Press release

Manhattan Real Estate Attorney Natalia Sishodia Explains How to Avoid Mortgage Recording Tax in New York

NEW YORK, NY - Buyers financing real estate purchases in Manhattan face one of the highest mortgage recording taxes in the country, often exceeding 2% of their loan amount. Manhattan real estate attorney Natalia Sishodia of Sishodia PLLC (https://sishodia.com/how-do-i-avoid-mortgage-recording-tax-in-ny/) explains strategies buyers can use to reduce or eliminate this significant closing cost through CEMA transactions and co-op purchases.According to Manhattan real estate attorney Natalia Sishodia, New York's mortgage recording tax is a combined state and local tax imposed when a mortgage is recorded with the county clerk. The tax applies to all new mortgages and refinances on real property, including condos, townhouses, and single-family homes. In Manhattan, the combined tax typically reaches approximately 2.05% to 2.175% of the mortgage amount for residential properties.

Manhattan real estate attorney Natalia Sishodia notes that the tax rate depends on both the loan amount and property type. For typical one to three-family homes and individual condo units in NYC, buyers generally pay roughly 1.8% on loans under $500,000 or 1.925% on loans of $500,000 or more. "On a typical $600,000 Manhattan condo mortgage, you'll pay approximately $13,050 in mortgage recording tax, including $11,550 from the borrower and $1,500 from the lender," Sishodia explains. "This represents more than 2% of your loan amount and is due at closing."

The most effective strategy to avoid the tax entirely involves purchasing a co-op apartment instead of a condo. Sishodia emphasizes that co-op ownership is considered personal property under New York law rather than real property. When financing a co-op purchase, lenders take a security interest in the shares and proprietary lease through a UCC filing, which does not trigger mortgage recording tax because it does not involve real property.

For buyers who prefer condos or houses, a CEMA (Consolidation, Extension, and Modification Agreement) can significantly reduce the tax burden. "A CEMA lets your lender assign and consolidate the seller's existing mortgage with your new loan," notes Sishodia. "Because you consolidate the old and new mortgages rather than recording an entirely new mortgage, you pay mortgage recording tax only on the difference between the two loans."

In a purchase CEMA transaction, the seller's lender assigns the existing mortgage to the buyer's lender, which then consolidates that balance with any additional amount being borrowed. If the seller has a $300,000 mortgage balance and the buyer needs to borrow $500,000, the buyer pays mortgage recording tax only on the $200,000 difference, saving approximately $3,600 to $3,850 compared to paying tax on the full loan amount.

Attorney Sishodia advises that successful CEMA transactions require cooperation from both lenders and the seller. The seller must have a substantial remaining mortgage balance for the strategy to provide meaningful savings. "While CEMAs add $1,500 to $2,000 or more in fees and can extend your closing timeline, the mortgage recording tax savings often exceed $5,000, making it worthwhile for many Manhattan buyers," Sishodia observes.

In certain transactions involving one to three family homes and individual condo units, a CEMA can also reduce the seller's transfer tax liability. When structured properly, the buyer is treated as a continuing part of the seller's existing mortgage rather than paying that portion as new consideration subject to transfer tax. Because sellers may pay less in transfer tax, many are willing to cooperate with a CEMA when buyers offer to share the total tax savings.

For refinance transactions, a CEMA works similarly. The current or new lender extends and modifies the existing mortgage rather than paying it off and recording a completely new one. Borrowers pay the mortgage recording tax only on any additional amount beyond their current principal balance. "If the current mortgage balance is $400,000 and you refinance for $450,000, you pay tax only on the $50,000 increase," Sishodia points out. "Without a CEMA, you'd typically pay tax on the full $450,000."

Mortgages on Manhattan properties are recorded with the Office of the City Register through the ACRIS system, which maintains digital records of all mortgages, deeds, and other property documents recorded in Manhattan since 1966. When buyers close on a property purchase or refinance, their title company or attorney submits mortgage documents through ACRIS, which calculates the tax owed and allows electronic payment. The eRecording process can provide faster notifications compared to paper workflows.

Understanding these tax reduction strategies requires careful coordination with experienced counsel and cooperative lenders. Buyers should address CEMA arrangements early in negotiations, ideally as part of their initial offer, to avoid disputes later. For those purchasing real estate in Manhattan, working with knowledgeable legal counsel can help structure transactions that minimize tax liability while protecting their interests.

About Sishodia PLLC:

Sishodia PLLC is a New York-based law firm focused on real estate, business, estate planning, elder law, and taxation. Led by attorney Natalia A. Sishodia, Esq., the firm represents clients throughout Manhattan and the greater New York City area in high-end transactions, including condo and co-op purchases and sales, new development purchases, conversions, leasing, and 1031 exchanges. For consultations, call (833) 616-4646.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=oqYDf-JHfz8

GMB: https://www.google.com/maps?cid=12450537318741950980

Email and website

Email: natalia@sishodialaw.com

Website: https://sishodia.com/

Media Contact

Company Name: Sishodia PLLC

Contact Person: Natalia A. Sishodia

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=manhattan-real-estate-attorney-natalia-sishodia-explains-how-to-avoid-mortgage-recording-tax-in-new-york]

Phone: (833) 616-4646

Address:600 3rd Ave 2nd floor

City: New York

State: New York 10016

Country: United States

Website: https://sishodia.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Manhattan Real Estate Attorney Natalia Sishodia Explains How to Avoid Mortgage Recording Tax in New York here

News-ID: 4367627 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

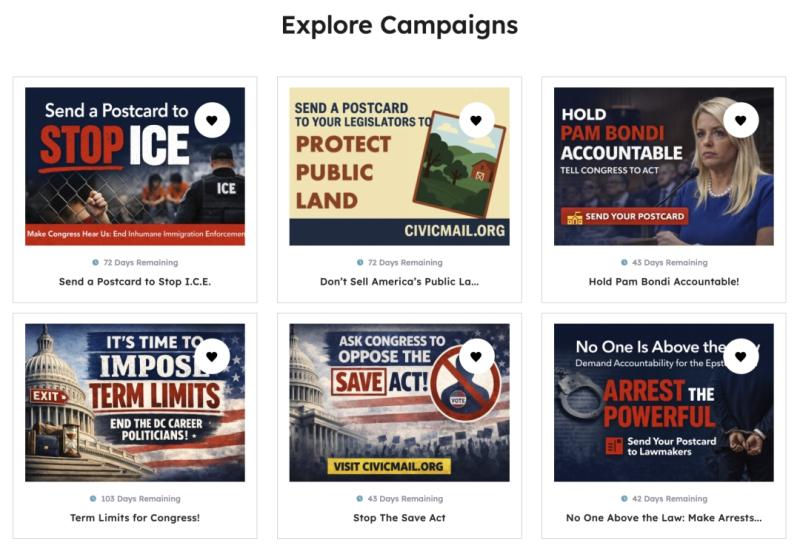

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Sishodia

New York Foreign Investment Lawyer Natalia A. Sishodia of Sishodia PLLC Breaks D …

NEW YORK, NY - For international investors looking to enter the New York real estate market, the range of property types available is broad and flexible. New York foreign investment lawyer Natalia A. Sishodia, of Sishodia PLLC (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), explains that non-U.S. citizens can purchase nearly any type of property across the city's five boroughs. From high-rise condos in Midtown to brownstones on the Upper West Side, foreigners have access to…

New York Foreign Investment Lawyer Natalia A. Sishodia of Sishodia PLLC Breaks D …

NEW YORK, NY - For international investors looking to enter the New York real estate market, the range of property types available is broad and flexible. New York foreign investment lawyer Natalia A. Sishodia, of Sishodia PLLC (https://sishodia.com/what-type-of-property-can-a-foreigner-buy-in-new-york/), explains that non-U.S. citizens can purchase nearly any type of property across the city's five boroughs. From high-rise condos in Midtown to brownstones on the Upper West Side, foreigners have access to…

Manhattan Deed Transfer Lawyer Natalia A. Sishodia Clarifies New York Transfer T …

Transferring real estate in New York requires careful attention to legal and tax obligations that can have long-term consequences. Natalia A. Sishodia (https://sishodia.com/do-i-need-to-pay-transfer-taxes-when-transferring-title/), a Manhattan deed transfer lawyer at Sishodia PLLC, outlines key considerations property owners should understand when changing a property's title through sale, inheritance, gift, or restructuring. In New York, real estate transfers typically involve the payment of transfer taxes, which can significantly affect the cost and timeline…

NYC Condo Attorney Natalia Sishodia Provides Insights on Manhattan Real Estate T …

NYC condo attorney [https://sishodia.com/manhattan-condo-real-estate-attorney/] Natalia Sishodia discusses key aspects of Manhattan real estate transactions, helping buyers and sellers navigate purchasing or selling a condominium in the city. With the competitive nature of the real estate market, having an understanding of legal requirements and potential challenges is essential. Sishodia PLLC provides guidance on contract negotiations, due diligence, and closing processes for those involved in condo transactions.

As an NYC condo attorney, Natalia…

Manhattan Deed Transfer Lawyer Natalia Sishodia Releases Insightful Article on P …

Manhattan deed transfer lawyer Natalia Sishodia (https://sishodia.com/manhattan-deed-transfer-lawyer/), of Sishodia PLLC, highlights the essential role of deed transfers in real estate transactions. A deed, which serves as the official document transferring property ownership from one party to another, is foundational in establishing clear and lawful property rights. Handling these transfers properly is critical to avoiding costly disputes or legal challenges.

A deed transfer is not just about signing paperwork. As Manhattan deed…

New York Estate Probate Lawyer Natalia Sishodia Explains the Probate Sale Proces …

Probate sales play an important role in settling estates after the death of a loved one. According to New York estate probate lawyer Natalia Sishodia (https://sishodia.com/what-is-a-probate-sale/) of Sishodia PLLC, a probate sale involves selling property under court supervision to meet the financial obligations of the deceased, such as debts and taxes, before distributing any remaining assets to beneficiaries. This legal process ensures that everything is conducted fairly, especially when real…