Press release

Lithium-Ion Battery Plant DPR 2026: Industry Trends, CapEx/OpEx and Market Growth

The global lithium-ion battery manufacturing industry is experiencing transformational growth driven by the explosive expansion of electric vehicles and surging demand for energy storage solutions. At the heart of this energy revolution lies a critical enabling technology lithium-ion batteries. As transportation and energy sectors transition toward electrification and renewable integration, establishing a lithium-ion battery manufacturing plant presents an extraordinarily compelling business opportunity for entrepreneurs and industrial investors seeking to capitalize on this massive and rapidly expanding market.Market Overview and Growth Potential

The global lithium-ion battery market demonstrates exceptional growth trajectory, valued at USD 59.97 Billion in 2025. According to comprehensive analyses from leading research firms, the market is projected to reach USD 155.16 Billion by 2034, exhibiting an extraordinary CAGR of 11.1% from 2026-2034. This unprecedented expansion is driven by explosive electric vehicle adoption, accelerating renewable energy storage deployment, expanding consumer electronics demand, declining battery costs, and strengthening regulatory support for electrification across developed and developing economies.

Lithium-ion batteries are rechargeable energy storage devices utilizing lithium ions moving between cathode and anode through an electrolyte to generate electrical energy. These batteries comprise cathode materials (lithium nickel manganese cobalt oxide, lithium iron phosphate, lithium cobalt oxide), anode materials (graphite), electrolytes (lithium salts in organic solvents), separators, and current collectors. Modern lithium-ion batteries deliver high energy density (150-250 Wh/kg), long cycle life (500-5,000+ cycles), minimal memory effect, and rapid charging capabilities. Due to superior performance characteristics, lightweight design, and declining costs, lithium-ion batteries have become the dominant energy storage technology powering electric vehicles, consumer electronics, grid-scale storage systems, and industrial applications worldwide.

The lithium-ion battery market is witnessing unprecedented demand driven by revolutionary transformation in transportation. The International Energy Agency forecasts over 125 million electric vehicles on roads by 2030. Each electric vehicle requires 40-100 kWh battery capacity, creating massive demand for battery manufacturing capacity. Simultaneously, renewable energy storage is accelerating, with global capacity projected to double by 2030, requiring gigawatt-hours of battery storage. Government policies including emission regulations, EV purchase incentives, renewable energy mandates, and local battery manufacturing support through production-linked incentive schemes are creating powerful market tailwinds supporting sustained industry growth.

Plant Capacity and Production Scale

The proposed lithium-ion battery manufacturing facility is designed with an annual production capacity ranging between 5 - 10 GWh per year, enabling economies of scale while maintaining market competitiveness. This capacity range allows manufacturers to serve diverse market segments from automotive original equipment manufacturers requiring large-format cells to consumer electronics manufacturers needing cylindrical and pouch cells ensuring steady demand and consistent revenue streams across multiple application verticals including electric vehicles, energy storage systems, and portable electronics.

Request for a Sample Report: https://www.imarcgroup.com/lithium-ion-battery-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis

The lithium-ion battery manufacturing business demonstrates attractive profitability potential under favorable market conditions. The financial projections reveal:

Gross Profit Margins: 25-35 %

Net Profit Margins: 10-15 %

These margins are supported by robust demand across automotive and energy storage sectors, economies of scale in large-volume production, continuous technological improvements reducing manufacturing costs, and the strategic nature of battery manufacturing in electrification supply chains. The project demonstrates strong return on investment potential with break-even typically achieved within 5-10 years depending on capacity utilization, technology selection, and offtake agreements, making it an attractive proposition for both industrial conglomerates and specialized battery manufacturers entering this high-growth sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and competitiveness. The cost structure for a lithium-ion battery manufacturing plant is primarily driven by:

Raw Materials: 70-80% of total OpEx

Utilities and Processing: 10-15 % of OpEx

Other Expenses: Including labor, equipment maintenance, quality control, depreciation, regulatory compliance, research and development, and taxes

Raw materials constitute the dominant portion of operating costs, with critical battery materials including lithium carbonate or lithium hydroxide for cathodes, nickel, cobalt, manganese compounds, graphite for anodes, electrolyte salts, separator films, and current collector foils. Cathode materials alone represent 40-50% of total battery cost. Securing long-term supply agreements with mining companies, chemical processors, and material suppliers is critical for cost stability. Energy consumption for high-temperature processes, controlled atmosphere environments, and cleanroom operations represents significant utility costs, with energy-efficient manufacturing technologies and renewable energy integration helping reduce per-unit energy costs.

Capital Investment Requirements

Setting up a lithium-ion battery manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic considerations including proximity to automotive manufacturing clusters, access to reliable power supply for energy-intensive operations, availability of skilled technical workforce, and logistics connectivity for raw material imports and battery exports. The site must have robust infrastructure supporting cleanroom environments, environmental compliance systems, and future expansion capacity. Proximity to key customers including EV manufacturers and energy storage system integrators helps reduce transportation costs and enables closer technical collaboration.

Machinery and Equipment: The largest portion of capital expenditure covers highly specialized manufacturing equipment essential for battery cell production. Key machinery includes:

- Material preparation systems including mixers and homogenizers for cathode and anode slurry preparation with precise composition control

- Coating equipment for applying electrode materials onto current collector foils with uniform thickness and high precision

- Calendaring machines for compressing coated electrodes to target density and porosity specifications

- Slitting and cutting equipment for precision electrode sizing and tab formation

- Stacking or winding machines for cell assembly with automated precision placement of cathodes, anodes, and separators

- Electrolyte filling stations with controlled atmosphere and precise volume dispensing capabilities

- Formation and aging equipment for initial charging cycles activating battery cells and stabilizing performance

- Testing and grading systems for quality control including capacity measurement, internal resistance testing, and safety verification

- Drying ovens and environmental control systems maintaining precise temperature and humidity throughout manufacturing

- Cleanroom infrastructure with HEPA filtration, controlled particle counts, and contamination prevention essential for quality battery production

Civil Works: Building construction, manufacturing facility layout optimization, and infrastructure development designed to support cleanroom requirements, material flow efficiency, safety protocols, and quality control throughout battery cell production. The layout should incorporate separate areas for material receiving and storage, dry room environments for moisture-sensitive operations, electrode preparation and coating zone, cell assembly cleanrooms, formation and aging areas, testing and quality control laboratories, finished goods storage, waste management and recycling facilities, utility infrastructure including deionized water systems, and administrative offices with research and development capabilities.

Speak to Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=8556&flag=C

Other Capital Costs: Pre-operative expenses, machinery installation and commissioning costs requiring specialized technical expertise, environmental clearances and comprehensive regulatory compliance certifications, initial working capital requirements for raw material inventory buildup, technology licensing fees for proprietary battery chemistries and manufacturing processes, employee training programs for specialized battery manufacturing operations, safety systems including fire suppression and thermal runaway containment, and contingency provisions for unforeseen circumstances during plant establishment and production ramp-up.

Major Applications and Market Segments

Lithium-ion battery manufacturing facilities serve extensive applications across rapidly growing market segments:

Electric Vehicles: Primary and fastest-growing revenue source through supply of battery cells and packs to automotive manufacturers producing battery electric vehicles, plug-in hybrid electric vehicles, and commercial electric vehicles. The automotive segment dominated the market with 67% share in 2024 and is projected to generate USD 225 billion by 2034, driven by accelerating EV adoption, expanding model availability, declining battery costs, and strengthening regulatory support for transportation electrification.

Energy Storage Systems: Rapidly expanding segment supplying batteries for grid-scale energy storage supporting renewable energy integration, frequency regulation, peak demand management, and backup power systems. With global renewable energy capacity projected to double by 2030, utility-scale and commercial energy storage deployment is accelerating, creating sustained demand for large-format lithium-ion batteries optimized for stationary applications with longer cycle life requirements.

Consumer Electronics: Established market segment providing batteries for smartphones, laptops, tablets, wearable devices, power tools, and portable electronics. While individual unit margins are lower than automotive batteries, massive production volumes, established supply chains, and continuous product innovation supporting premium devices create consistent revenue streams and manufacturing expertise transferable to larger-format cells.

Industrial Applications: Specialized applications including material handling equipment, electric forklifts, automated guided vehicles, electric buses, telecommunications backup power, medical devices, and marine propulsion systems. Industrial applications often require customized battery specifications, longer warranties, and higher reliability standards, supporting premium pricing and long-term customer relationships.

Emerging Applications: Growing opportunities in electric aviation, electric construction equipment, electric agricultural machinery, residential energy storage systems, and portable power stations. These emerging segments represent future growth vectors as electrification extends to additional transportation modes and energy applications previously dependent on fossil fuels or lead-acid batteries.

End-use industries include automotive manufacturing, renewable energy developers, consumer electronics producers, telecommunications infrastructure providers, industrial equipment manufacturers, and grid operators, all requiring reliable lithium-ion battery supply supporting electrification objectives and energy transition goals.

Why Invest in Lithium-Ion Battery Manufacturing?

Several exceptionally compelling factors make lithium-ion battery manufacturing an outstanding investment opportunity:

Explosive Market Growth: Market expanding from USD 75-134 billion in 2025 to projected USD 250-865 billion by 2034 represents unprecedented industrial growth opportunity. Electric vehicle sales surging from 17 million units in 2024 toward 125 million by 2030 creates exponential battery demand, with each vehicle requiring 40-100 kWh capacity representing massive manufacturing volume requirements.

Strategic Industry Position: Battery manufacturing represents critical enabling technology for transportation electrification and renewable energy integration. Governments worldwide prioritizing domestic battery production through production-linked incentive schemes, manufacturing subsidies, and strategic investment programs recognizing batteries as strategic industries essential for energy security, industrial competitiveness, and climate goals.

Declining Costs Expanding Markets: Lithium-ion battery pack prices declined from over USD 1,200/kWh in 2010 to approximately USD 130-150/kWh in 2024, with projections indicating continued cost reductions toward USD 80-100/kWh by 2030. Cost reductions driving EV price parity with internal combustion vehicles, expanding market accessibility, and accelerating adoption rates supporting sustained volume growth.

Strong Policy Support: Governments implementing comprehensive support including EV purchase incentives, emission regulations phasing out internal combustion engines, renewable energy mandates requiring storage, production-linked incentive schemes for battery manufacturing, and research funding supporting technological advancement. Europe, United States, China, India, and other major economies establishing ambitious electrification targets requiring massive battery production capacity.

Supply Chain Security: Geopolitical considerations and supply chain resilience driving localization of battery manufacturing. Automotive manufacturers and governments prioritizing regional battery production reducing dependence on concentrated supply chains, creating opportunities for new manufacturing facilities with long-term offtake agreements and strategic partnerships.

Technology Leadership Opportunity: Continuous innovation in battery chemistry, manufacturing processes, and performance characteristics creates differentiation opportunities. Next-generation technologies including solid-state batteries, silicon anodes, lithium iron phosphate advancements, and sustainable manufacturing processes offering competitive advantages and premium market positioning for technology-focused manufacturers.

Circular Economy Integration: Battery recycling and second-life applications creating additional revenue streams and sustainability credentials. Forward-thinking manufacturers integrating recycling capabilities, securing critical material supplies from recycled sources, and developing second-life energy storage solutions extending battery value and supporting circular economy business models.

Buy Now: https://www.imarcgroup.com/checkout?id=8556&method=2175

Manufacturing Process Excellence

The lithium-ion battery manufacturing operation involves several precision-controlled stages requiring cleanroom environments and quality control:

- Raw Material Preparation: Cathode materials (lithium metal oxides), anode materials (graphite), electrolyte components, and separator films are received, inspected, and stored under controlled conditions preventing moisture contamination and material degradation

- Electrode Slurry Preparation: Active materials are precisely mixed with conductive additives, binders, and solvents creating cathode and anode slurries with controlled viscosity, particle size distribution, and homogeneity essential for coating uniformity

- Electrode Coating: Prepared slurries are coated onto current collector foils (aluminum for cathode, copper for anode) using precision coating equipment achieving uniform thickness, edge definition, and coating quality critical for battery performance

- Drying and Calendaring: Coated electrodes are dried removing solvents, then calendared through compression rollers achieving target density, porosity, and thickness specifications optimizing energy density and power performance

- Electrode Cutting and Assembly: Dried and calendared electrodes are cut to precise dimensions and assembled with separator films through stacking or winding processes creating cell structures with exact layer registration and dimensional control

- Cell Packaging and Electrolyte Filling: Assembled electrode stacks are inserted into cell casings (cylindrical, prismatic, or pouch formats), sealed, and filled with electrolyte solution under dry room conditions preventing moisture contamination

- Formation and Aging: Filled cells undergo initial charging cycles (formation) activating electrode materials and forming solid electrolyte interphase layers, followed by aging periods stabilizing cell performance and identifying defects

- Testing, Grading, and Packaging: Finished cells undergo comprehensive testing including capacity measurement, voltage verification, internal resistance testing, and safety validation, then graded by performance characteristics and packaged for shipment to battery pack assemblers or end customers

Industry Leadership

The global lithium-ion battery industry is dominated by established technology leaders with extensive manufacturing capabilities, technological expertise, and strategic automotive partnerships. Key industry players include:

• BYD Co., Ltd.

• CALB (China Aviation Lithium Battery Co., Ltd.)

• EVE Energy Co., Ltd.

• LG Energy Solution Ltd.

• Panasonic Holdings Corporation

• Samsung SDI Co., Ltd.

• SK On Co., Ltd.

• Tesla, Inc.

These companies serve diverse end-use sectors including automotive manufacturing, consumer electronics, energy storage systems, industrial equipment, and emerging electrification applications, demonstrating the broad market applicability and mission-critical nature of lithium-ion battery manufacturing in the global energy transition.

Recent Industry Developments

November 2024: China passed its first comprehensive energy law establishing legal framework to achieve carbon neutrality through renewable energy adoption and energy storage systems deployment, signaling long-term policy commitment supporting battery manufacturing and electrification infrastructure development.

October 2024: Major automotive manufacturers including Tesla and Ford announced significant investments in lithium iron phosphate (LFP) battery production facilities in the United States, demonstrating strategic shift toward cost-effective, safer battery chemistries and domestic manufacturing capacity expansion.

2024-2025: Global battery manufacturing capacity additions exceeded 780 GWh in 2024, with announced projects indicating continued aggressive expansion supporting projected electric vehicle production ramp-up and energy storage system deployment requirements through 2030 and beyond.

Conclusion

The lithium-ion battery manufacturing sector presents an exceptionally compelling investment opportunity at the epicenter of transportation electrification and renewable energy transformation. With favorable profit margins ranging from 25-35 % gross profit and 10-15 % net profit, extraordinary market drivers including explosive growth from USD 75-134 billion in 2025 to projected USD 250-865 billion by 2034, electric vehicle sales surging from 17 million units in 2024 toward 125 million by 2030 creating exponential battery demand, battery pack costs declining from USD 1,200/kWh in 2010 to USD 130-150/kWh in 2024 with continued reductions expanding market accessibility, comprehensive government support through production-linked incentives, emission regulations, and strategic industrial policies, supply chain localization driving regional manufacturing capacity expansion, and technological advancement in battery chemistry and manufacturing processes enabling performance improvements and cost reductions, establishing a lithium-ion battery manufacturing plant offers exceptional potential for long-term business success and strategic positioning.

The combination of mission-critical enabling technology for electrification, massive market expansion across automotive and energy storage applications, strong policy tailwinds supporting industry development, continuous technological innovation creating competitive differentiation opportunities, and circular economy integration through recycling and second-life applications creates an extraordinarily attractive value proposition for serious industrial investors committed to technological excellence and operational scale.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excel in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium-Ion Battery Plant DPR 2026: Industry Trends, CapEx/OpEx and Market Growth here

News-ID: 4377460 • Views: …

More Releases from IMARC Group

Bamboo Pellets Manufacturing Plant (DPR) Report 2026: Unit Setup, CapEx/OpEx & P …

The global renewable energy landscape is undergoing a transformative shift driven by rising demand for clean energy sources, increasing environmental awareness, growing adoption of biomass fuels in power generation, and supportive government policies promoting sustainable energy solutions. At the forefront of this green energy revolution stands bamboo pellets-a versatile solid biofuel valued for its high calorific value, consistent combustion properties, and minimal environmental impact across industrial boilers, power plants, residential…

Silicones Market is Expected to Grow USD 23.1 Billion by 2033 | At CAGR 4.8%

IMARC Group, a leading market research company, has recently released a report titled "Silicones Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Silicones market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Silicones Market Overview

The global silicones market…

South Korea Tourism Market Size, Industry Analysis, Growth Drivers & Future Dema …

IMARC Group has recently released a new research study titled "South Korea Tourism Market Report by Tourism Type (Medical, Sports, Cultural, Culinary, Wellness, Educational, and Others), Tourist Type (Domestic, International), Travel Type (Solo, Group), Booking Channel (OTA Platform, Direct Booking), Age Group (Below 30 Years, 30 to 41 Years, 42 to 49 Years, 50 Years and Above), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth…

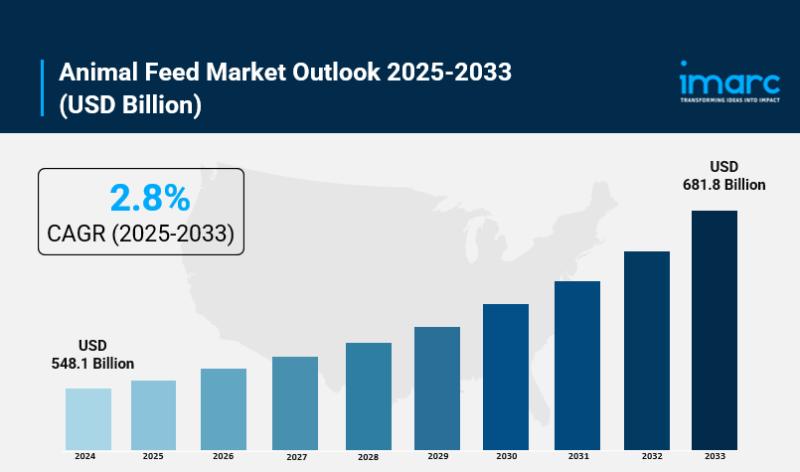

Animal Feed Market is Anticipated to Rise USD 681.8 Billion by 2033 | At CAGR 2. …

IMARC Group, a leading market research company, has recently released a report titled " Animal Feed Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033."The study provides a detailed analysis of the industry, including the Animal Feed Market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Animal Feed…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…