Press release

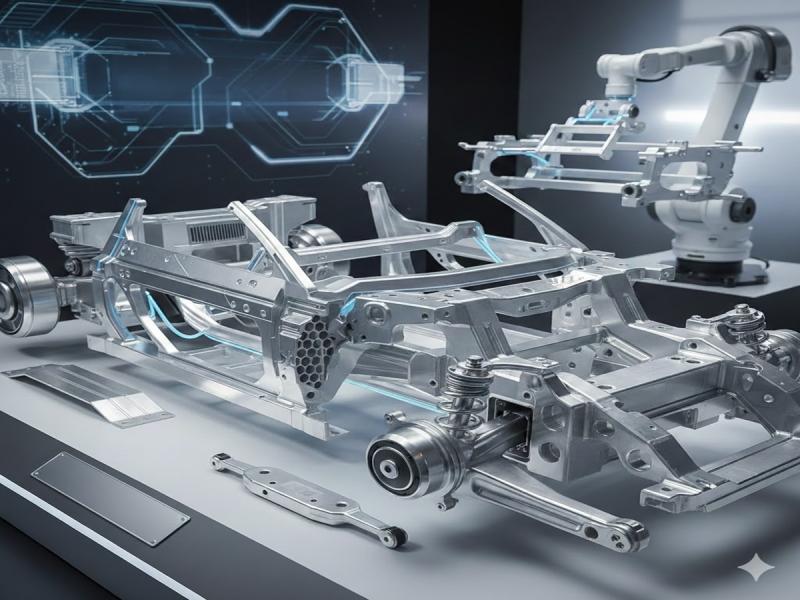

Automotive Aluminum Market to Reach USD 205.24 Billion by 2032 at 9.7% CAGR; Asia-Pacific Leads with 45% Share, Driven by EV Lightweighting and Sustainability Push; Key Players Include Alcoa, Novelis, Constellium, Rio Tinto

Market OverviewThe Global Automotive Aluminum Market reached US$ 97.86 billion in 2024 and is projected to reach US$ 205.24 billion by 2032, growing at a CAGR of 9.7% during the forecast period (2025-2032). The market is witnessing strong growth driven by the increasing demand for lightweight materials in vehicles. Aluminum, renowned for its lightweight and high-strength properties, plays a pivotal role in reducing vehicle weight, enhancing fuel efficiency, and improving performance. The global shift toward fuel-efficient and electric vehicles (EVs) has accelerated the adoption of aluminum as automakers strive to comply with stringent emission and fuel economy regulations.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/automotive-aluminum-market?Juli

Aluminum is increasingly being integrated into vehicle body panels, engine blocks, transmission housings, and wheels, replacing heavier metals like steel. The material's recyclability and corrosion resistance further enhance its value proposition in sustainable automotive manufacturing. As automakers and consumers continue prioritizing performance, efficiency, and environmental responsibility, the demand for automotive aluminum is expected to rise steadily. Leading market players, including Alcoa Corporation, Novelis Inc., and Constellium SE, are investing in technological innovation and capacity expansion to strengthen their positions in this rapidly evolving market.

Automotive Aluminum Market Trends

1. Increased Adoption in Electric Vehicles (EVs)

The electrification of the automotive industry is a major catalyst for aluminum demand. EV manufacturers are increasingly using aluminum to reduce overall vehicle weight, which directly enhances battery efficiency and driving range. For instance, Tesla's Model S and Model X feature extensive aluminum use in their chassis and body structures, achieving weight reduction without compromising safety or performance. Similarly, automakers like BMW and Rivian are integrating high-strength aluminum into battery housings and underbody structures to improve crash safety and energy absorption.

2. Advancements in High-Strength Aluminum Alloys

A growing trend is the use of high-strength aluminum alloys in structural and safety-critical components such as crash management systems, suspension arms, and battery enclosures. For example, the Audi e-tron uses over 40% aluminum in its architecture, ensuring both durability and lightweight performance. This trend is supported by continuous material innovations that improve formability, weldability, and fatigue resistance in advanced alloys.

Key Developments:

✅ In 2025, Hydro and Nemak, the two old allies, have reportedly formed another strategic partnership to develop low-carbon aluminum casting products for the automotive industry to decarbonise the car manufacturing sector and help automakers reach their sustainability goals.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=automotive-aluminum-market?Juli

Key Players:

ArcelorMittal - A global leader in steel and aluminum lightweight solutions, supplying advanced aluminum alloys for structural and body applications in electric and hybrid vehicles.

Alcoa Corporation - Specializes in high-strength, low-weight aluminum materials and sustainable smelting technologies, with growing emphasis on recycled automotive aluminum.

Rio Tinto Group - One of the world's largest aluminum producers, known for low-carbon aluminum production through its renewable energy-powered operations and advanced alloy development.

Novelis Inc. - A leading provider of flat-rolled aluminum products and the largest recycler of aluminum worldwide, heavily focused on circular economy initiatives in the automotive sector.

Aleris Corporation - Offers high-performance rolled aluminum products for vehicle body structures, hoods, and heat exchangers, emphasizing lightweighting and formability.

Constellium SE - Supplies innovative aluminum solutions for crash management systems, body-in-white components, and battery enclosures, particularly for electric vehicles.

UACJ Corporation - A Japan-based manufacturer producing advanced aluminum sheets and extrusions for automotive and industrial use, emphasizing energy-efficient alloy technologies.

Kaiser Aluminum Corporation - Focused on precision aluminum components for automotive, aerospace, and industrial markets, with growing investments in high-strength automotive applications.

CHALCO (Aluminum Corporation of China Limited) - A major Asian producer integrating mining, smelting, and fabrication, expanding its presence in automotive aluminum sheet and extrusion production.

Norsk Hydro ASA - A pioneer in sustainable aluminum solutions, focusing on low-carbon and recycled aluminum products through its Hydro REDUXA and Hydro CIRCAL product lines.

Market Segmentation:

By Product Type:

The global automotive aluminum market is segmented into cast aluminum, rolled aluminum, extruded aluminum, and others. Cast aluminum dominates the market, accounting for approximately 45% of the total share in 2024, owing to its extensive use in engine blocks, transmission housings, and wheels due to excellent strength-to-weight ratios and cost efficiency. Rolled aluminum holds around 30%, primarily used in body panels and structural parts for lightweight vehicle construction. Extruded aluminum represents roughly 20% of the market, driven by its increasing use in crash management systems, chassis components, and battery housings for electric vehicles (EVs). The remaining 5% comprises specialty aluminum products used in trim parts and heat exchangers.

By Vehicle Type:

The market is segmented into passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). Passenger cars lead with about 60% of the market share, reflecting the rising production of EVs and fuel-efficient vehicles globally. Light commercial vehicles account for 25%, benefiting from growing demand for logistics and e-commerce transport fleets, while heavy commercial vehicles contribute 15%, where the focus on fuel efficiency and load optimization is gradually increasing aluminum usage in engine and structural components.

By Application:

Based on application, the market is categorized into body structure, engine components, wheels, heat exchangers, and others. Body structure applications hold the largest share at approximately 35%, driven by the growing adoption of aluminum in body-in-white and chassis structures to reduce weight and enhance safety. Engine components and wheels together represent about 40%, while heat exchangers contribute 15%. The remaining 10% includes applications in interior trims, suspension systems, and battery enclosures, which are expanding rapidly in the EV sector.

By End User:

The end-user segmentation includes OEMs (Original Equipment Manufacturers) and the aftermarket. OEMs dominate the market with around 80% share, supported by the strong integration of aluminum components in new vehicle manufacturing and the shift toward electric and hybrid models. The aftermarket accounts for the remaining 20%, driven by replacement parts, refurbishing, and customization activities, particularly in developing markets.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/automotive-aluminum-market?Juli

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Regional Insights:

Asia-Pacific dominates the global automotive aluminum market, accounting for approximately 45% of the total market share in 2024. The region's leadership is driven by the presence of major automotive manufacturing hubs in China, Japan, South Korea, and India, coupled with the rapid adoption of lightweight materials in vehicle production. China leads regional growth due to large-scale EV manufacturing and government initiatives promoting sustainable mobility. Japan and South Korea are focusing on advanced aluminum alloys for high-performance and electric vehicles, while India's growing automotive output and adoption of energy-efficient vehicles continue to expand regional demand.

Europe holds the second-largest share, contributing about 25% of the global market. The region's growth is supported by stringent EU emission regulations, which have compelled automakers to integrate aluminum in body structures and powertrains to reduce vehicle weight and emissions. Countries such as Germany, France, and the U.K. are leading adopters, with significant investments in aluminum recycling and closed-loop manufacturing systems. The rising popularity of electric vehicles in Europe fueled by policy incentives and sustainability goals is expected to further accelerate demand.

North America accounts for roughly 20% of the global market, driven by the increasing production of electric and hybrid vehicles, strong presence of automotive giants in the U.S., and advancements in aluminum processing technologies. Automakers are adopting aluminum in pickup trucks, SUVs, and EVs to meet fuel-efficiency standards, with manufacturers such as Ford and General Motors leading this trend.

Market Dynamics:

Drivers:

Vehicle lightweighting has become a major growth driver for the global automotive aluminum market, fueled by the rising need to enhance fuel efficiency and meet stringent environmental regulations. Governments and regulatory authorities worldwide are imposing stricter emission norms to curb greenhouse gas emissions and reduce dependence on fossil fuels. Standards such as the Corporate Average Fuel Economy (CAFÉ) regulations in the U.S. and the European Union's CO2 emission targets require automakers to significantly cut fleet emissions.

Aluminum plays a pivotal role in achieving these targets due to its unique strength-to-weight advantage it is approximately 60% lighter than steel while maintaining high strength and crash resistance. A 10% reduction in vehicle weight can enhance fuel efficiency by 6-8%, making aluminum one of the most effective materials for achieving performance and sustainability goals. Automakers such as General Motors, Ford, and BMW have integrated aluminum into body panels, chassis, and engine components to optimize weight reduction without compromising safety or comfort.

The trend is even more pronounced in the electric vehicle (EV) segment, where lighter materials like aluminum directly improve battery efficiency, range, and vehicle handling. With EV adoption accelerating globally, aluminum's role in reducing vehicle mass while supporting structural integrity and safety is expected to remain a central pillar of automotive innovation and design.

Restraint:

Despite its advantages, the high cost of aluminum relative to steel poses a key restraint to market growth. Aluminum production, especially primary aluminum, is an energy-intensive process involving electrolysis in smelters, resulting in higher raw material and processing costs. Aluminum can be 2-3 times more expensive than high-strength steel, making it less feasible for mass-market and budget vehicle segments, particularly in emerging economies such as India, Brazil, and Southeast Asia.

Although recycling initiatives and technological advances in secondary aluminum production are helping reduce costs, the upfront investment in aluminum manufacturing and fabrication remains substantial. This limits its widespread adoption across low-cost vehicle categories and slows the overall rate of market penetration. As a result, while premium and electric vehicle manufacturers continue to lead aluminum integration, cost challenges remain a critical hurdle for broader adoption across the global automotive landscape.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Aluminum Market to Reach USD 205.24 Billion by 2032 at 9.7% CAGR; Asia-Pacific Leads with 45% Share, Driven by EV Lightweighting and Sustainability Push; Key Players Include Alcoa, Novelis, Constellium, Rio Tinto here

News-ID: 4373848 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

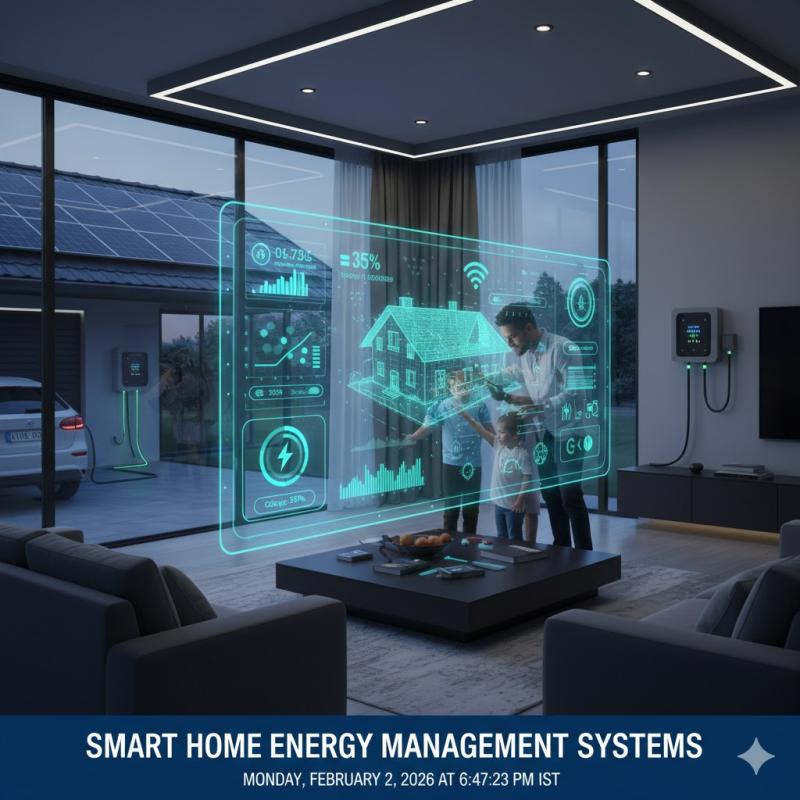

United States Smart Home Energy Management Systems Market to Reach USD 4.60 Bill …

Leander, Texas and Tokyo, Japan - Feb.2.2026

Global Smart Home Energy Management Systems Market reached USD 1.25 billion in 2022 and is expected to reach USD 4.60 billion by 2030 growing with a CAGR of 19.5% during the forecast period 2024-2031.

The market is driven by growing energy efficiency awareness and adoption of connected home technologies. Systems integrating smart meters, IoT-enabled appliances, and AI-based energy optimization dominate adoption. Residential households are the…

United States Ballast Water Treatment Systems Market 2032 | Growth Drivers, Key …

Market Size and Growth

Global Ballast Water Treatment Systems Market reached US$ 3.27 billion in 2024 and is expected to reach US$ 7.75 billion by 2032, growing with a CAGR of 11.39% during the forecast period 2025-2032.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/ballast-water-treatment-systems-market?sb

Key Development:

United States: Recent Industry Developments

✅ In January 2026, BIO‐UV Group partnered with MicroWISE to develop port‐side ballast water…

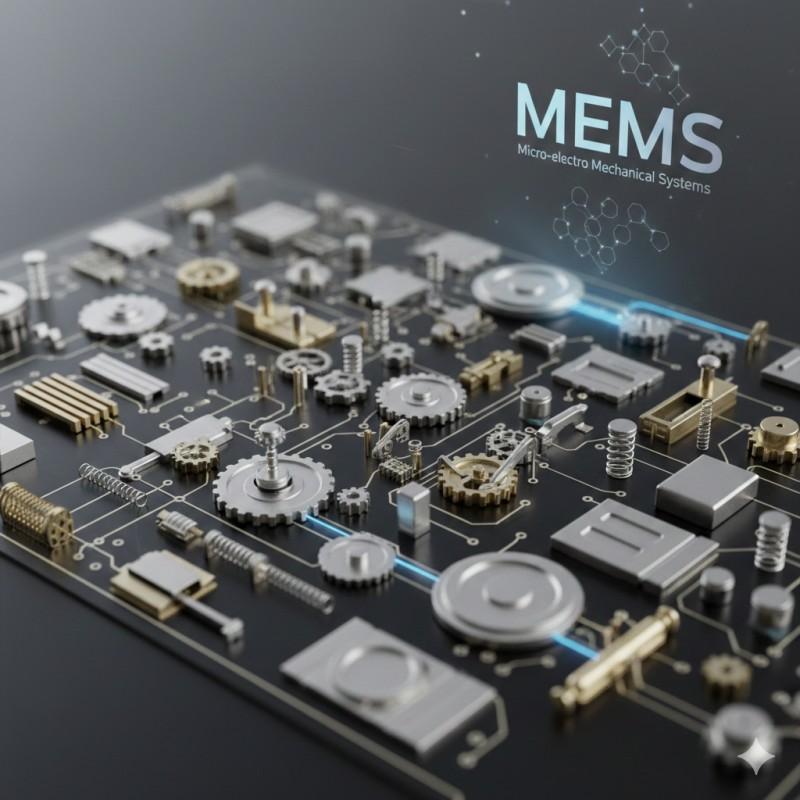

United States Micro-electro Mechanical Systems (MEMS) Market 2026 | Growth Drive …

Market Size and Growth

Report on Global Micro-electro Mechanical Systems by DataM Intelligence estimates the market to grow at a CAGR of 11.10% during the period 2023 - 2030.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/micro-electro-mechanical-systems-market?sb

Key Development:

United States: Recent Industry Developments

✅ In January 2026, MicroVision announced an agreement to acquire Luminar assets to accelerate its commercial strategy and expand its MEMS‐based…

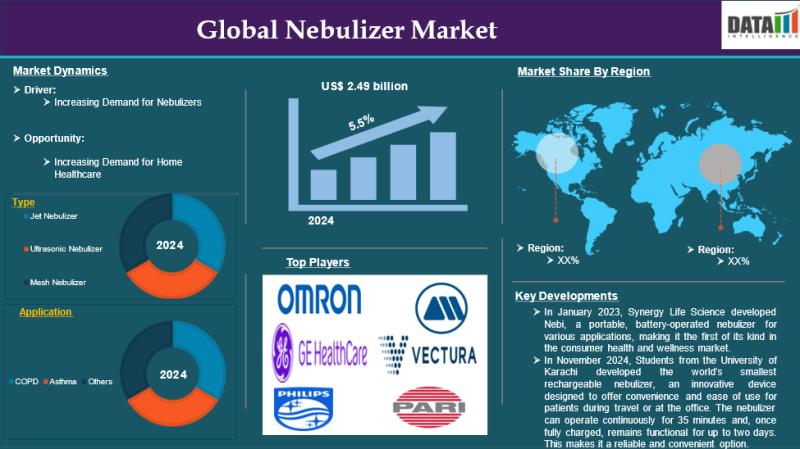

United States Nebulizer Market to Reach US$ 2.49 Billion by 2033 | CAGR 5.5%| As …

Leander, Texas and Tokyo, Japan - Feb.2.2026

The Global Nebulizer Market reached US$ 1.57 billion in 2024 and is expected to reach US$ 2.49 billion by 2033, growing at a CAGR of 5.5% during the forecast period 2025-2033.

The market is driven by the rising prevalence of respiratory diseases and growing demand for home healthcare solutions. Jet, ultrasonic, and mesh nebulizers dominate adoption. Applications include asthma, COPD, and other chronic respiratory conditions.…

More Releases for Aluminum

New Aluminum Material-Aluminum Foam Application Summary

Aluminum Foam [https://www.beihaicomposite.com/aluminum-foam-tag/] Characteristics

Ultra-lightness

The density is 0.2~0.4g/cm3, which is about 1/10 of the density of aluminum, 1/20 of the density of titaNium, 1/30 of the density of steel, 1/30 of the density of steel, and 1/3 of the density of wood.

Sound Absorbability

Aluminum foam [https://www.beihaicomposite.com/about-us/] can be used to muffle and reduce noise by absorbing sound energy through the vibration of the pores' walls.

Heat resistance

It has high heat resistance; the general…

5083 medium-thick aluminum plate 5083 marine aluminum plate 5083 automotive alum …

5083 aluminum plate(https://www.mingtai-al.com/5083-Aluminum-Sheet.html) is a typical aluminum-magnesium alloy with light weight and high strength. With its excellent performance, it can be widely used in many industries such as automobile manufacturing, shipbuilding and rail transportation. With the vigorous development of lightweight, the demand for 5083 medium-thick aluminum plate in aluminum tank trucks and marine aluminum plates has increased.

5083 medium-thick aluminum plate-5083 marine aluminum plate-5083 automotive aluminum plate manufacturer introduction

In recent years,…

Yocon Aluminum Announces Availability of 3003 Aluminum Coil

Yocon Aluminum, a leading supplier of aluminum coil products in China, today announced the availability of 3003 aluminum coil. The company's new product is made from high-quality, mill-finished 3003 alloy and features excellent formability, weldability, and corrosion resistance. It is ideally suited for a wide range of applications in the transportation, construction, and industrial markets. With its outstanding properties, 3003 aluminum coil is quickly becoming a preferred choice for customers…

Yocon Aluminum china factory offers 3003 Aluminum Coil

Yocon Aluminum china factory is proud to offer 3003 aluminum coil. This high-quality product is perfect for a variety of applications, and we are confident that you will be satisfied with its performance. We are committed to providing our customers with the best products and services possible, and we look forward to helping you meet your needs. Contact us today to learn more about our 3003 aluminum coil!

In an effort…

Yocon Aluminum Supplies Aluminum Foil Coils for Major Appliances

Yocon Aluminum, a leading manufacturer and supplier of aluminum foil coils, has announced that they are now supplying major appliance manufacturers with their high-quality aluminum foil coils. With over forty years of experience in the industry, Yocon Aluminum is known for their dedication to quality and customer satisfaction. Their products are used in a variety of applications, including air conditioners, refrigerators, and freezers. When it comes to choosing a supplier…

Aluminum Frp Market Size, Status and Global Outlook 2021-Shandong Nanshan Alumin …

The MarketInsightsReports has published the obtainability of a new statistical data to its repository titled as, Aluminum Frp market. The comprehensive report provides useful insights into Market growth, revenue, and market trends, in order to enable readers to gauge market scope more proficiently. Furthermore, the report also sheds light on recent developments and platforms, in addition to distinctive tools, and methodologies that will help to propel the performance of industries.…