Press release

Citric Acid Production Plant (DPR) 2026: Industry Trends, CapEx/OpEx and Market Growth

The global citric acid manufacturing industry is experiencing steady growth driven by the rapidly expanding food and beverage sector and increasing demand for natural preservatives and acidulants. At the heart of this expansion lies a critical industrial ingredient-citric acid. As consumers worldwide increasingly seek clean-label products and manufacturers prioritize natural food additives over synthetic alternatives, establishing a citric acid production plant presents a strategically compelling business opportunity for entrepreneurs and chemical industry investors seeking to capitalize on this essential and growing market.Market Overview and Growth Potential

The global citric acid market demonstrates a solid growth trajectory, valued at 3.07 Million Tons in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach 3.84 Million Tons by 2034, exhibiting a steady CAGR of 2.5% from 2026-2034. This sustained expansion is driven by increasing demand in the food and beverage industry for natural preservatives and flavor enhancers, growing adoption in pharmaceutical formulations and personal care products, rising utilization in household detergents and cleaning agents, expanding biotechnology advancements improving production efficiency, and growing consumer preference for natural and organic ingredients across developed and emerging economies.

Citric acid is a weak organic tricarboxylic acid naturally found in citrus fruits such as lemons, oranges, limes, and grapefruits. Commercially produced through microbial fermentation using Aspergillus niger fungus fed on glucose or sucrose-containing media, citric acid appears as white crystalline powder or granules with excellent water solubility. It serves multiple critical functions including pH regulation, flavor enhancement, preservation, chelating agent for mineral binding, and antioxidant properties. Available in two primary forms-anhydrous citric acid and liquid citric acid-this versatile compound is extensively used in food and beverages, pharmaceuticals, personal care products, household cleaners, and industrial applications.

The citric acid market is witnessing robust demand due to the global shift toward natural food additives and clean-label products. The food and beverage industry, which accounts for the largest application segment, increasingly relies on citric acid as a natural preservative, acidity regulator, and flavor enhancer in soft drinks, fruit juices, confectionery, canned foods, and dairy products. Growing health consciousness among consumers drives demand for products with recognizable, natural ingredients rather than synthetic additives. Additionally, regulatory restrictions on phosphate-based detergents in numerous countries are accelerating adoption of citric acid in household cleaning products. The pharmaceutical industry's expanding use of citric acid in effervescent tablets, syrups, and health supplements further strengthens market prospects.

Request for a Sample Report: https://www.imarcgroup.com/citric-acid-manufacturing-plant-project-report/requestsample

Plant Capacity and Production Scale

The proposed citric acid production facility is designed with an annual production capacity ranging between 50,000-100,000 MT, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to cater to diverse market segments-from food and beverage applications and pharmaceutical formulations to household detergents, personal care products, and industrial applications-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The citric acid manufacturing business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal:

Gross Profit Margins: 30-40%

Net Profit Margins: 12-18%

These margins are supported by sustained demand across food and beverage, pharmaceutical, and cleaning product sectors, established market presence as an essential industrial ingredient, long-term supply agreements with major food and beverage manufacturers providing revenue stability, and continuous technological improvements in fermentation processes reducing production costs. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established chemical manufacturers looking to diversify their product portfolio in the specialty chemicals sector.

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for a citric acid production plant is primarily driven by:

Raw Materials: 55-65% of total OpEx

Utilities: 20-25% of OpEx

Other Expenses: Including labor, fermentation media, quality control, packaging, transportation, maintenance, depreciation, and taxes

Raw materials constitute the largest portion of operating costs, with glucose or molasses (carbon sources for fermentation), Aspergillus niger culture, processing chemicals (calcium hydroxide, sulfuric acid), and nutrients for fungal growth being the primary inputs. Establishing long-term supply agreements with reliable sugar refineries and molasses suppliers helps mitigate price volatility and ensures consistent raw material supply, which is critical given that carbon source costs represent the most significant variable factor in citric acid production economics.

Capital Investment Requirements

Setting up a citric acid production plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to sugar refineries, molasses suppliers, or corn processing facilities to minimize raw material transportation costs. Proximity to major food and beverage manufacturing clusters will help secure customer relationships and reduce distribution expenses. The site must have robust infrastructure, including reliable power supply, water resources for fermentation and processing, effluent treatment capabilities, and transportation connectivity. Compliance with food-grade manufacturing standards, environmental regulations, and industrial safety requirements must also be ensured.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized fermentation and processing equipment essential for production. Key machinery includes:

Seed fermentation tanks for propagating Aspergillus niger fungal culture

Large-scale fermentation reactors (50,000-200,000 liters) with temperature and pH control systems

Aeration and agitation systems for maintaining optimal oxygen levels during fermentation

Filtration equipment for separating biomass from citric acid-containing fermentation broth

Precipitation tanks for calcium citrate formation using lime treatment

Acidulation reactors for converting calcium citrate to citric acid using sulfuric acid

Crystallization vessels for citric acid crystal formation through controlled cooling

Centrifuges for separating crystals from mother liquor

Drying equipment (spray dryers or fluid bed dryers) for moisture removal

Milling and sieving systems for particle size control and product uniformity

Blending and packaging lines for final product preparation

Storage silos for raw materials and finished products with moisture control

Clean-in-place (CIP) and sterilization systems for maintaining hygiene standards

Quality control laboratory with analytical instruments for purity testing, heavy metal analysis, and microbiological testing

Effluent treatment plant for managing fermentation wastewater and chemical effluents

Civil Works: Building construction, fermentation facility design, factory layout optimization, and infrastructure development designed to enhance workflow efficiency, maintain stringent hygiene standards, and ensure workplace safety throughout the production process. The layout should be optimized with separate zones for raw material storage, seed fermentation area, main fermentation hall, filtration and separation section, precipitation and acidulation zone, crystallization unit, drying and milling area, packaging section, quality control laboratory, finished goods warehouse, utility block with boilers and cooling towers, effluent treatment facility, and administrative offices.

Other Capital Costs: Pre-operative expenses, machinery installation and commissioning costs, food safety certifications (FSSAI, FSSC 22000, ISO 22000), regulatory compliance documentation, initial working capital for raw material procurement and fermentation media, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Citric acid products find extensive applications across diverse market segments, demonstrating their versatility and critical importance:

Food and Beverages: Primary application as a natural preservative, flavor enhancer, and acidity regulator in carbonated soft drinks, fruit juices, fruit-flavored beverages, confectionery, jams and jellies, canned fruits and vegetables, dairy products, frozen foods, and wine production where pH control and shelf-life extension are essential.

Pharmaceuticals: Critical applications in effervescent tablets, syrups, oral solutions, health supplements, and parenteral solutions where citric acid serves as an excipient, buffering agent, chelating agent, and antioxidant while improving palatability and stability.

Personal Care and Cosmetics: Widespread use in shampoos, conditioners, skin care formulations, bath products, and cosmetics where citric acid functions as a pH adjuster, preservative enhancer, chelating agent for hard water minerals, and alpha-hydroxy acid for gentle exfoliation.

Household Detergents and Cleaners: Growing applications in laundry detergents, dishwashing liquids, surface cleaners, and descaling agents where citric acid provides effective cleaning action, water softening properties, and serves as an environmentally friendly alternative to phosphates.

Industrial Applications: Specialized uses in metal cleaning and surface treatment, textile processing, leather tanning, photography chemicals, oil and gas drilling fluids, and water treatment where chelating and pH regulation properties provide functional benefits.

End-use industries include food and beverage manufacturing, pharmaceutical companies, personal care product manufacturers, household cleaning product producers, and various industrial sectors, all of which contribute to sustained market demand.

Speak to Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=7628&flag=C

Why Invest in Citric Acid Production?

Several compelling factors make citric acid manufacturing an attractive investment opportunity:

Essential Industrial Ingredient: Citric acid serves as a critical component in numerous industries with irreplaceable functionality in food preservation, pharmaceutical formulations, and cleaning applications, ensuring consistent long-term demand across economic cycles.

Clean-Label Movement: Growing consumer preference for natural, recognizable ingredients over synthetic additives drives increased adoption of citric acid in food and beverage formulations, positioning it favorably in the rapidly expanding clean-label product segment.

Regulatory Support: Increasing governmental restrictions on synthetic preservatives and phosphate-based detergents create regulatory tailwinds favoring citric acid adoption as a natural, environmentally acceptable alternative in multiple applications.

Diverse Revenue Streams: Multi-industry application portfolio spanning food, pharmaceuticals, personal care, and industrial sectors provides revenue diversification, reducing dependence on single market segments and enhancing business resilience.

Technological Advancement: Continuous improvements in fermentation technology, strain development, and downstream processing are reducing production costs, increasing yields, and improving product quality, enhancing manufacturing economics and competitive positioning.

Sustainability Alignment: Citric acid production through fermentation represents a sustainable, renewable manufacturing process aligned with circular economy principles and environmental responsibility trends, appealing to sustainability-focused customers and investors.

Growing Emerging Markets: Rapid industrialization, rising disposable incomes, expanding middle-class populations, and increasing processed food consumption in developing economies create substantial growth opportunities in high-potential geographic markets.

Manufacturing Process Excellence

The citric acid production process involves several precision-controlled stages:

Raw Material Preparation: Glucose syrup or molasses is diluted, sterilized, and fortified with essential nutrients (nitrogen, phosphorus, trace minerals) to create fermentation medium

Seed Culture Preparation: Aspergillus niger spores are propagated in small-scale seed fermentation tanks to build sufficient biomass for inoculation

Main Fermentation: Seed culture is transferred to large fermentation reactors where controlled conditions (temperature 28-32°C, pH 2-3, aeration) promote citric acid production over 5-10 days

Filtration and Clarification: Fermentation broth is filtered to remove fungal biomass and suspended solids, producing clear citric acid solution

Precipitation: Calcium hydroxide (lime) is added to citric acid solution, forming insoluble calcium citrate precipitate that is separated by filtration

Acidulation: Calcium citrate is treated with sulfuric acid, converting it back to free citric acid while precipitating calcium sulfate (gypsum) which is removed

Purification: Citric acid solution is treated with activated carbon for decolorization and passed through ion exchange or filtration for impurity removal

Crystallization: Purified citric acid solution is concentrated and cooled under controlled conditions to promote crystal formation

Centrifugation and Washing: Citric acid crystals are separated from mother liquor by centrifugation and washed to remove residual impurities

Drying: Wet crystals are dried in spray dryers or fluid bed dryers to achieve target moisture content (typically less than 1%)

Milling and Sieving: Dried citric acid is milled to desired particle size and sieved for uniformity according to customer specifications

Packaging and Storage: Final product is packaged in moisture-resistant bags or bulk containers and stored in dry, controlled-temperature warehouses

Industry Leadership

The global citric acid industry is led by established manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

Pfizer, Inc.

Tate & Lyle PLC

Danisco A/S

Cargill

Kenko Corporation

ADM

These companies serve diverse end-use sectors including food and beverage manufacturing, pharmaceuticals, personal care, household cleaning products, and industrial applications, demonstrating the broad market applicability of citric acid products.

Buy Now:

https://www.imarcgroup.com/checkout?id=7628&method=2175

Recent Industry Developments

October 2025: Health and wellness company Productive Health Co. launched Autofocus, a functional beverage designed as a cleaner substitute for traditional energy drinks and coffee. Developed to support cognitive performance and deliver long-lasting energy, the drink is formulated with naturally sourced, brain-supporting ingredients and contains no artificial additives. Autofocus is produced using a six-ingredient blend comprising coffee fruit, L-theanine, black currant, stevia, citric acid, and water.

November 2024: Jungbunzlauer collaborated with the Technical University of Vienna (TU Wien) to strengthen research initiatives aimed at enhancing citric acid manufacturing. The partnership operates through the newly established Christian Doppler (CD) Laboratory, where research activities focus on optimizing fungal strains to improve production efficiency and overall process effectiveness.

Conclusion

The citric acid production sector presents a strategically positioned investment opportunity at the intersection of food technology, natural ingredients, and sustainable manufacturing. With favorable profit margins ranging from 30-40% gross profit and 12-18% net profit, strong market drivers including increasing demand for natural preservatives, growing clean-label product trends, regulatory restrictions on synthetic additives, expanding pharmaceutical applications, rising adoption in household cleaners, and supportive consumer preferences for natural ingredients, establishing a citric acid production plant offers significant potential for long-term business success and sustainable returns. The combination of essential industrial functionality, diverse application portfolio, technological advancement opportunities, sustainability credentials, and growing emerging market demand creates an attractive value proposition for serious chemical industry investors committed to quality manufacturing, food safety excellence, and operational efficiency in serving multiple high-growth end-use sectors.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company excels in understanding its clients' business priorities and delivering tailored solutions that drive meaningful outcomes. IMARC Group provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Citric Acid Production Plant (DPR) 2026: Industry Trends, CapEx/OpEx and Market Growth here

News-ID: 4373645 • Views: …

More Releases from IMARC Group

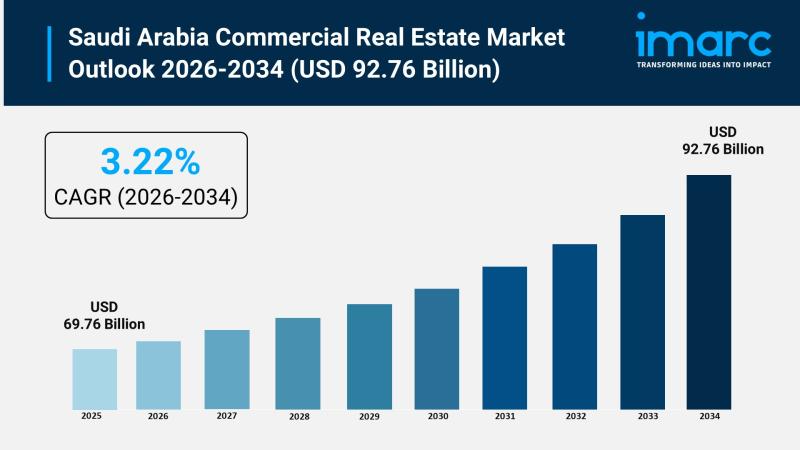

Saudi Arabia Commercial Real Estate Market is Booming with a CAGR of 3.22% by 20 …

Saudi Arabia Commercial Real Estate Market Overview

Market Size in 2025: USD 69.76 Billion

Market Size in 2034: USD 92.76 Billion

Market Growth Rate 2026-2034: 3.22%

According to IMARC Group's latest research publication, "Saudi Arabia Commercial Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia commercial real estate market size was valued at USD 69.76 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD…

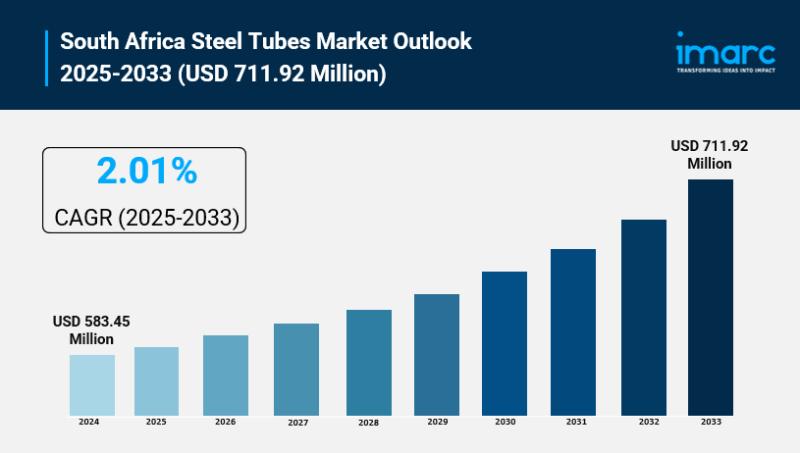

South Africa Steel Tubes Market Size to Hit USD 711.92 Million by 2033 | With a …

South Africa Steel Tubes Market Overview

Market Size in 2024: USD 583.45 Million

Market Size in 2033: USD 711.92 Million

Market Growth Rate 2025-2033: 2.01%

According to IMARC Group's latest research publication, "South Africa Steel Tubes Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa steel tubes market size reached USD 583.45 Million in 2024. The market is projected to reach USD 711.92 Million by 2033, exhibiting a growth rate…

Plant Based Food Market Size, Share, Industry Overview, Latest Trends and Foreca …

IMARC Group has recently released a new research study titled "Plant-Based Food Market Size, Share, Trends and Forecast by Type, Source, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Plant-Based Food Market Size Overview

The global plant-based food market size was valued at USD 13.1 Billion in 2025. Looking forward, IMARC Group…

Oxygen Price Index | January 2026 | Latest Trends | Data Analysis | Insights

Europe Oxygen Prices Movement January 2026:

Oxygen prices in Europe during January 2026 averaged USD 0.17/kg, declining by 5.6%. Reduced demand from steelmaking and manufacturing activities contributed to the decrease. Stable output from air separation units ensured adequate supply. Lower energy costs and sufficient inventories helped meet demand smoothly, preventing sharper declines and maintaining balanced regional availability.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/oxygen-pricing-report/requestsample

Note: The analysis can be tailored to align with the…

More Releases for Citric

Emerging Trends to Reshape the Citric Acid Market: Low-Calorie Rtd Beverages Fue …

Stay ahead with our updated market reports featuring the latest on tariffs, trade flows, and supply chain transformations.

Citric Acid Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

There has been a robust expansion in the size of the citric acid market in the previous years. The projected growth is from $4.51 billion in 2024 to $4.88 billion in 2025 with a compound annual growth rate (CAGR) of…

Evolving Market Trends In The Citric Acid Industry: Low-Calorie Rtd Beverages Fu …

The Citric Acid Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Citric Acid Market Size During the Forecast Period?

In recent times, the market size of citric acid has witnessed a robust growth. The market expanded from $4.51 billion in 2024 to…

How To Setup a Citric Acid Manufacturing Plant

Setting up a citric acid manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Citric Acid Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a citric…

Citric Acid Market: A Comprehensive Overview

Citric acid is a naturally occurring organic acid found in citrus fruits, such as lemons, limes, and oranges. Widely used in the food and beverage industry, pharmaceuticals, and personal care products, it plays a critical role as a preservative, flavoring agent, and cleaning component. This colorless crystalline compound is valued for its safety, environmental friendliness, and multifunctionality. The demand for citric acid has seen a steady increase, driven by its…

Citric Acid Market Size, Share, Development by 2025

LP INFORMATION recently released a research report on the Citric Acid market analysis, which studies the Citric Acid's industry coverage, current market competitive status, and market outlook and forecast by 2025.

Global “Citric Acid Market 2020-2025” Research Report categorizes the global Citric Acid market by key players, product type, applications and regions,etc. The report also covers the latest industry data, key players analysis, market share, growth…

Future of Fermented Citric Acid Market Size 2026

The recent research report on the global Fermented Citric Acid Industry market presents the latest industry data and future trends, allowing you to recognize the products and end users driving Revenue growth and profitability of the market.

The report offers an extensive analysis of key drivers, leading market players, key segments, and regions. Besides this, the experts have deeply studied different geographical areas and presented a competitive scenario to assist new…