Press release

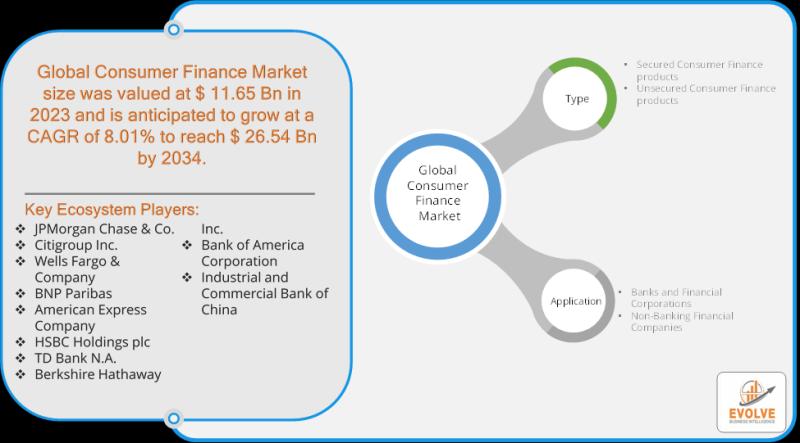

Consumer Finance Market Forecast to Reach USD 26.54 Billion by 2034

The consumer finance market presents a significant opportunity for banks and financial corporations, driven by evolving consumer behaviors, technological advancements, and a growing demand for diverse financial products. Despite certain challenges, the sector is poised for substantial growth, making it a critical area for strategic focus and innovation.Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-consumer-finance-market-analysis/

High Opportunity and Market Drivers

The consumer finance market is experiencing robust growth, fueled by several key factors:

• Affordable Interest Rates: Lower interest rates can stimulate borrowing and spending, enabling consumers to finance significant purchases like homes and automobiles, thereby boosting market activity.

• Rising Digital Banking: The increasing adoption of digital banking platforms has revolutionized access to consumer financial services. Consumers benefit from convenience, time-saving, and access to a wider array of products, including Equated Monthly Installment (EMI) options. This trend is particularly strong, with significant consumer interest in digital banking in various global markets.

• Growing Marketing Strategies: Innovative marketing approaches, leveraging big data and automation, are enabling financial institutions to better target and engage consumers. This allows for personalized services, such as pre-loan approvals or financial education, catering to specific consumer needs.

• Diversification of Products: The market is segmented across various types of secured finance products (housing loans, auto loans, mortgage loans) and unsecured finance products (personal loans, credit cards, home improvement loans, education loans), offering ample avenues for growth.

• Fintech Integration: The rise of Non-Banking Financial Companies (NBFCs) and online platforms, including fintech companies, is challenging traditional banking dominance. These entities offer flexible terms, quicker processing, and leverage data analytics and AI for enhanced risk assessment and customer engagement, pushing traditional banks to innovate and adopt omnichannel strategies for seamless customer experiences.

Problems Faced in the Consumer Finance Market

While opportunities abound, the consumer finance market is not without its challenges:

• Market Volatility and Data Limitations: Unpredictable market volatility, coupled with insufficient and over-reliance on historical data, can complicate the accuracy of financial models and risk assessment.

• Emerging Risks from Fintech: The rapid evolution of fintech can introduce new problems such as fraud, user errors, learning difficulties with new platforms, ineffective user experience (UX), and potential financial mismanagement if not properly regulated and designed.

• Data Privacy Concerns: Protecting research participants' privacy while collecting and analyzing data, especially in a technology-driven financial landscape, remains a significant challenge.

Proposed Solutions for a Robust Future

To navigate these challenges and fully capitalize on the opportunities, banks and financial corporations can implement several solutions:

• Advanced Data Integration: Integrating real-time information and diverse data sources can provide a more comprehensive and accurate picture of market conditions and consumer behavior.

• Adaptive Models: Adopting adaptive financial models that can quickly respond to changing market conditions and incorporate qualitative perspectives will improve forecasting accuracy and risk management.

• AI and Automation: Leveraging artificial intelligence for predicting consumer behavior, assessing risk, and automating processes can enhance efficiency, personalize offerings, and mitigate potential fraud.

• Omnichannel Strategies: Implementing omnichannel approaches that integrate physical branches, online platforms, mobile apps, and customer service centers can offer a cohesive and flexible experience, catering to diverse consumer preferences and strengthening customer loyalty.

• Enhanced Financial Literacy: Providing financial education and intuitive user interfaces can help mitigate issues related to user errors and financial mismanagement, building greater consumer trust.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-consumer-finance-market-analysis/

US Tariff Implications on the Consumer Finance Market

US tariffs can significantly impact the consumer finance market by influencing consumer purchasing power and broader economic stability:

• Increased Costs for Consumers: Tariffs, essentially taxes on imported goods, are often passed on to consumers as higher prices. This leads to an increased cost of living, affecting the affordability of various goods, from daily essentials to automobiles. For example, some estimates suggest significant increases in the average price of an automobile and specific consumer goods like clothing and textiles due to tariffs.

• Reduced Product Range: Tariffs can make certain imports unprofitable, potentially reducing the variety of products available in the market.

• Impact on Inflation: Tariffs contribute to inflationary pressures, as businesses face higher production costs which are then transferred to consumers. This can lead to a decline in purchasing power if wage growth does not keep pace with rising prices.

• Economic Slowdown: The imposition of tariffs can slow global economic growth, potentially leading to job losses in trade-reliant industries and dampened business investment. This overall economic uncertainty can negatively influence consumer confidence and spending patterns.

• Sector-Specific Effects: While some domestic manufacturing sectors might see an expansion due to protection from tariffs, other sectors like construction and agriculture could contract. This shift can impact employment and income stability, indirectly affecting consumer finance.

In conclusion, the consumer finance market presents a dynamic landscape of high growth potential and evolving challenges. By embracing digital transformation, implementing robust data analytics, and addressing regulatory complexities, banks and financial corporations can strategically position themselves to lead in this crucial sector.

To understand further and explore opportunities in the Consumer Finance Market or any related industry, please share your queries/concerns at info@evolvebi.com.

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Email: sales@evolvebi.com

Website: https://evolvebi.com/

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing

innovative solutions to challenging pain points of a business. Our market research reports include data

useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere

data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate

data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-

time data including, quarter performance, annual performance, and recent developments from

fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Consumer Finance Market Forecast to Reach USD 26.54 Billion by 2034 here

News-ID: 4365413 • Views: …

More Releases from Evolve Business Intelligence

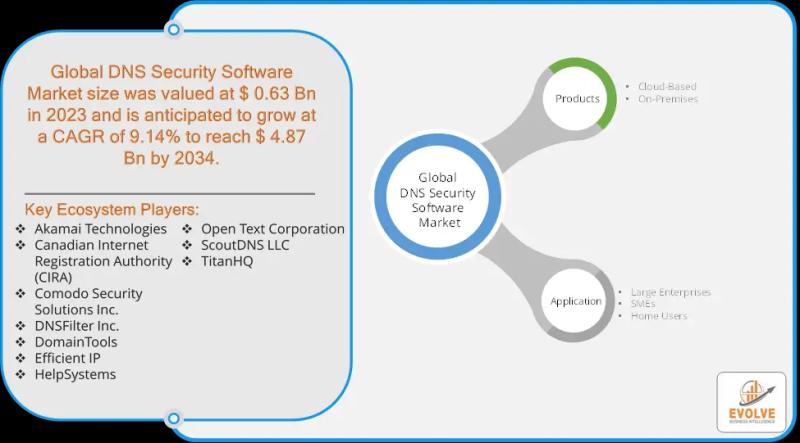

DNS Security Software Market Forecast to Reach USD 4.87 Billion by 2034

The digital landscape is fraught with evolving cyber threats, making robust cybersecurity a non-negotiable for businesses worldwide. At the heart of this challenge lies the Domain Name System (DNS), a critical component often targeted by sophisticated attacks such as DNS poisoning, hijacking, and Distributed Denial of Service (DDoS). The global DNS Security Software Market, valued at USD 0.63 billion in 2023, is projected to surge to USD 4.87 billion by…

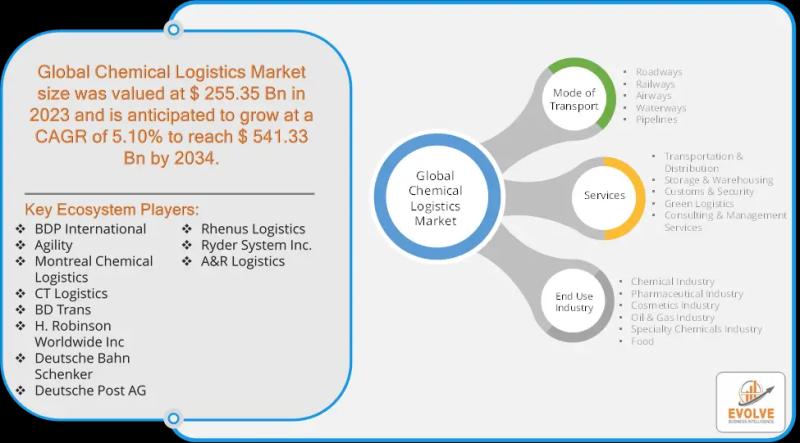

Chemical Logistics Market Forecast to Reach USD 541.33 Billion by 2034

The Chemical Logistics Market is a complex and vital sector, projected to grow from USD 298.41 Billion in 2024 to USD 541.33 Billion by 2034, at a compound annual growth rate (CAGR) of 5.10% from 2024 to 2034. While facing significant challenges, this dynamic industry presents high opportunities for advancements, particularly in leveraging airways for efficient logistics.

Download the full report now to discover market trends, opportunities, and strategies for success.

https://evolvebi.com/report/global-chemical-logistics-market-analysis/

The…

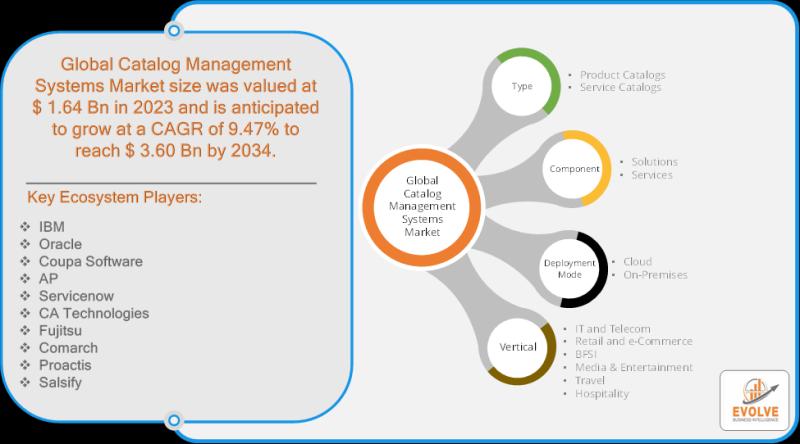

Catalog Management Systems Market Forecast to Reach USD 3.60 Billion by 2034

The Enduring Opportunity: On-Premises in the Catalog Management Systems Market

The Catalog Management Systems Market is undergoing significant expansion, driven by the increasing complexities of product information and the relentless growth of e-commerce. Valued at an estimated USD 1.64 Billion in 2023, the market is projected to reach USD 3.60 Billion by 2034, demonstrating a robust Compound Annual Growth Rate (CAGR) of 9.47% from 2024 to 2034. While cloud-based solutions often…

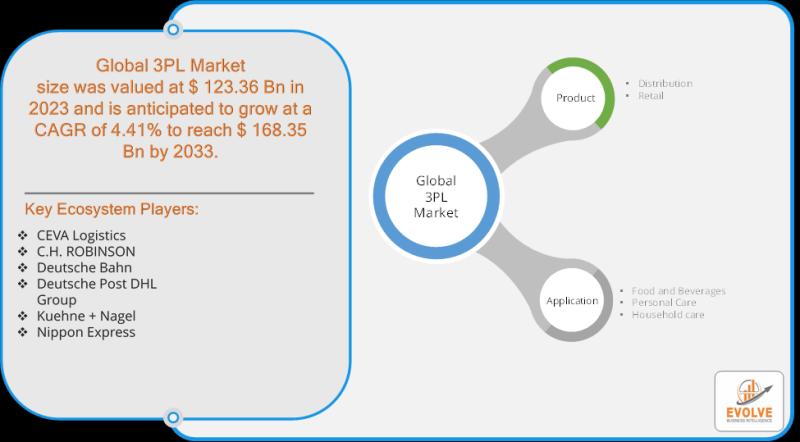

3PL in FMCG Market Forecast to Reach USD 168.35 Billion by 2033

The Third-Party Logistics (3PL) market, particularly within the Fast-Moving Consumer Goods (FMCG) sector, presents a significant and expanding opportunity for personal care brands. Driven by the increasing complexity of global supply chains and the constant pressure for cost optimization, the 3PL in FMCG market is projected to reach an impressive USD 168.35 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 4.41% from 2023. Within this robust…

More Releases for Consumer

AI Airport Retailing Consumer Electronics Market - Consumer-Centric Insights 202 …

Unlock fresh, first-hand consumer intelligence in the rapidly evolving AI Airport Retailing Consumer Electronics Market.

This primary research report goes beyond traditional secondary data-delivering insights directly from travelers, retail managers, airport operators, and service providers who engage with AI-driven consumer electronics in airport environments daily.

The global airport retailing consumer electronics market was valued at USD 2383.8 million in 2025 and is expected to reach USD 3166.6 million in 2032, with a…

Consumer To Consumer E-Commerce Market - Major Technology Giants in Buzz Again

Archive Market Research Released the latest study on Global Consumer To Consumer E-Commerce Market Growth Outlook 2024-2032 provides an opportunity to better understand details about fundamental restructuring and growth prognosis in Online Apparel Market. This study offers current relevant facts and correlations and elaborates long-term, sustainable strategic and operative suggestions taken up by leading and emerging manufacturers. The sector faces an unprecedented change with regard to the far-reaching effects that…

Analysis of Taiwanese Consumer Buying Behavior towards Fast-moving Consumer Good …

A report added to the rich database of Qurate Business Intelligence, titled “Fast-moving Consumer Goods Market – Global Industry Analysis and Forecast to 2024”, provides a 360-degree overview of the Global market. Approximations associated with the market values over the forecast period are based on empirical research and data collected through both primary and secondary sources. The authentic processes followed to exhibit various aspects of the market makes the data…

Consumer Health Market 2019 by Clinical Review and Key Player Analysis-Consumer …

Global Consumer Health Market 2018 Industry study report is an in-depth and deep research on the present condition of the Consumer Health industry in the global market. Furthermore, this report presents a detailed overview, cost structure, size, revenue, growth, share, dynamics, competitive analysis, manufacturers and global business strategy & statistics analysis. This report is segmented on basis of product type, end-user, application and geographical regions.

Get Sample Copy of this Report…

Dog Shoes Market Report 2018: Segmentation by Product (Nylon, Rubber, Leather, P …

Global Dog Shoes market research report provides company profile for Ultra Paws, Pet Life, WALKABOUT, Neo-Paws, DOGO, FouFou Dog, Ruffwear, Pawz, Muttluks, RC Pets and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The…

Digital Commerce Platform Market Analysis by Business Model ( Business to consum …

ALBANY, NY, March 6, 2017 : ResearchMoz presents professional and in-depth study of "Digital Commerce Platform Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024".

This report intends to provide a comprehensive strategic analysis of the global digital commerce platform market along with revenue and growth forecasts for the period from 2014 to 2024. With advancements in digital commerce platforms and rising demand for Internet based…