Press release

Saudi Arabia Duty-Free and Travel Retail Market Projected to Reach USD 726.1 Million by 2034, At 6.34% CAGR

Saudi Arabia Duty-Free and Travel Retail Market OverviewMarket Size in 2025: USD 417.7 Million

Market Forecast in 2034: USD 726.1 Million

Market Growth Rate 2026-2034: 6.34%

According to IMARC Group's latest research publication, "Saudi Arabia Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034", the Saudi Arabia duty-free and travel retail market size reached USD 417.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 726.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.34% during 2026-2034.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-duty-free-travel-retail-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Duty-Free and Travel Retail Market

● AI-powered personalization engines in Saudi duty-free and travel retail are using real-time data on spend, flight time, and loyalty status to push hyper-targeted offers, lifting conversion on digital touchpoints by more than 20% in premium categories.

● Smart computer-vision and RFID systems in airport and border-store environments are tracking stock levels and shopper flows minute by minute, helping operators reduce out-of-stock incidents by up to 30% and optimize high-margin shelf space automatically.

● Dynamic pricing tools are analysing demand peaks around big events and weekend travel surges, allowing duty-free operators to tweak prices and bundles in near real time, protecting margins while still delivering visible savings versus domestic retail.

● AI-driven language and translation chatbots are supporting travellers in Arabic, English, and multiple Asian and European languages, cutting average service wait times sharply and helping staff handle higher passenger volumes without compromising experience quality.

● Predictive analytics platforms are integrating tourism, airline, and spend data so Saudi operators can forecast passenger profiles per flight, pre-plan assortments, and target campaigns, increasing basket sizes and cross-category upsell opportunities in beauty, luxury, and F&B.

Saudi Arabia Duty-Free and Travel Retail Market Trends & Drivers:

One huge driver powering the Saudi Arabia duty-free and travel retail market right now is the massive boost from Vision 2030, which is all about ramping up tourism and making the country a go-to spot for visitors. With around 100 million tourists flocking in, the sector's pumping SAR 444.3 billion into the GDP, and international spending alone hits SAR 227.4 billion, showing how travelers are splashing cash on duty-free goodies like perfumes and fashion. The government's rolling out schemes like the Rules for Establishing Duty-Free Markets at air, sea, and land ports, setting standards for operations and licensing to make things smoother. In real life, this means airports and borders are turning into shopping havens, drawing crowds with exclusive deals. Companies are teaming up with global brands to stock up on luxury items, and it's creating over 2.5 million jobs in related areas, keeping the momentum strong as more events and attractions pull in diverse crowds.

Airport expansions are emerging as a key trend shaking up the duty-free scene in Saudi Arabia, with major upgrades making travel retail more accessible and appealing. The government's investing big in infrastructure under Vision 2030, like revamping hubs in Riyadh and Jeddah to handle surging air traffic and turn them into world-class shopping zones. Stats show the market's thriving thanks to these moves, with duty-free spots now at all entry points, boosting sales through better layouts and wider product ranges. For instance, the launch of Al Waha Duty-Free Company by the Public Investment Fund is a game-changer, as the first homegrown operator focusing on local flavors alongside international favorites. In practice, this means quicker customs and more engaging experiences for shoppers, like pop-up stores and tech-savvy kiosks, which are drawing in millennials and families alike, expanding the market by making every trip feel like a retail adventure.

Rising consumer affluence and the shift to digital tech are fueling growth in Saudi Arabia's duty-free and travel retail market, as shoppers crave personalized, seamless experiences. With over 60% of the population under 35 and super tech-savvy, there's a big push for apps and online pre-orders that let you snag deals before even landing. Government initiatives are backing this with better e-commerce regs and digital payment promotions, where cashless transactions now dominate retail. Companies like those in the market are rolling out AI-driven recommendations and virtual try-ons, helping boost basket sizes and loyalty. In everyday scenarios, this trend means tourists can browse duty-free catalogs on their phones during flights, with stats highlighting increased demand for luxury and sustainable products, turning occasional buyers into regulars and opening up new revenue streams for operators.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=31862&flag=E

Saudi Arabia Duty-Free and Travel Retail Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● Beauty and Personal Care

● Wines and Spirits

● Tobacco

● Eatables

● Fashion Accessories and Hard Luxury

● Others

Distribution Channel Insights:

● Airports

● Airlines

● Ferries

● Others

Regional Insights:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Duty-Free and Travel Retail Market

● January 2026: AI-powered personalization engines analyze passenger data at Saudi airports, delivering targeted recommendations that boost impulse buys by 25%.

● December 2025: Duty-free sector embraces AR platforms and data analytics for personalized promotions, driving 9.7% higher tourist spending via mobile apps and interactive virtual shelves in upgraded airport terminals.

● Aug 2025: Lagardère Travel Retail expands to 10 Saudi airports from 3 prior year, opening Aelia Duty Free at Tabuk with logistics center to support NEOM gateway traffic surge.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Duty-Free and Travel Retail Market Projected to Reach USD 726.1 Million by 2034, At 6.34% CAGR here

News-ID: 4371905 • Views: …

More Releases from IMARC Services Private Limited

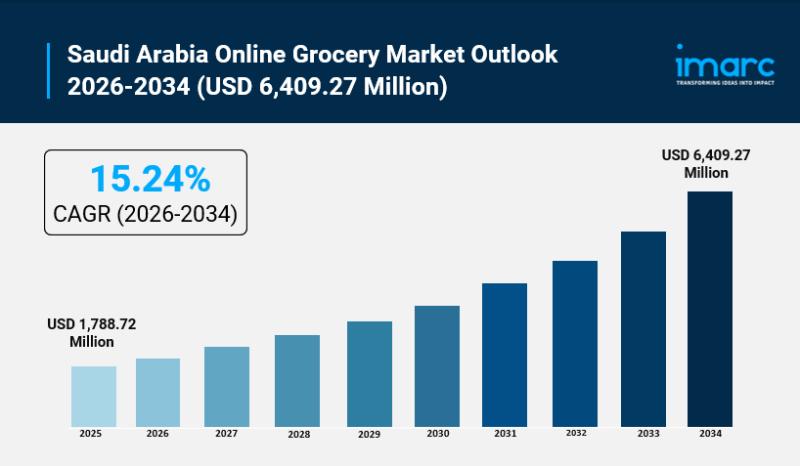

Saudi Arabia Online Grocery Market Set to Surge to USD 6,409.27 Million by 2034, …

Saudi Arabia Online Grocery Market Overview

Market Size in 2025: USD 1,788.72 Million

Market Forecast in 2034: USD 6,409.27 Million

Market Growth Rate 2026-2034: 15.24%

According to IMARC Group's latest research publication, "Saudi Arabia Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Region, 2026-2034", the Saudi Arabia online grocery market size was valued at USD 1,788.72 Million in 2025 and is projected to reach USD…

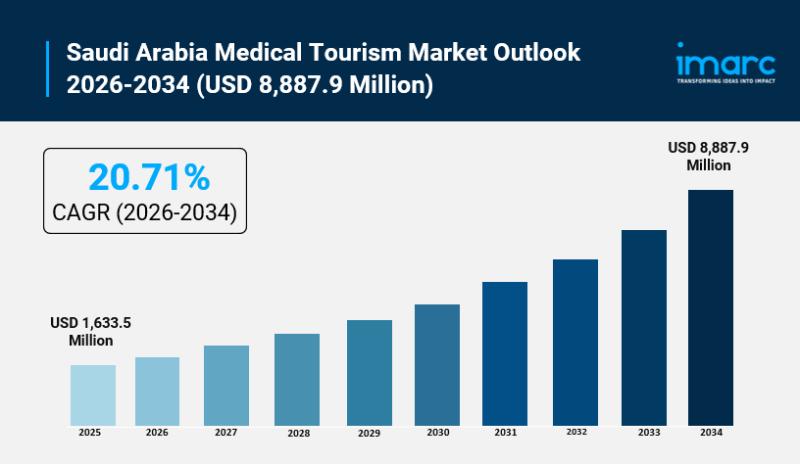

Saudi Arabia Medical Tourism Market Set to Surge USD 8,887.9 Million by 2034 Gro …

Saudi Arabia Medical Tourism Market Overview

Market Size in 2025: USD 1,633.5 Million

Market Forecast by 2034: USD 8,887.9 Million

Market Growth Rate 2026-2034: 20.71%

According to IMARC Group's latest research publication, " Saudi Arabia Medical Tourism Market Report by Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, and Others), Service Provider (Public, Private), and Region 2026-2034 ", the Saudi Arabia medical tourism market size reached…

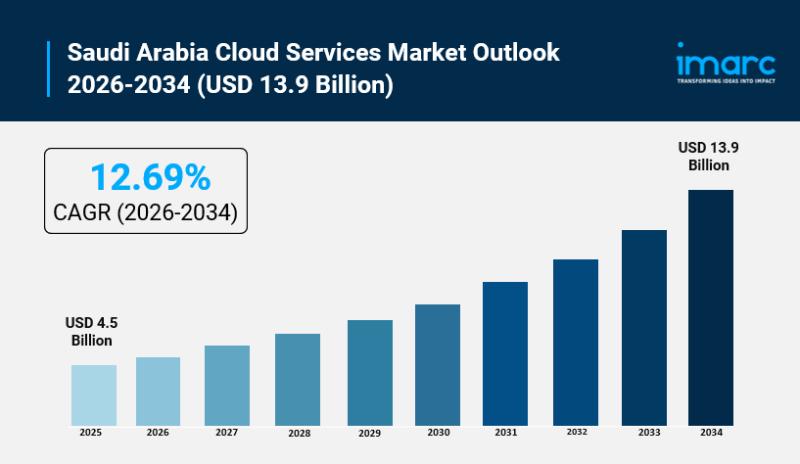

Saudi Arabia Cloud Services Market Projected to Reach USD 13.9 Billion by 2034 S …

Saudi Arabia Cloud Services Market Overview

Market Size in 2025: USD 4.5 Billion

Market Forecast in 2034: USD 13.9 Billion

Market Growth Rate 2026-2034: 12.69%

According to IMARC Group's latest research publication, "Saudi Arabia Cloud Services Market Report by Deployment (Public Cloud, Private Cloud), End Use Industry (Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, and Others), and Region 2026-2034", the Saudi Arabia cloud services market size reached USD…

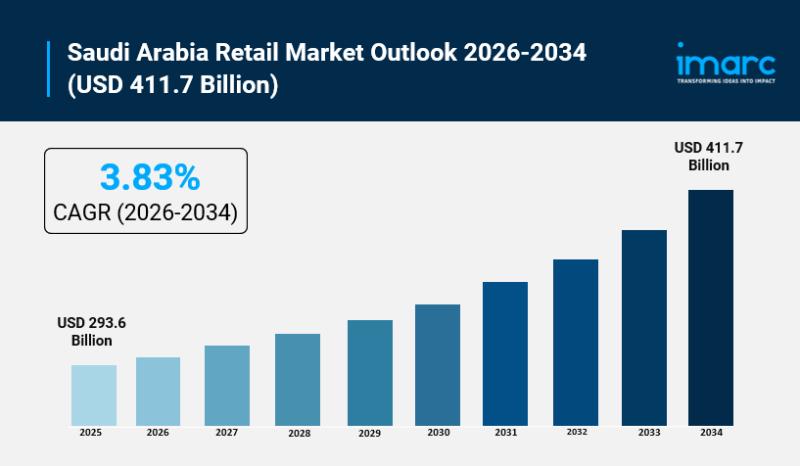

Saudi Arabia Retail Market to Touch USD 411.7 Billion by 2034, Expanding at 3.83 …

Saudi Arabia Retail Market Overview

Market Size in 2025: USD 293.6 Billion

Market Forecast in 2034: USD 411.7 Billion

Market Growth Rate 2026-2034: 3.83%

According to IMARC Group's latest research publication, "Saudi Arabia Retail Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034", the Saudi Arabia retail market size was valued at USD 293.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 411.7 Billion by…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…