Press release

Sulfuric Acid Production Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability

The global sulfuric acid manufacturing industry is experiencing robust growth driven by the expanding fertilizer production sector and increasing demand across diverse industrial applications. At the heart of this expansion lies a critical industrial chemical-sulfuric acid. As global food security imperatives drive fertilizer demand and industrial sectors require essential chemical intermediates, establishing a sulfuric acid production plant presents a strategically compelling business opportunity for entrepreneurs and chemical industry investors seeking to capitalize on this indispensable and foundational market.Market Overview and Growth Potential

The global sulfuric acid industry demonstrates a solid growth trajectory, valued at USD 16.11 Billion in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 19.17 Billion by 2034, exhibiting a steady CAGR of 2.0% from 2026-2034. This sustained expansion is driven by expanding fertilizer production supporting global food security initiatives, increasing battery manufacturing demand from electric vehicle adoption, growing metal processing and mining activities requiring acid leaching processes, rising chemical industry applications across pharmaceutical and specialty chemical sectors, expanding petroleum refining operations, and emerging semiconductor manufacturing demand for high-purity sulfuric acid across developed and emerging economies.

Sulfuric acid is a highly corrosive, strong mineral acid with the chemical formula H2SO4, appearing as a dense, oily, colorless to slightly yellow liquid. Commercially produced primarily through the contact process by oxidizing sulfur dioxide to sulfur trioxide and subsequently reacting it with water, sulfuric acid exhibits exceptional chemical reactivity and dehydrating properties. It serves multiple critical industrial functions including fertilizer production, metal processing, petroleum refining, chemical synthesis, battery manufacturing, and wastewater treatment. Available in various concentrations ranging from dilute solutions to concentrated forms (93-98%), this versatile chemical is extensively used in agriculture, automotive, mining, chemicals, pharmaceuticals, and semiconductor industries.

The sulfuric acid market is witnessing robust demand due to the critical role in global food production systems. Fertilizer manufacturing, particularly phosphate fertilizers, represents the largest application segment, accounting for over 60% of global sulfuric acid consumption. The compound is essential for processing phosphate rock into phosphoric acid, which is subsequently used to manufacture diammonium phosphate (DAP) and other phosphorus-based fertilizers. Growing global population, agricultural intensification, and soil nutrient depletion necessitate continuous fertilizer application, creating sustained demand. Additionally, electric vehicle battery production requires sulfuric acid for lead-acid and lithium-ion battery manufacturing, while mining operations depend on acid leaching for copper, zinc, and other metal extraction, further strengthening market prospects.

Request for a Sample Report: https://www.imarcgroup.com/sulfuric-acid-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed sulfuric acid production facility is designed with an annual production capacity ranging between 500,000-1,000,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from fertilizer production and metal processing to petroleum refining, battery manufacturing, chemical synthesis, and semiconductor applications-ensuring steady demand and consistent revenue streams across multiple critical industry verticals.

Financial Viability and Profitability Analysis

The sulfuric acid manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 25-35%

Net Profit Margins: 10-15%

These margins are supported by sustained demand across fertilizer, mining, and chemical sectors, essential role as a fundamental industrial chemical, long-term supply agreements with major fertilizer manufacturers and mining companies providing revenue stability, and production synergies when integrated with metal smelting operations as a byproduct recovery. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established chemical manufacturers looking to backward integrate or diversify their product portfolio in the commodity chemicals sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a sulfuric acid production plant is primarily driven by:

Raw Materials: 60-70% of total OpEx

Utilities: 20-25% of OpEx

Other Expenses: Including labor, catalyst replacement, maintenance, quality control, packaging, transportation, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with elemental sulfur, pyrite ore, or recovered sulfur from metal smelting operations serving as primary feedstock. Establishing long-term supply agreements with sulfur producers, oil refineries (which recover sulfur from petroleum), or base metal smelters helps mitigate price volatility and ensures consistent raw material supply, which is critical given that sulfur feedstock costs represent the most significant variable factor in sulfuric acid production economics.

Capital Investment Requirements

Setting up a sulfuric acid production plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to sulfur sources (refineries, smelters, or sulfur mines) and major consumption centers such as fertilizer plants, mining operations, or chemical manufacturing clusters. The site must have robust infrastructure, including high-capacity electrical power supply, water resources for cooling systems, railway or port access for bulk chemical transportation, and substantial buffer zones for safety considerations. Compliance with stringent environmental regulations, hazardous chemical handling standards, and industrial safety requirements must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized production equipment essential for the contact process. Key machinery includes:

Sulfur melting and filtration systems for feedstock preparation

Sulfur combustion furnaces for oxidizing elemental sulfur to sulfur dioxide

Heat recovery boilers for capturing thermal energy from exothermic reactions

Gas cleaning and drying systems for removing impurities from sulfur dioxide gas

Catalytic converters with vanadium pentoxide catalyst for oxidizing SO2 to SO3

Absorption towers for converting sulfur trioxide to sulfuric acid using oleum

Intermediate absorption systems for multi-stage acid production

Acid circulation pumps and storage tanks (acid-resistant materials)

Cooling systems for temperature control in exothermic processes

Emission control systems including scrubbers and stack gas treatment

Storage facilities for concentrated acid (93-98%) in acid-resistant materials

Dilution and blending systems for producing various acid concentrations

Quality control laboratory with analytical instruments for purity and concentration testing

Effluent treatment plant for managing acidic wastewater and emissions

Safety systems including acid leak detection, emergency shutdown, and neutralization equipment

Civil Works: Building construction, process plant design, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, ensure maximum safety standards, and minimize environmental risks throughout the production process. The layout should be optimized with separate zones for sulfur storage and melting area, combustion and conversion section, catalytic converter hall, absorption tower zone, acid storage tanks with secondary containment, dilution and blending facility, packaging area (for smaller volumes), quality control laboratory, utility block with cooling towers and power systems, emission control and environmental compliance area, emergency response equipment zone, and administrative offices with adequate safety distances.

Other Capital Costs: Pre-operative expenses, machinery installation and commissioning costs, catalyst procurement (vanadium pentoxide), regulatory compliance certifications (ISO 9001, ISO 14001, environmental clearances), pollution control equipment installation, initial working capital for raw material procurement, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Sulfuric acid products find extensive applications across diverse industrial market segments, demonstrating their versatility and critical importance:

Fertilizer Production: Primary application in manufacturing phosphate fertilizers (single superphosphate, triple superphosphate, diammonium phosphate) where sulfuric acid processes phosphate rock into water-soluble phosphorus compounds essential for crop nutrition and global food security.

Chemical Manufacturing: Critical applications in producing hydrochloric acid, nitric acid, phosphoric acid, aluminum sulfate, ammonium sulfate, titanium dioxide pigments, detergents, synthetic fibers, and numerous organic and inorganic chemicals where sulfuric acid serves as a key reagent or catalyst.

Metal Processing and Mining: Essential for ore leaching operations extracting copper, zinc, uranium, and rare earth elements from ores, as well as metal pickling for surface cleaning and oxide removal in steel production and metal fabrication industries.

Petroleum Refining: Critical applications in alkylation processes producing high-octane gasoline components, catalyst regeneration, and removing impurities from petroleum products where sulfuric acid's strong acidic and dehydrating properties are indispensable.

Battery Manufacturing: Fundamental component in lead-acid battery electrolyte for automotive and industrial battery applications, with growing demand from energy storage systems supporting renewable energy infrastructure and grid stabilization.

Wastewater Treatment: Applications in pH adjustment, neutralization of alkaline effluents, and precipitation of heavy metals in industrial and municipal wastewater treatment facilities.

Semiconductor Industry: Specialized high-purity electronic-grade sulfuric acid for silicon wafer cleaning, etching, and surface preparation in semiconductor fabrication, representing a premium market segment with stringent quality requirements.

End-use industries include agriculture and fertilizers, chemical manufacturing, mining and metallurgy, petroleum refining, automotive and batteries, electronics and semiconductors, and water treatment, all of which contribute to sustained market demand.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=7435&flag=C

Why Invest in Sulfuric Acid Production?

Several compelling factors make sulfuric acid manufacturing an attractive investment opportunity:

Fundamental Industrial Chemical: Sulfuric acid ranks among the most widely produced industrial chemicals globally, serving as an essential input across critical sectors including food production, metal extraction, energy, and manufacturing, ensuring consistent long-term demand regardless of economic cycles.

Food Security Alignment: The critical role in fertilizer production directly supports global agricultural productivity and food security objectives, positioning sulfuric acid manufacturing as strategically important infrastructure receiving governmental support and policy backing in many countries.

Diversified Revenue Streams: Multi-industry application portfolio spanning agriculture, mining, petroleum, chemicals, and emerging sectors like batteries and semiconductors provides revenue diversification, reducing dependence on single market segments and enhancing business resilience.

Integration Opportunities: Sulfuric acid production integrates synergistically with metal smelting operations where sulfur dioxide emissions from ore processing can be captured and converted to acid, creating dual revenue streams while addressing environmental compliance requirements.

Electric Vehicle Tailwinds: Growing electric vehicle adoption drives demand for both lead-acid batteries (12V auxiliary batteries in EVs) and lithium-ion battery production where sulfuric acid plays roles in material processing, creating new growth avenues beyond traditional applications.

Semiconductor Demand Growth: Expanding global semiconductor manufacturing capacity, particularly government-supported domestic chip production initiatives in Europe, United States, and Asia, drives demand for ultra-pure electronic-grade sulfuric acid at premium pricing.

Circular Economy Participation: Sulfuric acid recovery from spent acid regeneration, integration with sulfur recovery from petroleum and natural gas processing, and byproduct utilization from metal smelting align with circular economy principles and environmental sustainability trends.

Manufacturing Process Excellence

The sulfuric acid production process using the contact process involves several precision-controlled stages:

Sulfur Preparation: Elemental sulfur is melted, filtered to remove impurities, and prepared for combustion, or alternatively, sulfur-containing gases from smelting operations are captured and processed

Combustion: Molten sulfur is burned in excess air within combustion furnaces at temperatures around 1,000°C, producing sulfur dioxide gas (S + O2 → SO2) with heat recovery through waste heat boilers

Gas Cleaning and Drying: Combustion gases are cooled, cleaned to remove dust particles and impurities, and dried to prevent catalyst poisoning in subsequent conversion stages

Catalytic Conversion: Dried sulfur dioxide gas passes through catalytic converter beds containing vanadium pentoxide (V2O5) catalyst at 400-600°C, where SO2 is oxidized to sulfur trioxide (2SO2 + O2 → 2SO3) in multiple stages with intermediate cooling

Absorption: Sulfur trioxide is absorbed in circulating concentrated sulfuric acid (98-99%) or oleum in absorption towers, forming additional sulfuric acid (SO3 + H2O → H2SO4) while avoiding direct water contact which would create acid mist

Intermediate Absorption: Modern plants employ double-contact, double-absorption (DCDA) process where partially converted gas undergoes intermediate absorption followed by additional catalytic conversion, achieving 99.5%+ sulfur dioxide conversion efficiency

Acid Circulation and Cooling: Concentrated acid is continuously circulated through absorption towers with cooling systems to maintain optimal temperatures and acid strength

Product Withdrawal: Sulfuric acid at desired concentration (typically 93-98%) is withdrawn from the circulation system for storage or further processing

Dilution and Blending: For applications requiring lower concentrations, concentrated acid is carefully diluted with water under controlled conditions (adding acid to water, never reverse)

Quality Testing and Storage: Final product undergoes rigorous quality testing for concentration, purity, and contaminants before storage in acid-resistant tanks or packaging for distribution

Industry Leadership

The global sulfuric acid industry is led by established chemical manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

The Mosaic Company

AkzoNobel N.V.

BASF SE

PVS Chemical Solution

Solvay

Nutrien Ltd.

INEOS

These companies serve diverse end-use sectors including fertilizer manufacturing, mining operations, chemical production, petroleum refining, and specialty applications, demonstrating the broad market applicability of sulfuric acid products across global industrial value chains.

Buy Now:

https://www.imarcgroup.com/checkout?id=7435&method=2175

Recent Industry Developments

June 2025: Arya Engineers entered into a strategic partnership with P&P Industries AG to offer fully integrated, end-to-end solutions covering the engineering, manufacturing, and installation of complete sulfuric acid plants. The collaboration leverages P&P Industries' patented catalyst-based wet process technology-recognized for high steam recovery and ultra-low emissions-alongside Arya Engineers' strong project execution capabilities and advanced fabrication expertise.

April 2025: BASF revealed plans to expand its production capacity for semiconductor-grade sulfuric acid (H2SO4) by establishing a new facility at its Ludwigshafen, Germany site. This advanced production unit is designed to support the growing demand from Europe's semiconductor manufacturing sector, with commercial operations expected to commence by 2027, in line with capacity expansions planned by major chipmakers.

Conclusion

The sulfuric acid production sector presents a strategically positioned investment opportunity at the intersection of food security, industrial manufacturing, and emerging technology sectors. With favorable profit margins ranging from 20-30% gross profit and 10-15% net profit, strong market drivers including expanding fertilizer production, growing electric vehicle battery manufacturing, increasing mining and metal processing activities, rising chemical industry demand, semiconductor industry expansion, and supportive integration opportunities with metal smelting operations, establishing a sulfuric acid production plant offers significant potential for long-term business success and sustainable returns. The combination of fundamental industrial importance, diverse application portfolio, food security alignment, technological advancement opportunities in high-purity production, and circular economy integration possibilities creates an attractive value proposition for serious chemical industry investors committed to quality manufacturing, environmental stewardship, and operational excellence in serving multiple critical industrial sectors.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Sulfuric Acid Production Plant Setup 2026: Complete DPR with Process Flow, Machinery & Profitability here

News-ID: 4374336 • Views: …

More Releases from IMARC Group

Activated Alumina Balls Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with P …

Activated alumina balls are highly porous, spherical aluminum oxide materials used primarily as adsorbents, desiccants, and catalysts in various industrial applications. Due to their high surface area, excellent thermal stability, and strong affinity for moisture and impurities, activated alumina balls are widely used in water treatment, air drying, oil and gas processing, chemical manufacturing, petrochemicals, and pharmaceutical industries.

They play a critical role in applications such as fluoride removal from drinking…

Food Processing Plant Report DPR 2026: Business Plan, Requirements and Cost Invo …

A food processing plant is an industrial facility where raw agricultural commodities such as fruits, vegetables, grains, meat, dairy, and seafood are transformed into value-added food products through cleaning, grading, processing, preservation, packaging, and storage. Food processing enhances shelf life, food safety, convenience, and nutritional availability, making it a critical pillar of modern food supply chains.

Food processing plants cater to a wide range of products, including packaged foods, ready-to-eat meals,…

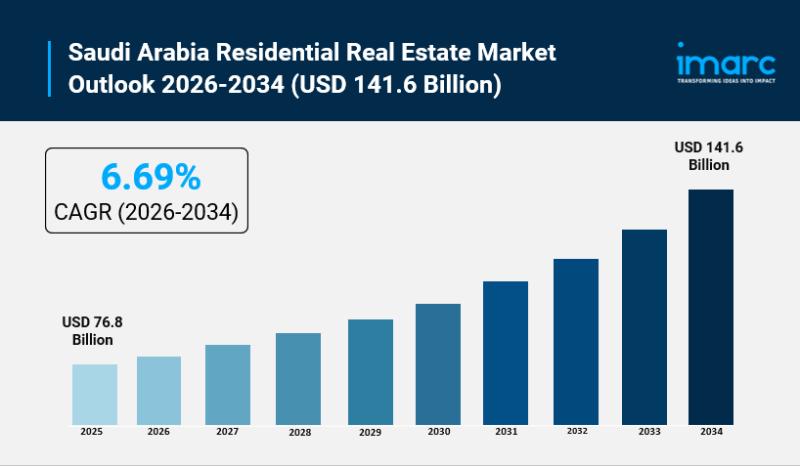

Saudi Arabia Residential Real Estate Market Size to Worth USD 141.6 Billion by 2 …

Saudi Arabia Residential Real Estate Market Overview

Market Size in 2025: USD 76.8 Billion

Market Forecast in 2034: USD 141.6 Billion

Market Growth Rate 2026-2034: 6.69%

According to IMARC Group's latest research publication, "Saudi Arabia Residential Real Estate Market Report by Type (Condominiums and Apartments, Villas and Landed Houses), and Region 2026-2034", the Saudi Arabia residential real estate market size reached USD 76.8 Billion in 2025. Looking forward, IMARC Group expects the market to…

Fuel Oil Prices See Strong Upside Momentum Across Key International Markets

Northeast Asia Fuel Oil Prices Movement January 2026:

Northeast Asia fuel oil prices in January 2026 were recorded at USD 0.84/kg, rising by 5.0% due to higher regional demand and limited supply. The fuel oil price trend showed upward momentum, while the fuel oil price index strengthened moderately. The fuel oil price chart reflected a clear price increase. The fuel oil price forecast suggests continued firmness in the short term.

Get the…

More Releases for Sulfur

Sulfur prices double; international supply and demand imbalance drags down sulfu …

Since 2025, the domestic sulfur market has experienced a sharp price surge, with prices soaring from approximately 1,500 yuan/ton at the beginning of the year to over 3,800 yuan/ton currently, an increase of more than 100%, reaching a new high in recent years. As an important chemical raw material, the soaring price of sulfur has directly impacted the downstream industry chain, and the sulfur dioxide [https://www.tyhjgas.com/sulfur-dioxide-so2-product/] market, which uses sulfur…

Prominent Sulfur Fertilizers Market Trend for 2025: Innovative Advancements Tran …

How Are the key drivers contributing to the expansion of the sulfur fertilizers market?

The sulfur fertilizer market is poised for growth thanks to an increase in demand for food. Food is considered any substance capable of supplying the body with essential nutrients, such as proteins, carbohydrates, and fats, vital for the organism's adequate growth. In agriculture, sulfur fertilizers play a significant role in various plant developmental processes, including nitrogen metabolism,…

Sulfur Dioxide Market Report 2024 - Sulfur Dioxide Market Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Sulfur Dioxide Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Sulfur Market 2022 : Trends, Business Growth And Major Driving Factors | Ohio Su …

The global sulfur mining market size is expected to grow from $9.95 billion in 2021 to $10.38 billion in 2022 at a compound annual growth rate (CAGR) of 4.3%. The global sulfur mining market size is expected to grow to $11.46 billion in 2026 at a compound annual growth rate (CAGR) of 2.5%.

The Business Research Company offers the Sulfur Global Market Report 2022 in its research report store. It is…

Sulfur Market Overview and Scope 2021: Ohio Sulfur Mining Company, Freeport Sulf …

Sulfur Global Market Report 2021

Sulfur Mining includes mining of sulfur and sulfur compounds that are used in manufacturing of black gunpowder, matches, and fireworks. Sulfur is a bright yellow crystalline material. It forms near volcanic vents and fumaroles, where it sublimates from a stream of hot gases.

The global Sulfur market was valued at $6.0 billion in 2017. Asia Pacific was the largest geographic region accounting for $2.2 billion or 37.7%…

Sulfur Fertilizers Market: Rise in Sulfur Deficiency in Soils and Growing Demand …

Allied Market Research recently published a report, titled, "Sulfur Fertilizers Market by Type (Ammonium Sulphate, Single Superphosphate, Sulphate of Potash, Ammonium Nitrate-Sulphate, and Sulphate Containing Compound Fertilizers), and Type of Agriculture (Controlled Environment Agriculture, Conventional Agriculture, and Others): Global Opportunity Analysis and Industry Forecast, 2019-2026". According to the report, the global sulfur fertilizer industry was pegged at $3.4 billion in 2018, and is projected to $4.1 billion by 2026, growing…