Press release

Retail Banking Market Revenue Modeling and Strategic Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Retail Banking Market Size, Share & Trends Analysis Report By Type (Public Sector Banks, Private Sector Banks, Foreign Banks), By Service (Saving & Checking Accounts, Credit & Debit Cards), Region, Market Outlook And Industry Analysis 2034"The global retail banking market is estimated to reach over 3591.16 billion by the year 2034, exhibiting a CAGR of 6.2% during the forecast period.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/1904

Retail banking, also referred to as personal or consumer banking, encompasses a comprehensive suite of financial services designed specifically for individual clients rather than corporate entities. These services provide secure and convenient solutions for managing personal finances, accessing credit, and utilizing deposit-based products. Growth in household debt, fueled by rising domestic consumption, has emerged as a key driver of economic activity across multiple regions. Simultaneously, there is a pronounced shift in consumer behavior toward digital banking platforms-including online and mobile channels-that enhance service accessibility and are expected to sustain sector growth.

To remain competitive and meet evolving customer expectations, both established financial institutions and emerging market players are increasingly integrating advanced technologies into their operations. Solutions such as artificial intelligence (AI), robotic process automation (RPA), robo-advisory services, and digital identity verification systems are being deployed to enable more personalized, efficient, and cost-effective service delivery while also optimizing operational performance and profitability.

In addition, the retail banking sector is benefiting from favorable macroeconomic conditions, including a growing working-age population, improved economic resilience, and increased public investment in banking infrastructure. Government-led initiatives aimed at promoting financial inclusion-particularly those focused on expanding access to banking services-are further driving market expansion by broadening the customer base and fostering deeper financial engagement.

List of Prominent Players in the Retail Banking Market:

• BNP Paribas

• Citigroup, Inc

• HSBC Group

• ICBC

• JP Morgan Chase & Co

• Bank of America Corporation; Barclays

• China Construction Bank

• Deutsche Bank AG

Mitsubishi UFJ Financial Group, Inc.

• Wells Fargo

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-02

Market Dynamics

Drivers:

The global retail banking sector is experiencing sustained growth, driven primarily by the expansion of financial products and services tailored to individual consumers. Financial institutions are increasingly broadening their portfolios to incorporate investment-focused solutions, including wealth management, retirement planning, financial advisory, brokerage services, and premium offerings for high-net-worth clients.

The extensive adoption of digital banking platforms-encompassing online and mobile channels-has further enhanced operational efficiency, reduced costs, and improved customer engagement. Market growth is also supported by value-added services such as real-time loan approvals, competitive interest rates on deposit accounts, minimal maintenance fees, and streamlined digital onboarding processes facilitated by video-enabled Know Your Customer (KYC) solutions.

Challenges:

Despite promising growth prospects, the retail banking sector faces several challenges. The accelerated shift toward digitalization has introduced complex operational and strategic requirements, including the need for robust partnerships, stringent data protection measures, and comprehensive cybersecurity frameworks to mitigate information security risks. In addition, heightened regulatory oversight and the increasing incidence of non-performing assets pose significant risks that may impede long-term market expansion.

Regional Trends:

North America is projected to maintain a dominant position in the global retail banking market, supported by favorable macroeconomic conditions, high per capita income, a growing population, and government initiatives promoting financial inclusion through expanded access to banking services. The Asia-Pacific region, however, is anticipated to witness the fastest growth, particularly in emerging economies such as China, India, Malaysia, and Indonesia.

This expansion is driven by demographic dynamics-including a rising working-age population-greater digital connectivity, and increasing adoption of financial services. Unlike regions where open banking is mandated through regulation, the United States is experiencing a market-led transition, with financial institutions progressively aligning with global standards for API integration and data sharing to enhance customer experience and service delivery.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/1904

Recent Developments:

• In May 2021-According to its plan to refocus on corporate and investment banking in Asia, HSBC stated that it is leaving the retail and small business banking sector in the United States.

• In November 2020-Wells Fargo launched a new method to assist business customers in stopping using paper checks. The method involves utilizing one-time virtual card numbers to pay payments online using the wellsone virtual card payments service.

Segmentation of Retail Banking Market-

By Type

• Public Sector Banks

• Private Sector Banks

• Foreign Banks

• Community Development Banks

• Non-banking Financial Companies (NBFC)

By Service

• Saving and Checking Account

• Transactional Account

• Personal Loan

• Home Loan

• Mortgages

• Debit and Credit Cards

• ATM Cards

• Certificates of Deposits

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/retail-banking-market-/1904

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: https://www.insightaceanalytic.com/

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Retail Banking Market Revenue Modeling and Strategic Forecast 2026 to 2035 here

News-ID: 4368632 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

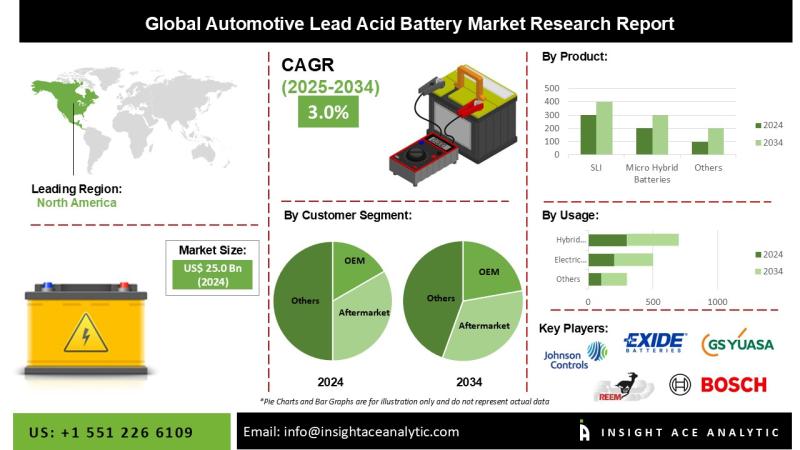

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

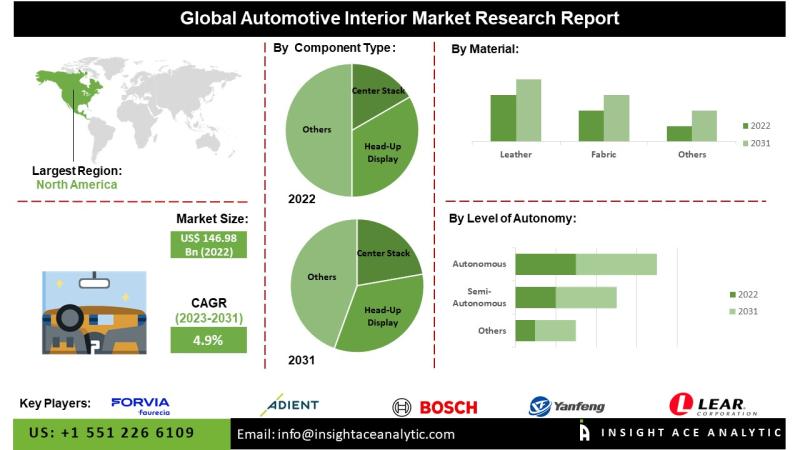

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

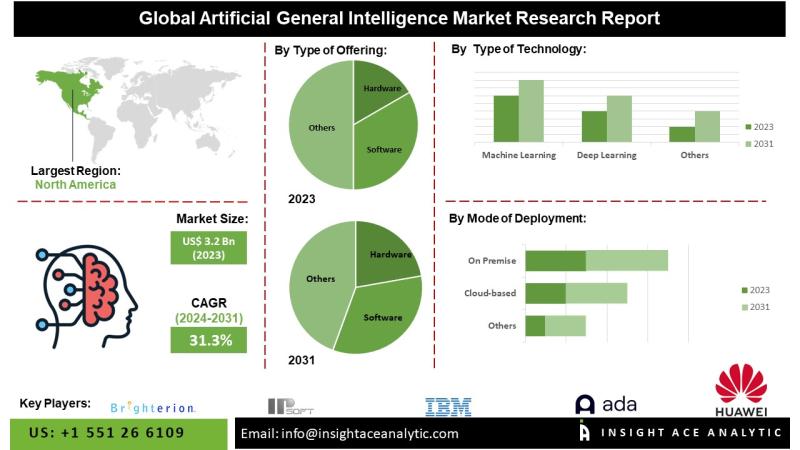

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

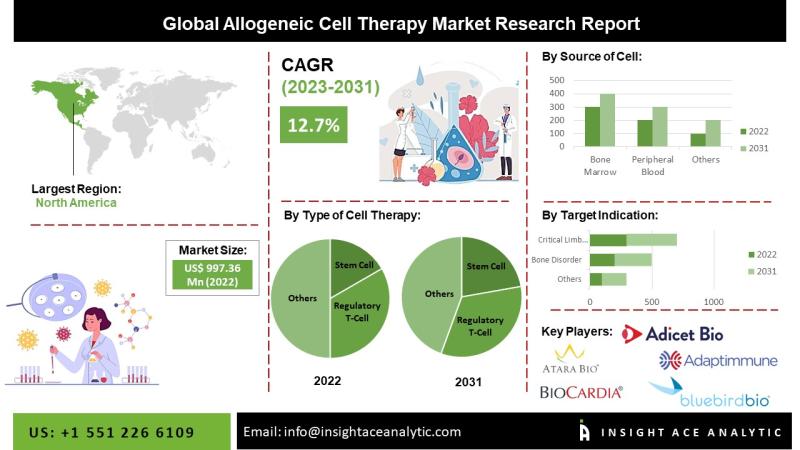

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…