034, reaching $2,290.7 billion by 2034. Key factors fueling this growth include a rise in the adoption of digital payment, expansion of the e-commerce sector, and the trends in corporate gifting to…

Unit Linked Insurance Market was valued at $1.1 trillion by 2024 in the short te …

Allied Market Research published a report, titled, 'Unit Linked Insurance Market by Mode (Online and Offline), and Distribution Channel (Direct from Insurers, Insurance Brokers and Agencies, Banks, and Others): Global Opportunity Analysis and Industry Forecast, 2025-2034'. According to the report, the unit linked insurance market was valued at $1.1 trillion in 2024 and is estimated to reach $3.3 trillion by 2034, growing at a CAGR of 10.5% from 2025 to…

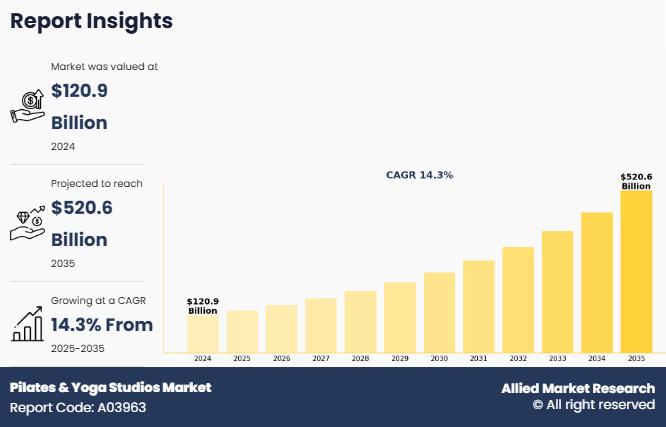

Pilates & Yoga Studios Market Predicted to Hit USD 520.6 billion by 2035, with a …

According to a new report published by Allied Market Research, titled, "Pilates & Yoga Studios Market," The pilates & yoga studios market size was valued at $120.9 billion in 2024, and is estimated to reach $520.6 billion by 2035, growing at a CAGR of 14.3% from 2025 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/4310

Pilates and yoga studios provide specific exercise courses that emphasize strength, flexibility, and…

HBPA Epoxy Resins Market Expanding at a Healthy CAGR of 5.4% by 2030

According to the report published by Allied Market Research, the global HBPA epoxy resins market generated $1.9 billion in 2020, and is anticipated to reach $3.1 billion by 2030, manifesting a CAGR of 5.4% from 2021 to 2030. In-depth information about key drivers, restraints, opportunities, current trends, and their impact on the market is offered in the report.

Download Sample PDF (280 Pages PDF with Insights): https://www.alliedmarketresearch.com/request-sample/13503

Rise in global…

More Releases for P2P

Millennials fuel P2P investment surge

According to the latest research, Robocash's core audience consists of millennial men with an average investment of up to €5,000. At the same time, the platform is becoming more appealing to a broader demographic, as well as geographically.

Robocash analysts studied how the profile of the platform's investors has changed over the past year.

Currently, the majority of investors on Robocash are aged 29-44. However, since 2024, the share…

P2P Content Delivery Network (P2P CDN) Market to Witness Growth by 2024-2031

The P2P Content Delivery Network (P2P CDN) market has emerged as a transformative force in the digital content distribution landscape. P2P CDNs leverage peer-to-peer technology to distribute content efficiently, reducing the strain on centralized servers and enhancing delivery speeds. This market has experienced substantial growth due to the increasing demand for high-quality video streaming, online gaming, and other content-rich applications. P2P CDNs enable more scalable and cost-effective content delivery, making…

P2P Content Delivery Network (P2P CDN) Market is Touching New Development Level …

The latest independent research document on P2P Content Delivery Network (P2P CDN) examines investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore their potential to become major business disrupters. The P2P Content Delivery Network (P2P CDN) study eludes very useful reviews & strategic assessments including the generic market trends, emerging technologies, industry drivers, challenges, and regulatory policies that propel the market growth,…

Revving Up Indonesia's P2P Lending Market: 3 Catalyst Driving the Indonesia's P2 …

Indonesia has witnessed a rapid increase in internet and smartphone usage, leading to greater accessibility and creating a conducive environment for P2P lending platforms to reach a large customer base.

Introduction

The peer-to-peer (P2P) lending market in Indonesia has experienced significant growth in recent years, driven by various factors. P2P lending platforms, also known as financial technology (FinTech) platforms, provide an alternative financing option for individuals and businesses, particularly those who are…

P2P Content Delivery Network (P2P CDN) Market to See Huge Demand by 2030: Alibab …

2022-2030 World P2P Content Delivery Network (P2P CDN) Market Report Professional Analysis 2022 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the P2P Content Delivery Network (P2P CDN) Market. Some of the key players profiled…

P2P Content Delivery Network (P2P CDN) Market to see Booming Worldwide | Major G …

A Qualitative Research Study accomplished by HTF MI Titled on Global P2P Content Delivery Network (P2P CDN) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 with detailed information of Product Types [Video & Non-video], Applications [Media and Entertainment, Gaming, Retail and eCommerce, Education, Healthcare & Others] & Key Players Such as Streamroot, Alibaba Group, Viblast, Globecast, Edgemesh, Peer5, Akamai, Qumu Corporation & CDNvideo etc. The Study provides…