Press release

Key Equity Indices Across Regions Offer a Structure to Assess Market Momentum

Image: https://www.abnewswire.com/upload/2026/01/71ca8a1e6555ab265c0a9fee5106dfa7.jpgEquity Indices are those flashing figures you see across your screens, and they provide a structure to assess the market momentum, leadership, and confidence across regions. By looking at the primary global market indices and comparing their performance with Nifty 50 today and Bank Nifty, one can paint a picture of how we create, adjust, and maintain momentum across all regions!

This article will explore how to conduct such a comparison by looking at global indices such as the S&P 500, DAX, and Nikkei and comparing Indian markets with Indias's leading Indices using Nifty 50 today and Bank Nifty, focusing on trend strength, market breadth, and sectoral leadership rather than short-term fluctuations.

Why Indices Are More Useful than Just Point Changes at any Given Moment

Indices symbolize a basket of stocks that index themselves and aggregate results from the stocks they comprise. Point changes in an index can reflect how an index performs daily, but they carry more useful information regarding:

Directional Momentum

Sectoral Participation

Risk Appetite Across Class

Institutional Participation

In this manner, momentum reflects not how much an index has moved at any given point but rather how stable the leadership and participation have been over time!

Global Indices Signal Momentum Strength Across RegionsS&P 500: Leadership Based on Breadth

Directional momentum strength for the S&P 500 comes from its broad sectoral leadership during expansionary trends.

Good momentum is when its leadership during its bullish trends rotates evenly among its sectoral leaders, including technology, financials, healthcare, and industrials.

Weakness in momentum comes when the S&P 500 narrows its leadership to individual stocks performance, even when the index performs well. This usually indicates a market prepped for consolidation or retracement.

DAX: Cyclical Performance

The DAX performs well to cyclical phases of global manufacturing and demand for capital goods.

It usually performs well when demand for machinery or other capital goods has increased.

Better performance from the DAX with associated strengths in sectors such as autos and industrials signals confidence in cyclical recovery in Germany or Europe as a whole.

Poor breadth (market participation) signals caution over the sustainability of such demand over time.

Nikkei: Earnings Growth vs Speculation

For investors, the Nikkei reflects momentum fueled by earnings growth from various company reforms conducted within Japan.

The growing index signals an emphasis on a structural advantage these companies enjoy rather than speculative investments!

It's also heavily impacted by the yen. Thus, the index's momentum reflects a competitive yen that allows Japanese export companies to generate more profits in offshore markets.

How to Use Global Indices' Sentiments Locally

India's stock markets react to global sentiments regarding market momentum; however, they also carry domestic features that make them unique to the Indian ecosystem.

This is where Indices like the Nifty 50 today [https://www.5paisa.com/share-market-today/nifty-50] and Bank Nifty can be powerful analytical measures to help assess the overall momentum across India's markets.

Nifty 50 Today: The Aggregate of All Internationally-Traded Sectors in India

The Nifty 50 today is the safest and widest lens to comprehend momentum across different sectors in India, as it comprises all sectors such as banking, insurance, IT, Energy, FMCG, metals, etc. This means you can compare each sector in India against the Nifty 50 today; how well they perform and their breadth gives you a signal of how most of the markets are performing.

When looking at the Nifty 50 today versus global market indices like the S&P 500 and DAX, it's important to consider the following:

The rotation of leadership across sectors

Momentum of cyclical versus defensive sectors

The breadth of the market that moved the index

You can assess how much momentum there is or is lacking when comparing the Nifty 50 today with other primary global indices.

Market Breadth: A Measure of Selective Participation

Market breadth measures how many stocks in a market moved positively versus those that moved negatively. Strongly broad market breadth indicates high confidence in bullishness; however, poor breadth or selective breadth signals a lack of confidence from broader market participants!

Investors reveal the following by looking at breadth:

India's markets can move in one direction while selectively separating themselves from their key index patterns!

This is why breadth can be used as Nifty 50 today for investors by monitoring patterns in different market segments!

When looking at breadth failure, it's easy to overlook larger pictures when you expect the breadth to mirror major indices like the Nifty 50 today! This is why adjusting your expectations toward a more fluid reading of breadth patterns can benefit you.

Here it makes sense that earlier strength in Bank Nifty leads while liquidity conditions became more of a concern than earlier bullish trends from world markets!

Bank Nifty: A Good Sectoral Indicator for Financial Sector Momentum

Banks in India directly correlate their health with credit growth and liquidity; thus, looking at Bank Nifty makes sense. This Index sees the health that the banking sector assigns to economic conditions.

Its movements assess:

Optimism about Loan Growth

Asset Quality Expectations (whether they are directly tied to loans)

Liquidity Conditions Across Markets

It can also be viewed as a great indicator for sectoral momentum for an economy. It's important to watch Bank Nifty [https://www.5paisa.com/share-market-today/nifty-bank] and how well it rises while other major indices stagnate!

This signals caution about liquidity or the lack of credit growth in a burgeoning financial sector!

Sectoral Leadership Signals Robust Market Momentum for Expansionary Periods

Global and developed market indices have certain leaders according to certain phases in their economy, as seen in the following:

Technology firms lead bullish patterns during expansionary periods

Defensives lead bearish markets/ periods of economic weakness

In India:

Bank Nifty leads relatively well across expansionary periods

IT reacts according to IT conditions globally (level of liquidity/ global demand)

Defensive sectors like healthcare and FMCG reflect where wealth was invested before patience points toward safer markets

Using Bank Nifty and how it compares against Nifty 50 today allows you to measure expansionary tendencies through responsiveness of Indian sectors against developed global markets.

Comparative Analysis of Global Trends

Comparative analysis of major indices across markets indicates a strong appetite for risk from traders or investors if they experience similar index momentum.

The lack of strength seen across Asian economies while American markets boom signals cautious optimism about future growth cycles.

By looking at comparative performance across Bank Nifty and Nifty 50 today compared to other major markets, investors can gain insight into:

The appetite for risk cycles versus cyclicality

Understanding performance in markets not heavily tied to core trading patterns/ cycles

Identify Points of Caution By Sector Against Bank Nifty Comparison

Institutional Participation Ensure Momentum Stays Strong

Momentum becomes weak when an index or trend is not underpinned by institutional buying; many institutional players rotating underpinned bullishness keeps a bullish trend ongoing; volatility only manifests itself when certain players are linked to these trends.

Comparing Bank Nifty with other market Indices across India enables investors to measure institutional buying. This can be completed with:

Domestic Banks or Foreign Banks

Conclusion: Key Indices Should Be Read as Momentum Signals Rather than Scoreboards

Overall key equity indices remain underutilized assets. Using them correctly may enable traders accurately reading sentiment across different regional markets before investing heavily elsewhere! By comparing indices like the S&P 500 or DAX against Bank Nifty and Nifty 50 today, one ensures a safer and ultimately more profitable investing experience!

After all, properly reading these Indices as accurate readings of momentum instead of scoreboards to measure movements against resolves unnecessary investing hesitation! Reminding yourself that investing has liquid returns the key to successful investing; do it by re-calibrating your focus!

Media Contact

Company Name: 5paisa

Contact Person: Sameer Mehta

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=key-equity-indices-across-regions-offer-a-structure-to-assess-market-momentum]

Country: India

Website: https://www.5paisa.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Equity Indices Across Regions Offer a Structure to Assess Market Momentum here

News-ID: 4371666 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

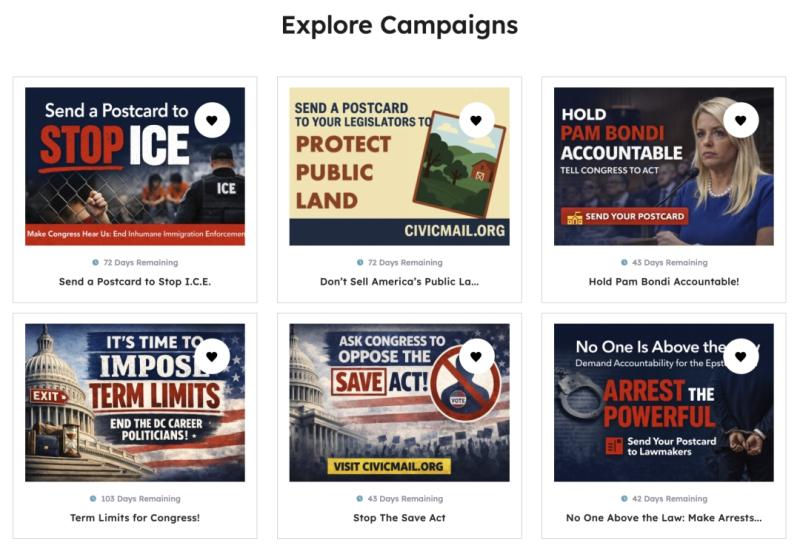

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Nifty

GIFT Nifty Indicates a Negative Opening; HAL Signs Rs. 62,700 crore Deal

Buy Watchlist

Bharti Airtel, Divis Laboratories, Blue Star, Aavas Financiers, Supriya Lifescience and view more.

Key News & Earnings Updates

Hindustan Aeronautics signs ₹62,700 crore deal for 156 helicopters; FY25 revenue at ₹30,400 crore.

Vodafone Idea to issue ₹36,950 crore equity to the government at ₹10 per share.

ITC to acquire Century Pulp and Paper for ₹3,500 crore, subject to approvals.

Vedanta extends demerger deadline to September 30, 2025, due to pending approvals from NCLT and…

NFT Music Market May See a Big Move | Rarible, OpenSea, Nifty Gateway, MakersPla …

Advance Market Analytics published a new research publication on "NFT Music Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the NFT Music market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the report, request…

Music NFT Market May Set New Growth Story | Rarible, OpenSea, Nifty Gateway

Latest published market study on Worldwide Music NFT Market provides an overview of the current market dynamics in the Worldwide Music NFT space, as well as what our survey respondents—all outsourcing decision-makers—predict the market will look like in 2027. The study breaks market by revenue and volume (wherever applicable) and price history to estimates size and trend analysis and identifying gaps and opportunities. Some of the players that are in…

Alliance Research – A stock advisory company announce nifty and commodity tips …

The number of commodity advisory companies is increasing, which provides a variety of business analysis services to the traders. Alliance Research comes first in this sequence as an Investment Advisory Company and Commodity Analysis Consultant, which has a major role in the recommendations of the National Stock Exchange (NSE) for eligible cash for stock and future stock. Alliance Research is one of the trusted Indian business analysis companies, which always…

Sofosbuvir Market 2017- NIFTY LABS PVT LTD, DEAFARMA

Marketreports.biz, recently published a detailed market research study focused on the "Sofosbuvir Market" across the global, regional and country level. The report provides 360° analysis of "Sofosbuvir Market" from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global Sofosbuvir industry, and estimates the future trend of Sofosbuvir market on the basis of this…

Global Aerial Platform Vehicles Market 2017 - Aichi, Haulotte, Skyjack, Nifty li …

The Aerial Platform Vehicles Market 2017 examines the performance of the Aerial Platform Vehicles market, enclosing an in-depth judgment of the Aerial Platform Vehicles market state and the competitive landscape globally. This report analyzes the potential of Aerial Platform Vehicles market in the present as well as the future prospects from various angles in detail.

The Global Aerial Platform Vehicles Market 2017 report includes Aerial Platform Vehicles industry volume, market Share,…