Press release

Mexico Power Transmission Equipment Market Size, Growth, Latest Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled "Mexico Power Transmission Equipment Market Size, Share, Trends and Forecast by Equipment Type, Voltage Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Market Overview

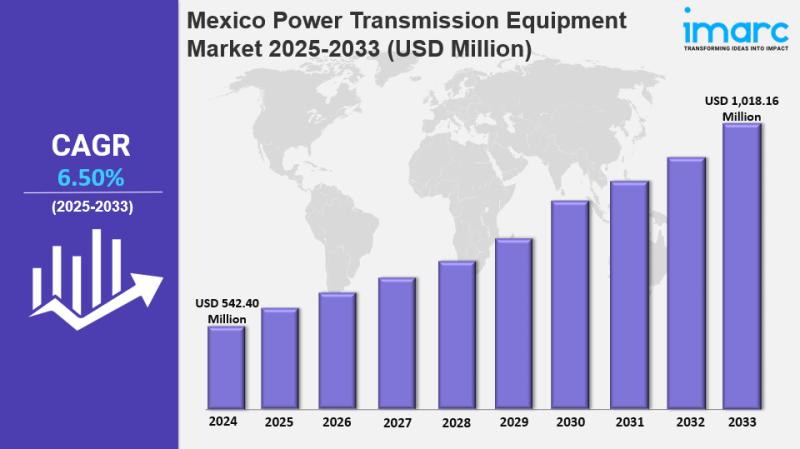

The Mexico power transmission equipment market reached USD 542.40 Million in 2024 and is projected to reach USD 1,018.16 Million by 2033, growing at a CAGR of 6.50% during 2025-2033. This growth is driven by increased electricity demand from urbanization and industrial development, coupled with grid expansion and modernization. Mexico's renewable energy push and smart grid investments also contribute to market growth, supporting a resilient and efficient power infrastructure.

Study Assumption Years

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Period: 2025-2033

Mexico Power Transmission Equipment Market Key Takeaways

• Current Market Size: USD 542.40 Million (2024)

• CAGR: 6.50% (2025-2033)

• Forecast Period: 2025-2033

• Growing electricity demand from urbanization and industrial zones drives infrastructure expansion.

• Increasing investments in high-voltage lines and substations improve grid reliability.

• Strong push for renewable energy integration necessitates advanced transmission solutions like FACTS and grid management software.

• Rapid growth of distributed generation with 3.89 GW capacity and 461,000 interconnection contracts by mid-2024.

• Advancements in smart grid technologies, including smart transformers and automated substations, enhance grid efficiency and resilience.

Sample Request Link: https://www.imarcgroup.com/mexico-power-transmission-equipment-market/requestsample

Mexico Power Transmission Equipment Market Growth Factors

Growing Electricity Demand and Infrastructure Expansion

Mexico's economic development and urbanization are driving unprecedented electricity demand. Rapid development of industrial zones, residential complexes, and tech parks exerts tremendous pressure on the national grid. To prevent congestion and blackouts, the government and independent energy players are investing heavily in constructing new high-voltage lines, substations, and related transmission equipment such as transformers, insulators, and switchgear. This infrastructure expansion addresses current needs while preparing the grid to handle future industrial and digital loads, ensuring capacity and reliability aligned with socio-economic growth.

Shift Toward Renewable Energy Integration

Mexico's strong renewable energy initiatives, primarily in solar and wind, are reshaping its power transmission infrastructure. With more energy from dispersed and variable renewable sources, advanced equipment like specialized transformers and flexible AC transmission systems (FACTS) are increasingly adopted. The rapid rise in distributed generation - reaching 3.89 GW capacity and nearly 461,000 interconnection contracts by mid-2024 - exemplifies widespread adoption of small-scale solar systems feeding the grid. Modernization efforts aim to integrate large-scale renewables and distributed energy seamlessly, addressing the increasing complexity of Mexico's energy landscape.

Grid Modernization and Technological Advancements

Mexico is enhancing its transmission network by integrating smart technologies such as smart transformers, digital switchgear, and automated substations with real-time monitoring and remote operation. These upgrades improve fault response, load balancing, and energy loss reduction. The push towards smart grid solutions is motivated by the need for resilience against breakdowns and weather events. Investments focus on IoT-enabled equipment facilitating condition-based maintenance and data analysis. This trend toward digitalization and automation fosters an adaptable, sustainable energy sector ready for emerging technologies like electric vehicles and distributed resources.

Buy Report Now: https://www.imarcgroup.com/checkout?id=37164&method=3682

Mexico Power Transmission Equipment Market Segmentation

Breakup By Equipment Type:

• Transformers: Fundamental devices that step voltage levels up or down to enable efficient power transmission and distribution.

• Circuit Breakers: Protective devices designed to interrupt fault currents and protect the electrical network from damage.

• Transmission Towers: Steel structures that support overhead power lines, ensuring safe and reliable electricity conveyance.

• Insulators: Components that prevent undesired current flow between conductors and the supporting structures.

• Conductors and Cables: Electrical conductors and cables that carry electricity from generation sources to consumers.

• Switchgear: Equipment used to control, protect, and isolate electrical equipment within the transmission network.

• Others

Breakup By Voltage Level:

• High Voltage (HV): Transmission voltage levels typically ranging from 69 kV to 230 kV, used for regional power transmission.

• Extra High Voltage (EHV): Voltages generally from 230 kV to 765 kV, facilitating bulk power transfer over long distances.

• Ultra High Voltage (UHV): Very high voltages exceeding 765 kV, enabling very efficient large-scale power transmission.

Breakup By Application:

• Utilities: Transmission equipment used by utility companies for grid operation and management.

• Industrial: Equipment applied in industrial settings to meet significant power demands.

• Commercial: Transmission devices used in commercial establishments for power supply and distribution.

• Residential: Equipment serving residential areas, ensuring safe and reliable power delivery to homes.

Recent Developments & News

In August 2024, CFE announced an investment of MX$2.903 billion (US$170.76 million) from 2024 to 2026 to maintain 399 transmission and 678 sub-transmission lines and acquire operational vehicles, aimed at reducing grid downtime and bolstering infrastructure critical for renewable energy growth and nearshoring demands. Experts warn that ongoing underinvestment in transmission and distribution contributes to blackouts and grid inefficiencies.

In January 2024, PNM Resources, New Mexico's largest electric utility, terminated its proposed $4.3 billion merger with Connecticut-based Avangrid, a subsidiary of Iberdrola. The cancellation eliminated a potential opportunity to expand renewable energy development and improve energy efficiency in New Mexico.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=37164&flag=C

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Power Transmission Equipment Market Size, Growth, Latest Trends and Forecast 2025-2033 here

News-ID: 4365384 • Views: …

More Releases from IMARC Group

South Africa Fintech Market Size to Surpass USD 3,688.72 Million by 2033 | With …

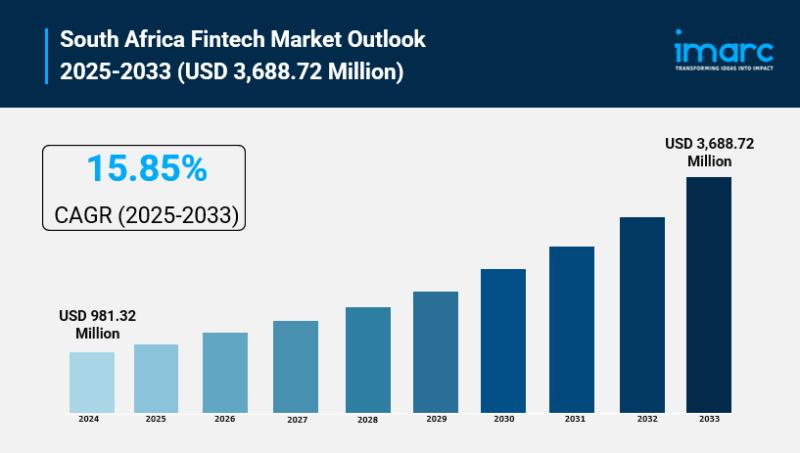

South Africa Fintech Market Overview

Market Size in 2024: USD 981.32 Million

Market Size in 2033: USD 3,688.72 Million

Market Growth Rate 2025-2033: 15.85%

According to IMARC Group's latest research publication, "South Africa Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa fintech market size reached USD 981.32 Million in 2024. The market is projected to reach USD 3,688.72 Million by 2033, exhibiting a growth rate (CAGR) of 15.85%…

South Africa Online Food Delivery Market Size to Hit USD 2.16 Billion by 2033 | …

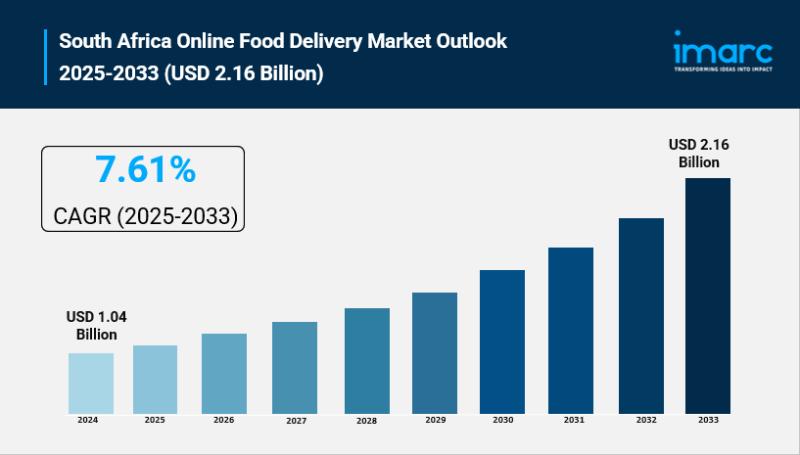

South Africa Online Food Delivery Market Overview

Market Size in 2024: USD 1.04 Billion

Market Size in 2033: USD 2.16 Billion

Market Growth Rate 2025-2033: 7.61%

According to IMARC Group's latest research publication, "South Africa Online Food Delivery Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa online food delivery market size reached USD 1.04 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.16 Billion…

Saudi Arabia Cloud Services Market Poised for Explosive Growth to USD 13.9 Billi …

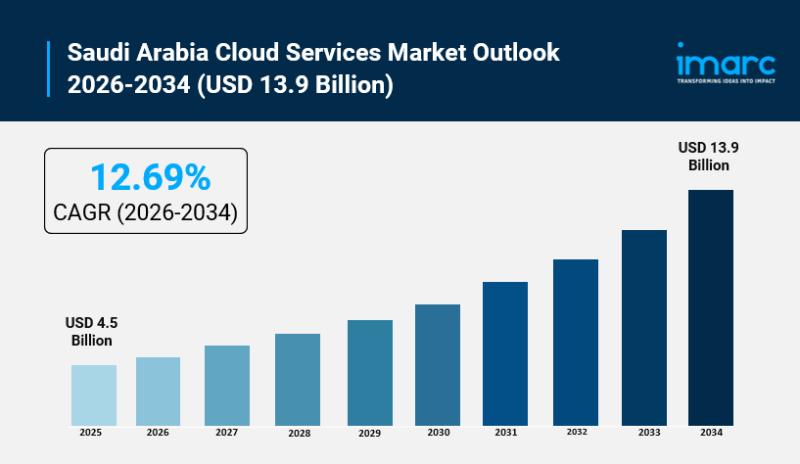

Saudi Arabia Cloud Services Market Overview

Market Size in 2025: USD 4.5 Billion

Market Forecast in 2034: USD 13.9 Billion

Market Growth Rate 2026-2034: 12.69%

According to IMARC Group's latest research publication, "Saudi Arabia Cloud Services Market Report by Deployment (Public Cloud, Private Cloud), End Use Industry (Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, and Others), and Region 2026-2034", The Saudi Arabia cloud services market size reached USD…

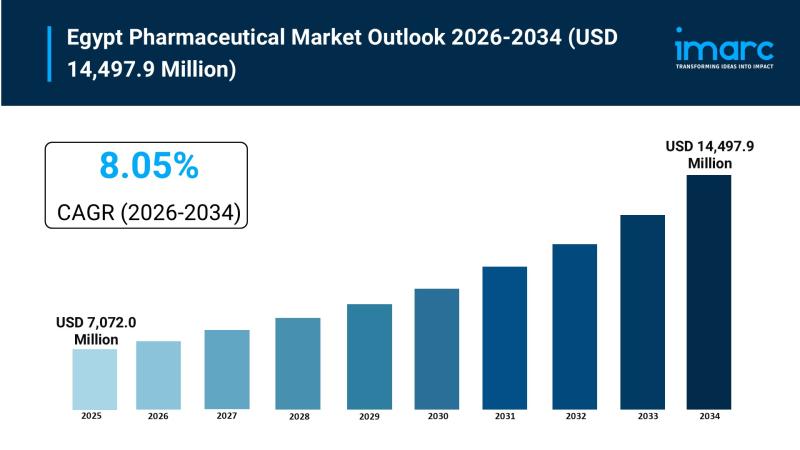

Egypt Pharmaceutical Market Size to Reach USD 14,497.9 Million by 2034 | With a …

Egypt Pharmaceutical Market Overview

Market Size in 2025: USD 7,072.0 Million

Market Size in 2034: USD 14,497.9 Million

Market Growth Rate 2026-2034: 8.05%

According to IMARC Group's latest research publication, "Egypt Pharmaceutical Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Egypt pharmaceutical market size reached USD 7,072.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 14,497.9 Million by 2034, exhibiting a growth rate (CAGR) of 8.05%…

More Releases for Mexico

Egg Freezing in Mexico: Leading Mexico City Clinics Launch 2026 Programs

Enlistalo Fertilidad offers expanded egg freezing services for international patients, including Americans, seeking fertility preservation.

Mexico City, Mexico - January 22, 2026 - Egg freezing is becoming an increasingly popular option for patients worldwide, and Mexico City continues to emerge as a leading destination for those seeking high-quality, affordable fertility care.

In 2026, Enlistalo Fertilidad stands out for its personalized approach, advanced medical standards, and focus on supporting international patients through every…

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…