Press release

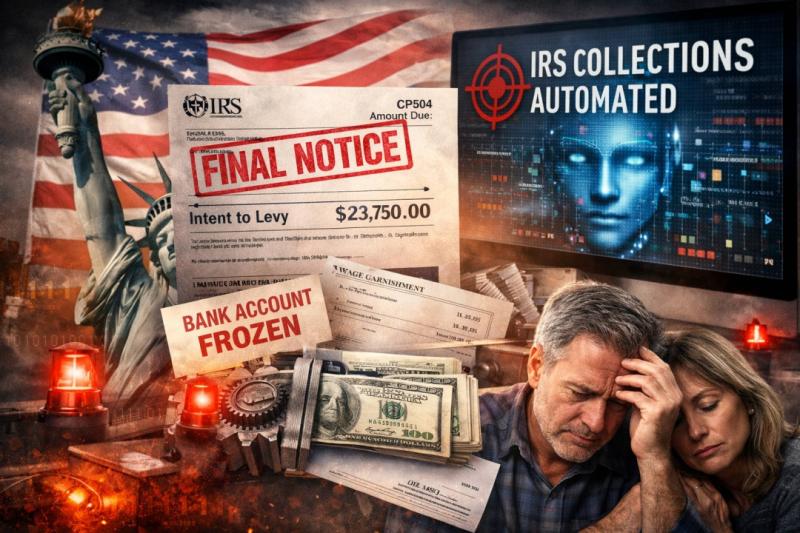

IRS Accelerates Automated Tax Collections as Modernization Push Expands Data-Driven Enforcement

"Automation is shortening the time between noncompliance and enforcement," said Rona Durandisse, an IRS Enrolled Agent and chief executive officer of Ultra Care Tax, a Florida-based tax resolution firm. "Taxpayers receiving final notices may have signific

CORAL SPRINGS, Fla. - Jan 30, 2026 - The Internal Revenue Service is expanding automated tax collection systems that could accelerate bank levies, wage garnishments and federal tax liens for delinquent taxpayers, tax professionals and policy analysts said, as the agency deploys data-driven enforcement tools following a multibillion-dollar modernization push.

Congress provided roughly $80 billion in additional funding to the IRS over a decade through the Inflation Reduction Act of 2022, including about $4.8 billion dedicated to business systems modernization, according to the U.S. Government Accountability Office. The agency has used the funding to upgrade analytics systems, automate case routing and expand third-party data matching to improve compliance and collections.

"Automation is shortening the time between noncompliance and enforcement," said Rona Durandisse, an IRS Enrolled Agent and chief executive officer of Ultra Care Tax, a Florida-based tax resolution firm. "Taxpayers receiving final notices may have significantly less time to negotiate before levies or garnishments begin."

The modernization effort is part of a broader strategy to close the federal tax gap - the difference between taxes owed and taxes paid on time - which the IRS estimates at roughly $696 billion annually for tax year 2022, with individual income taxes accounting for more than $500 billion of that total. GAO estimates show taxpayers voluntarily pay about 85 percent of taxes owed, leaving a substantial share subject to enforcement actions.

Durandisse said automated workflows can increase consistency but may reduce the time available for taxpayers to respond to notices such as CP504 and LT11, which precede levies and liens [https://ultracaretax.com/irs-cp504-notice-what-it-means-and-how-to-respond/].

"Technology improves scale and efficiency, but it also reduces human discretion in early stages of collections," she said. "That raises policy questions about procedural safeguards and error correction when decisions are increasingly data-driven."

Florida, one of the fastest-growing states by population and self-employment activity, represents a high-volume compliance market. Analysts say gig-economy income, real estate transactions and digital-asset reporting requirements are increasing the complexity of taxpayer profiles subject to automated compliance screening.

Tax professionals note that taxpayers still have options once final notices are issued, including installment agreements, offers in compromise and hardship classifications, but the window for intervention may narrow as automation accelerates enforcement timelines.

Industry and Policy Context

The IRS relies extensively on information technology to collect trillions of dollars annually and distribute hundreds of billions in refunds, and has spent about $1.5 billion on modernization programs in fiscal 2024 alone, GAO reported. Policymakers, financial institutions and tax practitioners are monitoring how algorithmic enforcement affects compliance outcomes, taxpayer rights and potential error rates as federal agencies expand data-driven regulatory tools.

About Ultra Care Tax

Ultra Care Tax is a Florida-based tax compliance and resolution advisory firm providing representation in federal and state tax matters, audit defense and regulatory consulting.

Media Contact

Company Name: Gadgetlesstech

Contact Person: Charmain Monroe

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=irs-accelerates-automated-tax-collections-as-modernization-push-expands-datadriven-enforcement]

Phone: 2032960995

Address:456 Glenbrook Rd. Suite11 #564

City: STAMFORD

State: CT

Country: United States

Website: https://gadgetlesstech.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release IRS Accelerates Automated Tax Collections as Modernization Push Expands Data-Driven Enforcement here

News-ID: 4371625 • Views: …

More Releases from ABNewswire

Key Factors to Consider When Choosing a Demolition Company in Singapore

Looking for a trusted demolition company in Singapore? Discover the key factors to consider, including experience, safety standards, licensing, and pricing, to ensure a smooth and compliant project. Read now and choose the right partner with confidence!

Demolition work is a critical part of construction and renovation projects in Singapore. Whether you are clearing a small residential property or a large commercial site, choosing the right demolition company in Singapore [https://demosquad.sg/services/commercial-hacking-and-demolition/]…

Choosing a Reliable Custom Mobile App Company in Singapore

Looking for a reliable custom mobile app company in Singapore? Discover key factors to consider, expertise, portfolio, pricing, and support, to ensure your app's success. Read now and choose the right partner today!

In today's digital landscape, mobile applications are no longer optional for businesses, they are essential. From improving customer engagement to streamlining internal operations, mobile apps play a pivotal role in business growth. However, the success of an app…

Life-Changing Injury: The need of a Greenville Spinal Cord Injury lawyer.

Image: https://www.abnewswire.com/upload/2026/02/11bdc9efa74221f15b62c0eea53d9460.jpg

Introduction

One of the worst effects of any accident is a spinal cord injury. One accident in Woodruff Road or a crash of a truck in I-385 or fall will permanently change your capacity to move, work, and live without assistance. The financial, emotional and physical burden is immense. The victims not only have to contend with an immediate medical emergency but also a life of specialized care and rehabilitation.…

Injured on the Job in Augusta The reason why a Workers' Compensation Lawyer is n …

Image: https://www.abnewswire.com/upload/2026/02/fdb5a0803ebb4effcac2ba3a57689a46.jpg

Introduction

An injury at a workplace can make your life another way within a second. It does not matter whether you are in construction, manufacturing, healthcare, or retail in Augusta, one lapse of care or a crash could leave you with crippling injuries, accruing medical care expenses and lost wages. The workers compensation system implemented in Georgia is aimed at offering compensation to injured employees but the employees find it…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…