Press release

Venture Capital Market Future Growth Hotspots and Forecast 2026 to 2035

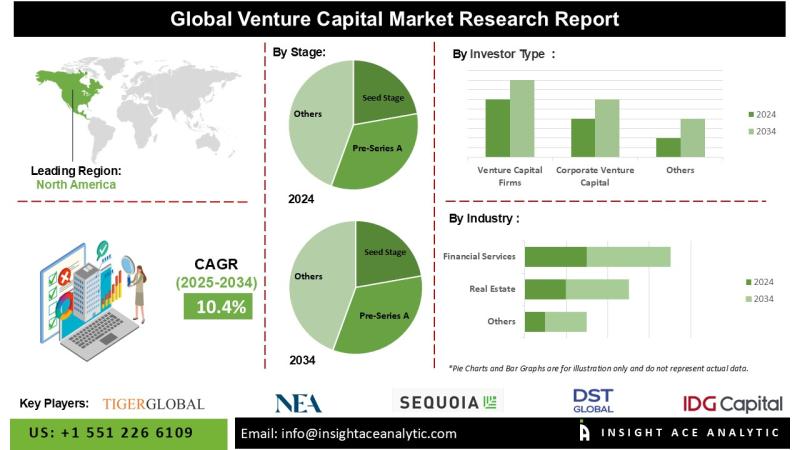

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the " Venture Capital Market- (By type (Local Investors, International Investors) and by end-user (Real Estate, Financial Services, Healthcare, Transport & Logistics, Food & Beverages, IT & ITeS, Education, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."According to the latest research by InsightAce Analytic, the Venture Capital Market Size is predicted to develop at a 10.4% CAGR during the forecast period for 2025-2034.

Request For Free Sample Pages:

https://www.insightaceanalytic.com/request-sample/3046

Venture capital refers to financial investments provided to early-stage and emerging companies with strong potential for long-term growth. It has become a vital funding source for entrepreneurs, particularly those who face challenges in securing financing from traditional, risk-averse banking institutions. The rapid expansion of the technology sector remains one of the primary drivers of the venture capital market. Technologies such as artificial intelligence (AI) and cloud computing currently attract a significant share of corporate venture capital investments.

Over the past decade, growth in these areas has substantially outpaced investment trends across other industries, collectively accounting for a considerable portion of total technology-focused venture funding.

At present, artificial intelligence and machine learning (ML) represent key trends shaping venture capital activity. These technologies have widespread applications across multiple industries, including healthcare, financial services, and transportation. Venture capital firms are increasingly prioritizing AI-driven solutions that enhance operational efficiency, enable automation, and deliver advanced predictive insights.

List of Prominent Players in the Venture Capital Market:

• Tiger Global Management

• New Enterprises Associates

• Index Ventures

• Healthcare Royalty Partners

• GGV Capital

• Sequoia Capital

• DST Global

• IDG Capital

• Nanjing Zijin Investment

• Greylock Partners

Market Dynamics:

Drivers-

The venture capital market is significantly driven by the global rise in entrepreneurial activity. An increasingly supportive ecosystem is encouraging individuals to pursue innovative business ideas, supported by the expansion of accelerators, incubators, and co-working spaces that promote collaboration, mentorship, and knowledge sharing. In addition, shifting societal attitudes-particularly among younger generations-favor autonomy, innovation, and flexible career paths over traditional corporate employment, further stimulating startup formation.

Curious About This Latest Version Of The Report? Enquiry Before Buying: https://www.insightaceanalytic.com/enquiry-before-buying/3046

Challenges:

The venture capital market faces notable regulatory challenges that can impede innovation and restrict investment activity. Governments often impose stringent regulations to protect investors, resulting in lengthy approval processes and increased compliance requirements. Adherence to tax regulations, anti-money laundering policies, and securities laws adds further complexity, which may discourage potential investors. Additionally, variations in regulatory frameworks across regions complicate cross-border investments, limiting market accessibility for venture capital firms.

Regional Trends:

North America is expected to account for a significant share of global venture capital market revenue, driven by the strong presence of financial institutions, mutual fund-backed venture firms, a mature startup ecosystem, and sustained market growth. Increased investment activity across multiple sectors, including media and entertainment, biotechnology, healthcare, and agriculture, continues to support regional expansion.

In contrast, the Asia-Pacific region is projected to experience the fastest growth over the forecast period, supported by strong economic performance, a rapidly expanding startup ecosystem, and accelerating digital transformation across key industries. Countries such as China, India, and several Southeast Asian nations have emerged as major hubs for venture capital investment, particularly in high-growth sectors such as fintech, e-commerce, health technology, and artificial intelligence.

Recent Development:

• July 2024: Index Ventures has declared $2.3 billion in new funds to establish connections with outstanding entrepreneurs developing disruptive, category-defining enterprises. In conjunction with Index's current $300 million Origin seed fund, Index is allocating $2.6 billion in financing to support creators from seed stage to IPO. This increases Index's cumulative capital raised since its inception to $15 billion.

Get Specific Chapter/Information From The Report:

https://www.insightaceanalytic.com/customization/3046

Segmentation of Venture Capital Market-

By Type-

• Local Investors

• International Investors

By End-user-

• Real Estate

• Financial Services

• Healthcare

• Transport & Logistics

• Food & Beverages

• IT & ITeS

• Education

• Others

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Get More Information @

https://www.insightaceanalytic.com/report/venture-capital-market/3046

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.https://www.insightaceanalytic.com/images_data/148861653.

Contact Us:

info@insightaceanalytic.com

InsightAce Analytic Pvt. Ltd.

Official Site Visit: www.insightaceanalytic.com

Tel.: +1 607 400-7072

Email: info@insightaceanalytic.com

Follow US On :

LinkedIn @ https://www.linkedin.com/company/insightace-analytic-pvt-ltd/

Twitter @ https://x.com/MInsightace

YouTube @ https://www.youtube.com/@InsightAceAnalytic

Instagram @https://www.instagram.com/insight_ace_analytic/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Venture Capital Market Future Growth Hotspots and Forecast 2026 to 2035 here

News-ID: 4365772 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

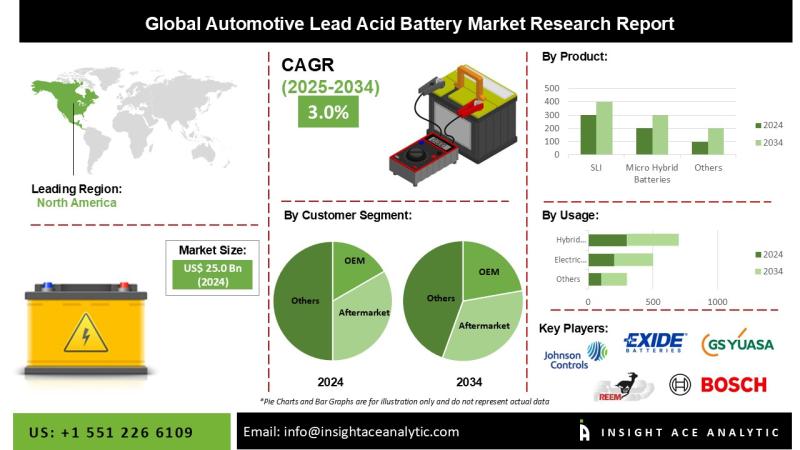

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

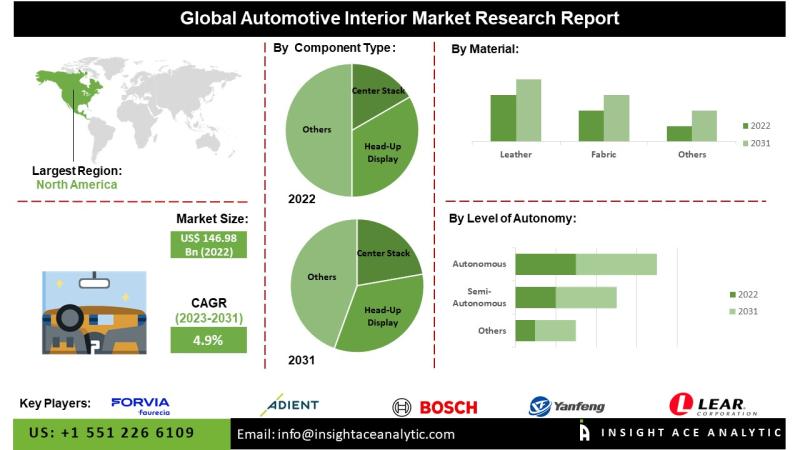

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

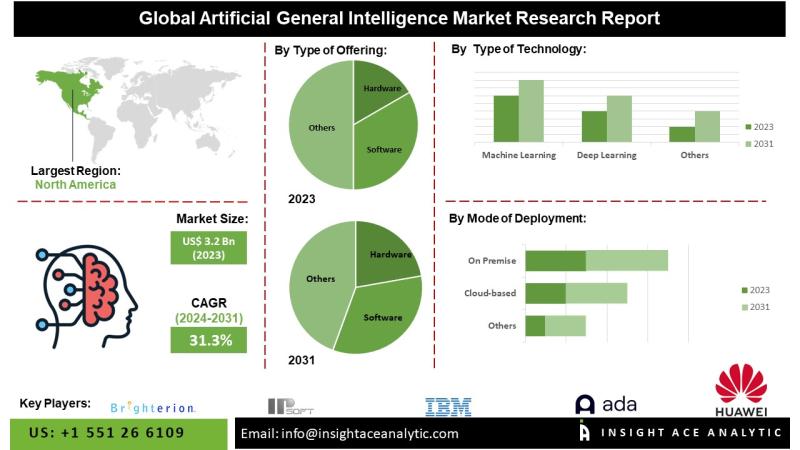

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

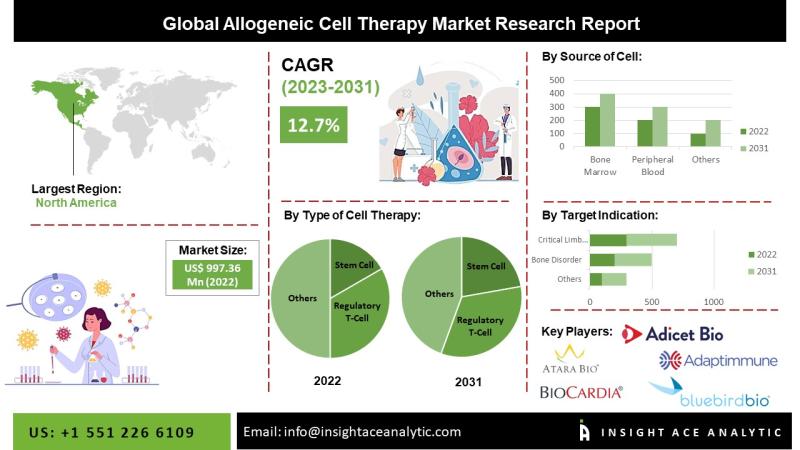

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Venture

Venture Solar Rebrands As Venture Home, Expanding Mission To Be Customers' Lifel …

After 11 years and 15,000+ solar installations, company evolves to meet growing demand for comprehensive home energy solutions

Venture Solar, a leading solar installation company serving the Northeast and Mid-Atlantic, today announced it is rebranding as Venture Home, reflecting the company's evolution from a solar-focused installer to a comprehensive home electrification partner.

The rebrand comes as the company enters its 11th year in business and marks a strategic shift to address the…

1752VC Launches 14th Venture Fellow & Emerging Angel Cohort, Training the Next G …

1752VC has launched the 14th cohort of its Venture Fellow and Emerging Angel program, an eight-week, hands-on experience designed to help aspiring investors, founders, and professionals gain real-world venture capital skills and access early-stage deal flow.

Santa Monica, CA - November 4, 2025 - 1752VC [http://www.1752.vc] announced the launch of its 14th Venture Fellow cohort, further expanding its nationwide network of more than 250 Fellows-a dynamic community of founders, operators, and…

Announcing G2C Venture Partners

Over a decade of Collaboration Transforms into a Venture Vision

We are thrilled to announce what we have been building behind the scenes - G2C Venture Partners is officially launching today!

As three founders-turned-investors - Sunil Grover, Amar Chokhawala, and Vik Ghai - we are bringing our combined decades of experience and co-investment partnerships to a new kind of venture fund.

We are combining our battle-tested experience, relationship networks, and investment…

Gary Fowler's GSD Venture Studios Redefines Venture Building Through Direct Lead …

GSD Venture Studios is an operational family office that created a 360-degree entrepreneurial ecosystem, taking a laser-precise approach to venture building from early stage to Series C companies.

Image: https://www.getnews.info/uploads/d9f450b06da75bff3aa844e08748b0ef.png

While many startups scrounge for capital, resources, and ideas wherever they can, those poised for success turn to Gary Fowler's GSD Venture Studios [https://www.gsdvs.com/]. With a proven track record of success, a forward-thinking actionable approach, a network of avenues connecting capital…

CleanTech Venture Capital Interest

Keynote speaker to share the vision for CleanTech and Venture Capital Funding at EngEx 2010

SAN DIEGO – CleanTech start-ups are grabbing increased interest and investments from venture capital groups that placed almost $2 billion into eco-friendly companies last year and increased the funding pace with another $773 million during the first quarter of 2010. Clean energy business owners and industry professionals attending EngEx 2010 will hear more about the…

Sep. 5th Venture Capital Event

(EMAILWIRE.COM, July 31, 2007)- New York - Argyle Executive Forum is pleased to present its 2007 Leadership in Venture Capital Forum. The event, to take place in Manhattan, will bring together 135–150 CEOs & Board members of public and private large cap and mid cap corporations, complementary areas of executive leadership (CFOs & COOs), members of the endowment, foundation, and family office community, select advisory firms, and select founders /…