Press release

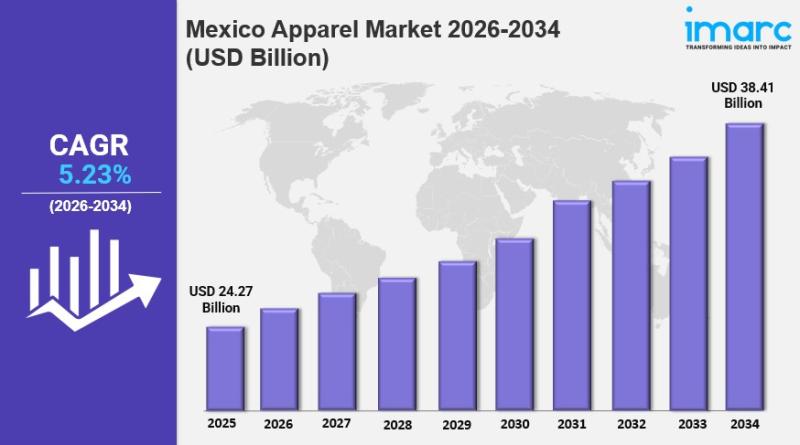

Mexico Apparel Market 2026 : Industry Size to Reach USD 38.41 Billion by 2034, At a CAGR of 5.23%

IMARC Group has recently released a new research study titled "Mexico Apparel Market Size, Share, Trends and Forecast by Type, Type of Fiber, End User, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Market Overview

The Mexico apparel market was valued at USD 24.27 Billion in 2025 and is forecasted to reach USD 38.41 Billion by 2034. It is expected to grow at a compound annual growth rate (CAGR) of 5.23% during the forecast period of 2026 to 2034. Growth is driven by rising disposable incomes, urbanization, evolving fashion trends, and increasing access to offline and online shopping. The influence of social media and connectivity is also changing consumer behavior.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Mexico Apparel Market Key Takeaways

● Current Market Size: USD 24.27 Billion in 2025

● CAGR: 5.23% from 2026-2034

● Forecast Period: 2026-2034

● Casual wear leads the market with a 43% share in 2025 driven by lifestyle preference shifts toward comfortable, versatile clothing.

● Man-made fibers dominate with a 45% share in 2025 due to cost-effectiveness and durability.

● Women are the largest end-user segment at 43% market share in 2025, influenced by workforce participation and social media.

● Offline distribution channels hold 70% market share in 2025, favored for tactile shopping experiences.

● Northern Mexico holds the largest regional share at 33% in 2025, supported by industrial cities like Monterrey and proximity to US trade routes.

Sample Request Link: https://www.imarcgroup.com/mexico-apparel-market/requestsample

Mexico Apparel Market Growth Factors

Rising disposable income and expanding middle-class households are significantly boosting consumer spending on apparel across Mexico. Economic development has seen Mexican consumer spending reach approximately 1.257 trillion US dollars in 2023, marking a 21.8% increase from 2022. This improved economic capacity translates directly into increased clothing expenditure as consumers prioritize fashion both as personal expression and a social status indicator. Continued growth in formal employment and service sector jobs further strengthen household purchasing power for discretionary goods like apparel.

Rapid digital adoption is revolutionizing apparel purchasing behaviors across Mexico. The strong internet infrastructure supports increasing e-commerce penetration where clothing is among the most favored online purchase categories. The Mexico e-commerce market size reached USD 54.4 Billion in 2025 and is anticipated to grow to USD 175.8 Billion by 2034, achieving a CAGR of 13.92% between 2026 and 2034. Smartphone penetration drives mobile commerce, accounting for over two-thirds of total e-commerce purchases, enabling consumers broader access to domestic and international retail offerings.

International fast-fashion brands have started recognizing Mexico's market potential, expanding retail presence nationwide. The influx of international brands enhances product variety and quality while fostering competitive pricing. Collaborations between these global brands and domestic distributors improve market tailoring to local consumer preferences. The entry of high-end and fast-fashion brands via flagship stores, franchises, and joint ventures highlights sustained faith in Mexico's fast-growing apparel industry and supports continuous market expansion.

Buy Report Now: https://www.imarcgroup.com/checkout?id=22169&method=3682

Mexico Apparel Market Segmentation

Breakup by Type:

● Formal Wear

● Casual Wear

● Sportswear

● Nightwear

● Others

Casual wear dominates with a 43% market share in 2025, driven by evolving lifestyle preferences favoring comfortable and versatile clothing suitable for diverse occasions. Urbanization and global fashion influence accelerate demand among young, fashion-conscious consumers seeking trendy yet affordable daily apparel.

Breakup by Type of Fiber

● Man-Made Fibers

● Cotton Fibers

● Animal-Based Fibers

● Vegetable Based Fibers

Man-made fibers, including polyester and nylon, lead with a 45% share in the market in 2025 due to cost-effectiveness, durability, and versatility across apparel types. Technological advancements and demand for performance and athleisure wear bolster this segment.

Breakup by End User

● Men

● Women

● Children

Women represent the largest segment at 43% market share in 2025, driven by purchasing power, diverse fashion needs, and increasing influence of social media and ethical fashion trends. The segment spans casual, formal, athleisure, and occasion wear.

Breakup by Distribution Channel

● Online

● Offline

Offline channels hold 70% of the market in 2025, supported by consumer preference for physical stores offering product evaluation and immediate purchase gratification. Department stores and specialty retailers remain key outlets.

Breakup by Region

● Northern Mexico

● Central Mexico

● Southern Mexico

● Others

Northern Mexico is the leading region with a 33% market share in 2025, benefiting from industrial economic strength, modern retail infrastructure, and proximity to US trade routes, particularly in cities like Monterrey.

Regional Insights

Northern Mexico dominates with a 33% market share in 2025. The region's higher income levels, industrial economic base, and developed retail infrastructure in Monterrey and surrounding cities underpin strong apparel consumption. Its strategic location near US trade routes enables robust manufacturing and distribution activities, strengthening its position as Mexico's leading apparel market hub.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22169&flag=C

Recent Developments & News

● In January 2024, Spanish brands Pdpaola, Blue Banana, and Hoff expanded into Mexico, with Hoff opening 15 franchise stores featuring outdoor-inspired casual fashionwear, indicating investor confidence in casual apparel growth.

● In November 2024, Onitsuka Tiger and PATOU launched a joint apparel and footwear collection in Mexico, signaling growth in luxury streetwear.

● In June 2024, TJX entered the Mexican market via a joint venture with Grupo Axo, acquiring a 49% stake in off-price retail chains Promoda, Reduced, and Urban Store, operating over 200 stores.

Key Players

● Pdpaola

● Blue Banana

● Hoff

● Onitsuka Tiger

● PATOU

● TJX

● Grupo Axo

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Apparel Market 2026 : Industry Size to Reach USD 38.41 Billion by 2034, At a CAGR of 5.23% here

News-ID: 4367433 • Views: …

More Releases from IMARC Group

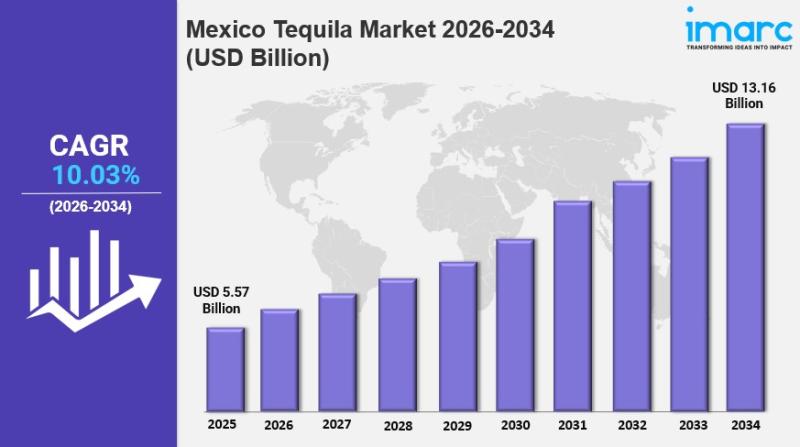

Mexico Tequila Market Size, Share, Industry Trends, Growth Factors and Forecast …

IMARC Group has recently released a new research study titled "Mexico Tequila Market Size, Share, Trends and Forecast by Product Type, Purity, Price Range, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico tequila market size was valued at USD 5.57 Billion in 2025 and is projected to reach…

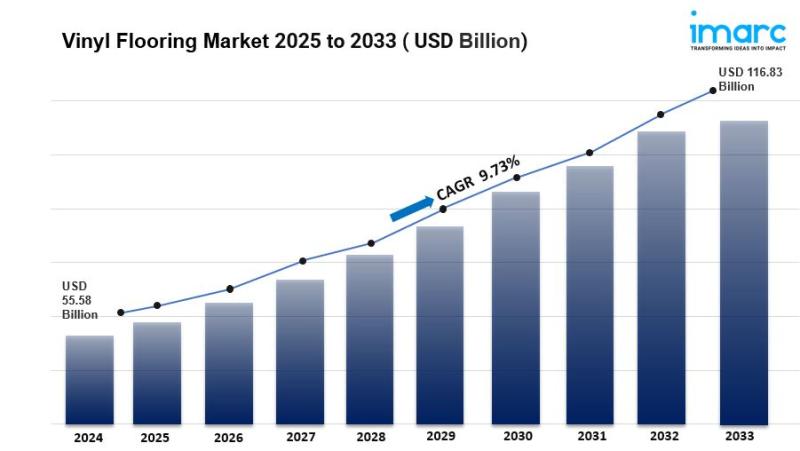

Global Vinyl Flooring Market Size, Share, Growth & Trends Report 2033

Vinyl Flooring Market Overview:

The global vinyl flooring market was valued at USD 55.58 Billion in 2024 and is projected to reach USD 116.83 Billion by 2033, exhibiting a CAGR of 9.73% during the forecast period from 2025 to 2033. The market is dominated by the Asia Pacific region, which accounted for over 52.2% of the market share in 2024. Factors such as increasing construction projects, affordability of vinyl flooring, and…

India Plant Based Protein Market Share, Size, Growth Rate & Forecast Report 2033

According to IMARC Group's report titled "India Plant Based Protein Market Size, Share, Trends and Forecast by Source, Type, Nature, Application, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plant Based Protein Market Overview

The India plant based protein market size reached USD 552.4 Million in 2024 and is projected to reach USD 1,916.1 Million by 2033, growing at…

Hydrochloric Acid Prices 2026: Latest Insights, Price Movement, and Forecast

Northeast Asia Hydrochloric Acid Prices Movement January 2026:

In January 2026, hydrochloric acid prices in Northeast Asia increased, supported by rising demand from steel pickling, chemicals, and electronics manufacturing sectors. Higher operating rates at downstream industries lifted consumption. While production remained steady, limited inventories and increased transportation costs added upward pressure, resulting in firmer pricing across key industrial hubs in the region.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/hydrochloric-acid-pricing-report/requestsample

Note: The analysis can be…

More Releases for Mexico

Egg Freezing in Mexico: Leading Mexico City Clinics Launch 2026 Programs

Enlistalo Fertilidad offers expanded egg freezing services for international patients, including Americans, seeking fertility preservation.

Mexico City, Mexico - January 22, 2026 - Egg freezing is becoming an increasingly popular option for patients worldwide, and Mexico City continues to emerge as a leading destination for those seeking high-quality, affordable fertility care.

In 2026, Enlistalo Fertilidad stands out for its personalized approach, advanced medical standards, and focus on supporting international patients through every…

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…