Press release

Carvina Capital: Strong Demand Lifts Aktis IPO

Radiopharmaceutical specialist Aktis Oncology prices an upsized Nasdaq flotation as a $100m anchor from Eli Lilly sharpens focus on targeted cancer platforms, while rate expectations and sector dealmaking revive appetite for new issues.Image: https://www.abnewswire.com/upload/2026/01/599b8ca738b2884b0640fff81a7cc261.jpg

Mid-January is bringing a sharper read on investors' willingness to fund high-risk science, and Carvina Capital Pte. Ltd. is following the message as Aktis Oncology opens the market for sizeable biotechnology flotations with a radiopharmaceutical listing that tests both price and patience.

The Boston-based, clinical-stage group prices 17.7 million shares at $18 in an offering launched in the first half of January, lifting gross proceeds to about $318 million and putting the implied market value at roughly $950 million at pricing. The final share count expands from an initial plan for about 11.8 million shares marketed at $16 to $18, implying roughly $201 million of proceeds at the top end, a 50% uplift delivered over the bookbuilding period. Trading begins on Nasdaq under the ticker 'AKTS', and in the first full session of dealing the shares trade at $22.5, 24.4% above the offer price, a move that "shows institutions are prepared to back specialist platforms when the science is matched by financial discipline", Peter Jacobs, Director of Private Equity at Carvina Capital.

Eli Lilly commits $100 million to the same issuance, taking close to one-third of the newly issued stock and giving the order book a cornerstone investor with a strategic interest in targeted oncology. The syndicate, led by J.P. Morgan, BofA Securities, Leerink Partners and TD Cowen, is steering a transaction that sits among the three largest biotech new issues of the past 18 months, and the signal is straightforward: "When a major drugmaker writes a cheque of this size at the offer price, it tightens the spread between promise and credibility for everyone else in the book", Jacobs.

The anchor investment also sits alongside a collaboration agreed over the preceding 12-month period, under which Aktis receives $60 million upfront plus additional equity support, with milestones and royalties that could reach up to $1.2 billion over the life of the programme. The structure matters because radiopharmaceuticals are no longer a niche corner of oncology, and the market increasingly values platforms on whether they can turn technical progress into repeatable development, manufacturing and distribution.

At the centre of the offer is a miniprotein radioconjugate approach, designed to carry alpha-emitting isotopes to malignant cells while limiting exposure to healthy tissue. The proposition is theranostic by design: imaging confirms target engagement, helping clinicians identify patients most likely to benefit and giving investors a clearer line of sight on whether clinical signals can translate beyond specialist nuclear medicine settings.

Carvina Capital highlights the way the clinical plan links science to measurable milestones, with the lead candidate, AKY-1189, targeting Nectin-4, a cell-surface protein expressed across several solid tumours, and the Phase 1b programme set up to enrol about 150 patients over its dose-escalation and expansion phases. Commercial precedent is already visible in the market, with an antibody-drug conjugate aimed at the same pathway generating about $2.4 billion of worldwide revenue over the preceding 12-month period, and the argument is that imaging-led selection could widen access while keeping the risk-reward calculation anchored in data.

A second candidate, AKY-2519, focuses on B7-H3, a target associated with treatment-resistant tumours, and first-in-human work is scheduled within roughly 18 months under current development plans. The listing documents set out a defined tranche of proceeds, about $88.2 million to $100.8 million over the next two years, for advancing that programme through early clinical development.

The wider equity backdrop remains delicate. Over the preceding 12-month period, only 10 biotechnology companies reach public markets, compared with 26 over the 12 months before that, and 93 over a 12-month period during the last cycle's peak. Aggregate IPO proceeds total about $1.8 billion over the preceding 12 months, a fraction of the roughly $17.7 billion raised over a 12-month peak period, but sentiment improves into the final quarter as the SPDR S&P Biotech ETF rises 33% over the 12 months ending in late December. Rate-cut expectations over the coming quarters are helping, lowering the discount applied to distant revenues.

Radiopharmaceutical dealmaking is underpinning that shift. Major drugmakers commit about $11.1 billion to acquisitions and partnerships in the space over the preceding 12-month period, including a $4.5 billion purchase of RayzeBio, a $2.7 billion deal for Fusion Pharmaceuticals and a $1.6 billion transaction for Point Biopharma. Market forecasts point to the sector expanding from about $10.1 billion in a recent baseline estimate to roughly $29.3 billion over the coming decade, with some projections extending to about $46.5 billion shortly after that.

For Carvina Capital, the lesson from Aktis' reception is that public markets are reopening selectively, with investors rewarding transparent use of proceeds, credible partnerships and technologies that can be measured as well as marketed. "Risk capital is returning, but it is arriving with a calculator and a timetable", Jacobs.

About Carvina Capital

Carvina Capital Pte. Ltd. (UEN: 201220825D) is a Singapore-based investment firm founded in 2012. It manages research-led, long-only public equity strategies for institutional and professional clients and is evaluating structures that could broaden access for retail investors. The firm's approach combines fundamental research with disciplined risk management, aiming to compound capital across full market cycles.

More information is available at https://carvina.com [https://carvina.com/].

Media Contact

Company Name: Carvina Capital Pte. Ltd.

Contact Person: Huacheng Yu

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=carvina-capital-strong-demand-lifts-aktis-ipo]

Country: Singapore

Website: https://carvina.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carvina Capital: Strong Demand Lifts Aktis IPO here

News-ID: 4365356 • Views: …

More Releases from ABNewswire

MT Dunn Plumbing Expands Emergency Services in Hillsboro & Across Portland, Oreg …

MT Dunn Plumbing LLC (CCB# 234243) expands 24/7 emergency services across Hillsboro, Beaverton, Portland & Washington County. The licensed, bonded, and insured contractor provides immediate response for burst pipes, water heater failures, sewer backups, and drain clogs. Operating from Hillsboro, owner Michael T Dunn serves residential and commercial properties region-wide. Emergency contact: 503-640-2458 or mtdunnplumbing.com.

Hillsboro, OR - MT Dunn Plumbing LLC, a licensed and established plumbing contractor serving the Portland…

Beyond the Prompt: How Mimic Motion Architecture is Redefining the 2026 Passive …

Image: https://www.abnewswire.com/upload/2026/02/ac57e1a7b6e53a95f52ea0f18fcb990c.jpg

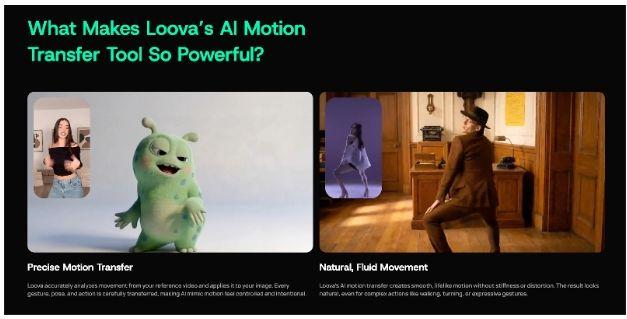

As we move through 2026, the digital economy is no longer just about "what" you show, but "how" it moves. Static content is losing ground to kinetic, motion-driven narratives that capture attention in seconds. At the center of this shift is Loova, whose proprietary Mimic Motion architecture has become the secret engine behind some of the most successful passive income streams this year.

This report breaks down the technical logic…

The Real Cost of Convenience: A Complete Guide to Vending Machine Startup Costs

Image: https://www.abnewswire.com/upload/2026/02/32ec9ac40420df59e70c21070d981def.jpg

The dream of earning passive income often leads aspiring entrepreneurs to the world of automated retail. It is a sector defined by low labor requirements and the ability to generate revenue around the clock. However, before you can stock your first row of snacks, you must understand the financial commitment required to get your equipment on-site. Many beginners find themselves asking how much do vending machines cost [https://dfyvending.com/vending-machine-startup-costs] as…

Benji Personal Injury Surpasses 1,000 Cases Won as California Accident Victims S …

Benji Personal Injury Accident Attorneys, A.P.C. has surpassed 1,000 personal injury cases resolved across California, reflecting a growing demand for trialready legal representation. The firm's litigationfirst approach has led to multimilliondollar verdicts and settlements, helping accident victims secure significantly higher compensation through courtroomfocused preparation.

LOS ANGELES, CA - Benji Personal Injury Accident Attorneys, A.P.C. announced today that the firm has successfully resolved over 1,000 personal injury cases, marking a significant milestone…

More Releases for Carvina

Carvina Capital: Broadcom Sees Strong AI-Driven Growth

Broadcom's latest quarterly results point to accelerating demand for custom AI chips and data-centre networking, with backlog offering 18-month visibility even as investors interrogate margin pressure and the economics of scale in silicon.

Image: https://www.abnewswire.com/upload/2025/12/fce5456dc838b0fe7ecbf8601c3f42bb.jpg

With December markets watching the next phase of the AI investment cycle, Carvina Capital Pte. Ltd. points to Broadcom's fiscal fourth-quarter numbers as a signal that spending is hardening into contract-backed demand, with group revenue rising 28%…

Carvina Capital: Apple Scales Back iPhone Air

Apple trims iPhone Air production to protect margins and rebalance supply toward stronger-selling models; investors monitor model mix, pricing discipline, and holiday demand signals across core smartphone lines, while suppliers and analysts assess how reallocation shapes short-term profitability and longer-term strategy.

Image: https://www.abnewswire.com/upload/2025/10/b11099b33b9b713c48f6496e0ff31ff1.jpg

Through the coming quarter Apple reduces planned manufacturing for its ultra-thin iPhone Air and reallocates capacity to higher-demand models, with Carvina Capital focusing on what this means for inventory,…

Carvina Capital on OpenAI's $500B Private Valuation

Artificial intelligence surge, record private valuation from a secondary share sale, institutional capital rotation into model infrastructure and applied software, semiconductor and cloud supply chains in focus, agentic systems adoption accelerating, earnings sensitivity to usage growth under scrutiny

Image: https://www.abnewswire.com/upload/2025/10/88b3bdfb1889adf5f415d54c3646536e.jpg

As the trading week concludes, Carvina Capital Pte. Ltd. assesses OpenAI at a headline private valuation of $500 billion following an employee secondary that concentrates substantial institutional demand, a development that reframes…