Press release

Past Car Finance, Present Consequences: Why Drivers Are Reviewing Old Agreements

A UK couple reviews old car finance paperwork at home, checking past agreement details as more drivers look back at PCP deals and potential mis-selling.

Manchester, UK - January 29, 2026 - A car finance deal might feel like something you leave behind once the car is sold or returned. But for many UK drivers, the cost of that agreement still matters today. With household budgets under pressure, more people are looking back and asking whether the deal they signed was fully explained, or whether car finance mis-selling [https://www.reclaim247.co.uk/claims-guide/pcp-refund-timelines-how-long-do-car-finance-claims-take/] played a part in what they ended up paying.

Reclaim247 is helping drivers get that clarity in a simple, practical way. Motorists can check for potential car finance claims and PCP claims in under a minute using just their name, address and date of birth. There's no paperwork to dig out, no lender details to remember, and no obligation to take things further if they do not want to.

"We hear from a lot of people who never thought to question the deal when they signed it," said Andrew Franks, Co-Founder of Reclaim247. "But now they want to know how the interest was set, if commission was added, or if they really had a choice of lenders. Those are fair questions, and they deserve clear answers."

Why Old Agreements Still Matter

Many drivers assumed their finance deal was standard. But some are now discovering that important details were not explained at the time. In PCP finance agreements, low monthly payments often drew attention away from the large balloon payment due at the end. Others were unaware that their broker had increased the interest rate to earn more commission.

These are just a few examples of car finance mis-selling that may lead to a valid car finance claim or PCP claim.

What the Regulator Found

The Financial Conduct Authority (FCA) has reviewed millions of car finance agreements signed between April 2007 and November 2024. It found several practices that may have resulted in mis-sold car finance [https://www.reclaim247.co.uk/claims-guide/car-finance-claims--refunds-how-to-claim-mis-sold-car-finance/], including:

Discretionary Commission Arrangements

Where the broker increased the customer's interest rate to boost their own commission, without making this clear.

Unfairly High Commissions

Where the amount paid to the broker was significantly higher than the size of the loan would usually justify.

Limited Finance Options

Where customers believed they were being shown a range of choices but were only offered one product.

Each of these issues could lead to a valid PCP claim or car finance claim. Even if the car was sold or returned long ago, the terms of the original agreement still matter.

Why PCP Claims Are Often Missed

PCP claims are common, yet many drivers do not realise they may have been affected. These agreements were often marketed as flexible and affordable. But the final payment or ownership terms were not always explained clearly. By the time the agreement ends, the real cost may be higher than expected.

"Some people only start asking questions when the final balloon payment arrives or when they look back and realise the deal didn't add up," said Franks. "That's often when a PCP claim comes into focus."

A Simple Way to Check for Mis-Sold Car Finance

Reclaim247 has created a free tool to help drivers check whether they may have been affected by car finance mis-selling. There is no need to find paperwork or contact your old lender. The process is based on a few simple details and takes less than a minute.

If signs of mis-sold car finance are found, the driver is referred to a regulated legal partner. The service is free to begin and operates on a no-win, no-fee basis.

Check the Past to Feel Confident About the Future

Drivers across the UK are beginning to treat car finance checks as part of everyday financial awareness. Whether you are managing a household budget, preparing to apply for a mortgage, or simply want to understand your past decisions better, checking for a car finance claim could be a smart step.

If you financed a car between April 2007 and November 2024, whether through PCP or hire purchase, Reclaim247 [https://www.reclaim247.co.uk/] can help you find out if a PCP claim or car finance claim may apply.

Start your free eligibility check at www.Reclaim247.co.uk

No documents required. No upfront cost. No pressure.

About Reclaim247

Reclaim247 is a UK-based claims management company that helps drivers check whether they may be affected by mis-sold car finance. The platform supports both PCP claims and car finance claims, offering a document-free process backed by regulated legal partners. The service is free to begin and operates on a no-win, no-fee basis.

Media Contact

Company Name: Reclaim247

Contact Person: Andrew Franks

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=past-car-finance-present-consequences-why-drivers-are-reviewing-old-agreements]

Country: United Kingdom

Website: https://www.reclaim247.co.uk/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Past Car Finance, Present Consequences: Why Drivers Are Reviewing Old Agreements here

News-ID: 4369751 • Views: …

More Releases from ABNewswire

Hypoglycemia Pipeline 2025: MOA and ROA Insights, Clinical Trials Status, and Ke …

(Las Vegas, Nevada, United States) As per DelveInsight's assessment, globally, Hypoglycemia pipeline constitutes 10+ key companies continuously working towards developing 12+ Hypoglycemia treatment therapies, analysis of Clinical Trials, Therapies, Mechanism of Action, Route of Administration, and Developments analyzes DelveInsight.

The Hypoglycemia Pipeline report embraces in-depth commercial and clinical assessment of the pipeline products from the pre-clinical developmental phase to the marketed phase. The report also covers a detailed description of the…

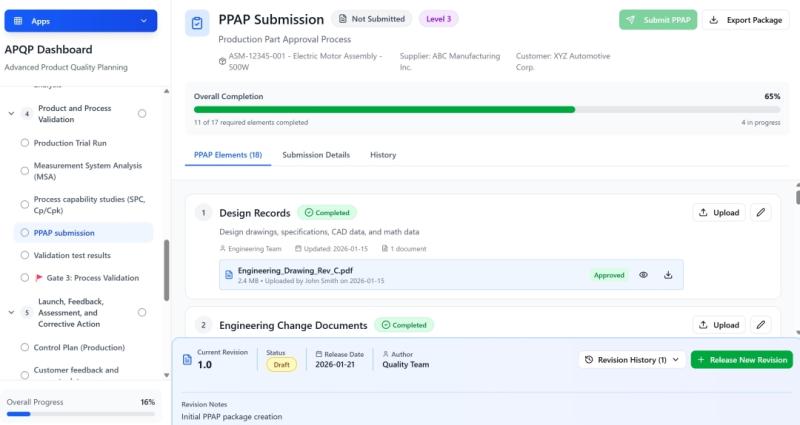

Excedify Launches AI-Powered APQP Management Software for End-to-End Product & P …

Excedify has launched a new AI-powered APQP management software designed to eliminate fragmented quality tools and manual coordination. The platform connects Voice of Customer, requirements, BOMs, FMEAs, phases, gates, timelines, teams, and release management in one synchronized system, helping engineering and quality teams execute APQP faster, with full traceability and audit readiness.

Germany - Excedify, a leading provider of engineering and quality training, today announced the launch of its new APQP…

Why SaaS Waste Is the Silent Drain on Growing Businesses

As businesses embrace digital tools, software-as-a-service, or SaaS, has become essential to day-to-day operations. From project management and communication platforms to specialised software, companies increasingly rely on multiple subscriptions to keep teams productive and competitive.

Yet managing these subscriptions can quickly become a challenge. Employees often sign up for new tools, abandon others, or even leave the company without cancelling accounts, leaving businesses paying for services they no longer use. Over…

Phoenix Auto Repair Shop Recognized for Nearly Three Decades of Honest Vehicle S …

J-N-J Auto Service, a family-owned Phoenix shop since 1997, delivers ASE-certified repairs for all makes and models with honest pricing and a 12-month/12K-mile warranty.

Phoenix, AZ - A family-owned auto repair shop [https://maps.app.goo.gl/rBv51GPGpgN4M6fWA] on West Cactus Road has quietly built a reputation that speaks louder than any billboard. Since 1997, J-N-J Auto Service has been the go-to destination for Phoenix drivers who want straight answers and dependable results. The shop, staffed…

More Releases for PCP

PCP Claims Surge as More Drivers Discover Undisclosed Commission Issues

Thousands of UK drivers are now uncovering potential car finance claims after learning their broker may have received hidden commissions. Reclaim247 is supporting the rise in PCP claims and mis-sold car finance cases by offering a simple, document-free eligibility check with no win no fee support.

Manchester, UK - January 2, 2026 - Drivers across the UK are beginning to ask serious questions about the fairness of their old car finance…

Reclaim247 Boosts Car Finance Claims Support as Drivers Revisit PCP Agreements

With concerns growing over hidden interest charges, Reclaim247 is stepping up efforts to help drivers understand past PCP and car finance agreements, and what action might now be possible.

Reclaim247 is increasing its support for drivers across the UK who are re-examining older car finance agreements, particularly Personal Contract Purchase (PCP) and Hire Purchase contracts.

The company, co-founded by Andrew Franks, has seen a sharp rise in the number of people wanting…

PCP Claimsline Strengthens Operations to Support Growing Wave of PCP Compensatio …

As PCP claims soar following the FCA's car finance review, PCP Claimsline is expanding its services to meet demand. The company remains committed to helping UK drivers with ethical, expert support through free eligibility checks and a No-Win, No-Fee model.

PCP Claimsline is expanding its services significantly due to increased demand after a rise in Personal Contract Purchase (PCP) claims throughout the UK. The company continues to strengthen its stance as…

Pneumocystis Carinii Pneumonia (PCP) Market - Industry Trends and Forecast to 20 …

Pneumocystis carinii pneumonia (PCP) market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses the market is growing at a CAGR of 3.75% in the above-mentioned research forecast period. Increase prevalence of HIV and increasing demand of novel treatments.

Market research analysis data included in this report lend a hand to businesses for planning of strategies related to investment, revenue generation,…

Progressive Cavity Pump (PCP) Market to Reach USD 4.36 Billion by 2028

Market Overview:

The Progressive Cavity Pump (PCP) Market Is Estimated To Grow From USD 3.10 Billion In 2021 To USD 4.36 Billion By 2028 At A CAGR Of 5% During The Forecast Period 2022- 2028.

A progressive cavity pump uses the displacement concept. Progressive cavity pumps are typically used for handling viscous fluids with high flow rates and high discharge pressures. Progressive cavity pumps are often used for liquids from sewage treatment…

Contracts Awarded for the Third and Final Phase of SELECT for Cities Pre-Commerc …

SELECT for Cities is pleased to announce that three contractors have been awarded contracts to start the third and final phase of its Pre-commercial Procurement (PCP).

SELECT for Cities started its pre-commercial procurement (PCP) to obtain R&D services to develop and build large-scale, city-wide, Internet-of-everything platforms to facilitate collaboration and open innovation. The process is highly competitive, and during the previous Phase II five companies produced platform prototypes which used open…