Press release

Activated Carbon Production Cost Report 2026: Detailed Guide on Plant Setup, CapEx/OpEx and Profitability

The global environmental and industrial sectors are experiencing a transformative shift driven by escalating pollution control requirements, stringent water quality regulations, and expanding purification applications across multiple industries. At the core of these developments lies a critical material-activated carbon. As municipalities, industries, and consumers increasingly demand effective solutions for air purification, water treatment, and industrial process applications, establishing an activated carbon production plant presents a strategically compelling business opportunity for entrepreneurs and industrial investors seeking to capitalize on this steadily expanding market driven by environmental protection imperatives.IMARC Group's report, "Activated Carbon Production Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," offers a comprehensive guide for establishing a production plant. The activated carbon production plant cost report offers insights into the production process, financials, capital investment, expenses, ROI, and more for informed business decisions.

Request for a Sample Report: https://www.imarcgroup.com/activated-carbon-manufacturing-plant-project-report/requestsample

Market Overview and Growth Potential

The global activated carbon market demonstrates solid growth trajectory, valued at USD 489.54 Million in 2025. According to IMARC Group's comprehensive market analysis, the market is projected to reach USD 802.12 Million by 2034, exhibiting a steady CAGR of 5.64% from 2026-2034. This sustained expansion is driven by increasing demand for air, water, and industrial process purification applications across diverse sectors.

Activated carbon, also known as activated charcoal, possesses a highly porous structure providing exceptional surface area for adsorbing undesired contaminants in gas, liquid, or solid form. This versatile material is manufactured through controlled pyrolysis of carbon-containing raw materials such as coal, coconut shells, or peat at elevated temperatures in the presence of oxidizing gases. The resulting product exhibits remarkable adsorption properties making it indispensable across water treatment, food and beverage processing, pharmaceutical manufacturing, automotive emissions control, mining operations, and air purification systems.

According to UNFPA projections, more than half of the world's population now lives in cities and towns, with this number estimated to increase to approximately 5 billion by 2030. This accelerating urbanization trend is driving heightened concerns about industrial pollution, water quality, and air quality, creating sustained demand for activated carbon solutions in both municipal and industrial applications. The growing emphasis on sustainable and renewable materials, particularly coconut shell-derived activated carbon, aligns with increasing focus on eco-friendly manufacturing practices.

Plant Capacity and Production Scale

The proposed activated carbon production facility is designed with an annual production capacity ranging between 10,000-20,000 MT per year, enabling economies of scale while maintaining operational flexibility. This capacity range allows manufacturers to serve diverse market segments-from municipal water treatment facilities and industrial chemical processing to pharmaceutical applications and automotive emissions control-ensuring steady demand and consistent revenue streams across multiple industry verticals.

Financial Viability and Profitability Analysis

The activated carbon production business demonstrates healthy profitability potential under normal operating conditions. The financial projections reveal attractive margins supported by technical value-addition and diverse application markets:

• Gross Profit Margins: 35-45%

• Net Profit Margins: 15-20%

These margins are notably higher than many commodity chemical products, supported by stable demand across environmental and industrial sectors, substantial technical value addition through activation processes, and the critical nature of activated carbon in regulatory compliance applications. The project demonstrates strong return on investment (ROI) potential, making it an attractive proposition for both new entrants and established industrial players looking to diversify their product portfolio in the environmental materials sector.

Buy Now: https://www.imarcgroup.com/checkout?id=9187&method=2175

Operating Cost Structure

Understanding the operating expenditure (OpEx) is crucial for effective financial planning and cost management. The cost structure for an activated carbon production plant reflects both raw material requirements and energy-intensive processing:

• Raw Materials: 50-60% of total OpEx

• Utilities: 25-30% of OpEx

• Other Expenses: Including labor, packaging, transportation, maintenance, depreciation, and taxes

Coconut shells, coal, or wood constitute the primary carbon-rich feedstock materials. The significant utilities component reflects the energy-intensive nature of carbonization and activation processes, which require controlled high-temperature operations. Establishing long-term contracts with reliable biomass or coal suppliers helps mitigate price volatility and ensures consistent material supply. The cost structure balance between raw materials and energy inputs emphasizes the importance of both feedstock management and operational efficiency in maintaining competitive production economics.

Capital Investment Requirements

Setting up an activated carbon production plant requires substantial capital investment across several critical categories:

Land and Site Development: Selection of an optimal location with strategic proximity to feedstock suppliers (coconut shell sources, coal mines, or forestry operations), target industrial markets, and robust infrastructure including reliable transportation networks, utilities, and waste management systems. The site selection process must consider environmental impact assessments, regulatory compliance requirements, and adequate space for thermal processing operations and future expansion.

Machinery and Equipment: The largest portion of capital expenditure (CapEx) covers specialized manufacturing equipment essential for production. Key machinery includes:

• Crushers for raw material size reduction

• Carbonization furnaces for controlled pyrolysis

• Activation reactors (steam or chemical)

• Washing systems for impurity removal

• Drying ovens for moisture reduction

• Grinding mills for particle size control

• Screening units for product classification

• Packaging machines for finished product handling

Civil Works: Building construction, factory layout optimization, and infrastructure development designed to accommodate high-temperature operations, ensure workplace safety, and minimize material handling complexities throughout the production process.

Other Capital Costs: Pre-operative expenses, machinery installation costs, regulatory compliance certifications, initial working capital requirements, and contingency provisions for unforeseen circumstances during plant establishment.

Major Applications and Market Segments

Activated carbon finds extensive applications across diverse industrial and municipal sectors, demonstrating its versatility and critical importance:

Water Treatment: Municipal drinking water purification systems and industrial wastewater treatment facilities utilize activated carbon for removing organic contaminants, chlorine, taste, and odor compounds, ensuring compliance with stringent water quality standards.

Food and Beverage: Activated carbon serves critical purification roles in beverage processing, sugar refining, edible oil clarification, and food additive production, ensuring product quality and safety.

Pharmaceuticals: Pharmaceutical manufacturing employs activated carbon for API purification, solvent recovery, and process stream treatment, meeting stringent pharmaceutical-grade purity requirements.

Automotive: Automotive exhaust emission control systems incorporate activated carbon canisters for capturing fuel vapors and meeting environmental emission regulations.

Mining: Gold recovery operations extensively use activated carbon for selective adsorption of gold-cyanide complexes from leach solutions, representing a critical application in precious metals extraction.

Air Purification: Industrial air pollution control systems, residential air purifiers, and gas mask applications rely on activated carbon for removing volatile organic compounds, odors, and toxic gases.

End-use industries encompass municipal utilities, chemical processing, food manufacturing, pharmaceutical production, automotive manufacturing, mining operations, and environmental control systems, all contributing to sustained market demand.

Speak to an Analyst for Customized Report: https://www.imarcgroup.com/request?type=report&id=9187&flag=C

Why Invest in Activated Carbon Production?

Several compelling factors make activated carbon manufacturing an attractive investment opportunity:

Critical Environmental and Industrial Input: Activated carbon serves as a core material for water and wastewater treatment, air purification, emissions control, food and beverage processing, pharmaceutical manufacturing, and chemical production-making it indispensable for public health protection, environmental compliance, and industrial operations across multiple sectors.

Moderate but Defensible Entry Barriers: While capital requirements are reasonable compared to advanced chemical manufacturing, achieving consistent product quality, controlling pore structure development, mastering activation technology, securing reliable feedstock sources, and navigating long qualification cycles with municipal bodies and industrial clients create meaningful barriers favoring technically capable and quality-focused producers.

Strong Megatrend Alignment: Global expansion in clean water access initiatives, air pollution control requirements, environmental remediation projects, food safety standards, and pharmaceutical quality regulations drives sustained demand for activated carbon. Stricter environmental norms and sustainability initiatives accelerate adoption across sectors.

Policy and Regulatory Push: Rising scrutiny of environmental regulations regarding wastewater discharge, air pollutant emissions, and industrial effluents, combined with increased government expenditure on environmental infrastructure including sanitation, clean water, and pollution control, provides sustained support for long-term activated carbon demand.

Localization and Supply Chain Resilience: Municipal utilities and industrial customers increasingly favor local and regional suppliers to reduce import dependency, ensure responsive technical support, and minimize supply chain vulnerabilities. This preference creates substantial opportunities for domestic activated carbon producers to establish market presence and secure long-term supply relationships.

Manufacturing Process Excellence

The activated carbon production process involves several precision-controlled stages ensuring optimal adsorption properties and product performance:

• Raw Material Preparation: Processing of biomass, coal, or coconut shells through cleaning and size reduction prior to carbonization

• Carbonization: Thermal decomposition of raw materials in controlled, oxygen-limited environments at elevated temperatures to produce carbonized char

• Activation: Physical or chemical activation processes exposing carbonized material to steam or activating agents at high temperatures to develop extensive pore structure and dramatically increase surface area

• Post-Processing and Packaging: Crushing, sizing, washing, drying, and packaging of activated carbon products according to customer specifications and application requirements

Industry Leadership

The global activated carbon industry is led by established manufacturers with extensive production capabilities and diverse application portfolios. Key industry players include:

• Cabot Corporation

• Calgon Carbon Corporation

• Kuraray Co. Ltd.

• Jacobi Carbons

• Haycarb PLC

These companies serve diverse end-use sectors including water treatment, food and beverage, pharmaceuticals, automotive, mining, and air purification, demonstrating the broad market applicability of activated carbon manufacturing capabilities.

Recent Industry Developments

July 2025: Jacobi implemented a price increase of 15-20% across all coconut shell-based activated carbons, depending on product grade. This adjustment was necessitated by continued surge in raw material costs, reflecting broader market dynamics affecting feedstock availability and pricing.

May 2024: Calgon Carbon Corporation announced an exclusive agreement with Sprint Environmental Services, LLC to acquire its industrial reactivated carbon business, including 21 employees and an industrial carbon reactivation plant located outside Houston, Texas. This strategic acquisition expands Calgon's reactivation capacity and strengthens its service capabilities in the industrial activated carbon sector.

Browse Related Reports:

• Watch Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/watch-manufacturing-plant-project-report-2025-raw-materials-investment-setup-cost-and-revenue

• Soya Bean Processing Plant Cost: https://industrytoday.co.uk/manufacturing/soya-bean-processing-plant-cost-2025-raw-materials-unit-setup-and-revenue

• Pesticide Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/pesticide-manufacturing-plant-setup-2025-details-project-capital-investments-and-business-plan

• Nut Spread Manufacturing Plant Cost: https://industrytoday.co.uk/manufacturing/nut-spread-manufacturing-plant-cost-2025-detailed-project-report-unit-setup-and-investment-opportunities

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company excels in understanding its client's business priorities and delivering tailored solutions that drive meaningful outcomes. We provide a comprehensive suite of market entry and expansion services. Our offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: (+1-201-971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Activated Carbon Production Cost Report 2026: Detailed Guide on Plant Setup, CapEx/OpEx and Profitability here

News-ID: 4366835 • Views: …

More Releases from IMARC Group

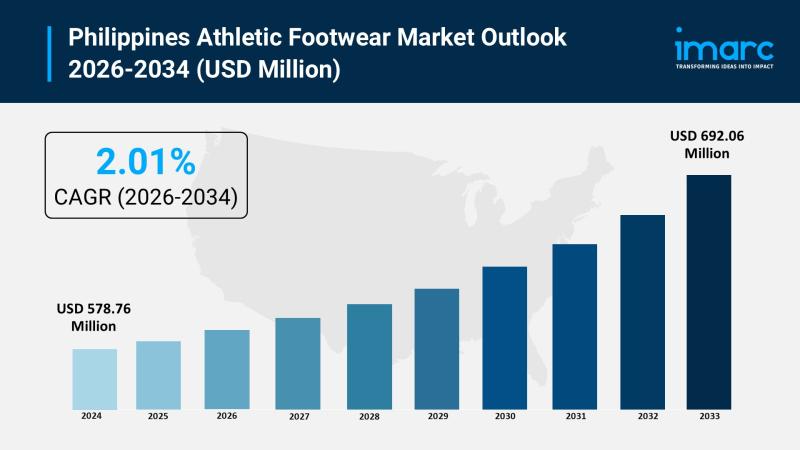

Philippines Athletic Footwear Market 2026 to Reach USD 692.06 Million by 2034 Am …

Market Overview

The Philippines athletic footwear market size was valued at USD 578.76 Million in 2025 and is projected to reach USD 692.06 Million by 2034, growing at a compound annual growth rate of 2.01% from 2026-2034. The market is expanding rapidly, driven by increasing health consciousness, fitness trends, and demand for stylish yet functional shoes. With a growing middle class and a focus on performance and comfort, the Philippines athletic…

IMARC Group: Philippines Lingerie Market 2026 | Poised for Rapid Growth at 6.70% …

Market Overview

The Philippines lingerie market size was valued at USD 433.27 Million in 2025 and is projected to reach USD 776.72 Million by 2034, growing at a compound annual growth rate (CAGR) of 6.70% during 2026-2034. The market is experiencing robust expansion driven by evolving consumer preferences, rising disposable incomes, and increasing emphasis on comfort and personal expression in intimate apparel. Urbanization and expanding retail infrastructure are reshaping purchasing patterns…

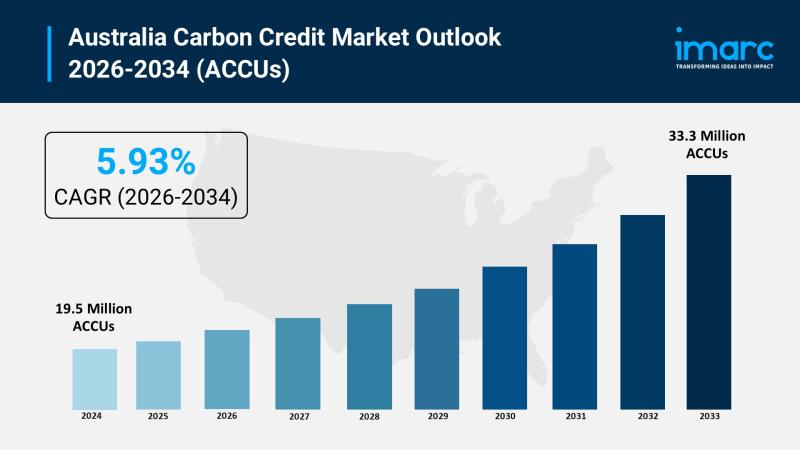

Australia Carbon Credit Market 2026 | Worth 33.3 Million ACCUs by 2034

Market Overview

The Australia carbon credit market size reached 19.5 Million ACCUs in 2025 and is projected to reach 33.3 Million ACCUs by 2034, exhibiting a CAGR of 5.93% during the forecast period 2026-2034. The industry is expanding significantly due to favorable government policies and regulations, increased dedication to corporate social responsibility, expanded international trade prospects, and significant expansion in renewable energy projects.

Request a Sample Report: https://www.imarcgroup.com/australia-carbon-credit-market/requestsample

How AI is Reshaping the…

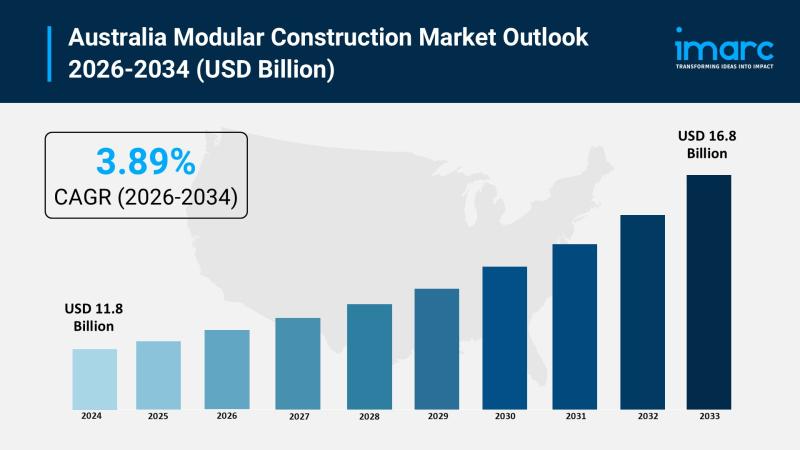

Australia Modular Construction Market 2026 | USD 16.8 Billion by 2034

Market Overview

The Australia modular construction market size reached USD 11.8 Billion in 2025 and is projected to reach USD 16.8 Billion by 2034, exhibiting a CAGR of 3.89% during the forecast period 2026-2034. The market is primarily driven by government infrastructure support, increasing housing demand, environmental considerations, and technological advances addressing the rising demand for efficient, adaptable housing solutions in urban and remote areas across the country.

Request a Sample Report:…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…