Press release

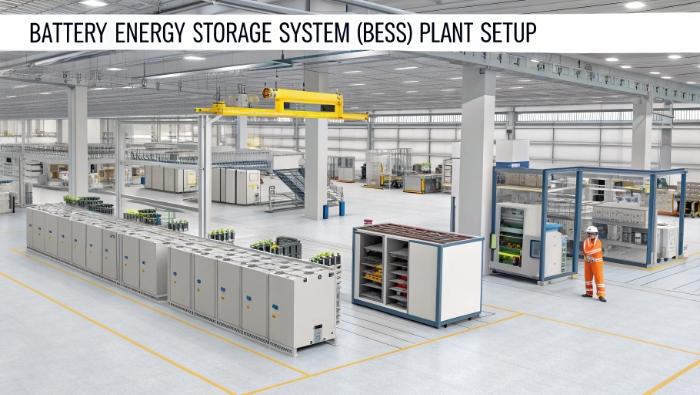

Battery Energy Storage System (BESS) Plant Setup | Profit Margins, Plant Capacity and Cost Analysis

Battery Energy Storage System Manufacturing Plant Project Report 2026: A Comprehensive Investment GuideThe global battery energy storage system (BESS) manufacturing industry is witnessing unprecedented growth, propelled by the worldwide transition toward renewable energy, decarbonisation commitments, and the urgent need for grid-scale energy storage solutions. At the heart of this transformation lies a critical technology-battery energy storage systems-that bridge the intermittency gap between solar and wind power generation and steady-state electricity demand.

As governments accelerate clean-energy mandates, utilities expand grid resilience programmes, and industries pursue net-zero targets, establishing a battery energy storage system manufacturing plant presents a strategically compelling business opportunity for investors and manufacturers seeking to capitalise on this rapidly expanding and essential market.

BESS Plant Capacity and Production Scale:

The proposed battery energy storage system manufacturing facility is designed with an annual production capacity ranging between 1-2 GWh, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve diverse end-use segments-from utility-scale grid storage and commercial and industrial applications to telecommunications backup power and electric vehicle charging infrastructure-ensuring steady demand and consistent revenue streams across multiple high-growth industry verticals.

See the Data First: Download Your Sample Report: https://www.imarcgroup.com/battery-storage-system-manufacturing-plant-project-report/requestsample

Financial Viability and Profitability Analysis:

The battery energy storage system manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

• Gross Profit Margins: 20-30%

• Net Profit Margins: 12-18%

These margins are supported by stable and escalating demand driven by global renewable-energy integration targets, value-added system-level engineering (battery management systems, power-conversion electronics, and enclosure design), and long-term supply agreements with utilities and independent power producers. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established electronics manufacturers looking to diversify their product portfolio into the high-growth clean-energy infrastructure sector.

Operating Cost Structure:

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a battery energy storage system manufacturing plant is primarily driven by:

• Raw Materials: 80-85% of total OpEx

• Utilities: 5-10% of OpEx

Other Expenses: Including labour, packaging, logistics, maintenance, depreciation, warranty provisions, and taxes

Raw materials constitute the largest share of operating costs, with lithium-ion battery cells or packs being the dominant input component. Securing long-term supply agreements with tier-one cell manufacturers helps mitigate price volatility and guarantees consistent quality, which is critical given that cell procurement represents the single most significant cost factor in battery energy storage system assembly.

Utilities, while comparatively moderate, are driven primarily by the climate-controlled environments required for cell handling, battery management system programming, and comprehensive end-of-line testing protocols.

Capital Investment Requirements:

Setting up a battery energy storage system manufacturing plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to major power-grid interconnection points and renewable-energy project clusters. Proximity to key logistics corridors will minimise distribution costs and delivery lead times. The site must feature robust infrastructure including high-capacity electrical supply, reliable water and compressed-air systems, and compliant waste-management facilities. Adherence to local zoning laws, environmental regulations, and electrical-safety codes must be ensured throughout.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialised manufacturing and assembly equipment essential for production. Key machinery includes:

• Cell-receiving and incoming-quality-inspection stations for verifying cell voltage, capacity, and internal resistance before assembly

• Automated cell-sorting and balancing systems to group cells with matched electrical characteristics for uniform pack performance

• Module assembly lines incorporating robotic welding or compression bonding for reliable cell-to-cell electrical and mechanical interconnection

• Battery management system (BMS) programming and flash stations for firmware loading and calibration of each module

• Pack-level assembly and enclosure integration equipment for mounting modules into fire-rated, IP-rated enclosures

• Power-conversion system (PCS) integration and wiring stations for installing inverters, converters, and associated electronics

• End-of-line testing and simulation rigs for full charge-discharge cycling, thermal-runaway detection validation, and communication-protocol verification

• Thermal-management component assembly lines for integrating cooling plates, heat exchangers, or air-management systems

• Quality-control laboratory equipment for electrochemical, thermal, and mechanical testing to ISO and IEC standards

Civil Works: Building construction, cleanroom and controlled-environment zones, factory layout optimisation, and infrastructure development designed to enhance workflow efficiency, ensure electrical and fire safety, and minimise material-handling complexities throughout the production process. The layout should be optimised with clearly segregated areas for incoming cell inspection, sorting and balancing, module assembly, BMS programming, pack integration, PCS installation, end-of-line testing, quality-control laboratory, finished-goods warehouse, utility block, fire-suppression systems, and administrative offices.

Other Capital Costs: Pre-operative expenses, machinery installation and commissioning, regulatory certifications (IEC 61508, UL 9540, UN 38.3, and local grid-connection approvals), initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

You Might Read Also Insight for BESS Production: https://www.imarcgroup.com/insight/optimizing-battery-energy-storage-system-production-a-comprehensive-cost-analysis

Major Applications and Market Segments:

Battery energy storage system products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

• Utility-Scale Grid Storage: Primary deployment alongside large-scale solar and wind farms to store excess renewable generation and discharge during peak-demand periods, providing frequency regulation, voltage support, and capacity-credit services to grid operators.

• Commercial and Industrial (C&I) Applications: Installed at commercial buildings, manufacturing facilities, and data centres to deliver peak-shaving, demand-response participation, and backup power, reducing electricity bills and improving energy resilience.

• Telecommunications Backup Power: Replacing legacy diesel generators at cell towers and network hubs with clean, maintenance-light battery systems that ensure continuous uptime during grid outages while eliminating fuel costs and emissions.

• Electric Vehicle Charging Infrastructure: Integrated with fast-charging stations to buffer high-power demand spikes, reduce grid-connection capacity requirements, and enable vehicle-to-grid (V2G) bidirectional energy flows.

• Microgrids and Remote Communities: Paired with distributed renewable generation to provide reliable, off-grid or islanded power supply to remote areas, military installations, and disaster-resilient communities.

• Industrial Process Applications: Deployed for power-quality conditioning, uninterruptible power supply (UPS) replacement, and voltage-flicker compensation in semiconductor fabs, pharmaceutical plants, and other sensitive manufacturing environments.

End-use sectors include utilities, commercial and industrial facilities, telecommunications, electric-vehicle charging, microgrids, and industrial process applications, all of which contribute to sustained and growing market demand.

Why Invest in Battery Energy Storage System Manufacturing?

Several compelling factors make battery energy storage system manufacturing an attractive investment opportunity:

• Accelerating Energy Transition: Governments worldwide have committed to aggressive renewable-energy and net-zero targets, creating a structural, long-term demand tailwind for grid-scale and distributed energy storage solutions.

• Grid Stability Imperative: As variable renewable generation (solar and wind) penetrates deeper into power systems, the imperative to deploy frequency regulation, voltage support, and spinning-reserve equivalents drives mandatory storage procurement by grid operators.

• Declining Battery Cell Costs: Lithium-ion cell costs have fallen by more than 90% over the past decade and continue to decline, steadily expanding the addressable market and improving project-level economics across all application segments.

• Favourable Policy Incentives: Investment tax credits, production tax credits, capital-linked subsidies, and concessional financing programmes in jurisdictions such as the United States, the European Union, India, and China de-risk capital deployment and accelerate payback periods.

• Growing EV Ecosystem Synergies: The rapid expansion of the electric-vehicle market generates second-life battery supply chains and V2G integration opportunities, creating complementary revenue streams and technology synergies for BESS manufacturers.

• Resilience and Climate Adaptation: Increasing frequency and severity of extreme weather events is raising demand for distributed storage that enhances grid resilience, disaster recovery, and community-level energy security.

• Export and Emerging-Market Opportunities: Rapidly developing economies across Southeast Asia, Africa, and the Middle East are prioritising domestic energy-storage manufacturing to reduce import dependency and support local job creation.

High Value-Add Manufacturing: System-level integration- encompassing BMS design, power electronics, thermal management, enclosure engineering, and grid-interface commissioning-offers significant value addition beyond raw cell procurement, supporting healthy margins and technology differentiation.

Manufacturing Process Excellence

The battery energy storage system manufacturing process involves several precision-controlled stages:

• Incoming Cell Inspection: Cells are received from qualified suppliers and subjected to voltage, temperature, and impedance screening to ensure batch consistency

• Cell Sorting and Balancing: Cells are graded and grouped by matched capacity and internal resistance to optimise cycle life and pack uniformity

• Module Assembly: Sorted cells are mechanically and electrically interconnected using busbars, welding, or compression fixtures to form modules

• BMS Integration and Programming: Battery management system hardware is mounted on each module; firmware is flashed and calibrated for cell-level monitoring and protection

• Thermal-Management Assembly: Cooling channels, heat exchangers, or phase-change materials are integrated to maintain cells within the safe operating temperature envelope

• Pack Integration: Modules are mounted into a fire-rated, IP-rated enclosure, with all inter-module busbars and signal cabling installed and verified

• Power-Conversion System Installation: Inverters, DC-DC converters, and grid-interface electronics are integrated and wired to the battery pack

• End-of-Line Testing: Each completed system undergoes full charge-discharge cycling, communication-protocol checks, safety-relay verification, and thermal-performance validation

• Packaging and Dispatch: Certified systems are documented, packaged with protective crating, and dispatched to project sites with full factory acceptance test reports

Industry Leadership:

The global battery energy storage system industry is led by established manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Tesla, Inc.

• LG Energy Solution

• Samsung SDI Co., Ltd.

• BYD Company Ltd.

• Fluence Energy, Inc.

These companies serve diverse end-use sectors including utility-scale grid storage, commercial and industrial facilities, telecommunications, electric-vehicle charging infrastructure, and microgrids, demonstrating the broad market applicability of battery energy storage system products.

Get a Personalized Setup Cost & ROI Analysis: https://www.imarcgroup.com/request?type=report&id=11912&flag=C

Conclusion:

The battery energy storage system manufacturing sector presents a strategically positioned investment opportunity at the intersection of the global energy transition, grid modernisation, and clean-energy infrastructure buildout.

With favourable profit margins ranging from 20-30% gross profit and 12-18% net profit, powerful market drivers including binding net-zero commitments, mandatory renewable-energy integration targets, declining lithium-ion cell costs, generous government incentives, and rapidly expanding demand from utilities, commercial facilities, and electric-vehicle ecosystems, establishing a battery energy storage system manufacturing plant offers significant potential for long-term business success and sustainable returns.

The combination of high value-add system-level engineering, indispensable role in grid stability, expanding global addressable market, and strong policy tailwinds creates an attractive value proposition for serious clean-energy investors committed to quality manufacturing and operational excellence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales[@]imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

How IMARC Can Help?

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Battery Energy Storage System (BESS) Plant Setup | Profit Margins, Plant Capacity and Cost Analysis here

News-ID: 4374560 • Views: …

More Releases from IMARC Group

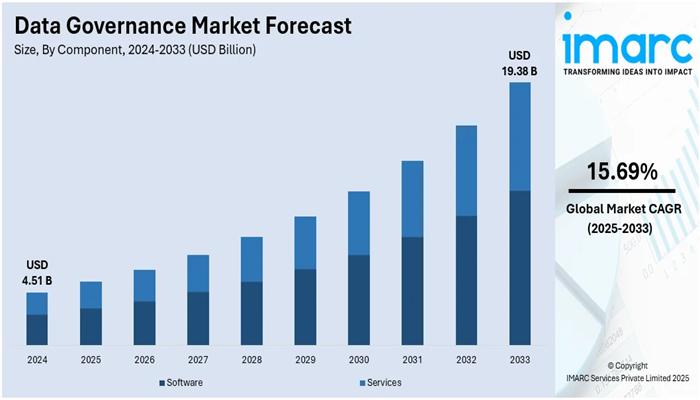

Data Governance Market to Grow at a CAGR of 15.69% during 2025-2033, Driven by R …

Market Overview

The global Data Governance Market was valued at USD 4.51 Billion in 2024 and is projected to reach USD 19.38 Billion by 2033. It is expected to grow at a CAGR of 15.69% during the forecast period 2025-2033. The market growth is driven by increasing demand for secure, high-quality, and compliant data management solutions focused on regulatory compliance, data privacy, and strong governance frameworks.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period:…

Global Voice and Speech Recognition Market Size projected to Reach USD 47.4 Bill …

Market Overview

The global voice and speech recognition market size reached USD 13.2 Billion in 2024 and is expected to reach USD 47.4 Billion by 2033, exhibiting a CAGR of 15.3% during the forecast period 2025-2033. Key drivers include rapid digitization, increased adoption of mobile devices with embedded voice and speech recognition software, and growth in the media and entertainment industry. North America currently holds the largest market share due to…

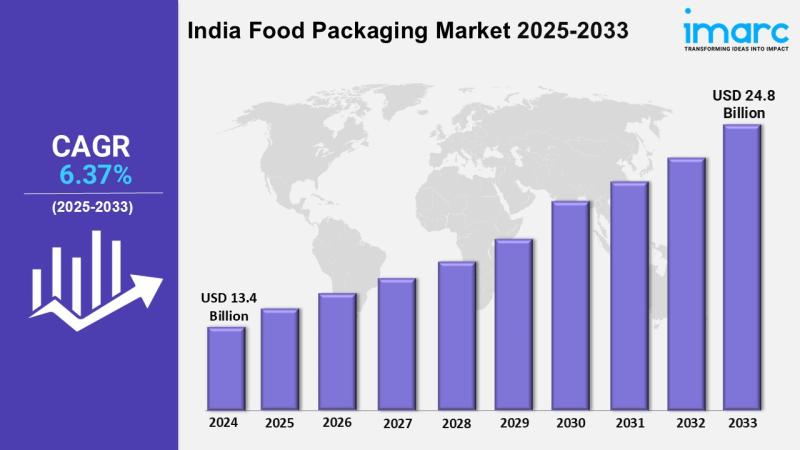

India Food Packaging Market to Reach USD 24.8 Billion by 2033 | 6.37% CAGR | Get …

According to IMARC Group's report titled "India Food Packaging Market Size, Share, Trends and Forecast by Packaging Type, Application, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Food Packaging Market Outlook

The India Food Packaging market size reached USD 13.4 Billion in 2024. The market is expected to reach USD 24.8 Billion by 2033, exhibiting a CAGR of 6.37%…

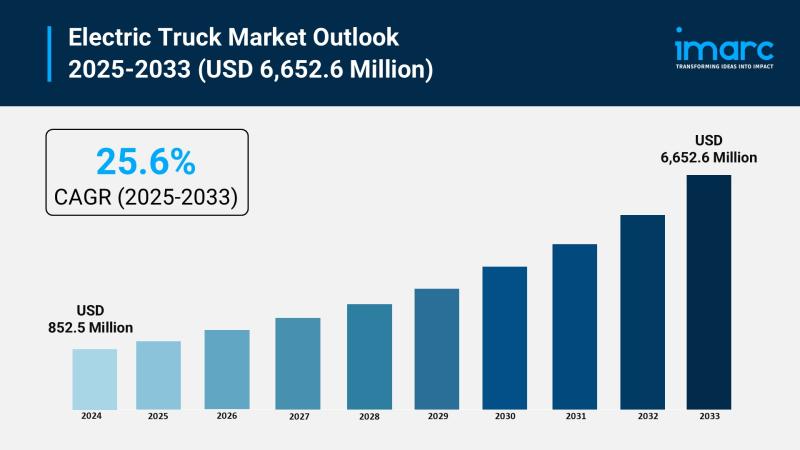

Electric Truck Market to Grow Worth USD 6,652.6 Million by 2033 | Exhibiting CAG …

Market Overview:

The electric truck market is experiencing rapid growth, driven by stringent global emission standards and regulatory mandates, declining battery costs and enhanced energy density, and explosion of e-commerce and last-mile delivery demand. According to IMARC Group's latest research publication, "Electric Truck Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion, Range, Application, and Region, 2025-2033", the global electric truck market size was valued at USD 852.5 Million in…

More Releases for Battery

Thin Film Micro Battery Market, By Rechargeability (Primary Battery, Secondary B …

The thin film micro battery market is expected to witness market growth at a rate of 30.9% in the forecast period of 2022 to 2029. Data Bridge Market Research report on thin film micro battery market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecast period while providing their impacts on the market's growth. The rise in the demand for the Internet of Things (IoT)…

Deep Cycle Gel Battery Market 2022 Analysis by Top Leading Players | Trojan Batt …

The Deep Cycle Gel Battery Market report offers qualitative and quantitative insights as well as a thorough examination of the market size and expansion rate of all potential market segments. The report has been put together using primary and secondary research methodologies, which offer an exact and detailed understanding of the Deep Cycle Gel Battery market. The Deep Cycle Gel Battery Market is projected to succeed at a CAGR of…

Global Power Energy Storage Battery Market 2019 - Lithium Ion Battery,All-vanadi …

Power Energy Storage Battery Market

The Global Power Energy Storage Battery Market 2019 Research Report incorporates a total and careful investigation of Power Energy Storage Battery industry covering diverse perspectives like market volume, piece of the overall industry, advertise techniques, Power Energy Storage Battery development patterns, assortment of uses, use volume, request and supply examination, creation limit and Power Energy Storage Battery industry cost structures amid Forecast period from…

Space Battery Market analysis report- with Leading players, Types Nickel-based B …

Space Battery Market

The Space Battery Market is defined by the presence of some of the leading competitors operating in the market, including the well-established players and new entrants, and the suppliers, vendors, and distributors. The report also analyzes the development proposals and the feasibility of new investments. The Space Battery Market report has been collated in order to provide guidance and direction to the companies and individuals interested in buying this…

Global EV Battery Recycling Market : Nickel–Cadmium Battery, Nickel–Metal Hy …

The EV Battery Recycling Market Research Report consists of all the essential information in regards to the global market. This report presents an in-depth analysis of various industry factors, such as the market trends, dynamics, production, estimates, industry development drivers, size, share, investigation, supply, forecast trends, sales, industry demand, as well as several other factors.

The Global EV Battery Recycling Market report has been generated leveraging a target amalgamation…

Global Lead Acid UPS Battery Market 2017 : Sebang Global Battery, CSB Battery, H …

Global Lead Acid UPS Battery Market 2016-2017

A market study based on the " Lead Acid UPS Battery Market " across the globe, recently added to the repository of Market Research, is titled ‘Global Lead Acid UPS Battery Market 2017’. The research report analyses the historical as well as present performance of the worldwide Lead Acid UPS Battery industry, and makes predictions on the future status of Lead Acid UPS Battery…