Press release

Revenue Cycle Management (RCM) Market Size to Worth USD 117.50 Billion by 2030

Revenue Cycle Management (RCM) Market by Offering [Product (Front, Mid, Back-end Solutions), Outsourcing Service], Enterprise Size [Large, SMEs], Technology [AI, Non-AI], End User [Inpatient, Outpatient, Payer, Pharmacy] & Region - Global Forecast to 2030The global revenue cycle management (RCM) market is experiencing unprecedented expansion, driven by fundamental shifts in healthcare economics and the strategic imperative for operational excellence. Valued at $58.27 billion in 2024 and reaching $65.49 billion in 2025, the market is projected to achieve $117.50 billion by 2030, advancing at a compound annual growth rate (CAGR) of 12.4% throughout the forecast period.

Download PDF Brochure:https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=153900104 [https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=153900104&utm_source=abnewswire.com&utm_medium=referral&utm_campaign=paidpr]

What is driving this transformative growth?

Healthcare organizations worldwide are confronting escalating operational costs, increasingly complex regulatory landscapes, and the accelerating transition to value-based care models. These converging pressures are compelling C-suite executives to fundamentally reimagine revenue cycle operations, moving beyond traditional billing processes toward intelligent, data-driven financial ecosystems.

The market's momentum reflects strategic responses to critical business challenges: rising claim denial rates that erode profitability, administrative inefficiencies that strain operational budgets, and compliance requirements that demand real-time accuracy. Healthcare providers are investing decisively in electronic health record integration, artificial intelligence-enabled automation, and comprehensive RCM platforms that deliver measurable improvements in cash flow velocity and revenue capture.

Why outsourcing is reshaping the competitive landscape

The outsourcing services segment commands approximately 60% of the market, as healthcare executives recognize the strategic value of partnering with specialized RCM vendors. This approach enables organizations to convert fixed operational costs into variable expenses while accessing expertise in complex billing regulations, payer-specific requirements, and evolving compliance frameworks.

Where technology maturity is creating competitive advantage

AI-enabled RCM solutions represent the fastest-growing segment, projected to expand at 14.2% CAGR from 2025 to 2030. Forward-thinking organizations are deploying machine learning algorithms for predictive denial prevention, natural language processing for automated coding, and advanced analytics for real-time financial visibility. Cloud-based delivery models are simultaneously gaining traction, expected to register 13.9% CAGR as enterprises prioritize scalability, interoperability, and reduced infrastructure investments.

Regional dynamics and market concentration

North America maintains market leadership with a 40.3% share in 2024, reflecting mature healthcare IT infrastructure and aggressive regulatory mandates. However, the Asia Pacific region is emerging as the fastest-growing market, propelled by healthcare infrastructure expansion, digital transformation initiatives, and cost-competitive outsourcing capabilities in India, the Philippines, and Southeast Asian nations.

Who is winning in the competitive arena

Market leaders Oracle, Optum, Epic Systems Corporation, Cognizant, and Experian Information Solutions have established dominant positions through innovation, comprehensive product portfolios, and demonstrated operational strength. These organizations are leveraging cloud infrastructure, AI/ML capabilities, and deep EHR integration to deliver unified financial workflows that address the complete revenue cycle continuum.

Strategic imperatives for decision-makers

The integrated software segment is experiencing the highest growth trajectory as healthcare executives demand end-to-end solutions that eliminate data silos and system redundancies. Large enterprises continue to dominate adoption, driven by substantial patient volumes, complex multi-payer contracts, and financial capacity for sophisticated technology investments. Healthcare providers remain the primary end-user segment, facing mounting pressure to optimize revenue collection amid declining reimbursements and increased patient financial responsibility.

How market dynamics are shaping investment decisions

Regulatory requirements-including the Patient Protection and Affordable Care Act, HITECH Act mandates, and Hospital Value-Based Purchasing programs-are accelerating RCM adoption by establishing quality-based reimbursement frameworks. Simultaneously, high deployment costs and IT infrastructure constraints in emerging markets present challenges that vendors must address through flexible pricing models and scalable implementation strategies.

Critical risk factors demanding executive attention

Data security incidents, exemplified by the February 2024 Change Healthcare cyberattack and R1 RCM breaches, underscore the vulnerability of RCM infrastructure to ransomware and unauthorized access. These events carry severe consequences-regulatory penalties, legal liabilities, operational disruption, and reputational damage-making cybersecurity investments non-negotiable for organizations handling sensitive patient and financial data.

Commercial applications driving enterprise value

Leading solutions are delivering tangible business outcomes. Oracle's cloud-based RCM suite integrates ERP and EHR data for unified billing and contract management across multi-facility networks. Optum's AI-enabled platform combines coding automation with predictive denial prevention and payer analytics. Epic Systems' integrated RCM module enables real-time charge capture and automated denial workflows within its dominant EHR ecosystem. These platforms demonstrate measurable improvements in cash flow visibility, revenue recovery rates, and administrative efficiency.

Request Sample Pages:https://www.marketsandmarkets.com/requestsampleNew.asp?id=153900104 [https://www.marketsandmarkets.com/requestsampleNew.asp?id=153900104&utm_source=abnewswire.com&utm_medium=referral&utm_campaign=paidpr]

Emerging opportunities in the global marketplace

The expansion of RCM outsourcing in emerging economies presents significant growth potential. Countries offering skilled healthcare billing professionals at competitive rates, supported by advanced telecommunications infrastructure and favorable regulatory environments, are attracting strategic partnerships from developed market providers. Time zone advantages enable 24/7 operations, accelerating claim processing and revenue collection cycles.

Future outlook and strategic implications

The RCM market is evolving from transactional billing systems toward comprehensive financial intelligence platforms. Predictive analytics, workflow automation, and AI-driven compliance modules are becoming table stakes for competitive differentiation. Healthcare executives who strategically invest in these technologies position their organizations to thrive in value-based care environments while achieving superior financial performance.

Recent market developments shaping the landscape

In March 2025, R1 RCM and Palantir Technologies launched R37, an AI laboratory dedicated to transforming healthcare financial operations. February 2025 saw Experian partner with ValidMind to enhance model risk management for financial institutions. Oracle introduced a patient portal application in October 2024, while Veradigm collaborated with Insiteflow in November 2024 to integrate real-time payer insights across multiple EHR platforms.

The convergence of regulatory pressure, technological innovation, and economic necessity is creating an inflection point for revenue cycle management. Healthcare organizations that embrace comprehensive RCM transformation-combining intelligent automation, strategic outsourcing, and data-driven decision-making-will capture sustainable competitive advantage in an increasingly complex financial landscape.

For strategic inquiries, partnership opportunities, or detailed market intelligence: Healthcare executives, technology vendors, and investment professionals seeking to understand RCM market dynamics and competitive positioning can access comprehensive research covering regional forecasts, technology adoption trends, vendor evaluation frameworks, and custom market assessments tailored to specific organizational requirements.

Media Contact

Company Name: MarketsandMarkets Trademark Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=revenue-cycle-management-rcm-market-size-to-worth-usd-11750-billion-by-2030]

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Florida

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/revenue-cycle-management-market-153900104.html

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Revenue Cycle Management (RCM) Market Size to Worth USD 117.50 Billion by 2030 here

News-ID: 4369815 • Views: …

More Releases from ABNewswire

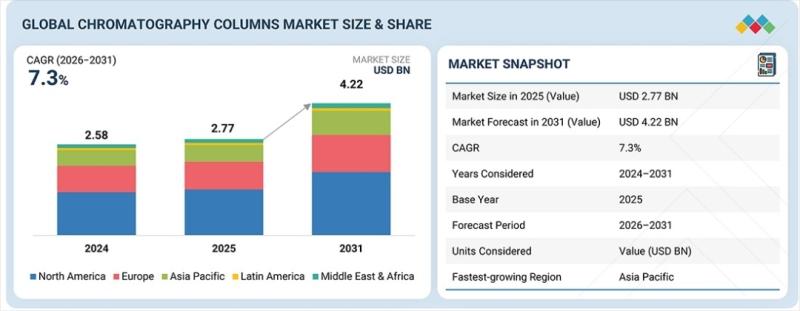

Chromatography Columns Market Size to Worth USD 4.22 Billion by 2031

Chromatography Columns Market by Column Type (Ion Exchange, Size Exclusion, Reverse and Normal Phases, HPLC, Affinity, Chiral), Capacity (1-100 ml, 100-1000 ml, >1 liter), End User (Pharma & Biotech, CRO, CDMO) Global Forecast to 2031

The global chromatography columns market is entering a period of sustained expansion, with valuation rising from $2.77 billion in 2025 to a projected $4.22 billion by 2031, reflecting a compound annual growth rate (CAGR) of 7.3%.…

ENDRA Life Sciences (NASDAQ: NDRA) Gaining Attention as HYPE Token Surges See Wh …

As markets increasingly blur the line between traditional finance and digital assets, ENDRA Life Sciences (NASDAQ: NDRA) is emerging as a unique small-cap story positioned at the intersection of health-tech innovation and next-generation treasury strategy. Recent developments in the digital asset markets-particularly the sharp rise in the HYPE token-are drawing renewed attention to companies that have strategically aligned their balance sheets with this convergence.

HYPE Token Momentum Signals a Broader Market…

Stocks Under $1: TOON, HCTI, XPON, PRSO, GCTS - Watch Now

As investors continue to search for high-upside opportunities in the microcap market, stocks trading under $1 remain firmly on the radar. While these names carry higher volatility and risk, they also tend to attract disproportionate attention during periods of market rotation, speculative momentum, and renewed retail participation.

The following under-$1 stocks span entertainment, healthcare technology, energy storage, and next-generation semiconductors-sectors aligned with long-term structural growth trends. Together, they form a microcap…

Caregiver Sleep Study Finds 70% of Parents Wake Every Night; Mothers Spend 50% M …

New research presented at Sleep 2025 highlights a growing insomnia crisis among caregivers, with women bearing the greatest burden.

SAN FRANCISCO - If you're a parent of young kids, this probably won't surprise you: new research shows you're not sleeping. But the extent of the problem - and what it's doing to your health - might.

A study presented at the U.S. Sleep 2025 and World Sleep 2025 conferences tracked 983 adults…

More Releases for RCM

RCM Matter, a TechMatter Company, Introduces Next-Gen Medical Billing & RCM Soft …

GLENDALE, CA, UNITED STATES, August 27, 2025 -- RCM Matter, a subsidiary of TechMatter, announced the launch of its flagship product, a next-generation Medical Billing and Revenue Cycle Management (RCM) software solution that's built for modern-day healthcare practices. The platform empowers providers with automation, compliance, and transparency, helping them reduce administrative stress and strengthen financial performance.

Built from the ground up with healthcare teams in mind, the RCM software offers…

Healthcare RCM Outsourcing Market Report 2024 - RCM Outsourcing Market Trends, S …

"The Business Research Company recently released a comprehensive report on the Global Healthcare RCM Outsourcing Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive…

Investigation announced for Investors in R1 RCM Inc. (NASDAQ: RCM) over potentia …

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its shareholders.

Murray,…

Investigation announced for Investors who lost money with shares of R1 RCM Inc. …

An investigation was announced over potential securities laws violations by R1 RCM Inc. in connection with certain financial statements.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM), have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm focuses on possible claims on behalf of purchasers of the securities of R1 RCM Inc. (NASDAQ: RCM) concerning whether a…

Investigation announced for Investors in R1 RCM Inc. (NASDAQ: RCM) over potentia …

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its…

Investigation announced for Investors in shares of R1 RCM Inc. (NASDAQ: RCM)

An investigation was announced over potential breaches of fiduciary duties by certain officers and directors at R1 RCM Inc.

Investors who purchased shares of R1 RCM Inc. (NASDAQ: RCM) have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain R1 RCM Inc. directors breached their fiduciary duties and caused damage to the company and its shareholders.

Chicago,…